Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Nov, 2022

More than half of U.S. equity real estate investment trusts reported third-quarter funds from operations that exceeded sell-side analyst expectations.

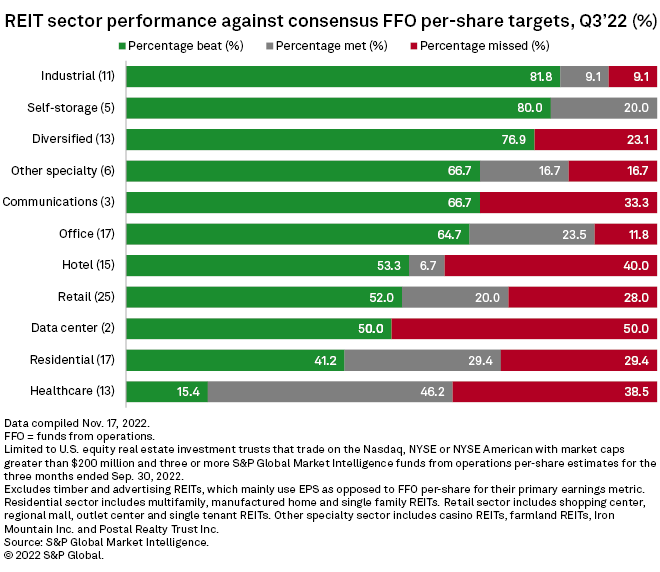

Among the 127 U.S. REITs analyzed by S&P Global Market Intelligence, 71 reported FFO per share higher than third-quarter consensus estimates. Another 24 of the REITs in this analysis equaled consensus expectations for the quarter, while 32 fell short of FFO expectations.

The analysis covered U.S. equity REITs that trade on the Nasdaq, NYSE or NYSE American with market capitalizations of more than $200 million and had three or more FFO-per-share estimates for the three months ended Sept. 30.

Industrial and self-storage REITs top estimates

Nine out of the 11 analyzed industrial REITs surpassed analyst FFO-per-share estimates for the third quarter. Cold storage-oriented Americold Realty Trust Inc. reported core FFO of 25 cents per share for the quarter, 31.6% above its consensus estimate of 19 cents per share. First Industrial Realty Trust Inc. beat its estimate by 9.1%, while STAG Industrial Inc. and Plymouth Industrial REIT Inc. topped their FFO per-share estimates by 5.6% and 4.5%, respectively.

Industrial Logistics Properties Trust was the sole industrial REIT to report FFO per share short of its consensus estimate.

* Click here to create email alerts for future Data Dispatch articles.

* For further earnings analysis, try the Real Estate Beats & Misses Excel template.

Four out of the five self-storage REITs also topped their consensus FFO-per-share estimates for the quarter. Life Storage Inc. beat its third-quarter estimate by 4.2%, while Public Storage, the largest self-storage REIT by market capitalization, topped its consensus estimate by 2.2%.

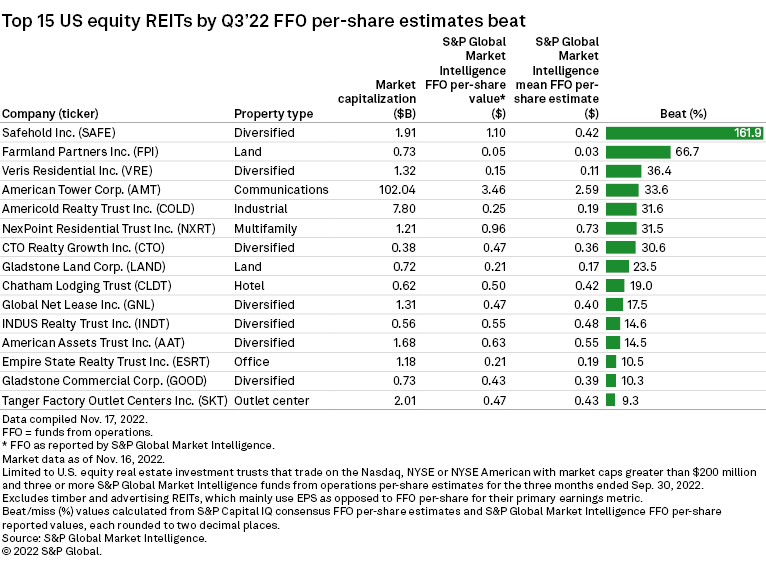

Largest beats

Among all analyzed REITs, ground lease-oriented Safehold Inc. beat its consensus FFO per-share estimate by the largest margin. S&P Global Market Intelligence calculated Safehold's FFO at $1.10 per share for the quarter, more than double its estimate of 42 cents per share. The large discrepancy between the two was driven by the sale of one of Safehold's ground leases for $136 million, 77% higher than the acquisition price approximately two years earlier.

Other top beats for the quarter included farmland-focused REIT Gladstone Land Corp. and diversified Veris Residential Inc.

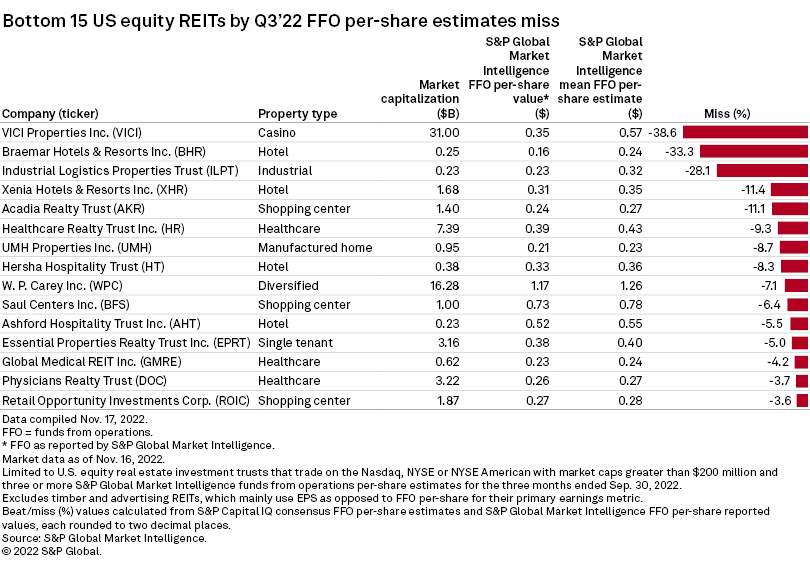

Largest misses

On the other end, VICI Properties Inc. reported FFO at 35 cents per share for the third quarter, 38.6% lower than its consensus estimate of 57 cents per share. VICI Properties records a noncash charge for current expected credit losses on a quarterly basis, based on the probability of default and loss given default of its tenants and borrowers. As a result, the company believes AFFO is the best way to evaluate its financial performance, and VICI Properties' AFFO rose 8.5% year over year to 49 cents per share, one cent higher than its consensus estimate for the quarter.

Hotel REIT Braemar Hotels & Resorts Inc. and industrial-focused Industrial Logistics Properties Trust also fell short of their consensus FFO-per-share estimates for the third quarter.