Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Nov, 2022

Singapore's major banks face slowing loan growth in 2023, weighed by monetary tightening and a weaker outlook for economies in Asia-Pacific as central banks remain focused on inflation control.

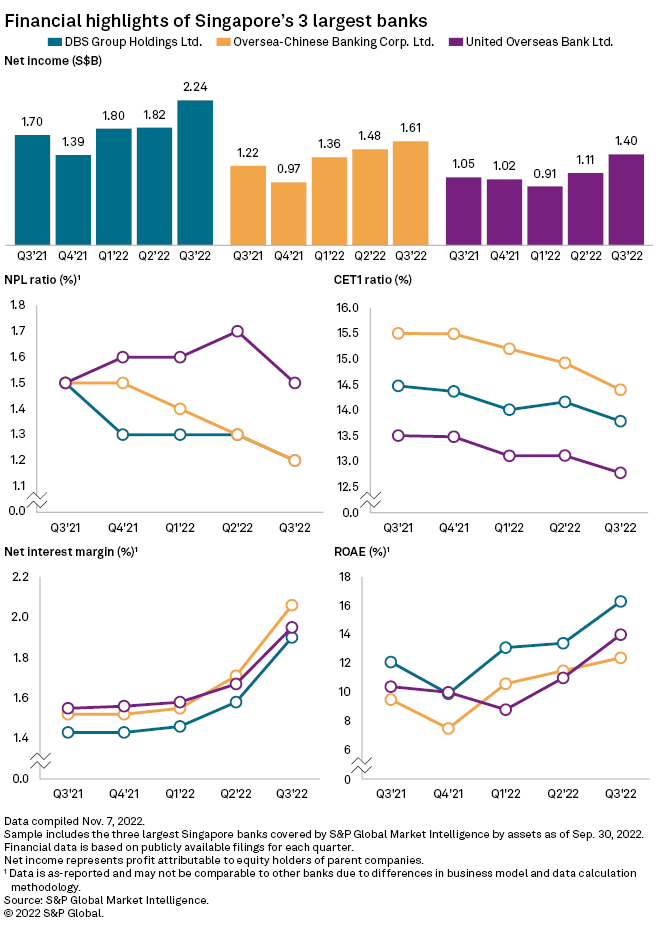

Rising interest rates since late 2021 have so far helped Singapore's biggest lenders by assets, DBS Group Holdings Ltd., Oversea-Chinese Banking Corp. Ltd., or OCBC, and United Overseas Bank Ltd., or UOB. All three reported record profits in the third quarter ended Sept. 30 as higher rates buoyed their net interest margins. But as rates continue to rise, they could impede borrowing, analysts said.

In 2023, "loan growth targets might be lowered as interest rates continue to increase," said Glenn Thum, a research analyst at Phillip Securities Research. The lenders will likely maintain their loan growth targets at mid-single digits in 2022, though they may lower the guidance to low-single digits for 2023, Thum said in an emailed interview with S&P Global Market Intelligence.

The IMF said in its outlook report in October that growth momentum is expected to be moderate somewhat in 2023 for Singapore, along with some of its regional peers. That reflects weaker external demand, supply chain disruptions, macro policy normalization and tighter financial conditions, it added.

Steep hikes

Singapore's economy, a bellwether for Asia, grew 1.5% on a quarter-over-quarter seasonally adjusted basis in the third quarter, reversing the 0.2% contraction in the previous three months. The nation's central bank was among the first in the region to start tightening monetary policy, setting the Singapore dollar on a steeper appreciation path versus its peers in October 2021 as inflation expectations started to mount. Since then, the central bank has tightened policy four more times, including two rare moves outside its regular reviews that typically happen in April and October of each year.

Helped by the higher rates, the net interest incomes of all three banks rose. DBS Group and OCBC both reported a 44% year-over-year increase in their net interest income to S$3.02 billion and S$2.10 billion, respectively. UOB posted a 39% gain to S$2.23 billion.

DBS Group's NIM for the quarter climbed 47 basis points year over year to 1.90%. OCBC's NIM for the period rose 54 bps to 2.06%, while UOB reported a 28-bps increase in its NIM to 1.95%. S&P Global Ratings expects further NIM expansion of around 15 to 20 bps to be possible in 2023 after rate hikes are fully priced in.

Asset quality

Singaporean banks continue to have sizable exposure to the property market and have revised home loan rates several times in 2022.

All three banks continue to have resilient asset quality on the back of lower nonperforming loan, or NPL, ratios. The NPL ratios of DBS Group and OCBC both improved year-over-year to 1.2% as of Sept. 30 from 1.5%, while UOB's NPL ratio for the period remained steady at 1.5% compared to the prior-year period.

"Overall asset quality should remain resilient. Banks' gross NPL ratios could, however, weaken slightly over the next 12 to 18 months. This is because of economic headwinds and increased vulnerability of small and midsized enterprises. We have become more circumspect on mainland China and some regional economies to which Singapore banks have exposure," said Ivan Tan, an analyst at S&P Global Ratings.

The lenders also posted year-over-year declines in their common equity Tier 1, or CET1, ratios as of Sept. 30, though DBS Group's figure is above its target operating range, while UOB's is at the upper end of its target operating range. Meanwhile, OCBC is subject to additional capital requirements imposed by the Monetary Authority of Singapore.

DBS Group said the decline in its CET1 ratio for the quarter was due to loan growth and the marked-to-market impact on fair value through other comprehensive income securities, while UOB said its lower CET1 ratio was largely due to interim dividends for 2022.

"Both DBS and UOB have spent capital this year, which lowered their CET1 ratio. OCBC still has the highest CET1 ratio among the three banks and there is a possibility of higher dividend payouts or a possible acquisition," said Thum of Phillip Securities.

As of Nov. 14, US$1 was equivalent to S$1.37.