Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

3 Nov, 2022

The Consumer Financial Protection Bureau faces a bumpy road ahead if the GOP gains an expected majority in the U.S. House of Representatives in the Nov. 8 midterm elections.

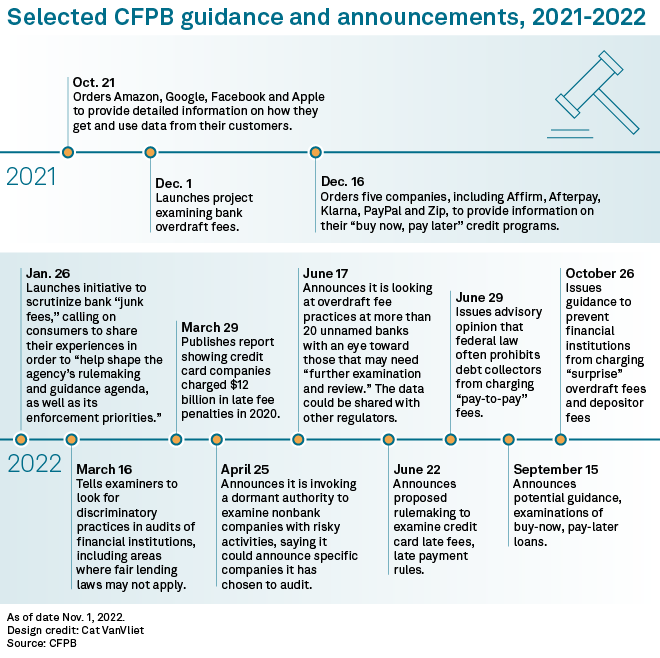

Republican lawmakers have voiced sharp opposition to the watchdog agency's power over the banking industry for years. Those complaints have only strengthened since CFPB Director Rohit Chopra took over in October 2021 and implemented an aggressive regulatory and enforcement agenda. Among other actions, Chopra has targeted junk fees, increased the power of the agency's examiners, launched numerous lawsuits against banks and other financial companies, and partnered with state regulators on enforcement actions.

|

While that agenda will not change under a House GOP majority, the agency may face a hostile Congressional environment as lawmakers attempt to slow down its work, former CFPB officials and analysts told S&P Global Market Intelligence.

"There's going to be enhanced scrutiny of everything the CFPB does," Jonathan Engel, co-leader of the enforcement and investigations practice within the banking services group at law firm Davis Wright Tremaine and a former CFPB enforcement attorney, said in an interview. "It's going to be a major distraction if you're trying to move enforcement or regulation forward."

Republicans warn of 'rigorous oversight'

Since taking the helm, Chopra has sued, fined or otherwise targeted some of the nation's biggest financial institutions, including Wells Fargo & Co., Bank of America Corp. and TransUnion. But if the GOP gains a majority in the House, the agency could face hostile hearings and potential legislation regarding its oversight and structure.

"There won't just be hearings, but hostile hearings," said Bert Ely, principal at bank consultancy Ely & Co. Inc. "They will beat up on the agency in the hope that the agency will back off."

One Republican representative warned of the oversight the CFPB would face if the GOP gains a majority in the House.

"We will perform rigorous oversight of the Bureau to stop its politically based attacks on U.S. companies," Rep. Blaine Luetkemeyer, R-Mo., ranking member on the House Financial Services Subcommittee on Consumer Protection and Financial Institutions, said in a statement provided to Market Intelligence.

The CFPB began prepping for increased Congressional oversight in July, when the agency announced in an internal memo that it ramped up hiring in its newly created Office of Oversight, American Banker reported.

What could come under scrutiny?

The CFPB's expansion of its examination manual to cover acts of illegal discrimination against borrowers is one of the issues that could come under scrutiny, Engel said. The manual is used to determine whether banks are using "Unfair, Deceptive and Abusive Acts or Practices," or UDAAP.

The U.S. Chamber of Commerce and several trade groups, including four banking groups, sued the CFPB in September, arguing that the expansion itself was illegal. Luetkemeyer said at the time that the lawsuit was "a welcomed statement that 'enough is enough.'"

The CFPB's wide-ranging attack on so-called junk fees, including recent guidance on overdraft and depositor fees, and its scrutiny of buy-now, pay-later arrangements are also likely to become targets of GOP lawmakers, according to Ian Katz, managing director at Capital Alpha Partners.

The agency's power structure would also likely come under pressure, Katz said. The CFPB was created under the Dodd-Frank Act in a way that largely insulates it from congressional actions. While the Senate confirms the director for a five-year term, that official can be removed only by the U.S. president. This has come under repeated attack from GOP lawmakers for years, who argue that Congress should have more oversight authority.

In recent years, Republican lawmakers have introduced legislation taking aim at the CFPB, including measures to replace the director role with a five-member bipartisan board. While those bills have failed to garner enough support to pass, House Republicans could try to pursue similar legislation.

"Republicans really do have it out for the CFPB," Katz said. "They ... think [Chopra] is pushing the limits or going beyond the limits of his authority. There's a particular animosity regarding the way that they believe Chopra is running the agency."

Katz said GOP lawmakers could be further emboldened by a recent decision that the CFPB's funding structure is unconstitutional from a three-judge panel on the Fifth Circuit Court of Appeals.

While the CFPB will likely appeal the decision, right now Republicans "feel like they've got the judiciary behind them as well. I think they feel it strengthens their arguments even more," Katz said.

CFPB agenda push continues

Despite the court's decision, the agency has continued to push ahead with its agenda . That push is expected to continue even if Republicans gain control of the House, Chris Willis, co-leader of the Consumer Financial Services Regulatory Practice at Troutman Pepper, said in an interview.

While House Republicans could create noise by distracting the agency with hearings and potentially introducing legislation, ultimately, little will change with President Joe Biden in the White House.

"In the short term, there's not much more they can do," Willis said. "They can pass all the legislation they want and the president will veto it."