Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Mar 23, 2023

By Michael Dall

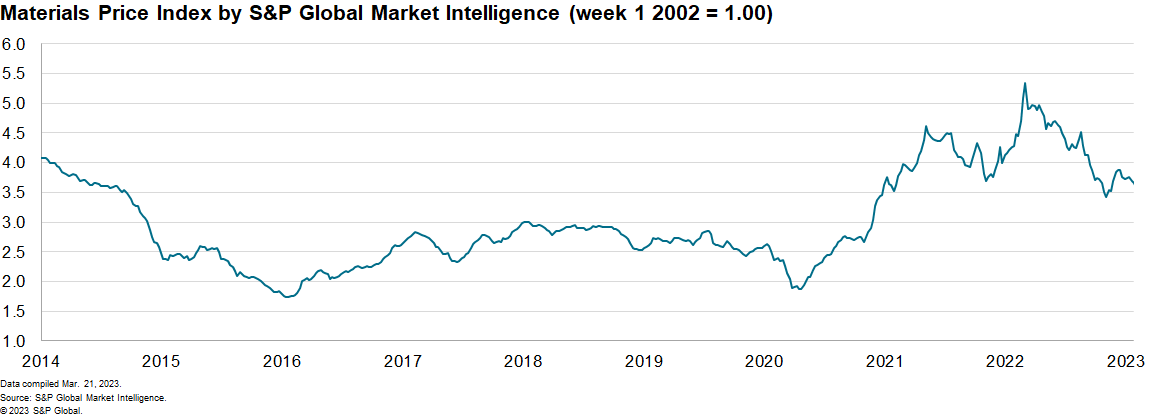

The Material Price Index (MPI) by S&P Global Market Intelligence decreased 0.1% last week, re-establishing downward momentum after two consecutive increases. The fall was broad with seven of the ten subcomponents declining. The MPI sits 29.4% lower year on year (y/y) which was the all-time peak. Prices, however, remain far higher (40%) than the pre-pandemic levels of the fourth quarter 2019.

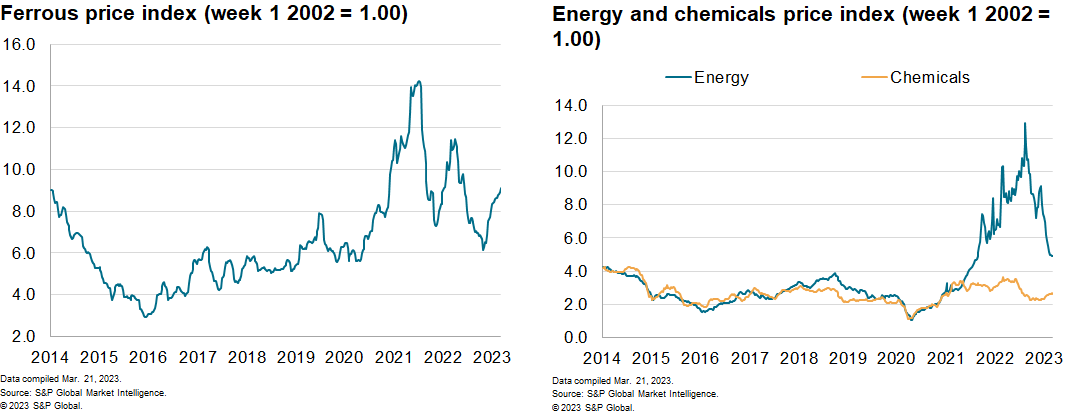

Oil prices slid last week bringing the energy sub-index down by 0.2%. Brent crude, the international benchmark, fell to $73 a barrel the lowest level since December 2021. Prices at the start of this month were $85 a barrel with the tumult in financial markets over the past two weeks sparking a major sell-off by oil traders. Markets are concerned that the fallout from the collapse of Silicon Valley Bank will hit economic growth and lower demand for oil. Similar sentiments dominated industrial metal trading last week with the nonferrous metal sub-index down 1.9%. Elements of the MPI showed strength last week with the lumber sub-index soared 10.3% after positive housebuilding data in the US. Single-family permits jumped a solid 7.6% to a 777,000 annual rate in February, the first increase in a year. Single-family permits are considered a better indicator than housing starts as they are accurately measured, not affected by weather as much, are forward-looking, and are not changed much by data revisions. Lumber prices have been in retreat over the past year as mortgage rates have soared and while it is premature to state that housing's slide has ended it is an indicator that prices will have some upside in the near term.

Markets continue to grapple with mixed signals on global economic growth, but sentiment turned more bearish last week. Bank shares slid further following the collapse of the Silicon Valley Bank, and the risk of contagion to other markets remains high. The announcement of a further 0.5% interest rate rise by the European Central Bank added to the gloom last week. On balance, markets still expect central banks to continue to implement interest rate rises in 2023. In the US, despite the financial turbulence surrounding the failure of Silicon Valley Bank, S&P Global Market Intelligence expects the Fed to continue with at least one more rate hike, with perhaps more to come if financial stability concerns continue to wane and inflation remains at unacceptably high levels. This, combined with falling energy costs for producers, will ultimately lead to lower commodity prices overall this year.

![]()

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.