Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Apr, 2023

By Taylor Kuykendall and Umer Khan

Most US publicly traded coal companies are expected to post another profitable quarter to kick off 2023 results, though earnings are likely to moderate from recent highs.

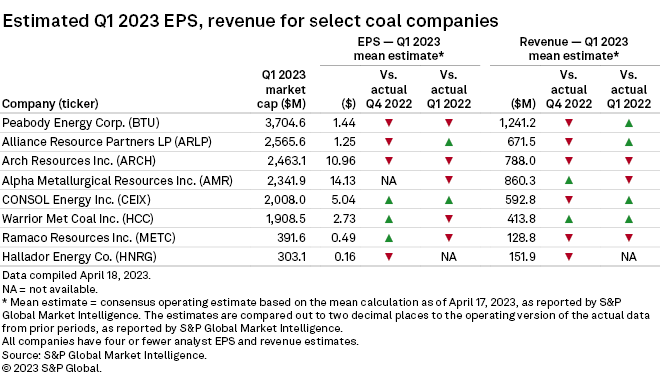

While earnings per share and revenues are expected to be lower compared to the prior quarter and the year-ago quarter for many coal producers, analysts expect all eight companies in an S&P Global Market Intelligence assessment to report positive EPS for the first quarter. The three largest US coal producers by market capitalization — Peabody Energy Corp., Alliance Resource Partners LP and Arch Resources Inc. — are all expected to report lower EPS and revenue in the first quarter compared to the final quarter of 2022, according to S&P Capital IQ consensus estimates.

Despite a structural, long-term decline in coal-fired power generation in the country, US coal producers have enjoyed relatively solid earnings for the past several quarters, in part thanks to higher demand abroad. However, coal-fired power plants continue to retire in the US, and they are by far the largest customer for coal producers. The US Energy Information Administration recently forecast that annual coal production in the US would decline by 6.5% in 2023 to 558.4 million short tons. Within the coal mining sector, B. Riley Securities analysts prefer thermal coal producers with access to export markets and metallurgical coal producers, according to an April 25 note to investors.

Analysts expect Peabody, the largest coal mining company in the US by market capitalization, to report EPS of $1.44 for the first quarter. That would be a 47.4% drop compared to the prior quarter and a 10% decrease from the first quarter of 2022. In the fourth quarter of 2022, the metallurgical and thermal coal producer beat analysts' consensus expectations by 42.0%, reporting $2.74 in EPS.

The top two coal miners in terms of expected EPS in the analysis are Alpha Metallurgical Resources Inc. and Arch Resources, which are both focused on selling metallurgical-grade coal used in the steelmaking process. Alpha and Arch are expected to report $14.13 and $10.96 in EPS, respectively, for the first quarter.

Two US coal companies analyzed, metallurgical coal producer Ramaco Resources Inc. and steam coal producer Hallador Energy Co., are expected to report less than $1 in EPS for the first quarter of 2023.

|

– – |

The Inflation Reduction Act has accelerated the retirement of the nation's coal plants. As of January, utilities had announced coal-fired power plant retirement dates that put the US on pace to have less than 100 GW of coal generation capacity as soon as 2037, down from 283 GW of capacity at the end 2015.

Arch and Peabody are scheduled to report earnings results on April 27.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.