Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Jun, 2022

By David Feliba and Rehan Ahmad

The three largest lenders in Puerto Rico will likely maintain profitability in the next few years, industry experts said, even as consumers brace for rising inflation and the threat of a U.S. recession.

The likelihood of a contraction is growing in the U.S., as the Federal Reserve undertakes a tightening cycle to cool down the economy and tame consumer prices that reached 40-year highs in May.

But in Puerto Rico, where recession has been the norm for the past 15 years, banks are showing signs of cautious optimism.

"We are definitely feeling the pinch of all the things that are going on," Carlos Vázquez, Chief Financial Officer at Popular Inc., said. "We may have a recession in 18 months, and that would change things. But we are not there yet. At this point in time, we feel pretty positive about the economy and the current demand will continue to be quite good."

Puerto Rican banks have seen strong loan demand in the latest quarters, as conditions improved substantially in 2021, following the government's restructuring of its sovereign debt. The recent approval of over $50 billion in steady inflows from federal aid — due to both pandemic-related stimuli and to help rebuild infrastructure damaged by Hurricane Maria — raised hopes that the island could finally put an end to years of economic woes.

"The macro-environment could be the best it's been in more than a decade," Brett Rabatin, managing director with Hovde Group, said in an interview. "It has changed tremendously because they finally did get through the restructuring, and they still have a ton of funds that are going to be disbursed and allocated."

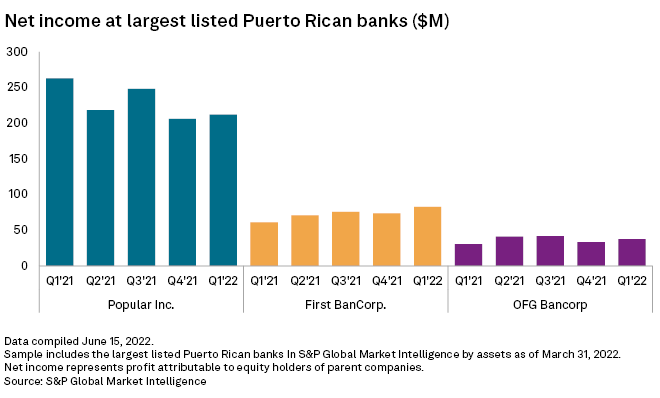

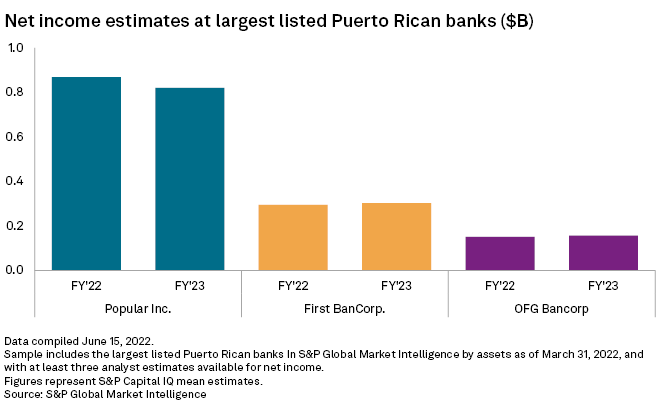

Two of the three main banks, First Bancorp and OFG Bancorp, reported year-over-year increases in net income for the first quarter of 2022. The positive trend is expected to continue for the two banks for the remainder of the year and into 2023, according to analyst estimates from S&P Global Market Intelligence. However, current estimates show an expected contraction in full-year net income for the largest lender, Banco Popular, whose net income is estimated to be $870 million for 2022.

In April, S&P Global Ratings raised the credit rating on First Bank to 'BB+' from 'BB' and that of Popular to 'BB+' from 'BB-'. The rating agency also affirmed the 'B+' issuer credit rating on OFG Bancorp.

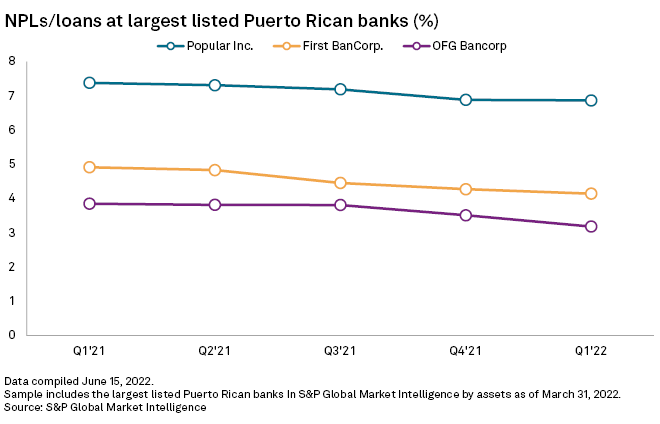

"The stable outlooks incorporate our view that the Puerto Rican banks will perform reasonably well over the outlook horizon, even though we expect asset quality metrics to remain worse than most rated U.S. banks," the rating agency said.

Ratings said "solid profitability" last year has benefited capital ratios, leaving lenders in a "good position" to weather a possible short-term impact from inflation and a decelerating economy.

As the conversation shifts to whether a likely recession would be short or prolonged, many in Puerto Rico believe that the massive size of inflows to the island will keep the economy afloat.

"If the U.S. is going to be in a recession, Puerto Rico could actually decouple from a GDP perspective and still have positive growth this year because of the funds," Rabatin said.

Lenders are bracing for a possible impact of rising gas prices on their loan portfolios, as the island's high reliance on automotive and truck transportation will likely put pressure on households.

Nonperforming loan ratios at listed banks have remained subdued throughout the pandemic and even declined in some cases in the first quarter of 2022. Popular's nonperforming loans-to-loans ratio receded to 6.87% from 7.38% in the year-ago period, while First Bank saw its ratio decline to 4.14% from 4.91%.

But even though bank analysts do not forecast a deep recession, they are still expecting delinquencies to tick up as COVID-19-related packages dwindle and inflation stymies debtors' capacity to repay loans.

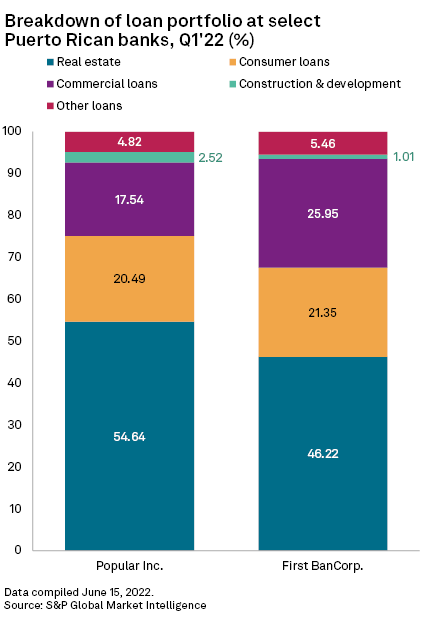

"I think the consumer segment will weaken at some point in Puerto Rico," Rabatin said. Popular and First Bank both have slightly more than 20% of their loan book allocated to consumer loans.

In that regard, banks are doing risk management ahead, but they are not expecting a dire scenario anytime soon.

"A long and deep recession would mean changing underwriting criteria and willingness to lend, adjust pricing … a number of things," Popular's Vázquez said. "And we are not there yet. We are not seeing any stress indications."

What is more, a period of several years of economic growth could also spur renewed opportunities. Once a vibrant industry, the construction sector in Puerto Rico has shrunk dramatically as a result of the 15-year recession.

Banks' tiny exposure to the sector speaks of that catastrophe. Less than 3% of the loan book is granted to companies in the construction industry. Now, with significant investment coming into the island, there is a chance that credit to the sector could be scaled back.