Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Apr, 2021

By Tom DiChristopher and Anna Duquiatan

Wall Street expects natural gas utilities to post improved earnings following recent strong reporting periods for the subsector and despite headwinds presented by extreme winter weather in February.

Analysts anticipate earnings per share to rise from the year-ago period for all nine local distribution companies in a select group of gas utilities, according to consensus estimates compiled by S&P Global Market Intelligence. In a group of 14 multiutilities, 11 companies are tipped to report higher year-over-year EPS.

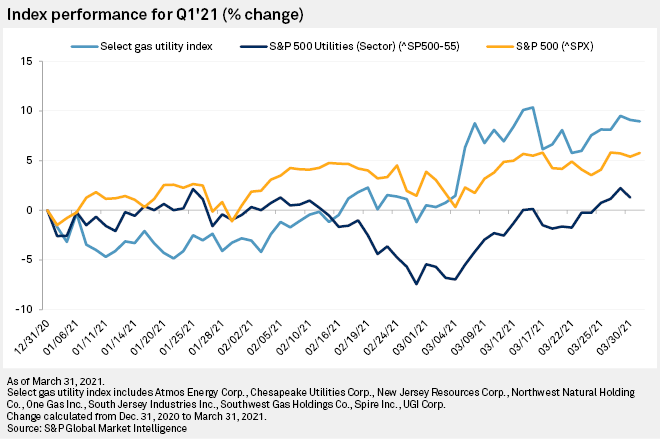

Analysts have credited solid earnings for helping to attract investors to the space amid a broader market rotation into value stocks.

The stock price bump, following a period of chronic underperformance, has narrowed the valuation gap between LDCs and electric utilities. The LDC discount to electrics is roughly 4.1%, down from 13%-15% in October 2020, according to JPMorgan Chase & Co.

Earnings offer views into M&A and winter storm recovery

Several gas utility operators begin announcing quarterly results the week of April 25, but many LDCs will report from May 4-7 this quarter, teeing up a busy four days for analysts and investors.

Dealmaking will be on their radar this quarter. CenterPoint Energy Inc. has guided toward a second-quarter announcement on the sale of its Arkansas and Oklahoma gas utilities, calling interest from potential buyers "robust" in February. Ahead of its April 29 earnings release, LDC operator AltaGas Ltd. announced the sale of its U.S. transportation and storage business on April 23.

JPMorgan expects investors to also focus on the fallout from February's winter storms and the outsize gas purchase costs that several LDCs absorbed. Atmos Energy Corp., CenterPoint and One Gas Inc. all reported multibillion-dollar expenses. Spire Inc. and Southwest Gas Holdings Inc. shouldered lighter costs, with each entering into $250 million loan agreements to cover the expenses during the first quarter.

The bank, however, noted there is positive momentum around recovering the costs, including legislation advancing in Texas to allow utilities to securitize the expenses. JPMorgan also saw the subsector gaining traction on the environmental, social and governance front with fresh emissions reduction targets and the launch of early-stage hydrogen and renewable natural gas pilot projects.

"We see tailwinds amid this rebound that include recent state legislative focus on pro-natural gas bills, and the group appears well positioned for continued operational strength following strong [fourth-quarter 2020] results to start the first heating season under COVID-19 conditions," JPMorgan analysts said in an April 22 research note. At least 21 states have adopted legislation or are advancing bills to prohibit local governments from adopting building gas bans, countering a movement to restrict gas use in new buildings.

Focus on ESG to continue

On its last earnings call, Atmos said it was seeking additional supplies of renewable natural gas, or RNG, a fuel processed from methane waste sources like landfills and farms. Chesapeake Utilities Corp. highlighted its first step into renewable hydrogen blending and its RNG strategy on its most recent earnings calls.

Similarly, UGI Corp. declared its intent to become an RNG leader on its November 2020 earnings call. On its next call, it announced that it had struck a pipeline interconnect agreement with an RNG project poised to become the largest U.S. supply point.

During the first quarter, Spire joined a coalition focused on reducing methane emissions intensity and appointed Vice President of Business and Economic Development Nick Popielski to a new head of environmental commitment role. In an interview, Popielski said Spire is supporting RNG development in its service territories.

Operating under a nation-leading RNG tariff in Oregon, Northwest Natural Holding Co.'s gas utility in January entered into a partnership to develop RNG projects at Tyson Foods Inc. facilities. In November 2020, Southwest Gas highlighted regulatory progress in Arizona and Nevada for RNG projects. One Gas also outlined early-phase RNG and hydrogen plans on its November call.

LDC operators in states with aggressive climate goals have been particularly active on the ESG front. Sempra Energy has announced several hydrogen projects and partnerships at its Southern California Gas Co. and San Diego Gas & Electric Co. utilities. In New York, National Grid USA and National Fuel Gas Co. are also highlighting their hydrogen aspirations.

South Jersey Industries Inc. signaled a tighter focus on RNG, as it seeks to align its business with state clean energy policy and meet a new target to achieve carbon-neutral operations by 2040. Fellow Garden State utility operator New Jersey Resources Corp. also telegraphed an RNG-heavy focus on its November earnings call. More recently, it announced a new target to cut operational emissions by 60% from 2006 levels by 2030.