Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

8 Jan, 2025

By Harry Terris and Hussain Shah

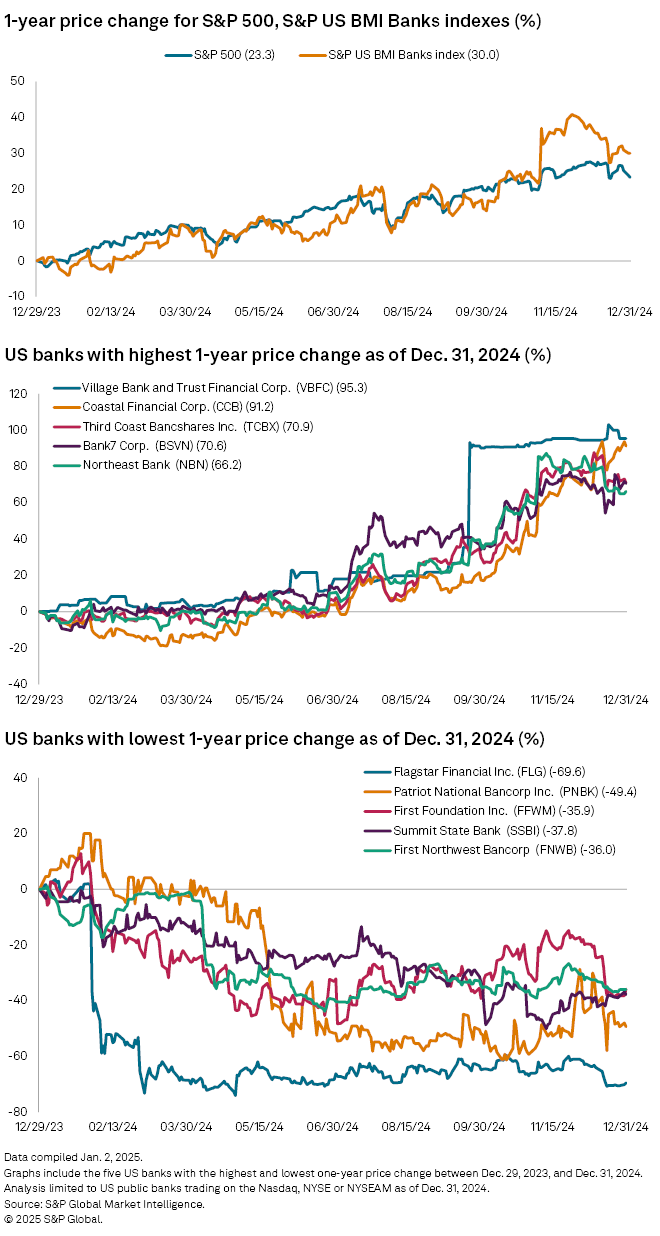

Outperformance by banks during a strong year for US equities broadly has investors wondering whether multiples are getting stretched.

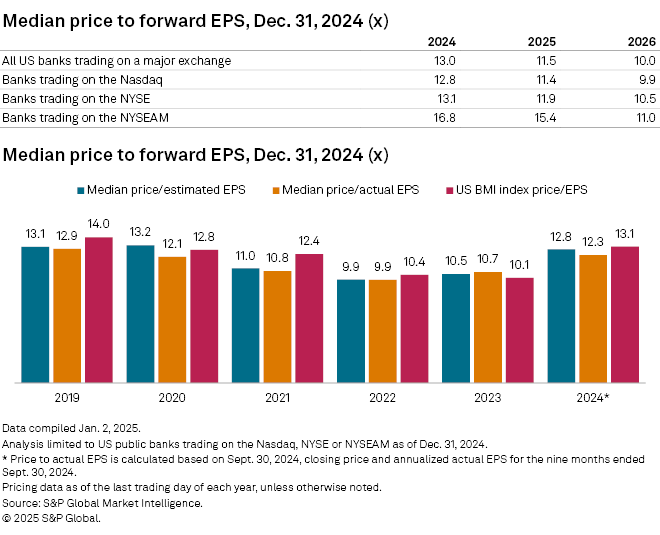

The S&P US BMI Banks index ended 2024 up 30.0%, even after a December swoon that took much of the air out of a post-election surge. That put bank earnings multiples at about their highest level in four years, and just a bit off multiples in 2019, right before the pandemic, according to data from S&P Global Market Intelligence. The median price to EPS for banks was 12.3x at the end of 2024, compared with 12.9x at the end of 2019.

The shift in sentiment reflects optimism about the net interest income outlook, looser regulation under the Trump administration, and fading worries about credit costs that were a center of focus only a year ago.

Analysts are generally confident about bank earnings growth, supported by a steeper yield curve and firming capital markets activity. Settling on where valuations should land is a more difficult matter, however.

"Without a doubt, this is the #1 question we've been asked by investors," analysts at Keefe Bruyette & Woods said in a note in December. The KBW analysts kept their "market weight" rating on the bank sector, though they identified "pockets of significant value" among the very biggest banks, which are poised to capitalize on momentum in Wall Street dealmaking.

|

– Set email alerts for future data dispatch articles.

– Download a template to generate a bank's regulatory profile.

– Download a template to compare a bank's financials to industry aggregate totals.

As bullish as ever

PNC Financial Services Group Inc., which already said it was on a trajectory for record net interest income in 2025, could put up records "again and again" over the next five years, Chairman and CEO William Demchak said during a conference in December 2024.

He described an uplift from assets repricing at higher yields as a long era of low interest rates appears to have come to an end. "It's as bullish as anything I've ever seen," Demchak said about the five-year outlook PNC recently presented to its board.

The rate environment has been a moving target, with markets currently anticipating fewer Federal Reserve cuts than they did a few months ago.

Still, while "we would have preferred a steady stream of measured rate cuts," Piper Sandler analysts said in a note Jan. 2, the net interest income "backdrop still looks quite positive given good deposit performance and better reinvestment rates."

Despite the favorable setup for banks, Demchak expressed emphatic qualms about valuations, saying that potential M&A targets are too expensive and that the "math doesn't work" for PNC.

He also offered a perennial caveat, saying, "We've never gone through a five-year planning period where something didn't blow up around us."

|

Investor positioning

Analysts have tracked growing investor interest in the bank sector.

Long-only funds increased their relative weight in financials by 3 percentage points over the last three months, BofA Global Research analysts said in a Dec. 30, 2024, analysis of disclosures by actively managed, large-cap mutual funds. Nevertheless, their exposure remains below the long-term average, and hedge funds, which tend to lead long-only funds, have moved more aggressively.

Another BofA Global Research measure, which tracks sell-side recommendations for allocations to equities as a contrarian indicator — when the recommended allocations get too high, it is time to sell — is approaching a "sell" signal across stocks, according to a Jan. 2 note. "Although a growing chorus of bulls increases the risk of complacency, our data show that sentiment can stay elevated for relatively long stretches before a bull market ends," BofA Global Research analysts said.

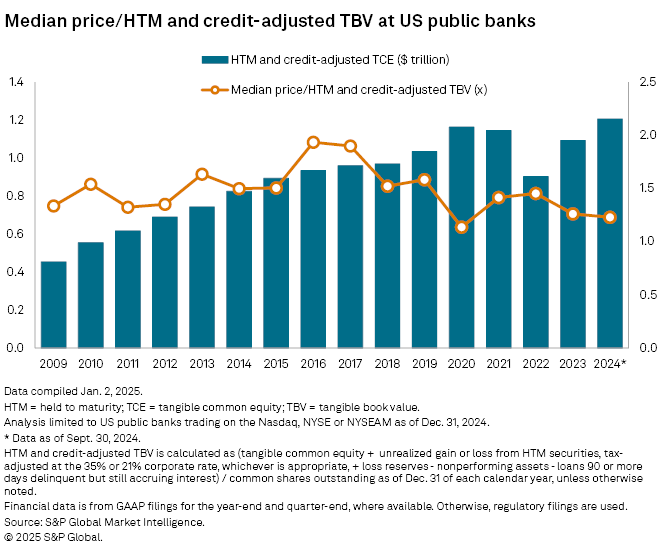

Perspectives on whether bank valuations are frothy vary according to different measures. As of the end of the 2024 third quarter, the US public banks' median price to tangible book value ratio was 123.0%, after adjusting for unrealized losses on securities and credit factors, according to data from Market Intelligence. That was lower than at any year-end since the Great Financial Crisis except for 2020. (A jump in medium- and long-term interest rates in the fourth quarter of 2024, which hurt bond values, likely put upward pressure on the ratio.)

Analysts at Raymond James expect banks to outperform again in 2025, though valuation has created "a challenging paradox for investors," they said in a December 2024 note. Expectations for earnings growth that have pulled bank allocations off "multi-year underweight positioning" will have to pan out for the sector to keep its momentum.

|