Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Aug, 2022

|

Workers at a cobalt mine in Congo. The country is a major cobalt producer and was one of several African nations visited by U.S. Secretary of State Antony Blinken during the week of Aug. 8, 2022. |

Electric vehicle battery-makers are reducing the amount of cobalt in their products in an effort to cut costs and avoid the stigma of buying a product fraught with troubling labor practices. But cobalt demand will soar anyway, due to the sheer volume of rising electric vehicle sales.

EVs will be a key part of the global drive to decarbonize the economy, and battery-makers face increased scrutiny from customers and investors. That means trying to cut back on purchases from Congo, which has a history of troubling cobalt mining labor practices, but is the world's largest producer of the metal by far. EVs can be made cheaper by reducing the contained cobalt, which is one of the most expensive parts of the battery, with prices jumping to more than $80,000 per tonne in March, according to S&P Global Market Intelligence.

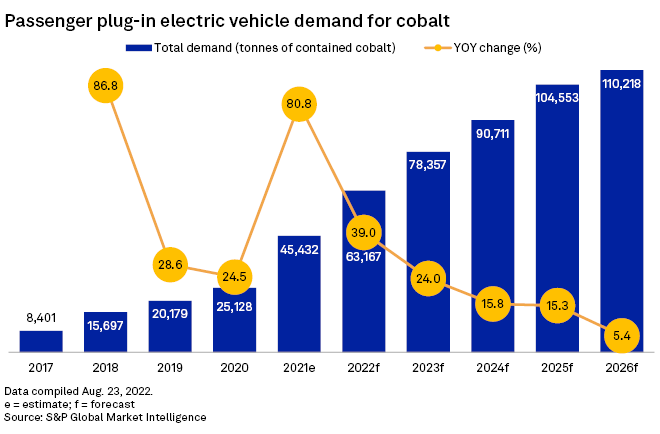

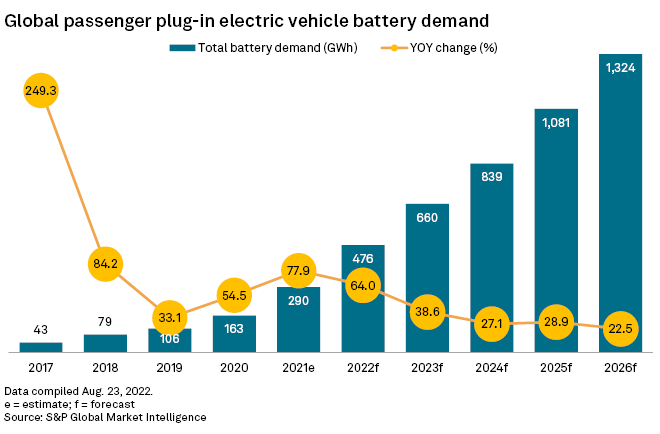

Battery-makers have heavily invested in developing new chemistries that use less cobalt than ever before, reducing their demand for the metal. But global annual passenger plug-in EV demand is expected to grow 127% to nearly 22 million vehicles by 2026, compared to 9.7 million anticipated sales in 2022, according to Market Intelligence data. That surge in demand will likely overwhelm any declines in cobalt demand generated by changing battery chemistries.

"Despite the prevailing transition to lower cobalt cathode chemistries and the growing share of non-cobalt chemistries, the cobalt bearing [nickel-cobalt-manganese] chemistry will remain the dominant chemistry in the foreseeable future," said Andries Gerbens, a physical trader at Darton Commodities. "Furthermore, the sheer absolute growth in EV sales will mean that EV-related cobalt demand will continue to accelerate in the years to come."

Less cobalt, cheaper batteries

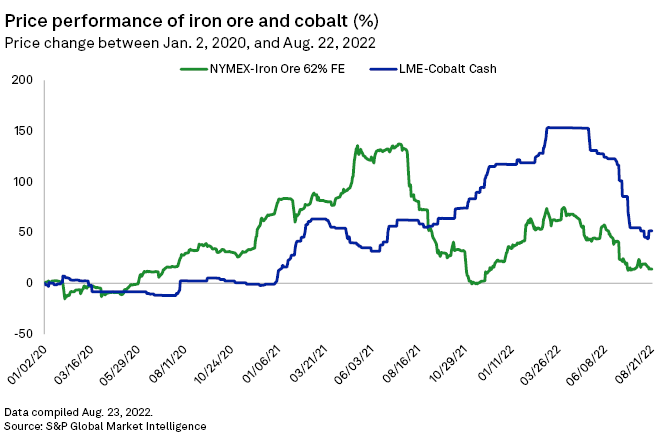

A key motivator for battery manufacturers to move away from cobalt is the high cost compared to other battery inputs. Cobalt prices have exceeded $50,000/t in 2021 and 2022, spiking to $82,840/t in March 2022, according to Market Intelligence data. And although prices for cobalt and industrial metals such as iron ore have fluctuated significantly in recent years, cobalt price changes have tended to be more volatile, particularly since fears of a cobalt shortage emerged in 2021.

New battery-cathode chemistries can contain six times less cobalt than earlier standards or more, potentially creating cost reductions for manufacturers.

Battery-cathode chemistries have shifted from 111 nickel-cobalt-manganese models, which use equal parts of each metal, to 622, 811 and even 9.5.5 chemistries, which would use just a half-part each of cobalt and manganese for every nine parts of nickel, Gerbens said.

"This trend substantially reduces the amount of cobalt used in a full ... electric vehicle battery," Gerbens added.

Solid Power Inc., a solid-state battery technology producer that holds partnerships with EV automakers including BMW AG and Ford Motor Co., plans to eventually adopt a new design based on an iron sulfide cathode free of cobalt.

"This [new] cathode design is expected to have incredibly high specific energy [in] watt-hours per kilogram with extremely low costs due to the abundance of the material," said Will McKenna, marketing communications director at Solid Power.

To put that in perspective, the price of cobalt stood at $51,500/t on Aug. 24, approximately 488 times higher than the $105.55/t cost of iron ore on the same day. Even when compared to other common battery inputs such as nickel, cobalt is more than 2.4 times more expensive.

"We expect the trend of lower cobalt intensity in EV batteries to continue, [in part] because cobalt is more expensive," said Alice Yu, senior analyst at Market Intelligence.

Overseas investments: A risky decision

Beyond simple price calculations, cobalt dependence frequently comes with geopolitical and ethical concerns that can add risk to supply chains.

Analysts expect EV battery-makers to continue reducing cobalt inputs to "de-risk the supply chain as the cobalt supply is highly concentrated," said Yu.

In 2020, eight of the top 10 cobalt-producing operations were located in Congo, according to Market Intelligence data. The country is frequently affected by political instability and plagued with labor concerns, making it a risky place for investment.

"[Automakers] and EV cell manufacturers are moving to higher nickel [and] lower cobalt chemistries," Darton Commodities' Gerbens said. "This has been driven by both cost considerations and concerns regarding unethical mining practices."

However, the relative size of Congo's cobalt reserves makes it almost impossible to

Cobalt demand from EVs is expected to reach 63,167 tonnes in 2022, increasing 74.5% to 110,218 tonnes by 2026. As a results, analysts forecast that EVs will surpass electronics as the largest end-sector for cobalt beginning in 2022, according to Yu.

Instead, cobalt end-users have said they avoid sourcing from cobalt mines that do not uphold best practices. Automobile manufacturers with EV models, including Tesla Inc., Ford and Nissan Motor Co. Ltd., have released statements or reports in recent years related to "responsible sourcing" standards.

At the same time, governments hoping to motivate a shift to EVs have expressed interest in taking a more active role in the management of Congo's cobalt exports. During the week of Aug. 8, U.S. Secretary of State Antony Blinken traveled to the country in part to discuss the role of the U.S. in "helping Congo responsibly develop its mineral sector," according to an Aug. 11 press briefing.

Reducing the cobalt inputs in batteries may help producers in Congo by slowing the acceleration of rising demand, giving them more time to improve their environmental and labor practices.

"In many ways, the shift towards lower volumes of cobalt on a per-cell basis may in fact be a positive for the cobalt industry, reducing the pressure on the supply side of the industry to keep pace with the levels of unprecedented demand growth," said Greg Miller, senior analyst at Benchmark Mineral Intelligence.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.