Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jun 15, 2022

By Michael Dall

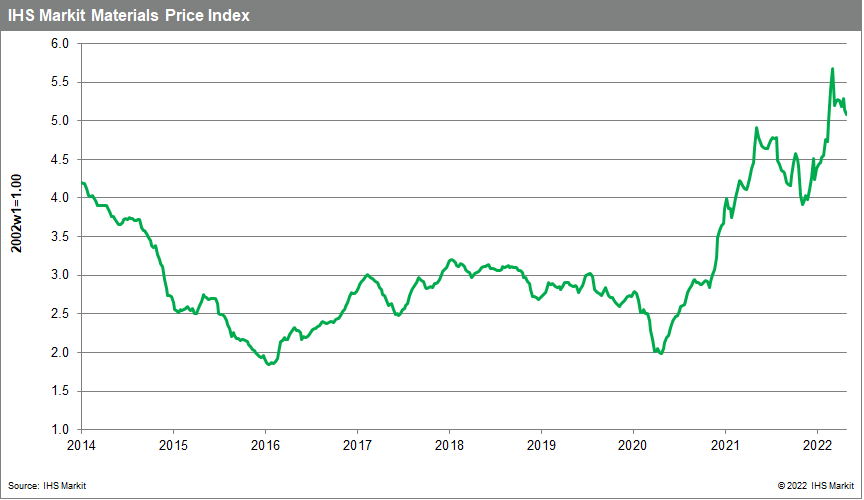

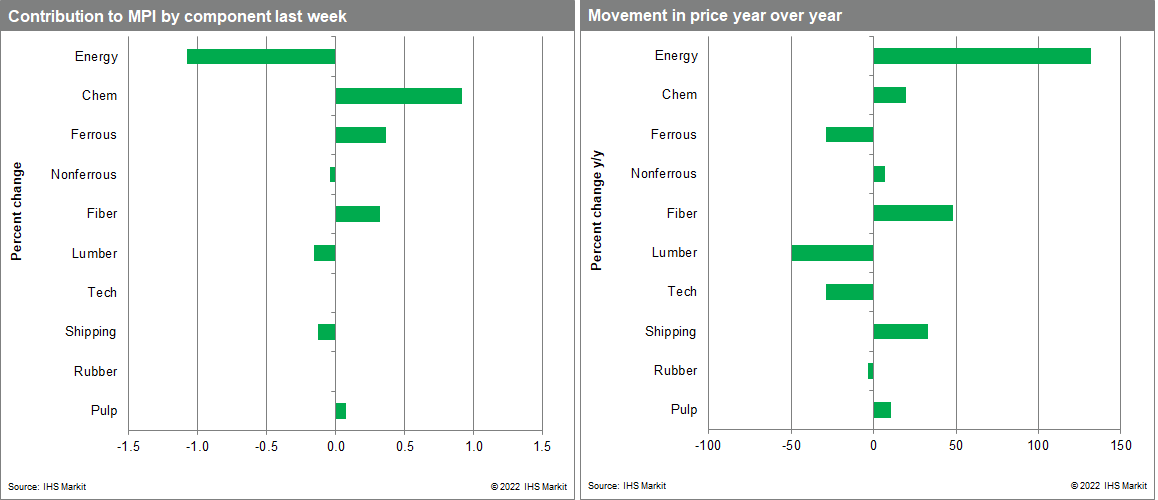

Our Markit Materials Price Index (MPI) rose 0.3% last week, following on from a 1.4% increase the previous week. This is the first time the MPI has increased for two consecutive weeks since March. However, commodity markets are currently gripped with uncertainty; demonstrated by the fact that only four of the ten subcomponents in the MPI rose last week. The general direction of commodity prices has been down over the past three months with the index now 12% lower than its all-time high established in early March.

Chemical and steel prices were the two largest upward movers last week. The chemical sub-index increased 5.2%, its biggest weekly rise since early March which was the immediate aftermath of the Russian invasion of Ukraine. The fallout from the Russia-Ukraine war, and the associated sanctions placed on crude oil products, were the major reason behind the rise in chemical prices last week. Benzene is a co-product of petroleum, so the recent rise in the Brent oil price above $120/bbl has sent global benzene prices to an all-time high. Asian benzene was up by $120/metric ton last week, the joint highest weekly increase ever recorded. Higher chemical costs have also driven up our fiber index in recent weeks. Polyester prices are at levels not seen since December 2018 as feedstock costs soar. In metals markets, the steel making raw materials sub-index increased 3% as the price of iron ore breached $140/tonne for the first time in over a month. Traders were reacting to continued easing of COVID-19 restrictions in mainland China with Beijing authorities announcing the resumption of public transport in most districts.

US equity markets suffered their worst week since January as the latest US inflation data showed elevated and more persistent consumer price pressure. The US equity market, as measured by the S&P 500 index, has now fallen in nine of the last ten weeks. US CPI inflation rose to another 40-year high in May. The 12-month change in the CPI increased 0.3 percentage point to 8.6% in May, the highest since December 1981. Inflation is unacceptably high, unemployment unsustainably low, and inflation expectations have crept above the Fed's long-run 2% objective. In addition, the European Central Bank meeting last week heralded an unprecedented signalling of successive policy rate hikes at its next two meetings, including increases potentially larger than 25 basis points at the latter, highlighting the central bank's heightened concerns over persistent, exceptionally high inflation and related risks. IHS Markit believes the data will soon show a peak in inflation, though its retreat over the next year may prove to be painfully slow. The looming threat, however, is in energy markets where growing physical tightness over the next six months may trigger record oil prices by year-end.

Posted 15 June 2022 by Michael Dall, Associate Director, Pricing and Purchasing, S&P Global Market Intelligence

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.