Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

7 Mar, 2022

|

Florida Power & Light's 409-MW/900-MWh Manatee Energy Storage Center is one of an emerging fleet of U.S. battery stations. |

Despite a snarled supply chain that forced significant project delays, U.S. developers of large-scale energy storage stations installed more batteries in 2021 than ever before — a trend that appears poised to continue.

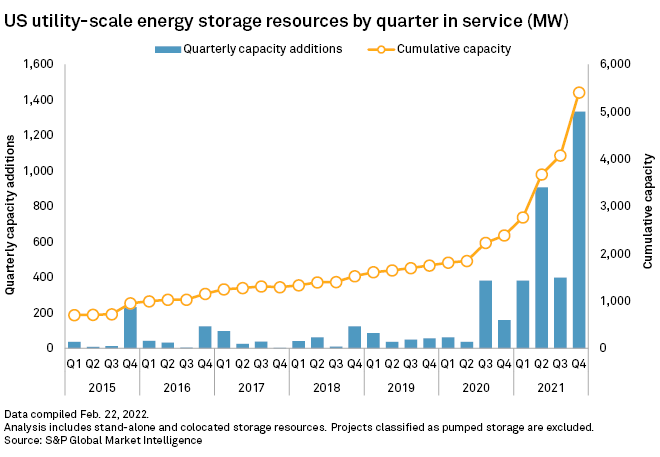

Developers added 1,335 MW of new power storage capacity in the fourth quarter of 2021, exceeding the previous two years combined, and energized more than 3,000 MW in 2021, according to S&P Global Market Intelligence data.

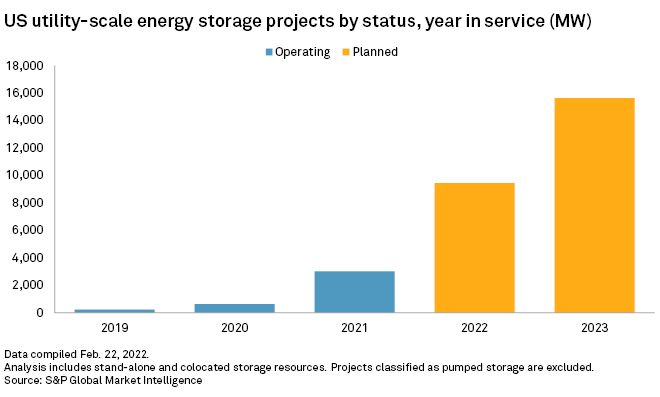

That surge pushed cumulative installed nonhydroelectric storage capacity to 5,410 MW entering 2022 and marked the start of a multi-gigawatt annual market. About 25 GW is planned to come online through 2023, including 9.4 GW this year and 15.6 GW in 2023, Market Intelligence data shows.

While developers had intended to complete over 5,000 MW last year, the still-robust expansion highlights the rise of electrochemical energy storage as a major resource for U.S. utilities and independent grid operators seeking to manage the variability of wind and solar energy and find alternatives to natural gas peakers.

The vast majority of projects completed in 2021 are lithium-ion battery systems with two to four hours of energy storage capacity. Nearly three-quarters of the power storage added in 2021 was located at generating facilities, mostly new and existing solar farms.

The largest such project completed last year was Florida Power & Light Co.'s 409-MW/900-MWh Manatee Energy Storage Center, which charges off the NextEra Energy Inc. utility subsidiary's FPL Manatee Solar Energy Center in Manatee County, Fla. Competitive generation affiliate NextEra Energy Resources LLC in 2021 also completed several battery projects at its Blythe and McCoy solar-plus-storage complex in Riverside County, Calif., totaling 523 MW/2,092 MWh.

Nearly 60% of the 25 GW of planned capacity through 2023 is co-located with other power plants, largely solar projects.

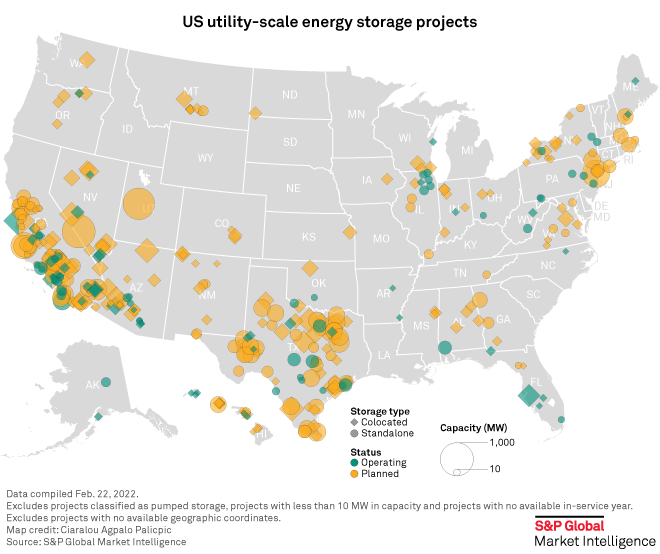

Centered in the Southwest

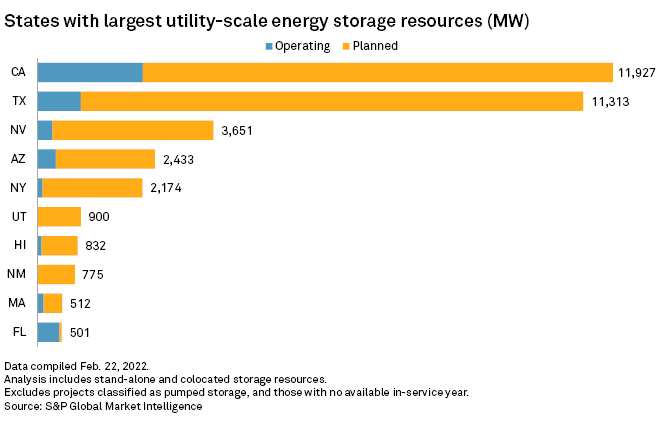

California and Texas are at the center of the U.S. energy storage market. Combined, the Golden State and the Lone Star State had nearly 3 GW of power storage capacity online entering 2022 and another approximately 20 GW planned, according to Market Intelligence data.

That does not reflect the deeper project development pipelines under study in the California ISO and Electric Reliability Council of Texas Inc. interconnection queues.

Substantial development is also underway in other Southwestern states, especially in Nevada, as well as in New York, Hawaii and Massachusetts.

Billed as the biggest such project in the world, Vistra Corp.'s Moss Landing Energy Storage Facility is an up to 1,500-MW project located at a gas-fired plant in Monterey County, Calif. Under contract with Pacific Gas and Electric Co., or PG&E, the facility ended 2021 with 100 MW/400 MWh online after 300 MW/1,200 MWh was taken out of service in September 2021.

Vistra intends to bring that capacity back online in the coming months and recently secured a new contract with PG&E for an additional 350 MW of four-hour batteries in 2023. Next to that facility, the PG&E Corp. utility this year plans to complete its 182.5-MW/730-MWh Elkhorn project, previously scheduled for completion in 2021.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.