Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Oct, 2021

By Jon Rees

The U.K.'s nascent build-to-rent housing market is drawing institutional investors seeking stable returns and a hedge against inflation.

Lloyds Banking Group PLC is leading the charge, with plans to build 50,000 homes within a decade, according to an August report in the Financial Times. That could make the London-based lender's Citra Living unit Britain's largest residential landlord.

The Goldman Sachs Group Inc., Macquarie Group Ltd. and Legal & General Group PLC have also moved into build-to-rent as the U.K.'s surging home prices and limited housing stock spur rental demand. Financial investors could ultimately own a third of the nation's rental stock, according to estate agent Savills, as depressed interest rates bolster the appeal of assets able to generate rising income over a large number of years.

"Similarly to banks like Lloyds, we're looking at really long-term stable cash flows," said Dan Batterton, head of build-to-rent at Legal & General's LGIM Real Assets arm. "Ultimately, we want income that we can match against pension fund liability and, in the U.K. rental market, over the long term, the rents go up by something similar to inflation." Financial investors account for just over 1% of rental stock at the moment, Batterton said.

Banks move in

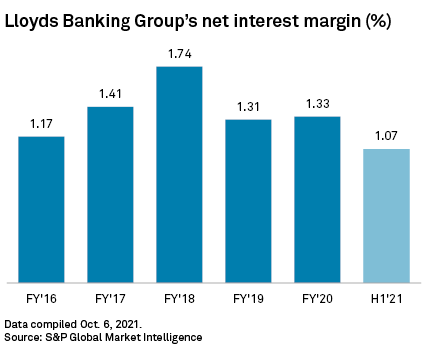

Lloyds wants to reach 10,000 properties by the end of 2025. Lloyds' CFO William Chalmers has previously said a move into the rental sector would allow it to build on existing housing market skills, and that there is the potential for complementary insurance business. Many banks are seeking alternative forms of revenues as they continue to face pressure on profits from their core lending business due to low rates. Lloyds' net interest margin for the first half of 2021 was 1.07%, down from 1.33% in 2020.

Australian bank Macquarie Group Ltd. earlier in 2021 teamed up with founders of a build-to-rent firm to create a new vehicle, Goodstone Living, that will "develop, own and operate units at scale" and has plans to invest £1 billion in the sector. U.S.-based The Goldman Sachs Group Inc. has teamed up with housing management specialist Pitmore to buy nearly 1,000 build-to-rent homes in northwest England.

Market dynamics are accentuating the opportunity for institutional investors. A nationwide shortage of housing stock has seen U.K. house prices rise at their fastest rate for 15 years, up 10% in the year to September according to building society Nationwide. First-time buyers have struggled, with mortgage approvals for these buyers down 6% in the year to March, according to Savills.

Meanwhile, private landlords who rented properties via buy-to-let mortgages have been exiting the market after tax changes made this a less attractive option. More than 180,000 such mortgages have been redeemed since the first quarter of 2017, Savills said.

'An enormous amount of capital'

There is "an enormous amount of capital" chasing the residential housing market, according to Simon Hampton, real assets leader and partner at professional services firm PwC.

For banks, build-to-rent is a natural hedge for mortgage books, Hampton said. Over the longer term, mortgage applications will fall if people cannot get on the housing ladder, while at the same time institutional investors looking to put money into real estate have a limited number of choices, wary as they are of putting money into offices and, especially, retail shopping centers, Hampton said.

Legal & General's Batterton said more banks are likely to enter the market, too. He noted that in the U.S., the Netherlands and Germany institutional owners have a far greater share of the market — as much as 50%.

But he cautioned that financial investors' promise of providing high-quality housing in a sector notorious for poor quality was key, and that the reputational risk is "significant" as banks attach their brand to build-to-rent.

L&G, an investment management and insurance company, has more than 5,000 build-to-rent apartments in planning, development or operation.

At maturity, institutional ownership of the rental sector could make up to a third of the market, or 1.5 million homes, according to Savills.

"Lloyds will not be the last financial investor to get into build-to-rent," said Lawrence Bowles, senior research analyst at the estate agent group. "The long-dated inflation-linked income that it offers is exactly what a lot of financial institutions are looking for in a low-interest rate environment."