Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 4 Aug, 2021

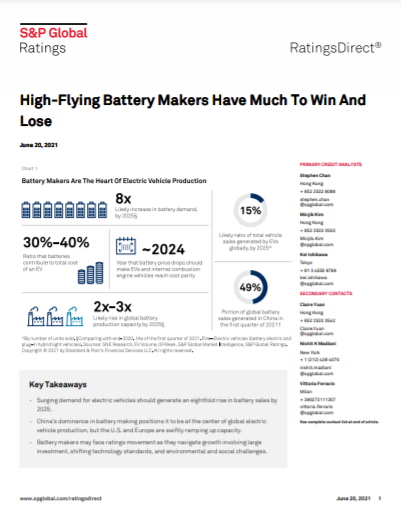

According to S&P Global Ratings report, the surging demand for electric vehicles should generate an eightfold rise in battery sales by 2025.China's dominance in battery making positions it to be at the center of global electric vehicle production, but the U.S. and Europe are swiftly ramping up capacity. It is expected that the global battery production capacity will grow two to three times by 2025, from 455 gigawatt hours (GWh) in 2020. However in the race for global battery dominance, battery makers may face ratings movement as they navigate growth involving large investment, shifting technology standards, and environmental and social challenges.

Discover the key factors that may impact on battery makers' credit health in their race to global battery dominance.

Download the full Report

Products & Offerings