All major US and European equity indices closed higher on the week, while APAC was mixed. US and benchmark European government bonds closed sharply higher on the week. European iTraxx and CDX-NA closed tighter week-over-week. The US dollar, natural gas, gold, and silver closed higher on the week, while oil and copper were lower.

Americas

All major US equity markets closed higher on the week; Russell 2000 +6.1%, Nasdaq +3.1%, S&P 500 +2.0%, and DJIA +1.4% week-over-week.

10yr US govt bonds closed 1.45% yield and 30yr bonds 1.89% yield, which is -11bps and -5bps week-over-week.

DXY US dollar index closed 94.32 (+0.2% WoW).

Gold closed $1,817 per troy oz (+1.8% WoW), silver closed $24.16 per troy oz (+0.9% WoW), and copper closed $4.34 per pound (-0.6% WoW).

Crude Oil closed $81.27 per barrel (-2.8% WoW) and natural gas closed $5.63 per mmbtu (+1.8% WoW).

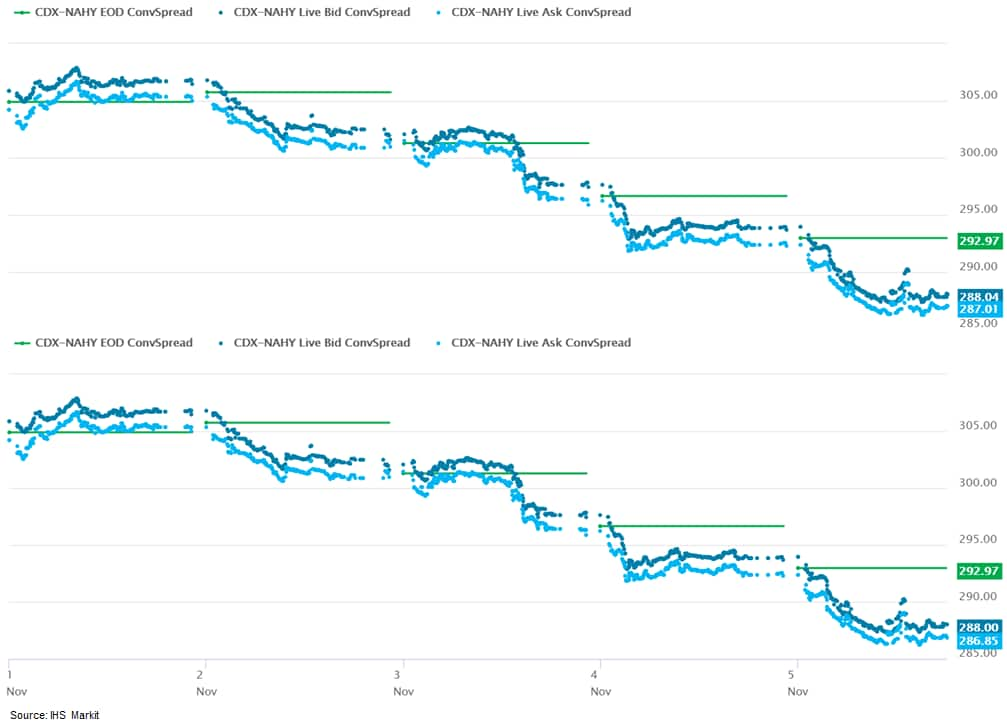

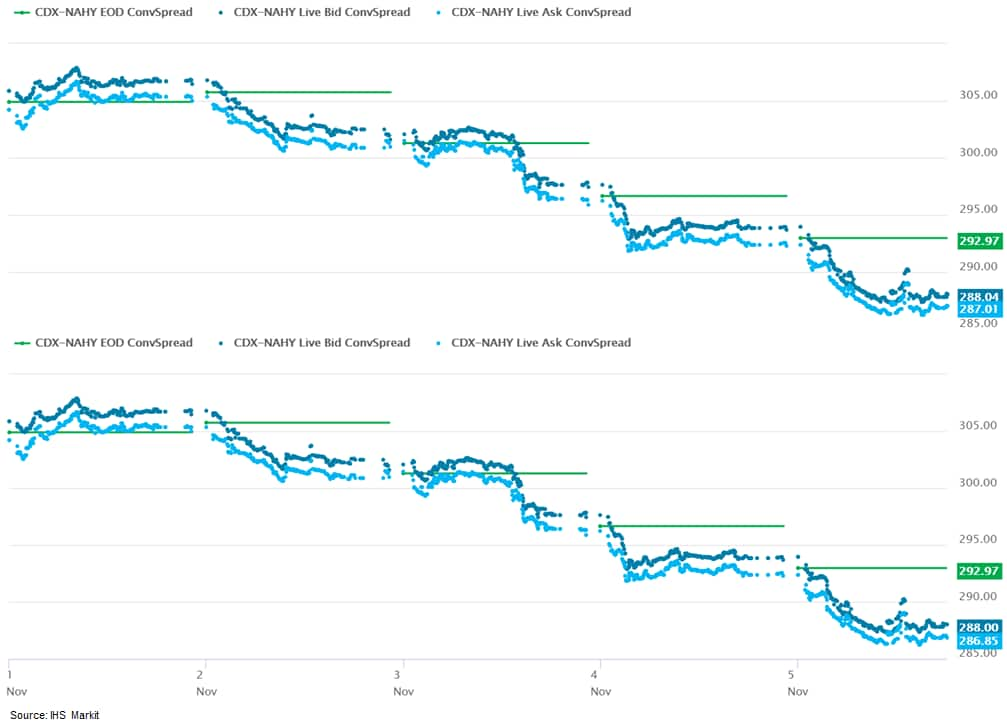

CDX-NAIG closed 49bps and CDX-NAHY 288bps, which is -3bps and -17bps week-over-week, respectively.

EMEA

All major European equity indices closed higher; Italy +3.4%, France +3.1%, Germany +2.3%, UK +0.9%, and Spain +0.8% week-over-week.

Major 10yr European government bonds closed sharply higher on the week; Italy closed -30bps, France -22bps, Spain -21bps, UK -19bps, and Germany -17bps week-over-week.

Brent Crude closed $82.74 per barrel (-1.2% WoW).

iTraxx-Europe closed 48bps and iTraxx-Xover 243bps, which is -3bps and -19bps week-over-week, respectively.

APAC

Major APAC equity markets closed mixed on the week; Japan +2.5%, Australia +1.8%, India +1.3%, South Korea flat, Mainland China -1.6%, and Hong Kong -2.0% week-over-week.

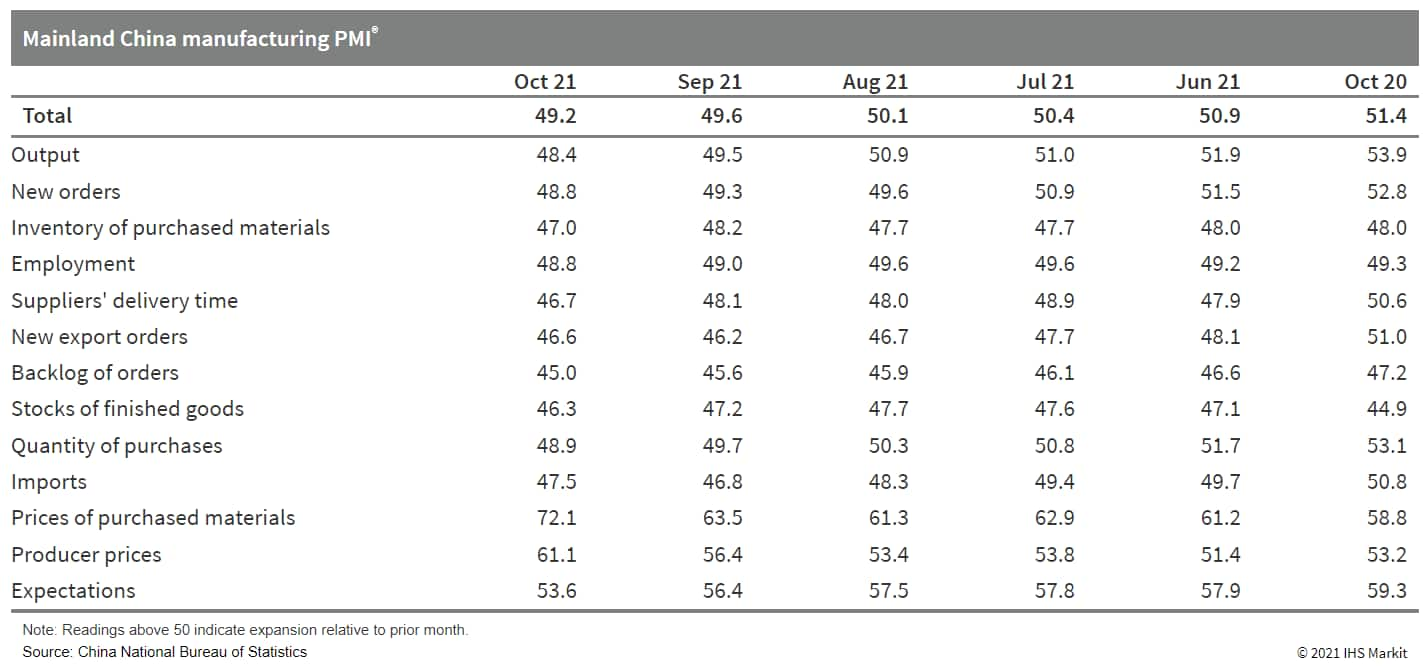

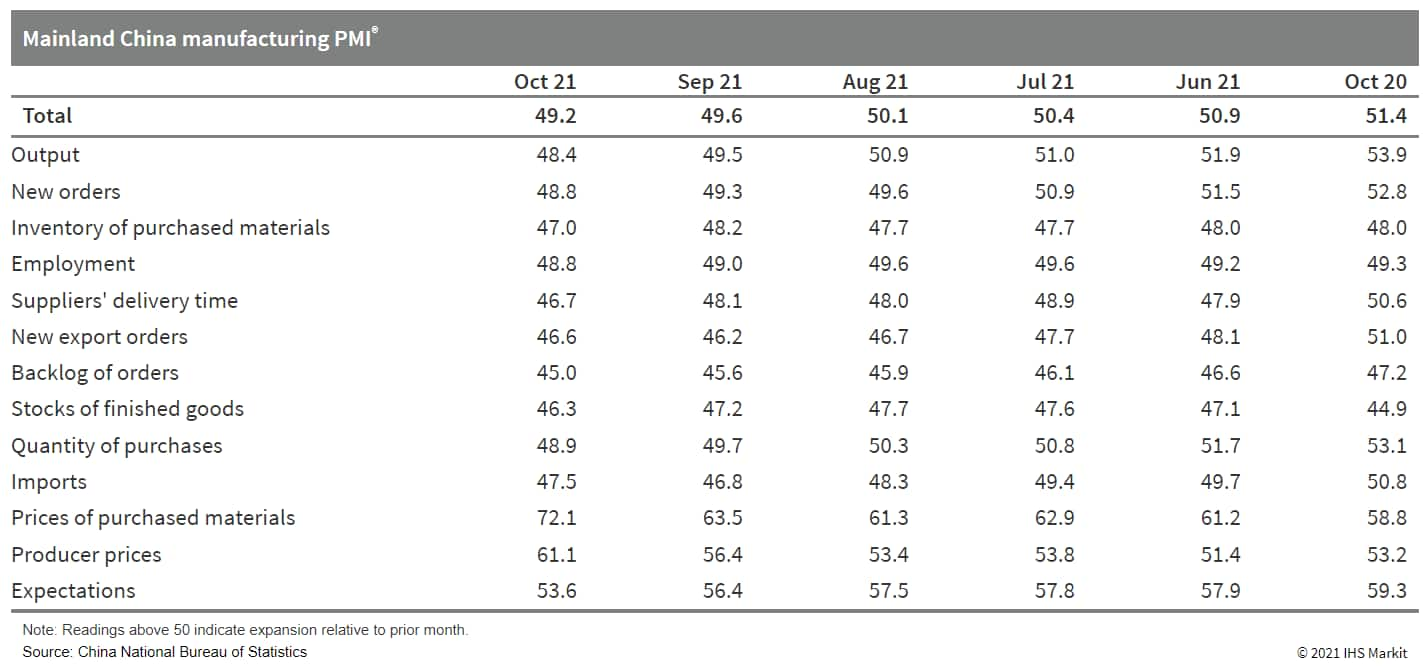

- Mainland China's official composite output purchasing managers' index (PMI), covering both manufacturing and non-manufacturing sectors, fell by 0.9 point from the previous month to 50.8 in October, with an acceleration of contraction in manufacturing and slower expansion in services and construction. (IHS Markit Economist Yating Xu)

- Mainland China's official manufacturing PMI declined by 0.4 point to 49.2, after a 0.5-point drop in the previous month as both demand and supply remained sluggish amid power crunch and raw material shortages. The breakdown of the survey showed that output and new orders both declined at a faster clip than in September. New export orders dropped for the sixth month in a row, while at a slower pace driven by the United States' strong consumption during Halloween and the upcoming Black Friday and Christmas.

- Manufacturers have been facing high inflationary pressure as prices of purchased materials surged at the fastest pace since June. Output prices also registered the fastest rate in recent years. Under the rising cost and weakening demand, inventory of purchased materials and finished goods both declined at faster paces compared with a month ago. Manufacturing growth outlook further weakened as expectations sub-index dropped to the lowest since March 2020.

- By scale of firms, the decline in manufacturing PMI was largely driven by faster contraction in medium-sized firms and continuous weakness in small firms, while the figure for large firms remained in expansion. Specifically, output sub-index for small firms declined to the lowest since the start of the pandemic while large firms' production improved. By sector, energy-intensive industries continued to lead the headline decline while high-tech and equipment manufacturing remained in expansion.

- Mainland China's non-manufacturing business activity index fell by 0.9 point to 50.8, staying in expansion territory for two consecutive months. Both service businesses and construction PMI moderated owing to the escalated pandemic control in response to the spread of Delta virus and the rising input prices. Telecommunication maintained robust growth and holiday-related catering and accommodation showed acceleration from September, while transportation sub-index declined to low 50 and finance and real estate remained in contraction territory.

- The seasonally adjusted IHS Markit U.S. Manufacturing Purchasing Managers' Index™ (PMI™) posted 58.4 in October, down from 60.7 in September and below the earlier released 'flash' estimate of 59.2. The latest improvement in the health of the U.S. manufacturing sector was sharp, despite being the weakest for ten months. (IHS Markit Economist Chris Williamson)

- Contributing to the overall upturn was a steep rise in new business at manufacturing firms in October. Companies continued to highlight strong demand conditions, but some noted that raw material shortages were hampering demand from clients as stocks of inputs had already been built or delivery times were too extensive.

- The pace of new order growth was the slowest for ten months. New export sales rose only fractionally as foreign demand was also weighed down by the knock-on effects of uncertain supply.

- Despite marked increases in costs, firms expanded their input buying sharply again in October. Although at the slowest pace for seven months, companies attributed higher purchasing activity to efforts to build stocks amid greater new order inflows. Meanwhile, stocks of purchases rose only modestly as firms utilized current input holdings to supplement production.

- Similarly, stocks of finished goods fell solidly as companies sought to meet new order deadlines. Backlogs of work rose markedly, and at one of the sharpest paces on record as firms grappled with pressure on capacity. The rate of growth eased to a four-month low, however, as employment increased at a solid pace.

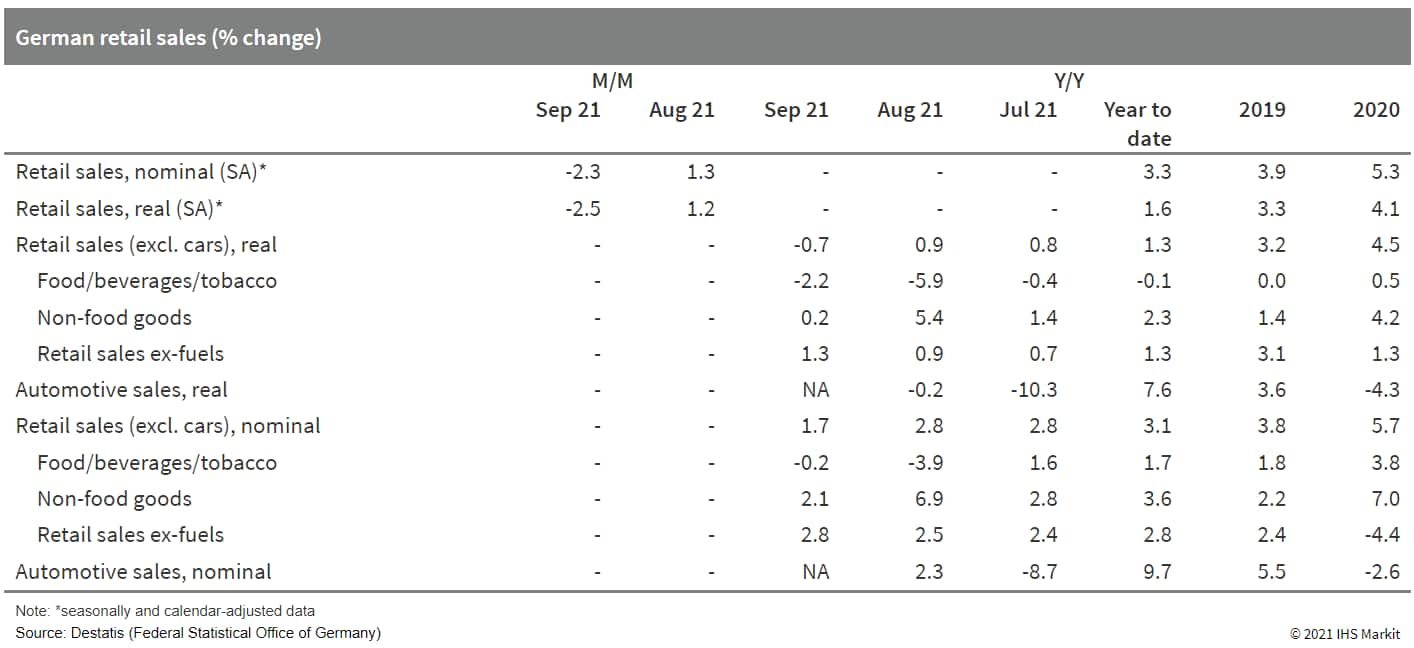

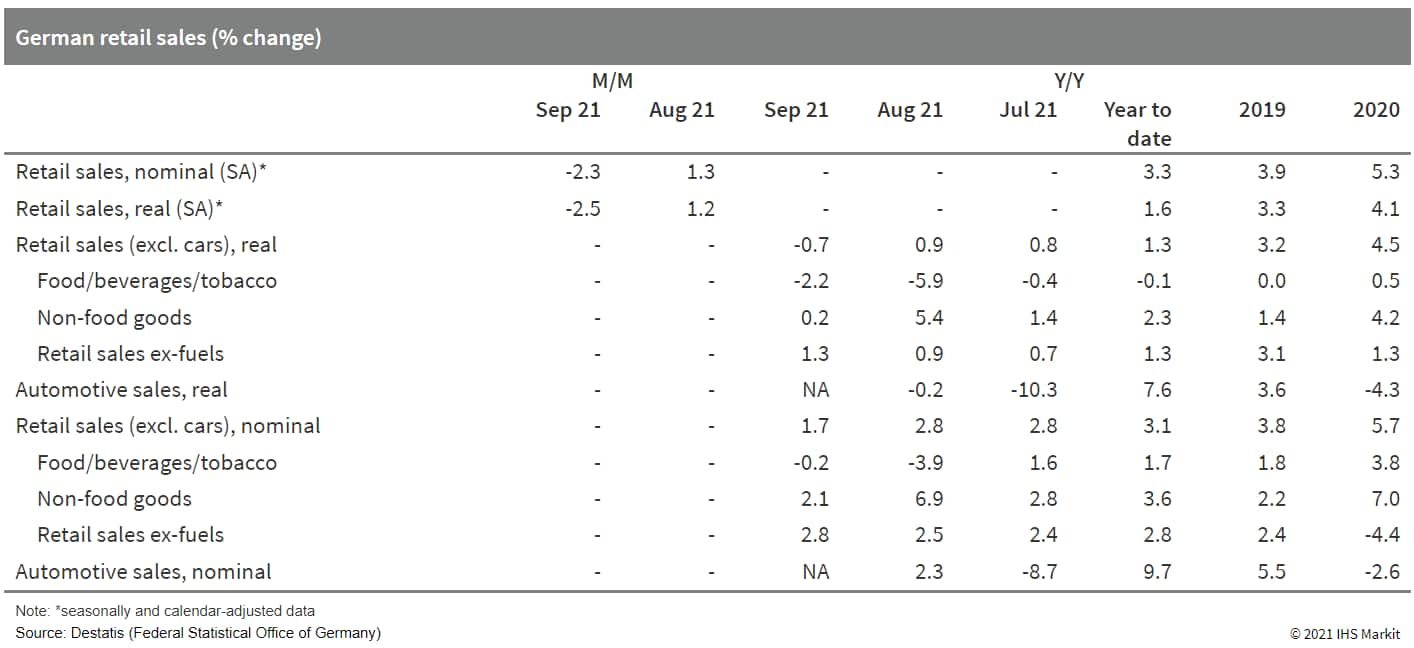

- According to German Federal Statistical Office (FSO) data, real retail sales excluding cars declined by 2.5% month on month (m/m; seasonally and calendar adjusted) in September. Combined with net declines during July-August, the level of real retail sales is now broadly where it was in September 2020 ahead of the second wave of the pandemic that eventually triggered another lockdown in December. (IHS Markit Economist Timo Klein)

- On the bright side, price- and calendar-adjusted retail sales still were around 4% higher in September 2021 than in February 2020, the last pre-pandemic month.

- September's breakdown by goods category, based on price-adjusted year-on-year (y/y) data (total -0.7% without shopping-day adjustment; details see table below), reveals another underperformance of food versus non-food sales, as in August. Food sales were 2.2% below year-ago levels whereas non-food sales increased by 0.2% y/y. Among the latter, 'internet and mail orders' re-established their traditional lead at 18.8% y/y, followed by pharmaceutical/cosmetic goods at 6.9% y/y. All other major categories experienced a decline in sales, foremost clothing/shoes at -14.2% y/y - this corrects for an unusual spike of 8.3% in August. Sales at general department stores (-9.7%) and of 'furniture/household goods/DIY' (-9.0%) also did badly, while sales at specialized shops lost only moderately (-1.9%).

- The G20 nations vowed to end public financing for overseas coal power plants and showed ambition about limiting global warming to 1.5 degrees Celsius above pre-industrial levels, but critics said the pledges lack new, clear objectives that can inject momentum into the COP26 talks. (IHS Markit Net-Zero Business Daily's Max Lin)

- The EU and 19 of the world's largest economies, responsible for over three-quarters of GHG emissions globally, concluded their latest summit in Rome 31 October as the UN climate talks began in Glasgow.

- Of the G20 nations, Australia, Canada, China, France, Germany, Japan, Italy, South Korea, Turkey, the UK, and the US had made similar pledges earlier.

- Many researchers believe that coal, as the most carbon-intensive fossil fuel, needs to be phased out in the power sector by 2040 to avert climate disaster.

- Since the Paris Agreement was sealed at 2015's COP21, the global pipeline of proposed coal-fired power plants has collapsed by 76%, or 1,175 GW, an analysis by think-tank E3G showed.

- The G20 refrained from committing to a phaseout date for domestic coal power generation. Among its members, China and India accounts for nearly two-thirds of the world's coal demand.

- Hyundai and Kia are partnering with Massachusetts-based electric vehicle (EV) battery startup Factorial Energy to test its novel solid-state battery technology and the battery's integration in Hyundai EVs, according to a press release by Factorial Energy. "Under the Joint Development Agreement, which includes a strategic investment, the companies will integrate Factorial technology at the cell, module, and system levels, perform vehicle-level integration, and co-develop specifications for manufacturing Factorial's batteries," the company said in its official statement. According to the battery startup, Hyundai's investment is its first major strategic investment from a major automotive group. It said that Hyundai's investment in Factorial would further deepen its existing research relationship with the South Korean automaker. Factorial is known to have developed a breakthrough solid-state technology that addresses key issues holding back the wide-scale consumer adoption of EVs, including driving range and safety. According to Factorial, its battery cell advances are based on FEST, which stands for 'Factorial Electrolyte System Technology.' It leverages a proprietary solid electrolyte material that enables safe and reliable cell performance with high-voltage and high-capacity electrodes and has been scaled in 40Ah cells that perform at room temperature. (IHS Markit AutoIntelligence's Jamal Amir)

- US President Joe Biden announced a range of domestic actions aimed notably at the oil and natural gas sector that the White House said will help as part of a push to reduce nearly one-third of worldwide methane emissions by the decade's end under a global pledge launched with the EU on 2 November. (IHS Markit Net-Zero Business Daily's Amena Saiyid)

- Released on the second day of the UN COP26 meeting in Glasgow, the actions recognize the opportunity capturing methane presents because of its potency as a GHG. Although a short-lived GHG, methane has a global warming potential that is at least 80 times that of CO2 over a 20-year span.

- At the global pledge launch, Biden released the US Methane Emissions Reduction Action Plan, which includes various actions his administration is taking to tackle methane emissions. The plan to a large extent targets methane leaks arising from the extraction, production, storage, transportation, and distribution of oil and gas products, but it also tackles emissions from the agriculture sector and landfills.

- The EPA is seeking increased monitoring at well sites and compressor stations to detect and plug methane leaks. At well sites with estimated methane emissions of at least 3 metric tons (mt) per year, EPA will require quarterly monitoring for leaks and prompt repairs for any that are found. This provision alone would result in routine monitoring at 300,000 well sites nationwide that are responsible for 86% of fugitive emissions.

- Among other provisions, the agency also is proposing to give owners and operators the flexibility to use advanced detection technology that can find major leaks more rapidly and at lower cost than ever before. It also is proposing standards to eliminate venting of associated gas and requiring capture and sale of gas where a sales line is available—at new and existing oil wells.

- South Africa received a promise of an $8.5-billion helping hand from five G20 members 2 November as the globe's 12th-largest emitter seeks to cuts its GHG emissions and transition away from a coal-centric power generation sector. (IHS Markit Net-Zero Business Daily's Keiron Greenhalgh)

- The climate finance backing came as the South African government prepared to submit a roadmap for tackling climate change to the nation's parliament and an initiative to transform the country's energy sector launched.

- Change is needed because the same day all these developments took place, state-owned power generator Eskom was warning of load shedding because its power plant fleet's health was even creakier than usual, with almost 18 GW of capacity offline for maintenance. South Africa's installed power generation capacity is just over 58 GW.

- Help from the G20 nations-France, Germany, the UK, the US, and the EU-will come in the form of the "Just Energy Transition Partnership." The partnership will mobilize an initial $8.5 billion in a first phase of financing involving grants, concessional loans and investments, and risk sharing instruments, its backers said. The premise of partnership is to prevent up to 1.5 gigatons of emissions over the next 20 years, and accelerate South Africa's transition to a low emissions, climate resilient economy, they said.

- Electric vehicle (EV) manufacturer Rivian is considering raising as much as USD8.4 billion in its initial public offering (IPO), according to the company's filing with the US Securities and Exchange Commission (SEC). The company is reportedly planning to offer 135 million shares at a price of between USD57 and USD62, with an option for underwriters to purchase up to 20.25 million additional shares. At the top of that range, Rivian would have a market value of USD53 billion based on the outstanding shares listed in its filing. Rivian's valuation could be as high as USD60 billion by taking employee stock options and other restricted shares into account. Rivian said investors, including Amazon and T. Rowe Price, have indicated an interest in buying up to USD5 billion in shares of Class A common stock, reports TechCrunch. (IHS Markit AutoIntelligence's Surabhi Rajpal)

- China's Ganfeng Lithium, a supplier of lithium to automakers, has signed a three-year supply deal with Tesla, according to Reuters. Ganfeng will supply battery-grade lithium products to Tesla, but the total sales amount and value of the deal has not been disclosed yet. In order to ensure uninterrupted production of their electric vehicles (EVs), automakers are securing direct contracts with suppliers for raw materials such as lithium hydroxide, which is used for battery production. In September 2018, Ganfeng signed a deal with Tesla regarding the supply of lithium hydroxide, under which Tesla's designated battery manufacturer would purchase lithium hydroxide from Ganfeng. The contract was effective until 2020, with an option to extend it for another three years. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Taiwan's economy lost some steam during the third quarter of 2021 amid an uneven performance in economic activities. Consumer spending also slumped at a record pace because of the prolonged scars from the coronavirus disease 2019 (COVID-19) virus outbreak in mid-May despite a slow improvement in the third quarter. That said, this was offset by buoyant investment demand that was prompted by booming exports and factory expansions. Uneven recovery is expected ahead as investment and exports will probably remain the driving force of the economy, while consumer spending will continue to lag behind. Meanwhile, unfavorable base effects, along with headwinds from mainland China's economic concerns, supply-chain disruption, and the continued fallout of the pandemic, will cloud the short-term outlook. (IHS Markit Economist Ling-Wei Chung)

- Preliminary data show that Taiwan's economy lost traction in the third quarter as the slump in consumer spending deepened at a record pace, partially offsetting a surge in investment demand and still-robust export performance. Real GDP expanded by 3.8% year on year (y/y) in the third quarter, decelerating from a 7.4% y/y jump in the second quarter and a 9.3% y/y surge in the first quarter. The first-quarter 2021 expansion was the fastest since the third quarter of 2010.

- In seasonally adjusted quarter-on-quarter (q/q) terms, the economy rebounded in the third quarter of 2021, as real GDP increased at an annualized 2.3% from the preceding quarter, reversing a 4.2% drop posted in the second quarter.

- Domestic demand turned into the driver's seat in the third quarter as investment spending soared at a pace not recorded in 11 years, outweighing the plunge in consumer demand. Domestic demand contributed 4.1 percentage points to GDP growth as gross investment added 6.3 percentage points and government spending contributed 0.5 percentage point, offsetting the subtraction of 2.6 percentage points by private consumption. On the other hand, net exports turned negative in the third quarter, subtracting 0.3 percentage point, reversing the contribution of 5.1 percentage points in the second quarter. Despite still-robust exports, import growth outpaced export gains in the third quarter, fueled by soaring investment demand.

- Gross investment provided the main impetus to economic growth in the third quarter of 2021, surging 28% y/y, which marked the fastest expansion since the third quarter of 2010. Local companies, such as semiconductor and other technology firms, have continued to expand capacity to meet demand, which has in turn bolstered investment in machinery equipment and related outlays.

- Peru's Consumer Price Index (CPI) increased by 0.6% month on month (m/m) and 5.8% year on year (y/y) in October, according to the National Institute of Statistics and Information (Instituto Nacional de Estadística e Informática: INEI). Annual inflation stood at 2.5% as recently as May. (IHS Markit Economist Jeremy Smith)

- Price movements were once again closely tied to renewed increases in international commodity prices, especially crude oil, staple grains, and vegetable oils. The electricity and housing, food and beverages, and transportation and communications consumption categories accounted for 88% of CPI variation compared with September.

- The Peruvian sol appreciated in October for the first time in 2021 following a cabinet reshuffle and reappointment of the highly regarded central bank president. In prior months, politics-driven currency depreciation had exacerbated the effect of rising import costs. Still, earlier bouts of depreciation were likely still filtering into consumer prices in October.

- The Federal Open Market Committee (FOMC) concluded its scheduled two-day policy meeting this afternoon. The statement released at the conclusion of the meeting was consistent with our expectations. First, the Committee announced that it would begin later this month to reduce the pace of its securities purchases in monthly increments of $15 billion, relative to the current pace of $120 billion per month. This would put them on track to decline to zero by the end of June 2022. Second, policymakers expressed less conviction that the surge of inflation largely reflects transitory factors, a hint that if inflation does not soon moderate, monetary policy could be tightened earlier than currently anticipated. (IHS Markit Economists Ken Matheny and Lawrence Nelson)

- The Reserve Bank of Australia (RBA) left the official cash rate target unchanged at 0.10% and there were no adjustments to the bank's government bond-buying program, but the monetary policy board decided to halt the yield-targeting program for three-year Australian Government Securities (AGS). Although the policy-anchoring yield target was dropped, Governor Philip Lowe continued to insist that interest rate hikes are not imminent. (IHS Markit Economist Bree Neff)

- The yield-targeting program commenced in March 2020 as a way to anchor monetary policy expectations to a longer-term horizon (three years) and to contain funding costs through the pandemic. The target had been extended to the April 2024 dated bond as the pandemic persisted and because the RBA still viewed three years as an appropriate timeframe to keep the policy rate on hold and gradually unwind other stimulus measures.

- As conditions have shifted - a lower-than-expected unemployment rate, higher inflation, and a potentially sharp rebound in activity post-lockdown - defending the AGS target at 0.10% over the past week has become far more difficult. The RBA had not defended the target since late February, but it was forced to intervene on 21 October and was expected to defend again last week after the higher-than-expected inflation reading, but it did not. This accelerated bets that the RBA would drop the yield-targeting program.

- The RBA's policy statements this month also highlighted revisions to the bank's core forecasts, which will be released in full at the end of this week. The bank's baseline forecast anticipates real GDP growth of 3% for 2021 (a downgrade from August), 5.5% in 2022 (an upgrade), and 2.5% for the subsequent two years. The adjustments to the GDP outlook stem from expectations of a fast rebound in activity following the Delta variant-induced lockdowns as vaccination rates have picked up quickly, allowing containment measures to be unwound.

- Finding clean energy and infrastructure projects to deploy trillions in private capital is the challenge that financiers face and governments must resolve, Black Rock CEO Larry Fink said 3 November. The financial community is committed to bringing that capital forward, but the "key is finding the jobs, and finding the ability to deploy that capital and there lies the fundamental issue today," said Fink, who heads the world's largest investment fund, which has $9.5 billion of assets under management. (IHS Markit Net-Zero Business Daily's Amena Saiyid)

- Speaking on a climate finance panel at the UN COP26 meeting, Fink was commenting on the $130 trillion in private capital commitments that the Glasgow Financial Alliance for Net-Zero (GFANZ) said it has secured to help economies transition to net zero.

- GFANZ is a network of more than 450 banks, insurers, and asset managers across 45 countries that was formed in April by former Bank of England Governor Mark Carney and US Special Presidential Envoy for Climate John Kerry to bring all net-zero financial initiatives, including the Net Zero Asset Managers Initiative, under one umbrella.

- With the $130 trillion in private commitments, Carney said: "We now have the essential plumbing in place to move climate change from the fringes to the forefront of climate finance so that every financial decision takes climate change into account."

- Fink cautioned Carney and other financial leaders that there is currently no system in place to rapidly deploy private capital to the emerging world without "three, four, five, six years of waiting for regulation and having it passed."

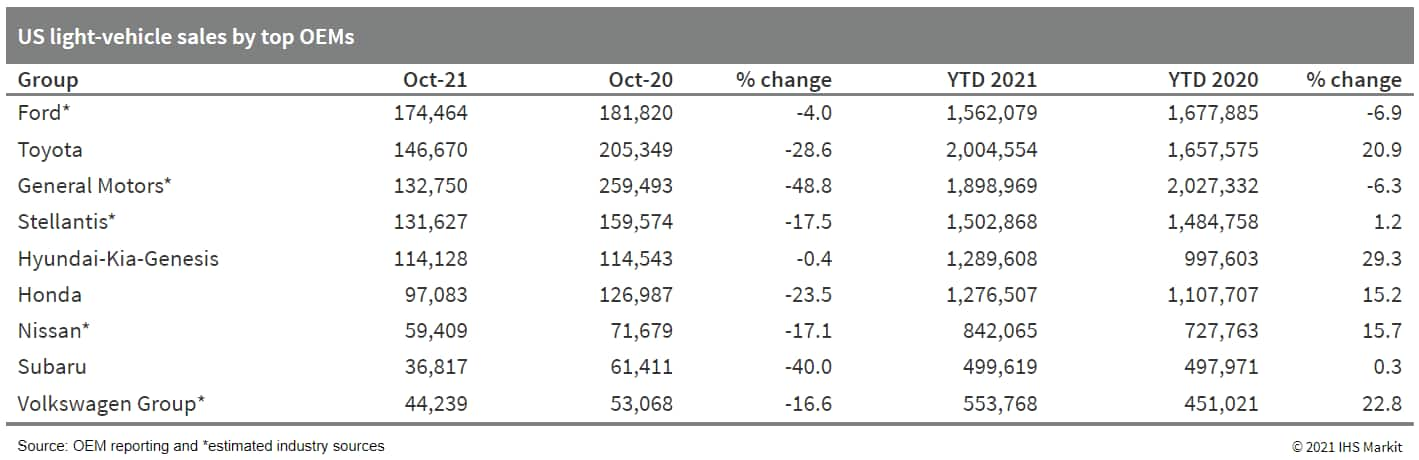

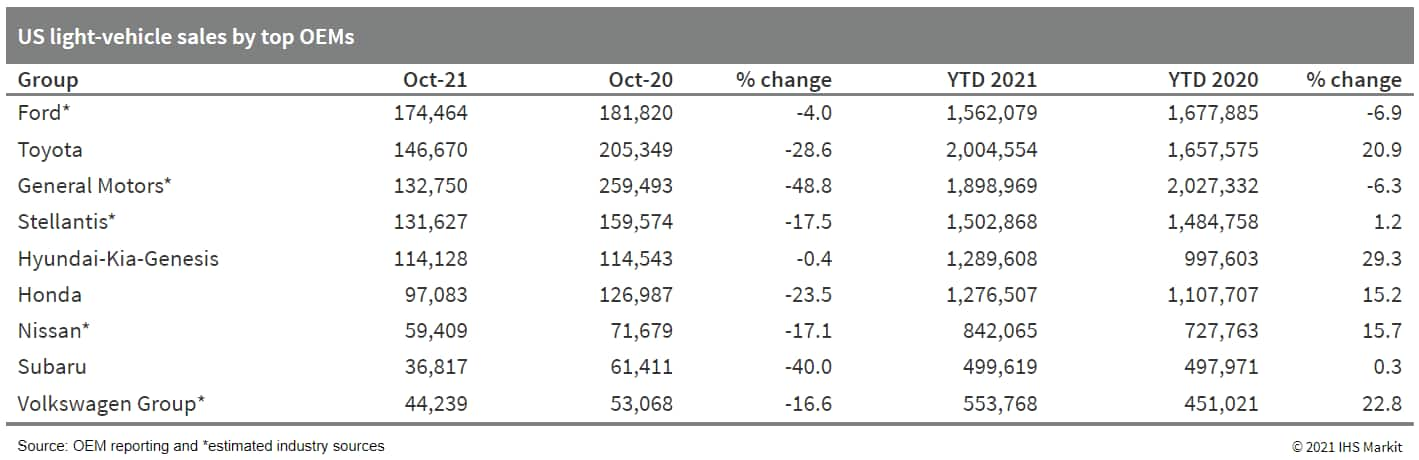

- The lack of inventory pushed US light-vehicle sales down by 22.5% y/y in October; YTD sales were up by 9.2%. October's 1.0 million units were similar to the volume in September. Although the pace of sales is projected to have increased mildly from September, auto demand levels in the US continue to be subdued by new vehicle inventory constraints. IHS Markit forecast as published in October stands at 15.1 million units, but the softer-than-expected October sales point to potential that full-year sales could possibly be somewhere between 14.9-15.1 million units. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Geely Auto Group has launched its global powertrain brand "Leishen Power", and a new modular intelligent hybrid powertrain platform, Leishen Hi-X. According to a company statement, the Leishen hybrid platform features ultra-high 43.32% thermal efficiency engine, three-speed Dedicated Hybrid Transmission (DHT), 40% lower fuel consumption NEDC rating, and full powertrain FOTA (Firmware Over the Air) update capabilities. The modular platform can be used for A-C-segment models and in HEV/PHEV/REEV configurations for brands within Geely Auto Group. The 40% lower fuel consumption NEDC rating would mean a substantial reduction in emissions and a shorter time to achieve the clean air targets set up by the Chinese authorities. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Coca-Cola HBC, a strategic bottling partner of The Coca-Cola Company, announced that juice volumes increased 14.0% y/y in the third quarter, outperforming the company's overall volume growth of 13.1% y/y in Q3. (IHS Markit Food and Agricultural Commodities' Vladimir Pekic)

- "Juice volume was up 14.0%, with growth in all three segments [established, developing, and emerging markets], while ready-to-drink tea volume grew by 6.5%," said Coca-Cola HBC.

- The company's overall volumes grew fastest in the emerging markets segment (+21.3% y/y), followed by an increase of 8.0% y/y in established markets and a drop of 1.9% y/y in developing markets.

- Emerging markets' volume increased by 21.3%, with continued strong performance from Nigeria, Russia, Ukraine and others. "Sparkling volumes were up low 20s, while adult sparkling and energy [drinks] performed very well in the quarter, both increasing high double digits. Stills volumes were up mid-teens with strong performance from water led by Russia, and juice led by Nigeria," said the company.

- Nigerian performance gained momentum in Q3, with volume up mid-30s despite the double-digit comparator. Sparkling grew by high 30s with very strong performance from Coke Zero. Stills grew by low-double digits with a high-double digit increase in the juice segment.

- US oil production will grow 800,000 b/d entry to exit in 2022. Onshore production will contribute 550,000 b/d—with slightly over 50% of growth coming from private companies, while public operators shift form maintenance mode to 2-5% growth. Strong Gulf of Mexico growth comes from both the basing effect of Hurricane Ida and the start-up of new projects (Spruance, Vito, and Mad Dog Phase 2). Entry-to-exit growth in 2023 reaches 600,000 b/d, reflecting continued cash harvest as WTI eases owing to strong 2022 global supply and a tapering COVID-19 restart. (IHS Markit Energy Advisory's Raoul LeBlanc, Reed Olmstead, Narmadha Navaneethan, Imre Kugler, and Prescott Roach)

- Producers are restraining reinvestment of the cash bonanza from rising prices in line with our expectations, resulting in minimal changes to the IHS Markit production outlook. While the production outlook rose less than 100,000 b/d compared with the previous forecast, free cash flow has ballooned to $87 billion, which should offer a competitive (perhaps even compelling) yield for the publicly listed operators.

- Reinvestment of the incremental dollar remains the key corporate decision determining US supply growth. Both debt repayment—to achieve debt/EBITDA ratios under 1.5x—and substantial share price reflation are necessary preconditions before executives risk the embryonic credibility of their business model by returning to hypergrowth, or even a hybrid returns plus growth strategy. The 2021-23 cash surplus should more than compensate for the previous decade of deficits (although not on a discounted basis). Accelerated balance sheet repair should mostly end in 2022, shifting surplus cash toward buybacks if shares do not reflate, and reinvestment if they do.

- Our large jump in annual capex from $60 billion to $87 billion (45%) seems out of step with the discipline story and the low-growth headline, but a decomposition analysis shows the figure results from the compounding effect of reasonable assumptions for five drivers: 1) modest (7-9%) service cost reflation, 2) fewer drilled but uncompleted well (DUC) conversions, 3) base decline increase from the robust rise in activity over the course of 2021, 4) rapidly expanding budgets of smaller private operators, and 5) diluted overall capital efficiency due to low-grading and lower well performance exhibited by private operators.

- The Permian remains the growth engine but loses a step in 2022. A few factors decelerate growth: the 570,000 b/d growth in 2021 is revving up the base decline for 2022 by 400,000 b/d, tempering overall oil growth to just 400,000 b/d. Independents will ramp up rigs in 2022, but private companies will continue to respond more aggressively to price signals and make up more than 50% of activity in 2022. Most of these increases are from micro-private operators running a single rig, often in legacy plays or non-core areas.

- US productivity (output per hour in the nonfarm business sector) declined at a 5.0% annual rate in the third quarter, more of a decline than we had expected, following an increase of 2.4% in the second quarter that was revised up 0.3 percentage point. (IHS Markit Economists Ken Matheny and Lawrence Nelson)

- Compensation per hour rose at a 2.9% annual rate in the third quarter and at a 3.5% rate in the second quarter. The second-quarter increase was revised up 0.1 percentage point. Compensation per hour has risen at a 5.9% annual rate from the fourth quarter of 2019, far higher than the 1.6% annualized increase in productivity over that span. The marked increase in compensation per hour reflects pandemic-induced effects on employment: employment in lower-wage sectors has declined relative to employment in higher-wage sectors.

- Unit labor costs surged in the early stages of the pandemic, as compensation per hour rose much more than productivity. The rise in unit labor costs had slowed on average in more recent quarters but jumped again in the third quarter. After declining at a 0.9% rate over the first half of 2021, unit labor costs rose at an 8.3% rate in the third quarter. Over the last four quarters, unit labor costs have risen 4.8%, up from a 0.1% increase over the four quarters ending in the second quarter.

- Hours rose at a 7.0% rate in the third quarter, continuing a strong recovery that began in the third quarter of 2020. Over the last five quarters, hours have risen 15.7% (not annualized), reversing nearly all of the 14.5% decline over the first two quarters of 2020.

- Preliminary data show that Hong Kong SAR's real GDP expanded 5.4% year on year (y/y) in the third quarter of 2021, after jumping 7.6% y/y in the second quarter and 8% y/y in the first quarter, which marked the fastest expansion since the first quarter of 2006. For the first three quarters of the year, real GDP climbed 7% y/y, following six straight quarters of contraction that began in mid-2019. (IHS Markit Economist Ling-Wei Chung)

- Domestic demand continued to provide the main impetus to the economy as contained local infections supported consumer and business sentiment and spending. Domestic demand contributed 8.7 percentage points to third-quarter growth as private consumption added 4.4 percentage points and fixed investment contributed 1.8 percentage points. On the other hand, net exports remained negative in the third quarter, subtracting 3.3 percentage points from GDP growth, as the pick-up in domestic demand bolstered import growth, which outpaced export expansions.

- Merchandise exports continued to expand at a double-digit pace, albeit at a slower rate in the third quarter. Exports of goods climbed 14.3% y/y, after jumping 20.5% y/y in the second quarter. It also represented a second straight quarter of deceleration. Exports to all major markets continued to climb at the double-digit pace in the third quarter, except Vietnam due to the worsening outbreak conditions there. In September alone, merchandise exports expanded 16.5% y/y, slowing from a 25.9% y/y jump in August. It also marked the slowest reading since December 2020, although the deceleration was attributed partially to an unfavorable comparison base.

- In particular, accounting for about 60% of total exports, shipments to mainland China increased 11.2% y/y in September, decelerating markedly from a 30% y/y surge in August and also represented the lowest reading since November last year.

- Fixed investment climbed 11% y/y in the third quarter, after surging 23.9% y/y in the second quarter. Although part of the gain was boosted by a low comparison base, business spending strengthened as overall business sentiment improved, supported by the stabilized local pandemic conditions, the corresponding relaxation in social distancing measures, and robust overseas demand. In addition, the property market has remained active in the third quarter and resulted in the increase in the costs of ownership transfer. That said, mainland China's crackdown on business as well as volatilities in the local stock market somewhat restrained business sentiment.

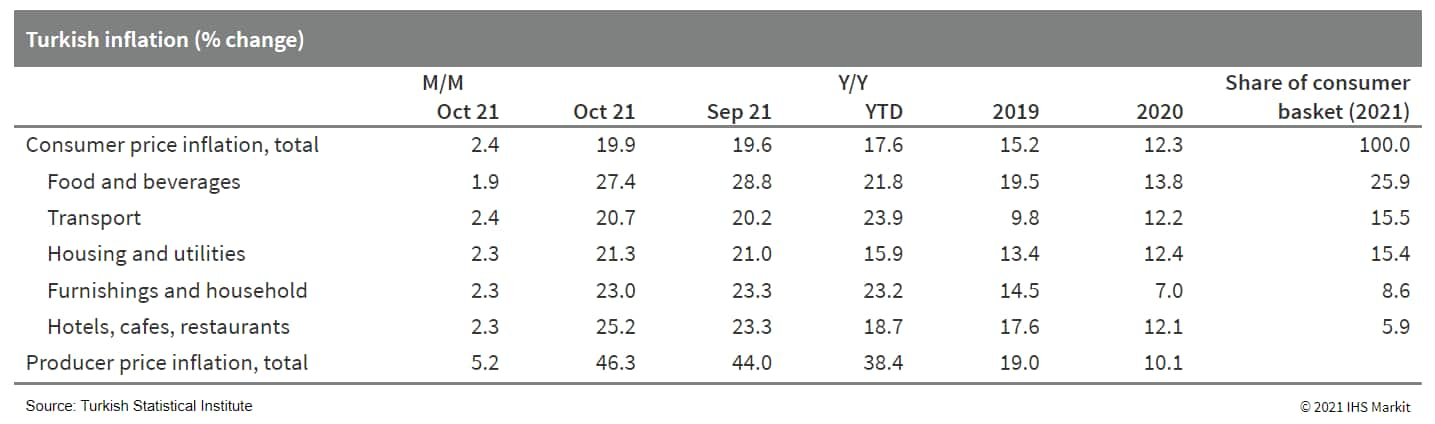

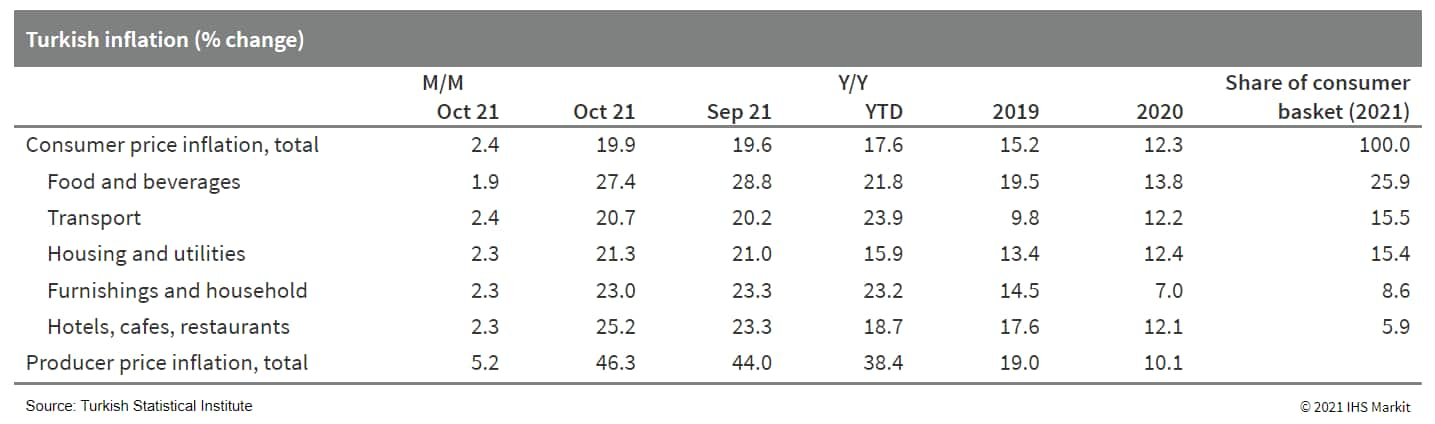

- Both Turkish consumer and producer price inflation continued to build in October, according to the latest data from the Turkish Statistical Institute (TurkStat). That month, annual consumer price inflation pushed up to 19.89%, rising by over 0.4 percentage point from the previous month and exactly eight percentage point higher than it had been a year earlier. (IHS Markit Economist Andrew Birch)

- In October, the consumer prices of food had posted the most extreme annual increase, up by 27.41%. However, food price inflation has actually been subsiding slightly since an August peak. Annual energy price inflation, on the other hand, continued to build in October, rising by nearly 0.5 percentage point from September to reach 25.41%.

- Stripping out these and other highly volatile prices, the annual core inflation rate was lower overall, at 16.82% as of October 2021. Core inflation actually subsided very slightly from September, when it had reached 16.98%. Although the easing of core inflation was meagre, it may provide justification for the Central Bank of the Republic of Turkey (TCMB) to cut its main policy rate again, as it is indexed to that rate.

- Meanwhile, annual producer price inflation soared in October to reach 46.31%, the highest rate it has been since the Justice and Development Party took office in 2002. Soaring energy costs and the sharp depreciation of the lira are fueling the rapid producer price increases.

- Global CO2 emissions in 2021 are on a pace to make up nearly all of the decline experienced in 2020 due to the economic slowdown created by the COVID-19 pandemic, according to findings released 4 November by the Global Carbon Project at COP26. (IHS Markit Net-Zero Business Daily's Kevin Adler)

- CO2 emissions are projected to reach 36.4 billion metric tons (mt) in 2021, just 0.8% below the record of 36.7 billion mt in 2019, and nearly a 5% rise from 2020's level. This has driven the global CO2 concentration to 415 ppm in 2021, compared to 277 ppm in 1750.

- The report said China and India were chiefly responsible for the overall increase in global CO2 emissions.

- "Reaching net zero CO2 emissions by 2050 entails cutting global CO2 emissions by about 1.4 billion tons each year on average," he said. "Emissions fell by 1.9 billion tons in 2020. So, to achieve net zero by 2050, we must cut emissions every year by an amount comparable to that seen during COVID."

- Looking at a long-term trend, the 2021 forecast is that global CO2 emissions will be 36.4% higher in 2021 than in 1990.

- While the overall trajectory highlights the immense challenge of carbon reduction, an adjustment in Global Carbon Tracker's accounting for land use in this year's report suggests that the increase in emissions is not as high as reported earlier. Previously, the GCP data showed global CO2 emissions increasing by 15 billion mt from 2011 through 2019, but this new report revises that increase down to 0.8 billion mt, due to a higher annual credit for land sinks.

- The Global Carbon Tracker said that coal contributed 40% of global emissions, followed by oil (32%) and natural gas (21%). Coal and gas will surpass their pre-pandemic emissions levels this year, but the report said "oil emissions remain around 6% below 2019 levels, and this persistent reduction is one of the main reasons 2021 [total] emissions did not set a new record."

- The Volkswagen (VW) Group has announced that it is to take a stake in EIT InnoEnergy, an alternative energy investment fund, in which the European Union (EU) is a major investor, according to a company statement. VW will partner with EIT InnoEnergy to invest in technologies and business models to 'achieve economic breakthroughs which will contribute to the decarbonization of the transport sector and accelerate the shift to electromobility.' Commenting on the investment Jens Wiese, Head of Group M&A, Investment Advisory and Partnerships at VW, said, "In order to decarbonize the transport sector, we will need a wide range of innovations. In addition to our own activities, in the future we will also increasingly rely on cooperation with start-ups to achieve this. The partnership with EIT InnoEnergy will help us find the most promising companies from all areas of the energy transition, which we can then support in scaling their business models." VW and EIT InnoEnergy have already been co-operating for five years, with both organizations working together on the European Battery Alliance (EBA), with VW's stake in Swedish startup Northvolt a key element in this project. (IHS Markit AutoIntelligence's Tim Urquhart)

- South Korean automakers posted a 22.3% y/y plunge in their combined global vehicle sales to 548,162 units in October, according to data released by the five major domestic manufacturers, as reported by the Yonhap News Agency and compiled by IHS Markit. The five automakers reported a 21.5% y/y decline in their combined domestic sales last month to 106,424 units, while their combined overseas sales went down by 22.4% y/y to 441,738 units. (IHS Markit AutoIntelligence's Jamal Amir)

- The country's best-selling automaker, Hyundai, posted a global sales decline of 20.7% y/y to 307,039 units in October. Its domestic sales totaled 57,813 units, down 12.0% y/y, while its overseas sales decreased by 22.5% y/y to 249,226 units. Global sales of its affiliate, Kia, fell by 18.9% y/y to 217,872 units, with its domestic sales down 21.2% y/y to 37,837 units and its overseas sales down 18.4% y/y to 180,035 units.

- The plunge in South Korean OEMs' combined global sales during October was mainly due to the global semiconductor shortage and the prolonged COVID-19 virus pandemic, which continued to weigh down on vehicle production and sales. South Korea relies heavily on overseas sources for automotive chips. The current shortage has disrupted automakers' production in the country and the issue is expected to continue to have an impact as manufacturers ramp up production of next-generation electric vehicles (EVs).

- Automakers are readjusting their vehicle production volumes while competing with electronics companies to acquire more chips to minimize the reduction in output.

- As the global semiconductor shortage has intensified because of lockdown measures to prevent the spread of the COVID-19 virus in Southeast Asia, we expect vehicle production in South Korea to be significantly affected throughout this year. As a result, we now expect light-vehicle production in the country, including passenger vehicles and light commercial vehicles, to decline by 1.9% y/y in 2021 to 3.39 million units.

- California-based Impossible Foods is accelerating its international expansion with the launch of its flagship plant-based burger in Australia and New Zealand. The company's flagship product, Impossible Beef Made From Plants (known as Impossible Burger in other markets), is now available at all 150+ locations of Australia's burger brand, Grill'd, and also at Butter—a fried chicken concept with several locations in the greater Sydney area. (IHS Markit Food and Agricultural Policy's Max Green)

- In New Zealand, Impossible Beef will debut at burger chain Burger Burger along with a number of other restaurants in Auckland.

- Earlier this year, regulatory body, Food Standards Australia New Zealand (FSANZ), approved Impossible Foods' key ingredient, heme (soy leghemoglobin), for use in plant-based meat products, paving the way for the commercial launch in both markets.

- In its approval, FSANZ noted that the decision "supports greater consumer choice for meat analogue products with a source of iron which may benefit consumers wanting to reduce or eliminate animal products from their diet." The body added that approval of the ingredient "supports greater consistency with international food regulations, industry innovations and creates trade opportunities for Australia and New Zealand."

- Impossible Foods' products are already available in the US, Canada, Singapore, and Hong Kong, and were recently launched in the UAE, the company's first market in the Middle East. Impossible Foods' stated mission is to be sold in every major market globally where conventional meat from animals is sold.

- US nonfarm payroll employment rose 531,000 in October, beating expectations, and the unemployment rate declined 0.2 percentage point to 4.6%. Combined with upward revisions to payroll gains for prior months, these developments reveal a labor market on a solid footing heading into the fourth quarter. (IHS Markit Economists Ben Herzon and Michael Konidaris)

- The gain in overall payroll employment was more than accounted for by a 604,000 increase in private payrolls. Notable gains there included leisure and hospitality (164,000), professional and business services (100,000), manufacturing (60,000), and transportation and warehousing (54,000).

- The latter two industries have been boosted by elevated demand for goods, as the composition of consumer spending remains more heavily tilted toward goods (and away from services) than pre-pandemic norms.

- The recovery in payroll employment has come a long way, but the count of jobs still remains 4.2 million below the February 2020 level.

- This is not for a lack of trying on the part of business. As of August, there were considerably more job openings than job seekers (in the labor force and unemployed), and the labor-force participation rate has barely budged since spring. At some point, continued robust job growth will likely require a rising labor-force participation rate.

- Elsewhere in this morning's report, average hourly earnings rose 0.4%, while the average workweek slipped 0.1 hour to 34.7 hours. Combined with the robust gain in private payrolls, these indicators set up private wage and salary income for solid annualized growth of roughly 8% in the fourth quarter.

- IHS Markit's AAA Tax-Exempt Municipal Analytics Curve (MAC) rallied 5bps for 9-year and longer paper, with that same part of the curve 9-10bps better week-over-week.

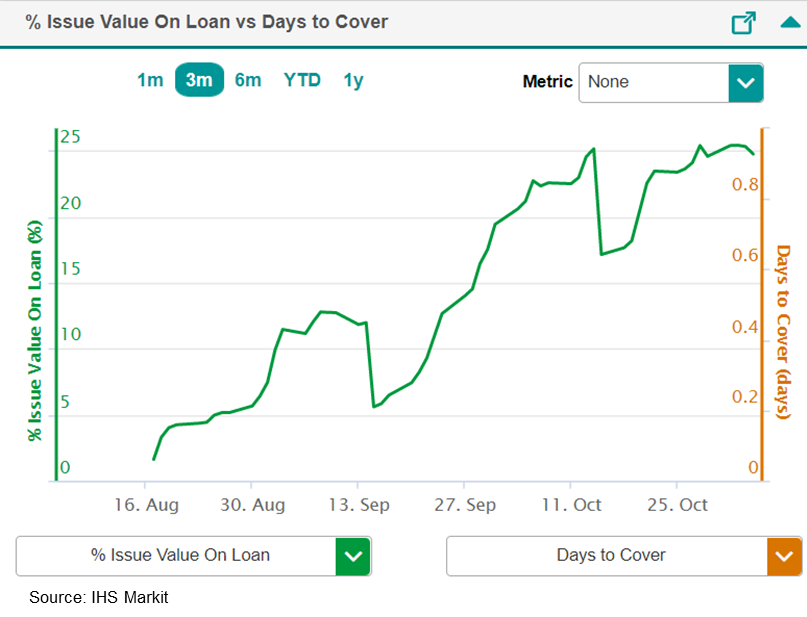

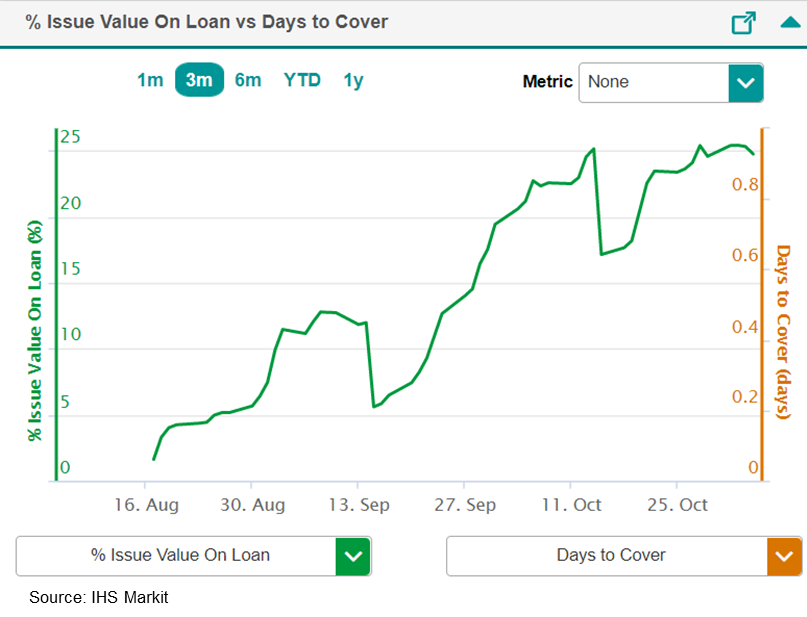

- IHS Markit Securities Finance data indicates that 24.7% of the issue value of the current on-the-run 10yr US government bond were on loan as of the 4 November close, which is near the highest level since the bond was issued in August.

- The UK's Monetary Policy Committee (MPC) voted 7-2 to maintain the Bank of England's (BoE) Bank Rate at 0.1% at its meeting that ended on 3 November. The dissenting voices were deputy governor Dave Ramsden and Michael Saunders, who voted to increase the Bank Rate by 15 basis points to 0.25%. They were the first members of the MPC to vote for an interest-rate rise since August 2018. (IHS Markit Economist Raj Badiani)

- The MPC voted unanimously to maintain the stock of sterling non-financial investment-grade corporate bond purchases at GBP20 billion (USD28 billion), financed by the issuance of central bank reserves.

- Meanwhile, the MPC voted 6-3 in favor of the BoE continuing with its existing program of UK government bond purchases, financed by the issuance of central bank reserves, maintaining the target for the stock of these purchases at GBP875 billion to be achieved by end-2021. The existing program of GBP150 billion of UK government bond purchases started in January 2021 and is close to completion.

- Three members (Catherine L. Mann, Dave Ramsden, and Michael Saunders) voted to reduce the target for the stock of UK government bond purchases from GBP875 billion to GDP855 billion.

- As of 2 November 2021, the total stock of assets held in the Asset Purchase Facility had reached GBP871 billion, including GBP127 billion of the GBP150-billion program of UK government bond purchases announced on 5 November 2020.

- In its November update, the BoE expects its policy rate to rise from the current 0.1% to 0.2% by the end of 2021 and to 1.0% (from 0.3% in the August update) in the final quarter of 2022, based on the market path for interest rates.

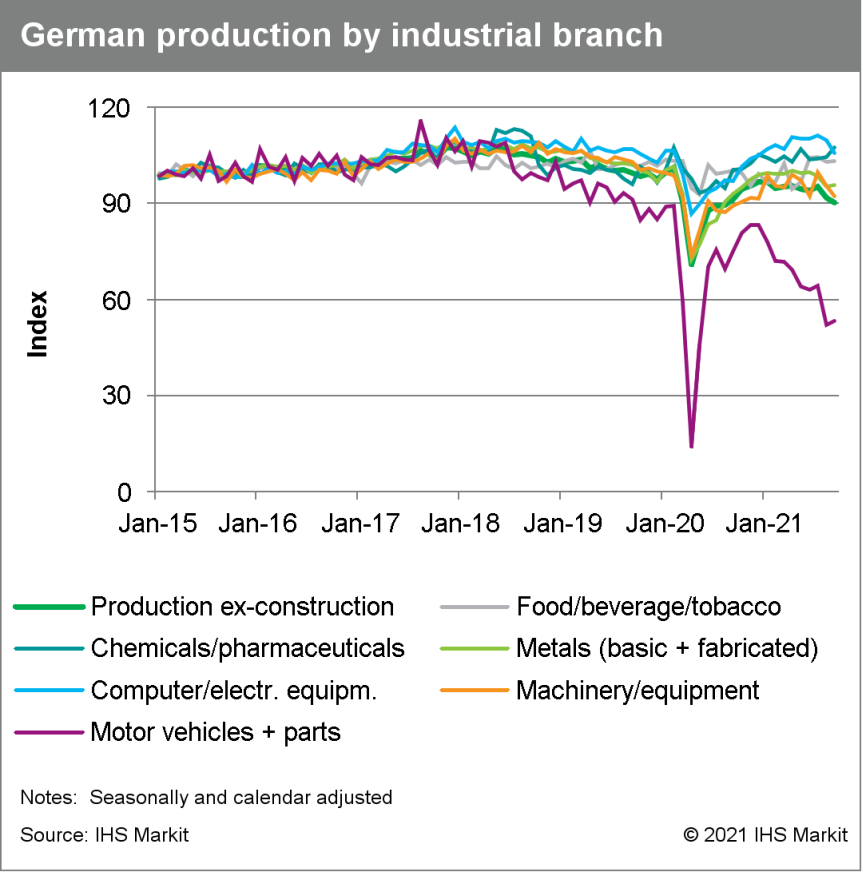

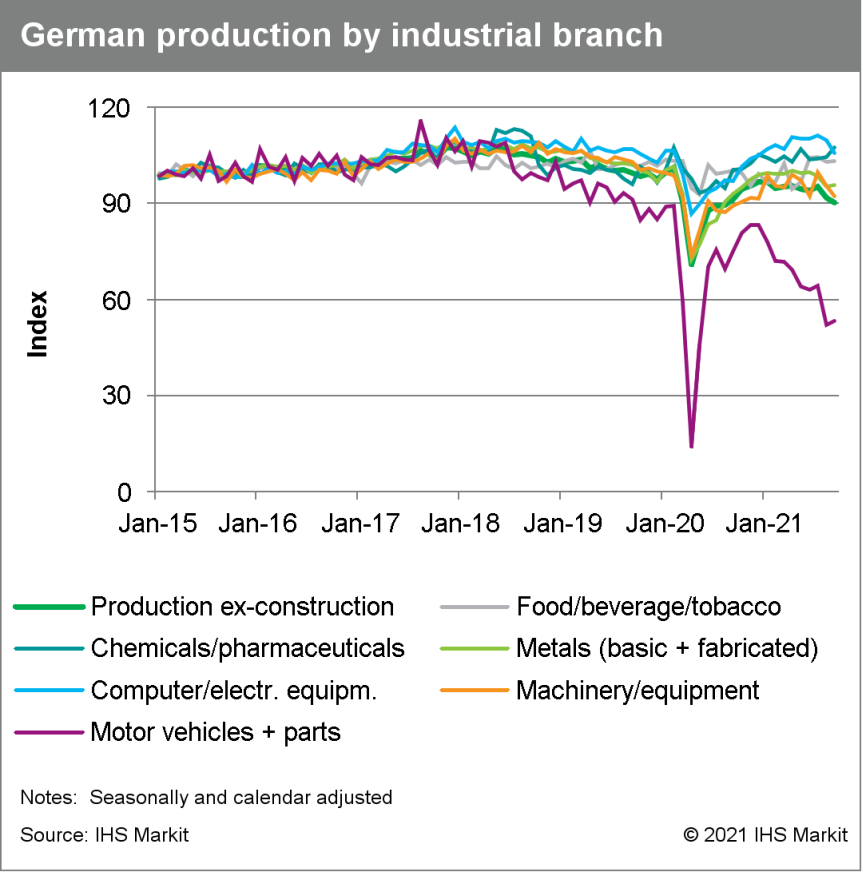

- Seasonally and calendar-adjusted German industrial production excluding construction declined by 1.4% month on month (m/m) in September, extending a 3.7% m/m setback in August. Thus, the latest output level remains almost 11% below its February 2020 pre-pandemic high. (IHS Markit Economist Timo Klein)

- Total production including construction was a little firmer, falling 1.1% m/m in September to a level that was 9.5% below that of February 2020. This owed to construction output increasing by 1.1% m/m in September and generally having held up much better than manufacturing throughout the pandemic. Meanwhile, energy output rebounded during August and September after a major decline in the May-July period.

- The split by type of good (see table below) reveals that the investment goods sector, which had already suffered a major setback in August, extended its decline in September. Intermediate goods production declined for the fourth consecutive month, but not to the same extent as investment goods. In contrast, consumer goods output was broadly flat in September and maintained an upward tendency when compared with levels at the start of 2021. This was enabled by the loosening of coronavirus disease 2019 (COVID-19)-related restrictions since May.

- The September breakdown by industrial branch reveals diverging developments. Motor vehicle production at least stabilized (up 2.1% m/m) following a huge drop in August (-18.9%). Nevertheless, output in this sector remains some 40% below pre-pandemic levels, linked primarily to the shortage of semiconductors that turned into a severe bottleneck once manufacturers ran out of stocks accumulated in early 2021. The other main sector posting higher output in September was chemicals/pharmaceuticals, which increased by 2.9% m/m, its fourth increase in the past five months. In contrast, output in the food/beverages/tobacco and metal sectors was broadly flat in September (both up 0.3% m/m), and production in the machinery and equipment and electronic and electric equipment sectors declined anew by 3.3% and 3.7% m/m, respectively.

- The Central Bank of the Argentine Republic (Banco Central de la República Argentina: BCRA) on 4 November temporarily changed the regulations detailing the minimum net foreign-exchange position ratio. Banks will need to maintain this ratio at the same levels as the lowest between the average daily ratios during October 2021 or the ratio displayed in 4 November. This regulation is intended to last until the end of the month and was instituted to limit demand for dollars in the financial sector. (IHS Markit Banking Risk's Alejandro Duran-Carrete)

- So far, banks' holding of dollars is relatively high, making this movement relatively inconsequential if only kept through November. The net foreign-exchange position was instituted to limit the exposure of financial institutions to foreign-exchange fluctuations. Owing to Argentina's historical context, banks have typically remained in a positive position, reducing direct exposures to a depreciation of the local currency.

- However, this action was primarily triggered as a de-facto capital control aimed at stopping the drain of dollars in the country. IHS Markit forecasts that capital controls will continue until at least 2023, increasing the probability of these measures being rolled over or reintroduced after the end of November.

- In turn, this would both reduce the holding of dollarized securities and depress the already declining pace of dollarized credit. These are a significant hedge against the weak monetary situation that the country currently has. Going forward, the relatively low levels of foreign-exchange reserves at the BCRA threaten the reserve requirements for dollar deposits placed at the central bank, tightening the sector's foreign-exchange liquidity.

- Autonomous truck startup TuSimple, in collaboration with UPS, is mapping new freight lanes in southern states of the United States. TuSimple's autonomous trucks will operate on new routes between Arizona and Florida, reports Reuters. TuSimple said that since 2019 it had logged 160,000 miles transporting freight for UPS's North America Air Freight (NAAF) division. It has achieved 13% fuel savings at speeds between 55 and 68 miles per hour. TuSimple focuses on developing Level 4 autonomous solutions for the logistics industry and its trucks run out of facilities in Arizona and Texas (United States), China, Japan, and Europe. TuSimple, in partnership with Navistar, is developing Level 4 autonomous trucks and has received 6,775 reservations for these vehicles, with manufacturing scheduled to start in 2024. (IHS Markit Automotive Mobility Surabhi Rajpal)

- Geely Auto Group has revealed its vision for the next five years with nine ambitious initiatives under its "Smart Geely 2025 Strategy". The initiatives include full-stack in-house development of autonomous vehicle (AV) technologies, CNY150 billion (USD23.4 billion) of investment in research and development (R&D), and launching over 25 new smart vehicle models in the next five years. The automaker aims to achieve global sales of 3.65 million units, with overseas sales of 600,000 units, by 2025. Geely also aims to reduce its carbon emissions by 25% in the next five years, realize a 100% full-scenario digital value chain, achieve an EBIT margin of over 8%, and assign 350 million shares to the first batch of 10,000 employees, reports Gasgoo. This development coincides with Geely launching global powertrain brand Leishen Power and a new modular intelligent hybrid powertrain platform, Leishen Hi-X. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- EU lamb prices have pushed back up towards the record-high levels recorded in the spring of this year, as purchasers continue to fret about availability of supplies. (IHS Markit Food and Agricultural Commodities' Chris Horseman)

- Throughout of lambs at EU abattoirs remains at below-average levels, while imports of sheepmeat from the UK are still constrained by border checks and other paperwork.

- Meanwhile, supplies from New Zealand are still tracking some 17% below the levels of last year, primarily because of very high transport costs and constrained availability of containers.

- This is all adding up into an EU benchmark price which looks poised to break through the EUR700 per 100kg barrier for what would be only the second time.

- In the week ending 31 October, the EU average price for heavy lambs was EUR693.04 per 100kg, up by 1.1% on the previous week.

- Prices have risen especially sharply in Germany - up by 3.9% week-on-week to EUR780.82 per 100lkg - and also in Spain, where the reference price has now risen by 11% over the past five weeks.

Posted 08 November 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.