Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Mar, 2021

A combination of unfavorable conditions in the U.S and increased liquidity at home means the Hong Kong Stock Exchange is looking at a strong pipeline of IPOs and secondary listings in 2021, analysts told S&P Global Market Intelligence.

Chinese search engine Baidu Inc., which is also listed on the Nasdaq, joined the Hong Kong Stock Exchange on March 23, with video streaming platform Bilibili Inc. to follow suit on March 29.

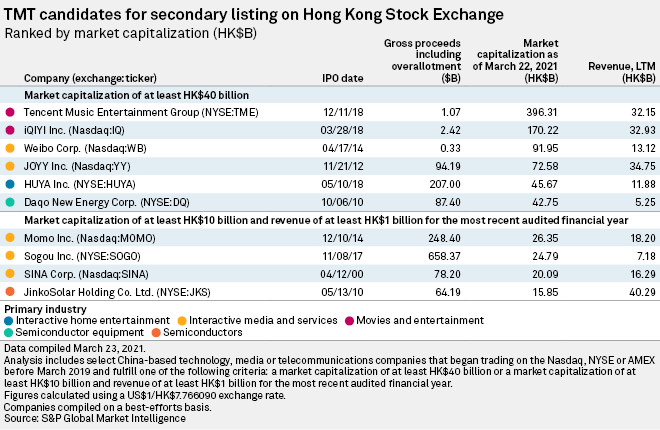

Data compiled by S&P Global Market Intelligence shows that an additional 10 Chinese technology, media and telecom companies listed in the U.S. meet the Hong Kong exchange's secondary listing requirements. They include online music streaming platform Tencent Music Entertainment Group, social media Weibo Corp., livestreaming platform HUYA Inc. and video-based social media platform JOYY Inc.

Companies must have minimum market cap of HK$40 billion, or a minimum market cap of HK$10 billion and at least HK$1 billion in revenue for the most recent audited financial year. They must also be listed on a recognized exchange.

"With political tensions and the restrictions on moving money outside of China or Hong Kong, it makes it easier for Asian investors if the stock is listed on the Hong Kong exchange," Dennis O'Neill, CEO of O'Neill Capital Advisors and president of BioMediCan Inc, told S&P Global Market Intelligence.

Chinese investors have limited access to the U.S. market due to the Chinese government's restrictions on money leaving the country. The U.S. has banned domestic investment in blacklisted Chinese companies.

In Hong Kong, meanwhile, Chinese investors are able to trade an unlimited amount of money through the city's Stock Connect service. The daily turnover of Chinese investors trading through Stock Connect reached HK$29.1 billion as of March 4, according to the Hong Kong stock exchange's website.

Companies choosing Hong Kong as their secondary listing venue are in some cases doing so to mitigate risks stemming from regulatory uncertainties between U.S. and China, Wang Lei, portfolio manager and managing director at Thornburg Investment Management, said.

Friction between the two countries has resulted in the delisting of three Chinese telcos and the trade blacklisting of a number of Chinese technology companies, including facial recognition companies Beijing Kuangshi Technology Co. Ltd., known as Megvii, and SenseTime group Ltd., telecommunications equipment maker Huawei Technologies Co. Ltd. and chip maker Semiconductor Manufacturing International Corp.

"We will continue to see the trend of homecoming secondary listings in Hong Kong as it provides another viable fundraising option for issuers and enables them to broaden their investor base to access new Hong Kong and China-based investors," Allan Chu, head of APAC Technology, Media and Telecoms of Investment Banking and Capital Markets at Credit Suisse, said.

A secondary listing in Hong Kong brings practical advantages, too. "[Investors and portfolio managers based in China] no longer have to trade during U.S. hours and they have a 24-hour trading cycle open to them," Chu said.

The launch in 2019 of the tech-focused, Nasdaq-like Shanghai bourse, the Star Market, primed investors for TMT listings, Bruce Pang, head of macro and strategy research at investment bank China Renaissance, said.

"After the Star Market, Chinese investors have been more familiar with [technology, media and telecom] companies, in terms of the valuation model and the logic of their businesses, [and it is the] same in Hong Kong," Pang said. And increased investor interest in Hong Kong seems here to stay, analysts said.

The Hong Kong exchange's average daily turnover in 2020 increased 49% year over year to $129.5 billion from $87.2 billion in 2019, while in December 2020, the average daily turnover jumped 86% year over year to $140.8 billion.

"We believe the trend of increased investor participation is irreversible [as Hong Kong] has been able to prove that there is enough liquidity in the system to support strong daily liquidity," Sundeep Gantori, equity analyst at the Chief Investment Office of UBS Global Wealth Management, said.