Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Mar, 2023

By Vanya Damyanova and Mohammad Taqi

The emergency takeover of Credit Suisse Group AG opens UBS Group AG to significant risks as it embarks on a costly turnaround of its troubled peer.

The deal, in which Zurich-based UBS acquired its cross-town rival for CHF3 billion, was orchestrated by the Swiss authorities over the weekend to shore up struggling Credit Suisse and prevent further market panic. Swiss law requiring shareholder approval was swept aside, and holders of certain bail-in-able debt had their investments controversially wiped out.

The banks have little time to work out how to integrate Credit Suisse's core businesses into the UBS franchise, and there are questions about both the reputational impact on UBS and the legal risks, analysts said.

"This is probably the most badly executed shotgun merger we've ever seen," Darko Kapor, partner at research company Tricumen, told S&P Global Market Intelligence. The cost of winding down certain operations could be very high, and UBS must deal with the persistent asset outflows that weakened Credit Suisse over recent quarters.

The integration bears "material execution risk" due to the size and weaker credit profile of Credit Suisse and the complexity of winding down its investment banking operations, S&P Global Ratings said March 20 as it downgraded the outlook on UBS credit ratings to "negative" from "stable." It could also weaken the combined group's competitive position and cause it to miss financial targets because of restructuring or litigation costs, pressure on revenues or setbacks in realizing cost savings.

UBS expects an annual cost reduction run-rate of more than $8 billion by 2027. It anticipates that the integration will take three to four years, excluding the planned rundown of noncore activities, CEO Ralph Hamers said March 19. Restructuring and integration costs will affect UBS's return on common equity Tier 1 capital in the short- to medium-term, keeping it below the target of 15% to 18%. UBS will temporarily suspend its share buyback program under which it aimed to repurchase more than $5 billion of its own shares in 2023.

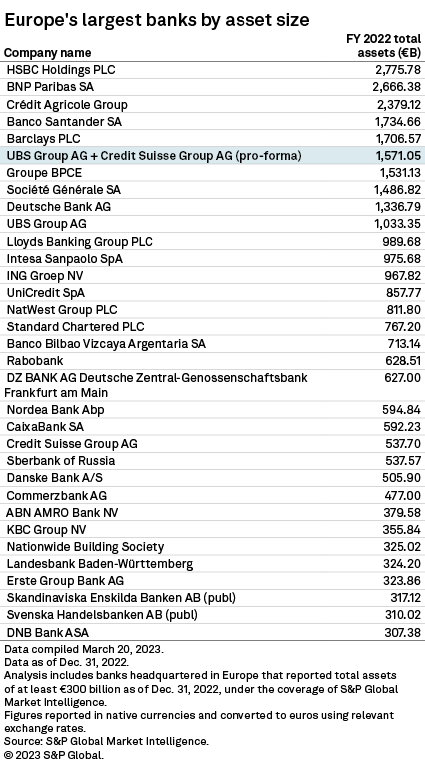

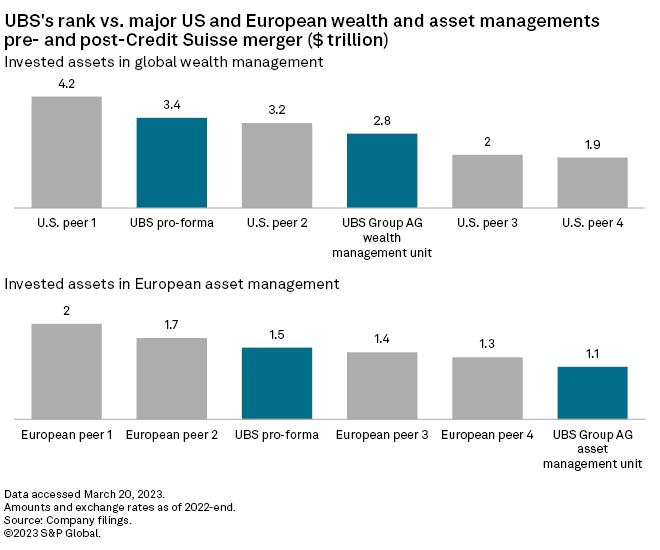

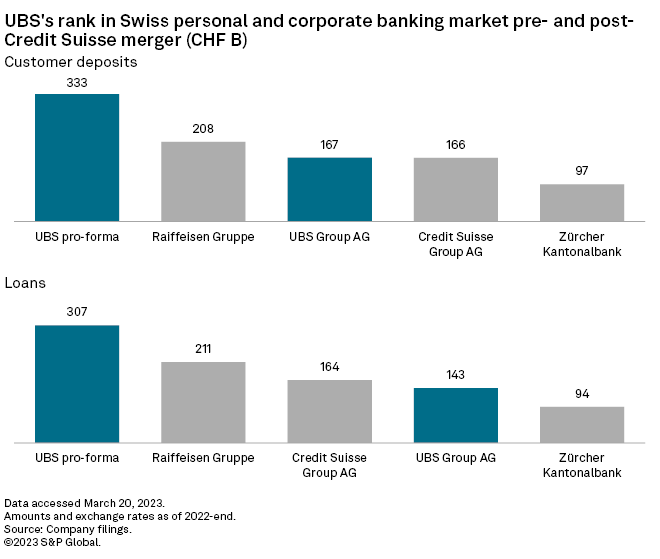

The merger will add scale and boost capabilities in UBS' wealth and asset management businesses, making it the second-largest global wealth management franchise and the third-largest European asset manager in terms of invested assets, the CEO said, adding that it will create the leader in personal and corporate banking in Switzerland, enhancing its position in the corporate market.

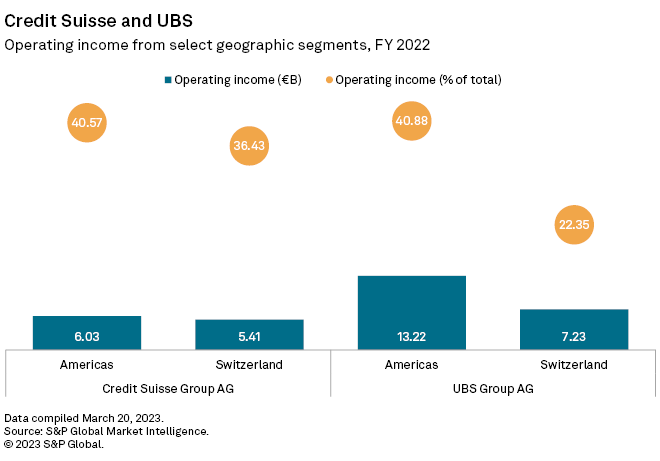

UBS generated over 22% of its operating income in Switzerland in 2022, while that share was over 36% at Credit Suisse, Market Intelligence data shows.

UBS was not immediately available to comment.

Bond market jitters

The Swiss government, central bank and financial regulator wrote off all CHF15.8 billion of Credit Suisse's Additional Tier 1 capital instruments — debt which is converted to equity, or "bailed in," if a bank gets into trouble — as downside protection for UBS. Some shareholders' equity remained intact, a reversal of the usual hierarchy.

The decision "massively affected" the $275 billion AT1 market and is "troubling" given that AT1 holders had little input in driving banks' strategies but are now, unlike shareholders, taking maximum loss, Sam Theodore, senior consultant at Scope Insights, wrote in a March 20 note. As part of the deal, Credit Suisse shareholders will receive CHF3 billion in UBS shares. To calm the market, EU and U.K. bank authorities issued statements reassuring investors that AT1 holders rank above shareholders under resolution frameworks in their jurisdictions.

"The ability of Swiss regulators to write off AT1s before equity in certain circumstances was set out in Credit Suisse's AT1 prospectus," Elisabeth Rudman, global head of financial institutions at DBRS Morningstar, told Market Intelligence.

The merged group faces legal risk as it works through Credit Suisse's legacy issues and others that may be "lurking in the shadows," and it remains to be seen whether markets will be patient in case of future trouble, ING senior financial sector strategist Suvi Platerink Kosonen told Market Intelligence.

Litigation firm Quinn Emanuel Urquhart & Sullivan said March 20 that it is in discussions with Credit Suisse AT1 holders regarding potential legal action. The firm worked on litigation arising from the resolution of and sale to Banco Santander SA of Spain's Banco Popular, in which shareholders and AT1 holders were wiped out.

Short-term pain

Ratings expects the merged entity to face client churn, especially in wealth management and Swiss banking due to "significant client overlaps" between the current UBS and Credit Suisse franchises.

In the short term, UBS will struggle to grow revenues, stem outflows and manage job cuts in wealth management and private banking as it integrates Credit Suisse due to business mix differences and regional overlaps, Tricumen analysts said in a note to clients seen by Market Intelligence.

Half of Credit Suisse's revenues in these businesses depend on net interest income, which is much more volatile than recurring fee income, accounting for three-quarters of UBS's sector revenues. Credit Suisse's sector loan book has been shrinking for years, with a "huge decline" of 24% booked in 2022, while deposit margins fell more than those at major peers, the analysts said.

UBS must also tackle the strong asset outflows Credit Suisse booked in 2022. Before the merger, net new money for the first quarter was negative at $71 billion, which, taking into account volatile market developments, resulted in $159 billion negative net new assets, Tricumen estimated.

Job cuts coming

About 2,000 jobs are expected to be cut in the wealth management and private banking businesses over the next 12 months due to business overlaps in Europe, the Middle East and Africa, and Asia-Pacific, Tricumen analysts said.

Credit Suisse will bear the brunt of the cost reduction, with job cuts likely to exceed the 9,000 announced before the merger with UBS, Scope Insights' Theodore told Market Intelligence. UBS has no reason to cut its own staff, he said.

The investment bank is likely to see the biggest cut, as UBS molds Credit Suisse's franchise into its own business model based on a large wealth management business supported by a much smaller investment bank, Theodore said.

Wealth management accounted for over half of UBS's operating income in 2022, while the investment bank brought in a little over a quarter, Market Intelligence data shows.

UBS's investment bank unit "will remain right-sized and focused on areas most relevant to our institutional corporate and wealth management clients," UBS Chairman Colm Kelleher said during the March 19 call, adding that it intends to de-risk and downsize Credit Suisse's trading operations, which will be mostly managed in a separate noncore division.

The cost of winding down the noncore trading business could be "very high," Tricumen's Kapor told Market Intelligence.

UBS said it will cover the first CHF5 billion of these costs, while Swiss authorities have offered an additional CHF9 billion in loss protection if losses exceed this figure.

"This was the key part of the announcement because it suggests the current state of CS Global Markets ... is much worse than market participants (and us) expected," Kapor said via email. "The regulators forced this deal on UBS' shareholders, even though — aside from imposing years of distraction on UBS's top management — the acquisition evidently weakens UBS."