Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Feb, 2021

By Michael Gibney and Jason Woleben

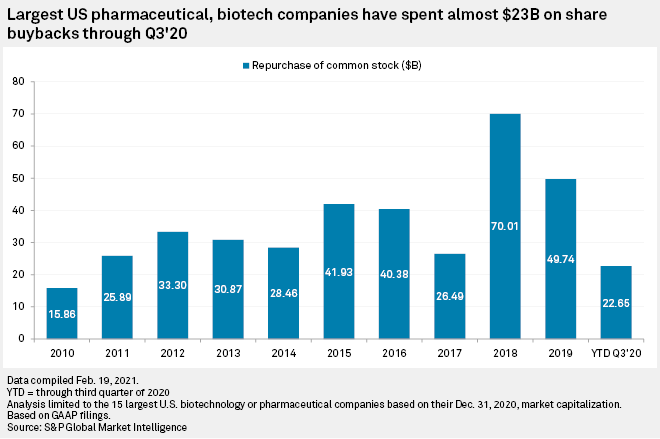

Most U.S. companies shied away from share repurchases during the height of the COVID-19 pandemic in 2020, although the technology and healthcare sectors — drugmakers and big biotechs in particular — showed greater resiliency and a willingness to splash out on their own stocks.

|

|

Among the top biotechnology and pharmaceutical companies announcing stock buybacks since the beginning of 2020 are Bristol Myers Squibb Co. and Regeneron Pharmaceuticals Inc. — each with two repurchasing announcements totaling $7 billion and $6.5 billion, respectively, according to S&P Global Market Intelligence data.

Vertex Pharmaceuticals Inc., Biogen Inc., Alexion Pharmaceuticals Inc. and Gilead Sciences Inc. also have announced share repurchases since the beginning of 2020, according to S&P Global data.

Fitch Ratings said in a February report that of the companies covered by the rating agency, drugmakers Bristol Myers, Amgen Inc., Merck & Co. Inc. were among the top 10 companies ranked by net share repurchases during the 12 months before Sept. 30. Technology giant Microsoft Corp. led all companies in net share buybacks.

Following a significant pullback in share repurchases in 2020 due to the pandemic, activity is expected to rebound to almost historical levels in 2021, Fitch Senior Analyst Philip Zahn told S&P Global Market Intelligence in an interview.

"Over the course of the year, you'll probably see share repurchases moving up as performance improves, where we're back to normal again," Zahn said. "All sectors are gradually going to get back to their old ways, and the more stable sectors that are somewhat unaffected by the pandemic have been able to continue doing what they've been doing."

Companies with cash on hand often seek to support their stock price by repurchasing shares and reducing the share count, effectively pumping up earnings per share over time, Zahn said. Managers at these companies with stock options are "very keen to do what they can to support the stock price," Zahn added.

The percentage of share repurchases to revenues averages about 2% in all sectors but fluctuates due to external forces, Zahn said.

"The percentage has varied from 0% in 2009 up to over 3% in 2018 when companies were repatriating a lot of cash following the tax law change," Zahn said. "But it's been around 2% over time, so it seems it will move back towards that and approaching that historical level as the economy recovers."

However, each market sector is at a different stage of recovery. Stable growth areas like pharma tend to be more resilient, Fitch Ratings Senior Analyst and Head of Healthcare and Pharmaceuticals Britton Costa said in an email.

But the same does not ring true for all of the healthcare industry. For healthcare providers, share buybacks have been less frequent during the pandemic.

"The degree to which healthcare companies' share repurchase activity changed in 2020 was a tale of two subsectors — healthcare providers curtailed buybacks during the early days of the pandemic," Costa said. "We surmise they did so given the uncertainty around how much operations and cash flows would be affected as well as the optics of receiving monies via the CARES Act and then repurchasing stock."

Costa said healthcare providers' capital allocation is expected to normalize in 2021.

Stable growth is the best predictor of share repurchasing activity, Zahn said.

"It's a combination of companies that generate just way more cash than they can reinvest in their own business and growth products or M&A, and companies that tend to be stable year to year," Zahn said. "They know that cash will be flowing next year and the year after — they're not terribly cyclical businesses."

Cash flow vs. credit

Most share repurchases are performed using free cash flow, Zahn said, but some companies turn to borrowed shares, trading credit rating for an increased share price.

"There are always every year some ratings actions that we take that are at least partly if not fully a consequence of aggressive share repurchases," Zahn said. "It's a small piece of the total universe but it's very predictable."

And despite a stable pandemic performance relative to the overall markets, the pharmaceutical credit outlook calls for an eighth straight year of deterioration in 2021, S&P Global Ratings said in a Feb. 23 report. Drivers of the trend are continued M&A and drug pricing constraints in the U.S.

Although an economic recovery is potentially on the horizon, share buybacks in the pharmaceutical industry could decline as a result of these outside factors.

"We expect companies with elevated leverages to limit share buybacks to amounts needed to offset dilution from stock-based compensation, as several did in 2020," S&P Global Ratings said.

Still, share repurchases that risk high credit ratings could still happen in a low-interest-rate environment, Zahn said.

"Interest rates are low, so it doesn't penalize them that much so they make that trade-off to be a bit more aggressive, and so in some cases, we have taken negative action," Zahn said. "The consequence of that is pretty limited in a low interest-rate environment — if and when we see interest rates moving up, then maybe there's more of a consequence, and companies would think twice about it."

This S&P Global Market Intelligence news article may contain information about credit ratings issued by S&P Global Ratings, a separately managed division of S&P Global. Descriptions in this news article were not prepared by S&P Global Ratings.