Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 May, 2021

|

| BHP Group's Olympic Dam operation in South Australia, which produces copper along with uranium, gold and silver. |

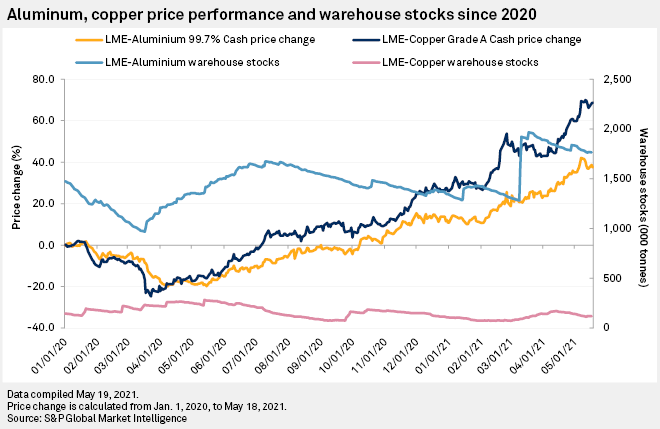

Mining majors remain bullish on copper prices citing stimulus driven gains, though some investment advisers and analysts believe that the red metal's recent price rise should logically contract over the next year.

After copper hit a record high of $10,724.50 per tonne May 10 having soared 90% over the past year to hit $10,000/t for the first time since 2011, Australian group Barclay Pearce Capital said May 11 that investors should "strap on, because it still has plenty more room to run."

BHP Group and Rio Tinto Group's CEOs talked up their long-term bullishness on the fundamentals underpinning copper demand at the May 18 virtual Bank of America Global Metals, Mining and Steel Conference.

BHP chief Mike Henry said the miner expects primary copper demand to more than double over the next 30 years over what was produced over the past 30, in a scenario where temperature rises are limited to 1.5 degrees C above pre-industrial levels, in keeping with the targets outlined in the Paris Agreement on climate change.

Rio Tinto's Jakob Stausholm said that while "the last 12 months have told us to be really cautious" regarding popular predictions of a "super cycle," he does see a "huge niche" for copper, along with iron ore and aluminum as "governments around the world have become increasingly aligned in their focus on the transition to a lower carbon world."

Anglo American PLC CEO Mark Cutifani told the conference that miners are "perched on the edge of quite a material opportunity," citing an estimated $10 trillion to $20 trillion worth of stimulus packages set to be rolled out over the next decade and a growing world population and middle class.

Cutifani said that "when viewed in the context of the pandemic, the fragility of our species becomes an even more compelling case for new actions" on climate change. Thus, "the transition to a decarbonized society and what that means for supply and demand for our products becomes the defining issue of our time."

Stausholm also said Rio Tinto's portfolio metals like copper, iron ore and aluminum vital to a greener future are "not easily substituted."

However, Wood Mackenzie Metals and Mining Vice Chair Julian Kettle said in a May 18 note that while "copper is the major metal par excellence in terms of electrical conductivity," eclipsed by only the far more costly and much less abundant silver, aluminum is a looming substitution threat.

While aluminum's conductivity is about 40% below copper's, its density being 30% of copper's means aluminum cable is about half the weight of a copper one with the same conductivity, a property which aids handling and installation, Kettle said.

Karri Asset Advisors Principal Rob Zdravevski told S&P Global Market Intelligence that while both copper and aluminum have experienced "parabolic" rises of late, meaning a dramatic surge, such moves cannot last long, and predicts copper will fall by a third over the next 10 to 14 months.

The Western Australia-based global cross-asset investment advisor said that at its height in May, copper was trading at about 60% above its 200-week moving average.

This surge, coupled with the fact that copper was also 2.5 standard deviations over its weekly mean, show the commodity is in "dangerous territory," given 97% of asset prices generally live within two standard deviations of their mean.

"When you see commodity prices at above two standard deviations above its mean I tell clients they're at the wrong end of the cycle to be buying copper," he said.

Strong fundamentals

Zdravevski does not subscribe to the "supercycle" theory, though he has been a "commodities bull" for the past year and "absolutely" believes in copper's fundamentals, particularly the electrification theme.

London-based Kettle told Market Intelligence that while it is "a bit too early to call a supercycle in copper," his firm sees a period of structural undersupply from the mid 2020s as the lack of investment in mine supply means demand expected from the accelerating energy transition cannot be met.

"Economic growth will slow from 2022 onwards as interest rates rise to head off inflation, as quantitative easing is progressively unwound and as taxes rise to help pay off debt," he said, all of which will occur as additional copper mine supply comes online from projects sanctioned from 2017 to 2020.

Though copper stocks will decline in 2021, Wood Mackenzie expects them to rise from 2022 to 2024 which should "take some heat out of prices."

However, "right now there is so much momentum in the copper price with so many bullish price forecasts and narrative around energy transition induced shortages it is likely that prices will remain above fundamentally justified levels, albeit lower than current spot prices," he said.

Investment advisory Shaw and Partners' senior analyst, Peter O'Connor, told Market Intelligence that pockets of demand recovery underscored by curtailed Latin American production due to COVID-19 are creating a market backdrop which is "without doubt positive."

Just how long that will last depends on how much further China and the U.S. will stimulate their economies, he said, while political risk in the world's top two copper producing countries Chile and Peru is also important.

An overhaul of Chile's market-orientated constitution is underway with mining royalties being debated, while a socialist who wants to redistribute mining wealth is leading the polls ahead of a June presidential election in Peru, Bloomberg reported May 17.

All this appears to be pointing to "some moderation" in copper prices in the second half of 2021, into 2022, O'Connor said.