Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

4 May, 2021

By Ellie Potter and Meghan Gordon

Just over 100 days into President Joe Biden's term, the U.S. Department of the Interior has already taken several steps to enact his climate and clean energy policies while also taking aim at the fossil fuel sector.

|

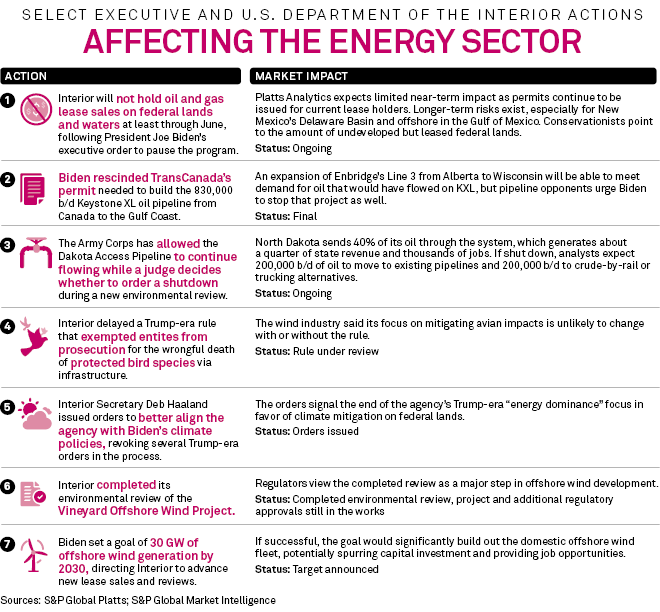

As part of his slew of climate- and energy-related executive orders, Biden called on Interior to pause new oil and gas leases on federal lands while the agency reviews the program, a move that drew swift condemnation from the industry and many Republican lawmakers. Biden also rescinded a presidential permit needed for the Keystone XL oil pipeline and directed Interior to help spur the development of 30 GW of offshore wind generation by 2030.

"Green lighting and expediting wind and slowing down or stopping oil and gas through the same agency sends a pretty clear signal," said Kevin Book, managing director of research firm ClearView Energy Partners LLC. "You kind of get a message, and I think that message is going to matter for investment."

Interior has always played a "critical role for energy production," but the Biden administration seems to be taking an even "more refined approach" in using the agency to advance its energy goals than the Obama administration, said Kelly Johnson, a partner with the law firm Holland and Hart.

"A lot of the folks at the Department of the Interior … have a lot of history in the agency," Johnson said. "They know the various bureaus, they know the statutes, they know the people that work there. So, they're in good stead to come in and implement an agenda, at least from the production side."

'More bark than bite'

So far, the Biden administration's fossil fuel decisions have not drastically changed the outlook for U.S. oil and gas producers. "There has been more bark than bite from this government," said Ash Singh, manager of supply and production analytics at S&P Global Platts.

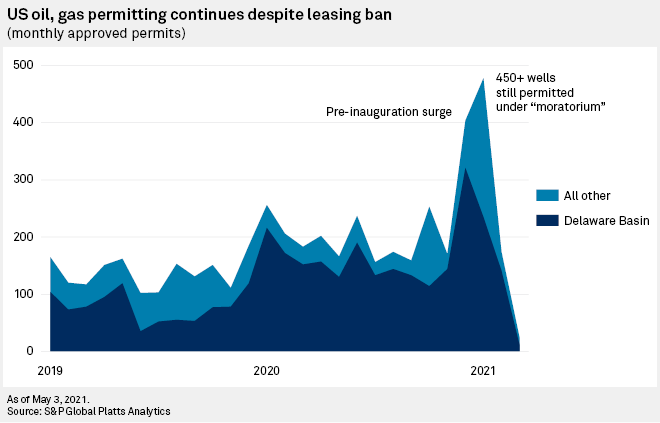

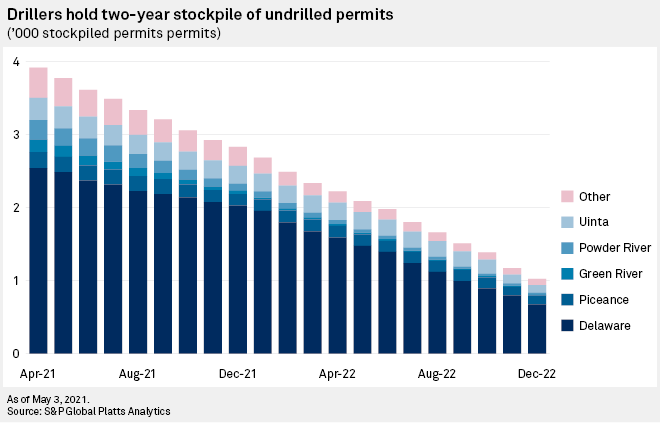

Drillers rushed to secure federal permits before the November 2020 election and January inauguration, and permitting has continued for holders of current leases. More than 450 permits have been issued since Interior's Jan. 27 order pausing lease sales, which is on par with previous years, Singh said. Operators hold nearly two years' worth of permits for undrilled wells.

"They were well-prepared if there was a federal drilling ban on the first day of this administration," Singh said.

Singh said he does not expect the Biden administration to make the leasing moratorium permanent, noting that lease sales might restart in the second half of the year, albeit possibly less frequently and under more scrutiny than in the past.

The leasing moratorium could lower U.S. onshore production by 1 million to 1.2 million barrels per day in the next five years, while risks to onshore production will not show up for at least 10 years, Singh said. Platts Analytics expects U.S. oil production to grow by 200,000-300,000 b/d in 2021 and by 1 million b/d in 2022, but it won't reach its pre-pandemic peak of 12.8 million b/d until at least 2023.

Cause for industry concern

The Independent Petroleum Association of America, however, is "very concerned that the temporary pause turns into a permanent ban," said Dan Naatz, executive vice president.

Although drillers are operating on existing leases, Naatz said, they're not able to start the long process of lining up all the pieces needed for new leases, which will create "a kink in the hose" months from now.

"You have to have a long horizon," Naatz said. "Sometimes from when you acquire a lease until you start exploration, not just production, can take years."

Naatz said the regulatory uncertainty will drive some drillers away from federal lands and the offshore Gulf of Mexico altogether.

"It's already difficult to operate on federal lands," Naatz said. "But as you make those regulatory hurdles so much higher, it really is a concern that it will really slow down production and people will leave."

Interior has not released a timeline for its leasing program review and faces several legal challenges to the pause. Courts tend to give new administrations deference to hire new staff, review the prior administration's actions and plan their path forward, "but that deference doesn't last forever," Johnson said.

"The longer that goes on, I think the more problematic that is going to be from a defensibility standpoint," Johnson said.

Book noted that the Biden administration could seek to modify what constitutes "available lands" to help skirt the Mineral Leasing Act requirement that Interior hold quarterly lease sales. The agency could also "make the economic opportunity less attractive" by shortening the life of federal leases, implementing higher royalty rates and rents, or modifying lease terms — all serving to reduce uptake without ending leasing entirely, he said.

"When we look at federal lands, the question is how far he goes into ending leasing," Book said. "Even the substantial curtailment of leasing would be a very significant change."

Offshore wind sees action

Changes are in the offing for the offshore wind industry as well. In January, Biden told Interior to map out a plan to double offshore wind generation by 2030. By late March, he launched a series of coordinated actions to foster the development of 30 GW of offshore wind by the end of the decade.

His administration also reversed a Trump-era legal opinion restricting Interior's ability to approve offshore wind projects, offering a broader interpretation of the statute. And it recently completed its environmental review of the Vineyard Offshore Wind Project, a proposed 800-MW wind farm that developers want to bring online in 2023.

Wind industry advocates have welcomed Biden's policies, touting the regulatory certainty such actions have created.

"Creating a stable policy platform for offshore wind development and facilitating the first wave of significant projects will provide certainty for the industry, strengthen the workforce, and revolutionize domestic supply chains up and down the coasts and across the country," American Clean Power Association CEO Heather Zichal said in a March 29 statement. "Now is the time to seize on this once-in-a-generation opportunity."

Meghan Gordon is a reporter for S&P Global Platts. S&P Global Platts and S&P Global Market Intelligence are owned by S&P Global Inc.