Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 6 Oct, 2020

Opportunities for mobile virtual network operators in the 5G era lie in enterprise internet of things 5G instead of consumer 5G, according to panelists at MVNOs World Congress 2020, held virtually Sept. 15-17, 2020.

MVNOs World Congress is one of the largest global industry conferences focused on mobile virtual network operators. This year's gathering was originally scheduled to be held in Berlin on April 27-30, but the COVID-19 pandemic forced the event to turn virtual.

Omdia Principal Analyst and Practice Leader Dario Talmesio opened the first day of the conference by discussing the challenges and emerging opportunities for MVNOs amid ongoing industry trends such as 5G.

According to Talmesio, MVNOs are at the mercy of mobile network operators when it comes to 5G because MNOs control infrastructure rollouts. In the past, MNOs used to keep new technologies such as 4G to themselves because they wanted to reap a return on their heavy capital investments before offering wholesale access to MVNOs.

This has changed in the 5G era, said Talmesio. He noted that it only took months for some MVNOs to start offering wholesale 5G services after the 5G launch of MNOs. In South Korea, MNOs SK Telecom Co. Ltd., KT Corp. and LG U+ launched commercial 5G services for individual consumers in April 2019. MVNOs started reporting their own 5G subscribers just eight months later, in December 2019, according to official data from the local regulator.

US Mobile Founder and CEO Ahmed Khattak observed that the same situation exists in the USA. "There is definitely a shift — a seismic shift — with how operators are going about with 5G in America," said Khattak. Instead of holding back access to 5G for some time like they did with 4G before, major MNOs in the USA such as T-Mobile US Inc. and Verizon Communications Inc. opened the gates for wholesale 5G to MVNOs such as Xfinity Mobile and US Mobile quite quickly. U.S. Mobile, in particular, announced that it plans to officially launch 5G next month.

5G will impact wholesale pricing agreements, according to panelists. Because future 5G data usage will likely surpass current 4G data usage levels, keeping current wholesale contracts priced according to data usage might be disadvantageous to MVNOs, Talmesio argued. Instead, he suggested shifting to wholesale pricing based on the number of SIM connections in a network or based on speed.

Related to this is the consensus of panelists that growth potential for MVNOs lies more in enterprise 5G rather than consumer 5G. Instead of simply offering MNO-based connectivity, MVNOs will benefit by focusing and specializing in business-to-business 5G use cases in order to differentiate themselves from the crowd. These use cases rely less on high data volume (eMBB) and more on high reliability (URLLC) and massive connectivity (MMTC) of 5G networks.

This affirms what industry leaders have speculated in earlier conferences such as ITU Telecom World 2018 and Telecoms World Asia 2019: that 5G will be the catalyst for the rise of focused and specialized MVNOs.

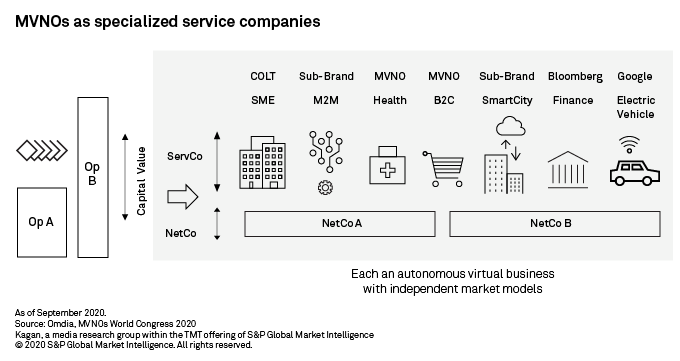

Specialized MVNOS can be useful for MNOs who are looking for ways to segment their user base. Talmesio mentioned that this is a great opportunity for MVNOs since many MNOs are starting to offer multiple, niche-focused brands to serve specific segments of the market.

Referencing a study published by McKinsey & Company Inc. in January 2020, MDS Global Ltd. CEO Steve Bowen said letting MVNOs take differentiated roles is ultimately financially beneficial to MNOs.

Bowen suggested that MNOs should focus on being "network companies" — that is, maintaining networks and offering connectivity. MVNOs, on the other hand, should become "service companies" that focus on delivering specific services enabled by 5G, such as electric vehicles, finance and banking, healthcare and others.

Several specialized MVNOs showcased their services in the summit, such as finance-focused Standard Bank Mobile by Standard Bank Group Ltd. in South Africa and healthcare-focused Lanmao Mobile from China.

Bowen added that in order to catch all these opportunities, MVNOs need to start adopting "frictionless technologies" such as cloud-based networks and eSIM. 5G network slicing will make it easy for MNOs and MVNOs to switch from one network to another to serve varied business use cases, according to Bowen. Having a cloud-based network is essential to make this business model possible.

ESIM or embedded SIM, on the other hand, can be a potential revenue-generating and customer-retention tool for MVNOs, according to Khattak. It has applications not only in consumer connectivity but more importantly in B2B internet of things solutions such as wearables and remote devices. Talmesio mentioned that the market for eSIM has matured, with every major original equipment manufacturer now supporting eSIM. Cross-border SIM and eSIM solutions are currently a major revenue source for both MNOs and MVNOs serving the interconnected markets of Hong Kong, Macau, mainland China and Taiwan.

The bottom line is that 5G and ongoing trends offer a ton of opportunities, but that MVNOs must be willing to transform in order to grab these opportunities, according to panelists. "MVNOs need to be faster and digital before the big guys if they want a space for themselves in the market," according to Talmesio.

Wireless Investor is a regular feature from Kagan, a media market research group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

Research

Blog