Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Apr, 2021

By Brian Scheid and Polo Rocha

Futures markets have begun to bet on an interest rate hike as soon as next year despite clear signals from Federal Reserve leadership that an increase will likely be on hold at least until 2024.

Recent trading in the Eurodollar and Fed Funds futures markets, which both track short-term interest rate expectations, along with a run-up in the five-year Treasury note yield, show that investors believe rising inflation during the post-pandemic economic recovery will trigger the Fed to prematurely abandon its policy of keeping rates at or near 0%.

While Fed Chairman Jerome Powell has repeatedly committed to keeping rates low and policy accommodative until maximum employment and inflation goals are reached, there appears to be a fundamental disconnect with the market. The shift in sentiment has investors banking on a rise in rates well ahead of any suggested timeline.

"We're just so pre-programmed as traders to think that when things heat up in the economy the Fed is going to have to react to shut it down because that's what they've done in the past," Patrick Leary, chief market strategist at Incapital, said in an interview. "But I've yet to see any indication out of this Fed that that's what they're going to do."

Early this month, trading in Eurodollar futures showed that the market expected the Fed's first post-pandemic rate hike in December 2022, although those expectations fell to February and March of 2023 a week later.

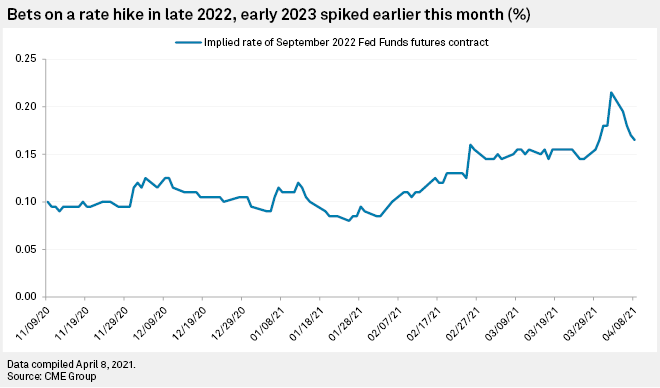

Those expectations have shown up in the less-liquid Fed Fund futures contract as well. The implied rate of the September 2022 contract, for example, jumped to 0.215% on April 2. While the contract has only increased 8 basis points since the start of the year, the higher settlements show that investors may be viewing a rate hike as early as September 2022 as more likely to take place than they may have believed one to be earlier this year.

"We're seeing a replay of overly aggressive expectations about Fed rate hikes similar to post-2009," said Michael Crook, deputy chief investment officer at Mill Creek Capital Advisors. "The new 'broad-based and inclusive recovery' framework means the Fed will be more patient than they have been historically and that patience is not being fully recognized by the market."

As of the April 8 settlement, both futures contracts show expectations of a March 2023 rate hike. The recent increase in implied rates in these futures contracts may leave traders vulnerable to potential losses if the Fed sticks to its plan to avoid a hike until at least 2024.

A premature rate hike could be a boon for bank profits but may hurt the post-pandemic economic recovery with higher capital costs.

The yield on the five-year Treasury note, another proxy for interest rate expectations, jumped 61 basis points from 0.36% at the start of 2021 to 0.97% on April 2. The yield has since fallen to 0.87%.

"That pricing is already quite aggressive," said Gennadiy Goldberg, a senior U.S. rates strategist with TD Securities, in an interview.

Tapering the Fed's quantitative easing program, including winding down the Fed's $120 billion in monthly bond purchases, could take the better part of a year, Goldberg said. And inflation is unlikely to immediately skyrocket, giving the Fed breathing room before seriously considering a rate hike.

In their latest forecasts, most Fed officials agreed they could keep rates on hold through 2023, although a growing number of Fed officials saw rate hikes starting in 2022 or 2023.

Seven of the 18 Federal Open Market Committee members see at least one hike by 2023. Four Fed officials also believe at least one hike may be necessary in 2022.

Leary with Incapital sees a hike potentially in late 2023, although the Fed faces a lengthy task list to complete before it gets there. For one, the Fed's maximum employment goals go beyond just an increase in raw job numbers. The Fed's priorities, Leary said, include significant gains in minority employment and boosting women in the labor force.

"They're trying to create an amicable environment for the government to issue debt, to spend and deficit spend in order to try to fix some of these societal problems," Leary said. "That means zero interest rate policy will be here for a long time."

It also means that the market must adjust its expectations and not let history serve as a guide anymore, he said.

"Traders and investors and market participants still need to go back and rewrite their books on Fed policy," Leary said. "This is a new Fed."