Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Jan, 2021

By Jakema Lewis

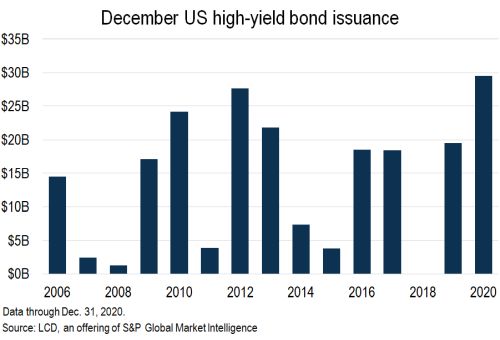

Unprecedented December 2020 volume capped a record-smashing year for U.S. high-yield bond issuance, as participants brace for another hectic year ahead. The healthy $29.5 billion tally was the most-ever for the calendar-month period, pushing 2020 full-year volume to roughly $435 billion, according to LCD.

The prior peak for December volume was $27.6 billion in 2012. Issuance was below $20 billion in December 2019, and the average volume over the five Decembers from 2014-2018 was less than $10 billion, including a goose-egg output in 2018.

The new monthly high in December 2020 followed record-setting totals for each of the monthly periods from May to August. Federal Reserve policy provided a tailwind for bond issuance, and the loan sector was much slower to rebound from the pandemic-driven market shutdown in March. High-yield issuance totals for September, October and November each represented the second-highest totals on record for those calendar-month periods.

|

New-issue volume for high-yield bonds in December again surpassed its leveraged loan counterpart, which itself showed signs of increasing vigor. Loan issuance totaled $27.7 billion in December, up nearly 40% month-to-month. Total leveraged finance volume was $57.3 billion for December, more than double the $27.5 billion issued in December 2019.

Nevertheless, loan issuance of $393 billion in 2020 was down 20% from 2019. The $435 billion of high-yield bond issuance, meantime, was up nearly 60% year over year and well ahead of the prior annual peak of $345 billion in 2012.

|

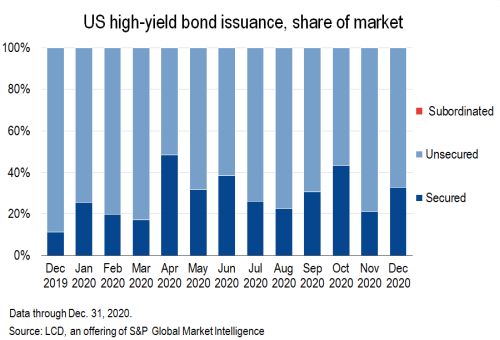

Secured bond issuance edged slightly higher in the final month of 2020, accounting for $9.7 billion of U.S. high-yield issuance, versus $6.8 billion in November. Still, December's tally was far below the peak levels for secured bonds in the early months of the pandemic, when bonds picked up the slack for a largely sidelined loan sector. Secured high-yield bond issuance in the second quarter of 2020 was $54.8 billion to set a new best for a single quarterly period, then declined to $33.3 billion in the third quarter and $31.3 billion in the fourth quarter.

|

The ratings dispersion signaled wide-open markets at the tail-end of the year. B rated issuance dominated the December supply story with 30.1% of the month's volume garnering the rating, little changed from November's proportion, but well above just 7.1% in April, when risk sentiment balanced on a knife's edge. The second-highest share for December was the BB category at 25.7%, a decrease from 33.5% in the previous month. Notably, CCC rated issuance increased nearly 3 percentage points month over month, to 10.2%, as split-rated paper B/BB rated issues declined to 14.9%, from 21.6%.

|

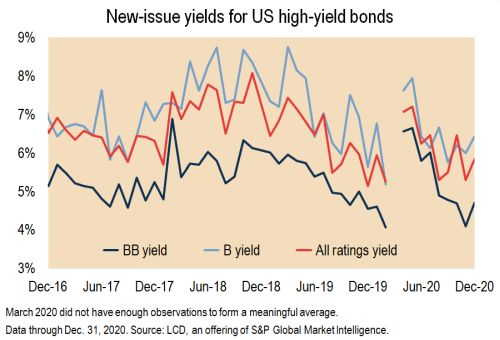

The average new-issue yield increased month to month to 5.84%, from 5.31% but remained well below averages of 7.07% in April and 7.20% in May, as the markets reopened from the largely shuttered March period.

|

On a stand-alone basis, the average yield for newly minted BB bonds was 4.71%, from 4.08%, while B rated paper on average was finalized with a 6.43% yield versus 6.00% in the prior month.

|

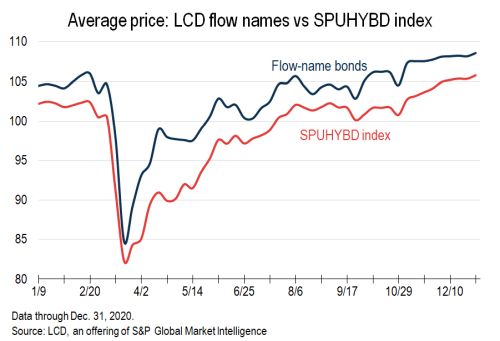

The appetite for paper in the secondary market proved voracious at 2020's close. The year-end assessment of LCD's 15-bond sample of liquid high-yield issues showed the average bid higher by 40 basis points over the week to Dec. 31, at 108.55% of par. The reading marked a new peak for the pandemic era. For reference, the average bid price on Nov. 24, the final reading for that month, was 107.73, reflecting a potent rally on election clarity and positive vaccine news, from 104.49 at the end of October.

The S&P U.S. Issued High Yield Corporate Bond Index also closed the year on a strong note with a 105.80 average bid price on Dec. 31, versus 104.15 on Nov. 24. The index was noted with a 6.78% return at year-end, with an average option-adjusted spread, or OAS, at T+356 and an average yield-to-worst of 4.06%, a retreat from 2019 closing with a 14.5% return, with an OAS at T+320 and an average yield-to-worst of 5.15%.

|

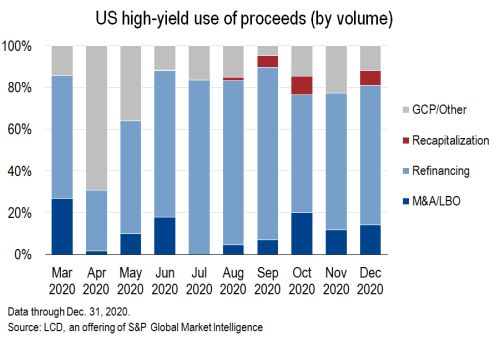

Against the backdrop of the Fed signaling that rates will remain lower for longer, companies continued to raise debt to chip away at existing borrowing costs and debt maturities. Refinancing activity in December accounted for 67% of the month's volume, a slight increase from 66% in November. Completed prints for Community Health Systems Inc., Occidental Petroleum Corp. and Tallgrass Energy Partners LP contributed to the sum.

Deals pitched to fund M&A and leveraged buyout transactions — widely viewed as wildcards for 2021 issuance projections given deep pools of liquidity — gained traction in December with a 14% carve-out of the total, up from 12% in the prior month. The share was boosted by deals for E.W. Scripps Co., AdaptHealth LLC, NFP Corp., Virtusa Corp., US LBM Holdings Inc. and Radiology Partners Inc.

After having zero presence in the market one month earlier, recapitalization bond issuance accounted for a 7% share of December's issuance, while paper printed for general corporate purposes grabbed a 12% share, or roughly halved from its November level. For reference, GCP-driven deals for liquidity-challenged issuers accounted for more than 69% of April 2020 volume and nearly 36% of May 2020 volume.

|

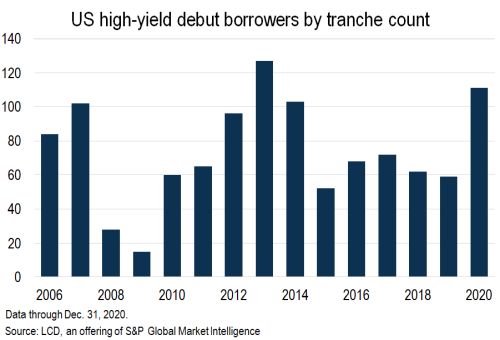

Further emphasizing the investor preference for high-yield paper during 2020, 111 tranches were signed by debut borrowers, the most for a single year since 2013 and the second-most for any annual period.

|