Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

8 Feb, 2022

Banks are consolidating all types of branches, but closure rates have been especially elevated for in-store branches.

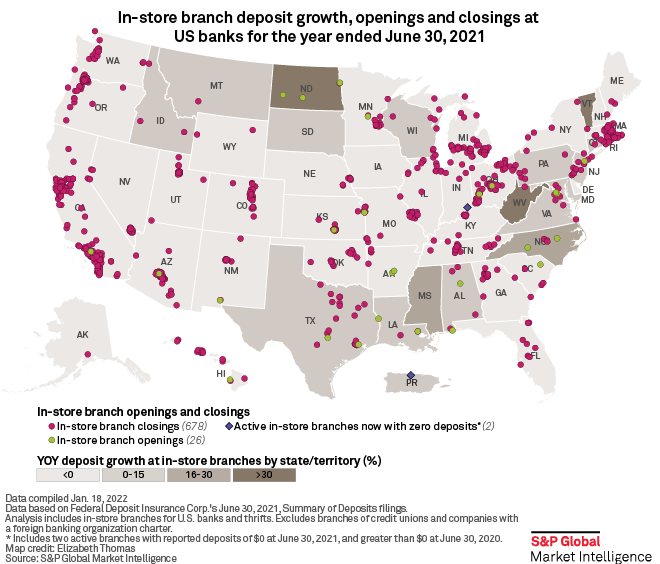

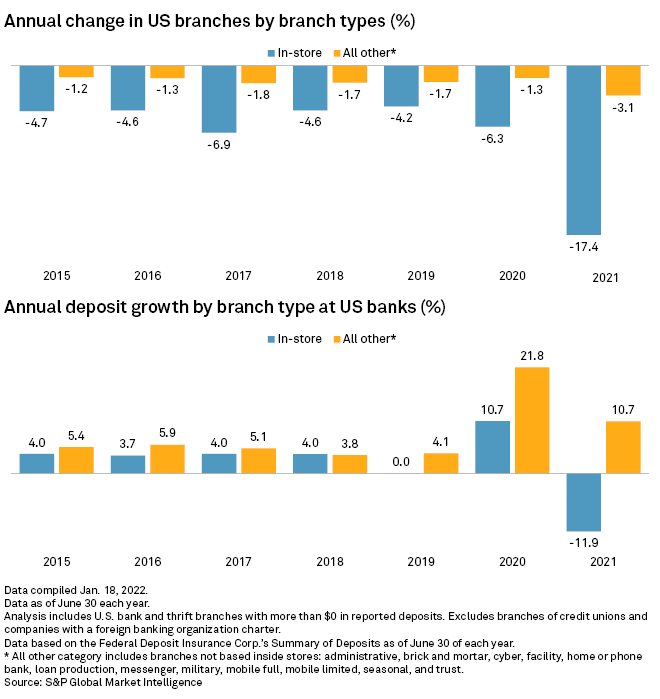

Banks shuttered 17.4% of their in-store branches, compared to a closure rate of 3.1% for all other branches, according to data for the year ended June 30, 2021. Since 2015, banks have closed 37% of their in-store branches compared to a net closure rate of 10% for all other branch types. In-store branches are typically small stores located within a retail business such as a grocery store. As a result of the closures, the portion of branches represented by an in-store location declined to 3.9% in 2021 from 5.5% in 2015.

The closure rate of in-store branches was so great that it helped drive a year-over-year decrease in deposits at a time when a crush of liquidity has pushed up deposit levels dramatically across the industry. The banking industry, in aggregate, reported an 11.9% year-over-year decrease in deposits at in-store branches in 2021, compared to a 10.7% year-over-year jump for all other types of branches.

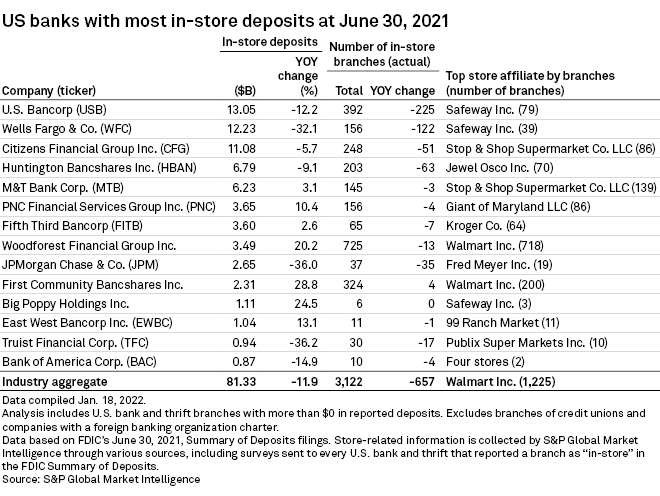

Large banks have been especially aggressive in moving away from in-store branches. U.S. Bancorp, which reported the most in-store branch deposits in the banking space in 2021 with $13.05 billion of such deposits, closed the most in-store branches in the year ended June 30. The superregional bank closed 225 in-store branches, on net, representing a 36% closure rate.

U.S. Bancorp CEO Andy Cecere highlighted the bank's branch-closing efforts, across all store types, during the company's Jan. 19 earnings call. Cecere said the closures have delivered greater efficiency and would remain a strategy moving forward. As the bank invests in financial technology, the company sees less need for an extensive retail branch network.

"Those digital capabilities allow us to do things more effectively and more efficiently. We've also optimized the branch network, and we're going to continue to focus on that," Cecere said, according to a transcript.

In-store closure rates were even larger at Wells Fargo & Co., which shrank its in-store branch footprint by 44%. JPMorgan Chase & Co. also closed more than 40% of its in-store branches in 2021, though the branch type was not an area of focus for the megabank with just 37 branches left as of June 30, 2021.

Woodforest Financial Group Inc. has been the bank most reliant on in-store branches. The company reported the most in-store branches with 725 locations as of June 30, 2021, and just 52 branches that were not classified as in-store. Nearly all of the bank's in-store branches, 718 of the 725, are located within a Walmart Inc. store. Woodforest also tops the list of banks most reliant on deposit service charges, the largest component being overdraft fees.