All major European equity indices closed higher on the week, while most US indices were lower, and APAC markets were mixed week-over-week. US and benchmark European government bonds closed lower on the week. European iTraxx and CDX-NA closed wider on the week across IG and high yield. The US dollar, oil, gold, silver, and copper closed higher on the week, while natural gas closed sharply lower.

Americas

Most major US equity indices closed lower on the week except for Russell 2000 +1.4%; DJIA -1.0%, S&P 500 -1.8%, and Nasdaq -2.2% week-over-week.

10yr US govt bonds closed 1.92% yield and 30yr bonds 2.24% yield, which is +2bps week-over-week for both tenors.

DXY US dollar index closed 96.08 (+0.6% WoW).

Gold closed $1,842 per troy oz (+1.9% WoW), silver closed $23.37 per troy oz (+4.0% WoW), and copper closed $4.51 per pound (+0.4% WoW).

Crude Oil closed $93.10 per barrel (+0.9% WoW) and natural gas closed $3.94 per mmbtu (-13.8% WoW).

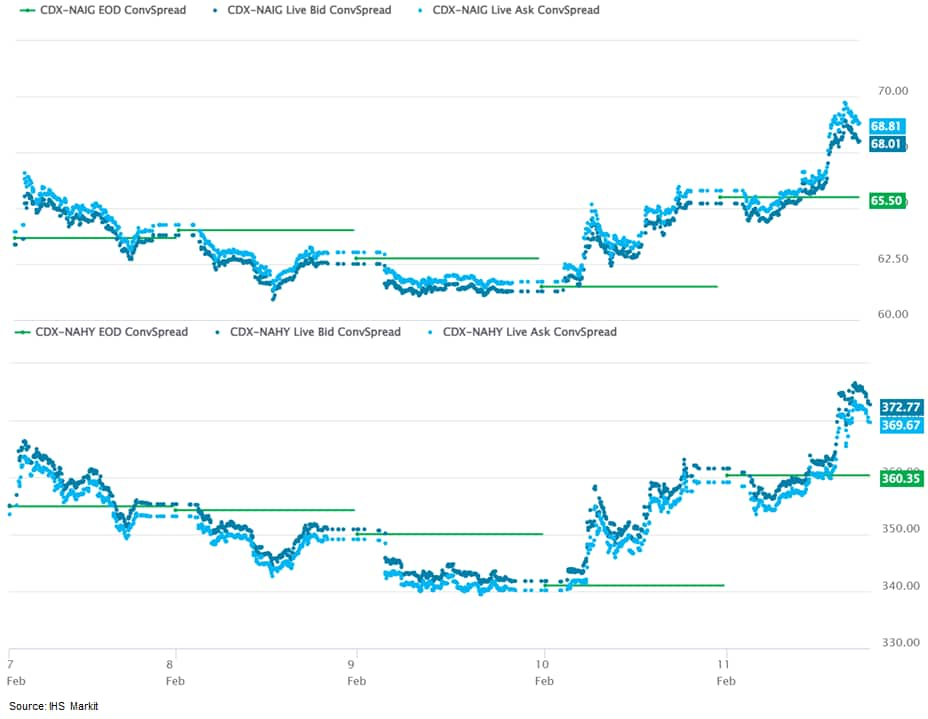

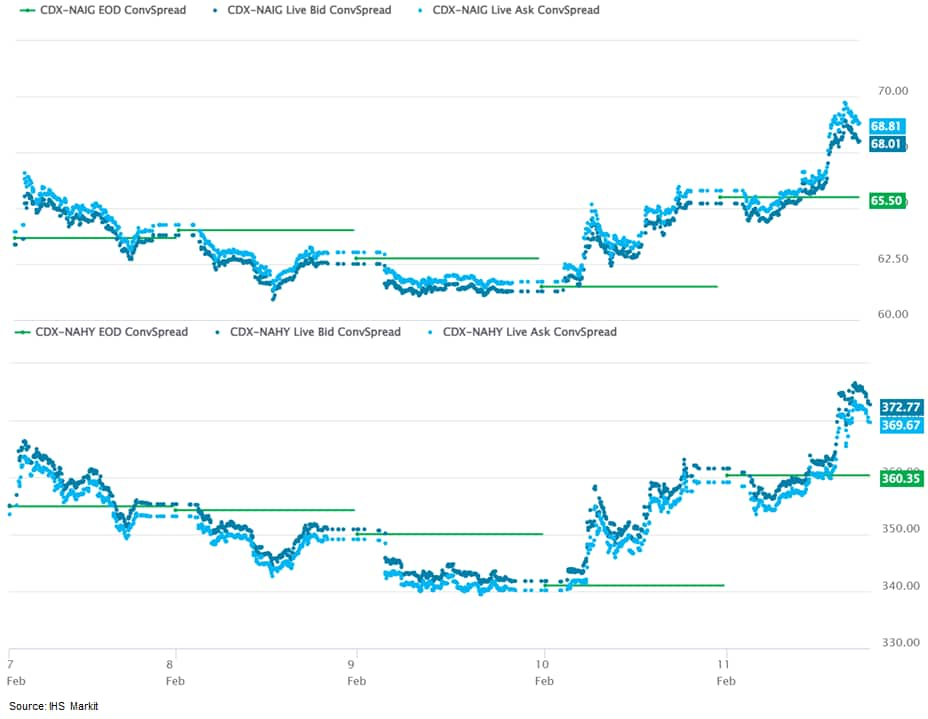

CDX-NAIG closed 68bps and CDX-NAHY 371bps, which is +4bps and +16bps week-over-week, respectively.

EMEA

All major European equity indices closed higher; Spain +2.4%, Germany +2.2%, UK +1.9%, Italy +1.4%, and France +0.9% week-over-week.

All major 10yr European government bonds closed sharply lower on the week; Germany closed +9bps, France +12bps, UK +13bps, Spain +15bps, and Italy +21bps week-over-week.

Brent Crude closed $94.44 per barrel (+1.3% WoW).

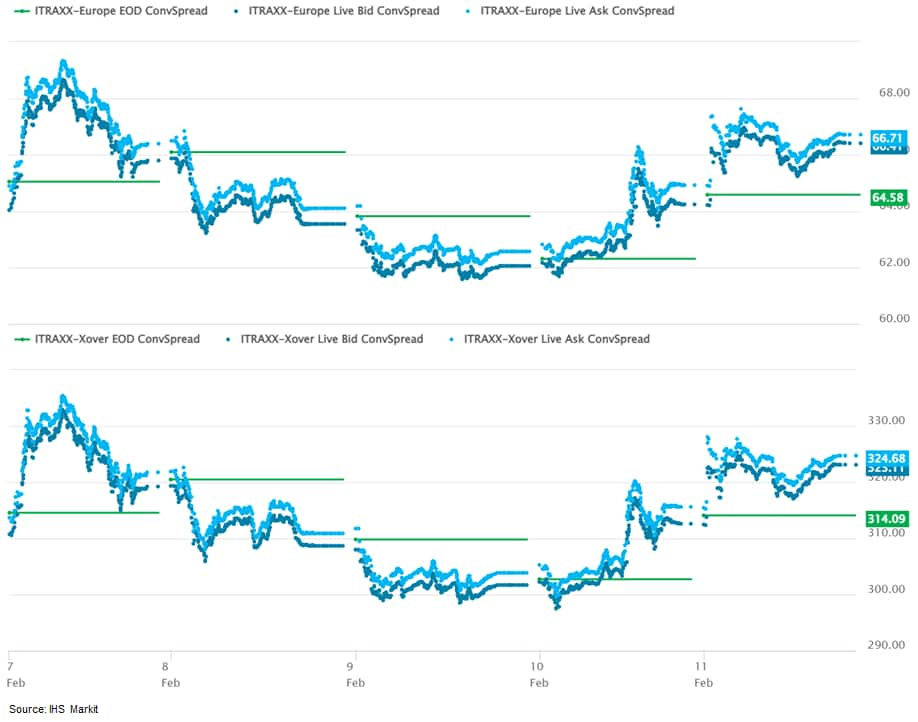

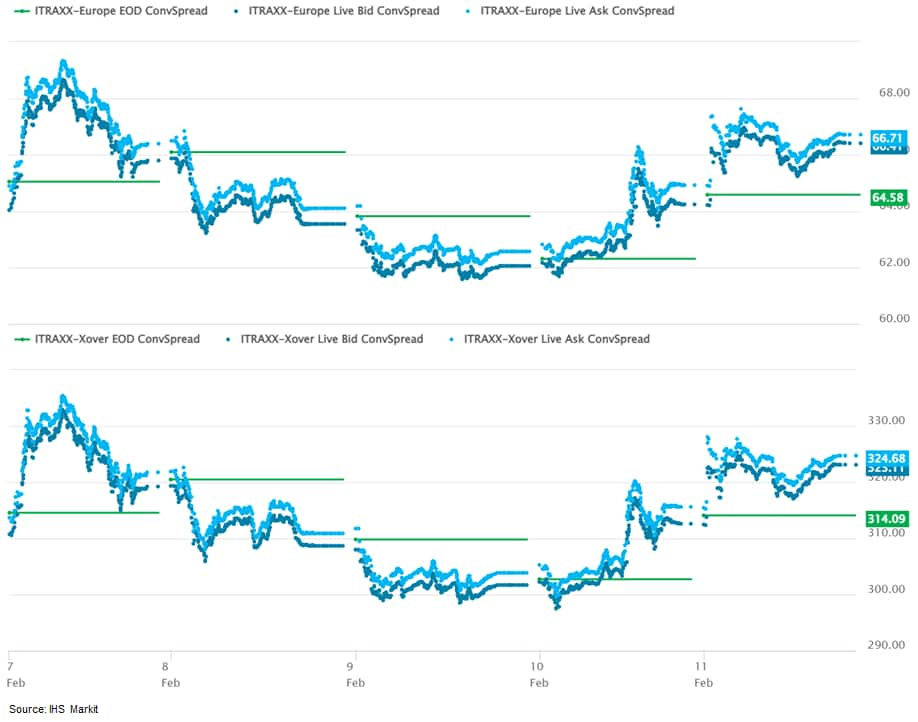

iTraxx-Europe closed 67bps and iTraxx-Xover 324bps, which is +2bps and +9bps week-over-week, respectively.

APAC

Major APAC equity indices closed mixed on the week; Mainland China +3.0%, Australia +1.4%, Hong Kong +1.4%, Japan +0.9%, South Korea -0.1%, and India -0.8% week-over-week.

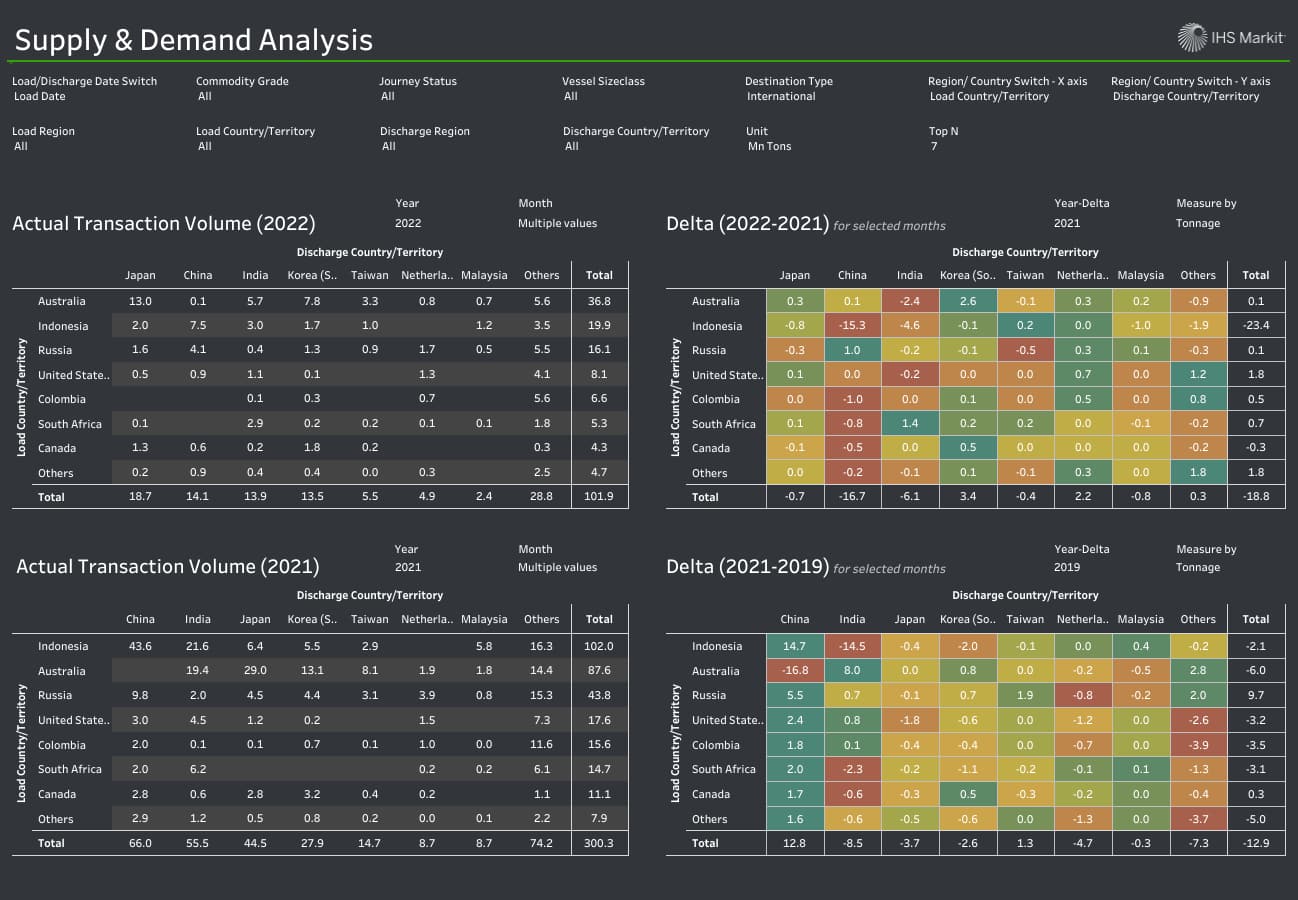

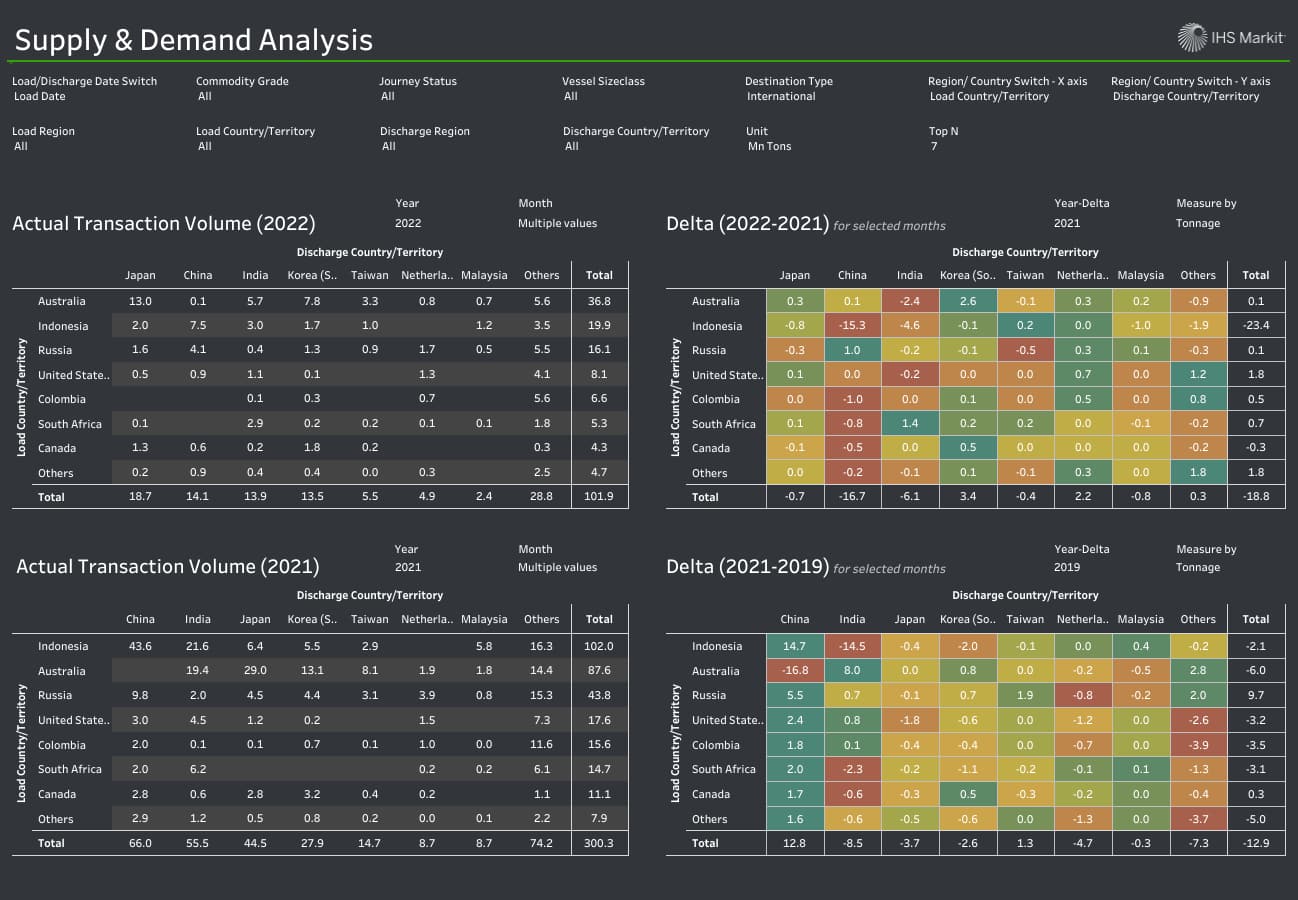

- As per IHS Markit's CAS Supply & Demand Analysis tab, there was a significant decline in coal supply during the Jan-Feb period (first 37 days of 2022) from Indonesia (19.9 metric tons(mt), down 23.4mt y/y), and marginally lower from Canada (4.3mt, down 0.3mt). While supply increased from the USA (8.1mt, up 1.8mt), marginally higher from Colombia (6.6mt, up 0.5mt), South Africa (5.3mt, up 0.7mt), and mostly stable from Australia (36.8mt, up 0.1mt y/y), and Russia (16.1mt, up 0.1mt). The slump in Indonesian coal supply was due to the coal export ban implemented by the government during January 2022 amid critically low PLN stocks. The export ban has now been lifted. (IHS Markit Maritime and Trade's Chia Yee Koay and Pranay Shukla)

- Demand Side: In terms of recipient countries/territories, coal demand from Mainland China and India was quite weak at 14.1mt (down 16.7mt) and 13.9mt (down 6.1mt), resp. While slower from Japan, Taiwan, and Malaysia during the period, standing at 18.7mt (down 0.7mt), 5.5mt (down 0.4mt), and 2.4mt (down 0.8mt), respectively. On the other hand, strong coal demand was observed from South Korea (13.5mt, up 3.4mt) and NW Europe (8.0mt, up 3.3mt). The plunge in Mainland China coal import demand was due to a record high domestic coal production, and anticipated emissions restrictions during Winter Olympics.

- Supply/Demand Balance: Total seaborne flows during the first 37 days of 2022 were calculated at 101.9mt, down 18.8mt y/y. Although demand into Mainland China and India were lower still supply tightness prevailed and coal prices increased during the reported period. For week-05, thermal coal benchmark M42 and API2 price stood at $72.15/t (up 21% m/m and 81% y/y) and $178.06/t (up 27% m/m and 174% y/y), resp; while Australian mid-vol PHCC prices were assessed at $445.00/t (up 23% m/m and 188% y/y).

- Japan's Mitsui & Co. has invested in Canada's Ekona Power Inc. to commercialize Ekona's clean hydrogen technology, both companies announced last week. The Japanese company is one of several partners including energy companies and venture funds injecting CAD $79 million ($61.93 million) in equity investments to the project, Ekona said. (IHS Markit Chemical Market Advisory Service's Chuan Ong)

- Funding was led by US-based industrial company Baker Hughes, participated by industrial investors such as the US's ConocoPhillips, Continental Resources, Japan's Mitsui, Russia's Severstal, and Canada's TransAlta. Venture capital firms such as Canada's NGIF Cleantech Ventures, BDC Capital, were also investors, Ekona said.

- Using combustion and high-speed gas dynamics, Ekona believes its process is low-cost, scalable, and can be flexibly sited wherever natural gas infrastructure exists.

- Ekona's investor Mitsui said that hydrogen will play a key role in industrial decarbonization, agreeing on its potential as a clean energy source as hydrogen emits no CO2 when burned, and can be used in power generation, mobility, and other industries.

- However, technical and economic challenges in clean hydrogen production include CO2 capture and storage (CCS) needed for abating CO2 emitted from hydrogen production, Mitsui explained. Mitsui believes that EKONA's technology not only offers lower CO2 emissions, but also lower production costs comparable to other conventional hydrogen production technologies, such as steam methane reforming.

- Ekona's technology generates a majority of carbon in solid form, eliminating the need for CCS, said Mitsui.

- As part of its aim to provide clean hydrogen, fuel ammonia, CCS, and carbon capture, usage and storage (CCUS), Mitsui said it will use Ekona's technology to explore clean hydrogen opportunities in Japan.

- Mitsui said that Ekona produces clean hydrogen by decomposing methane into hydrogen and solid carbon under high temperatures, with a proprietary pyrolysis method that does not require any catalysts.

- According to Mitsui, producing hydrogen by burning fossil fuels into gas and extracting hydrogen from the gas (reforming), particularly steam reforming using methane as a feedstock, is widespread in the industry and relatively low cost. However, the accompanying CO2 emission is challenging.

- The number of firms in the eurozone reporting labor shortages as a factor limiting production continued to increase during the three months to January. Labor shortages, as measured by the European Commission business and consumer survey, reached a record high in the industrial, construction, and services during the period. (IHS Markit Economist Diego Iscaro)

- The indices started to trend upwards in late 2020 (early 2021 for the construction sector) due to a combination of a recovering economy and a lower availability of workers as a result of the pandemic.

- Labor shortages can also be seen in the eurozone vacancy rates, which measure the proportion of job openings that are currently vacant. The eurozone vacancy rate stood at 2.7% during the third quarter of 2021, which is highest level since the figures started to be collected in 2014 (it had averaged 2.3% in 2019).

- The increase in unfilled vacancies has been particularly acute in Belgium, the Netherlands, and Austria. On the other hand, vacancy rates remain substantially lower in Southern European countries.

- The breakdown of vacancy rates by sector suggests that labor conditions have significantly tightened in the administrative and support services, construction, and hospitality sectors. Vacancy rates in other sectors are not too dissimilar to where they were in late 2019.

- Labor shortages are being reported despite the recovery of labor market participation rates. The eurozone participation rate declined from 57.5% during the fourth quarter of 2019 to 55.6% in early 2020, but it returned to its pre-COVID-19 level during the third quarter of 2021

- At 1.1% month on month (m/m), seasonally and calendar-adjusted German industrial production excluding construction posted their third consecutive increase in December, thus broadly returning to average levels of the first half of 2021 ahead of the mid-year slump. The latest output level still is about 6% below its February 2020 pre-pandemic high, however. (IHS Markit Economist Timo Klein)

- Total production including construction (see table below for a breakdown of recent history) posted only -0.3% m/m owing to a major drag from construction output (-7.3%). Construction was a key supportive force for overall production between mid-2018 and mid-2021, but this was no longer the case during the second half of 2021.

- The split by type of good reveals that the production of investment goods was the driving force during the fourth quarter of 2021. Admittedly, this only compensated for net declines during the second and third quarters, but this is nonetheless encouraging in view of persisting uncertainty in late 2021 about the duration of pandemic-related disruptions to both supply and demand. Intermediate goods displayed a similar pattern during 2021, though with less m/m volatility. Finally, consumer goods production has been moving sideways since September 2021.

- December's breakdown by industrial branch reveals that motor vehicle production - as has been the case since September 2021 - greatly outperforms all other branches, increasing another 12.1% m/m in December. This reflects their particularly sharp decline during January-August 2021, however, mainly owing to the global scarcity of semiconductors. Even in December, motor vehicle output was approximately 21% below pre-pandemic levels. In other sectors, December production of electronic and electric equipment did quite well too (2.3% m/m), whereas there were declines in the machinery & equipment sector (-3.7% m/m) and the food and beverage sector (-3.1%). Output slipped just slightly in the chemicals/pharmaceuticals and metals sectors.

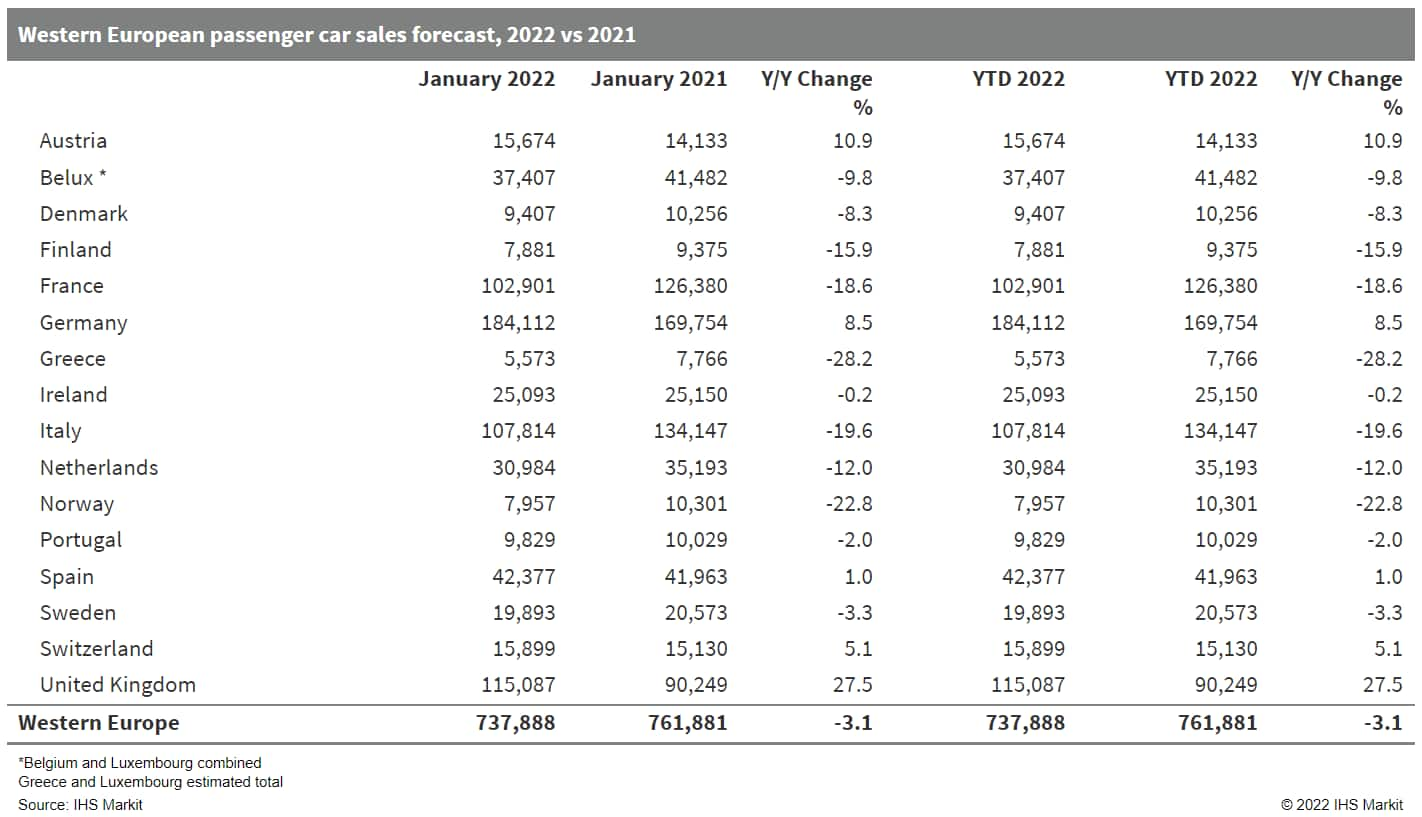

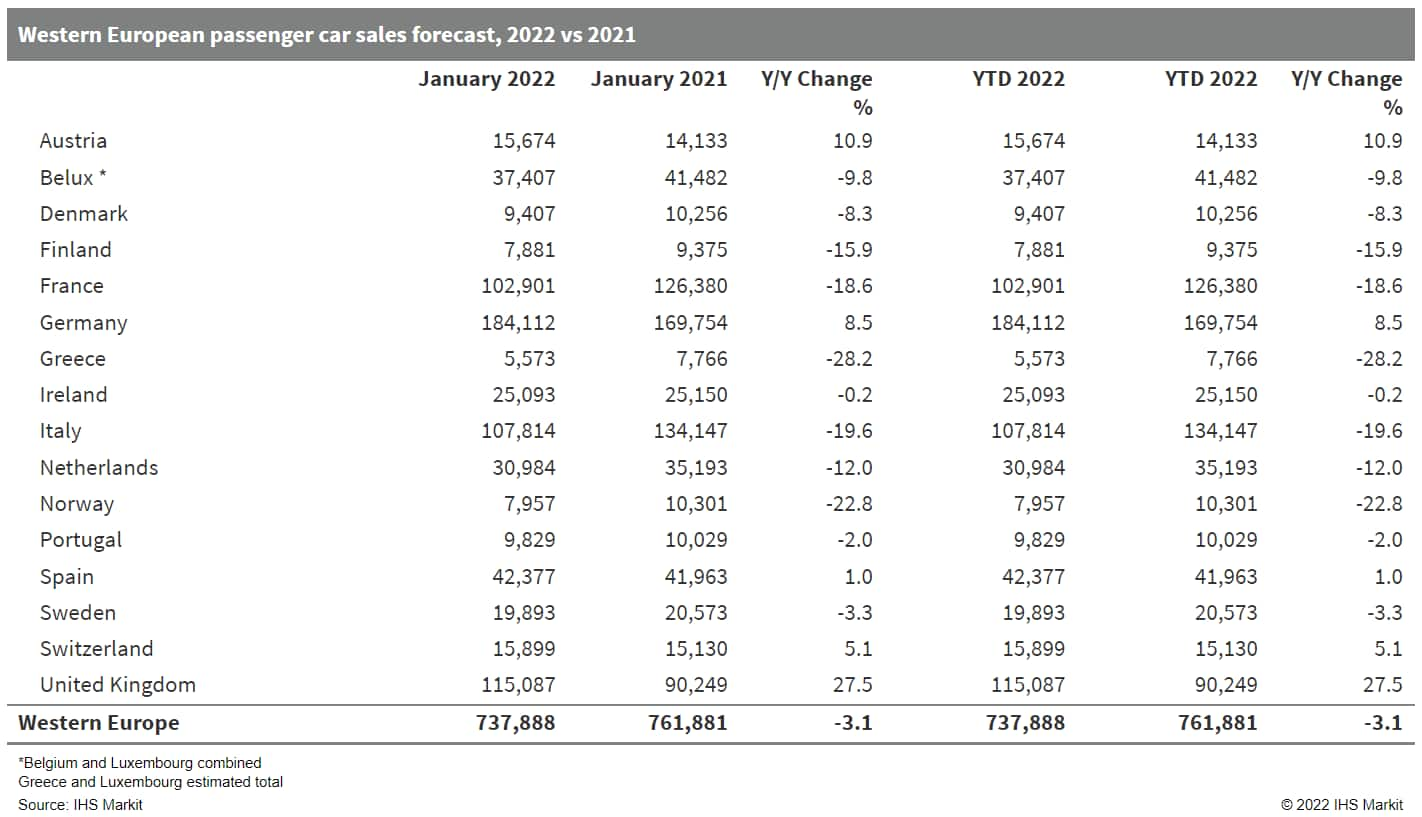

- Western European passenger car registrations have slipped by 3.1% year on year (y/y) in January despite an already very weak January 2021 caused by coronavirus disease 2019 (COVID-19) virus measures in some markets as semiconductor shortages continue to hurt vehicle availability. According to IHS Markit's latest forecast, registrations in the region dropped to 737,888 units from 761,881 units in January 2021. While the decline in January is relatively modest compared to some that were seen during the second half of 2021, this is against a 25.7% y/y fall recorded in January 2021 thanks to a combination of COVID-19 virus-related lockdown restrictions, uncertainty over the impact of the pandemic prior to vaccination programs being accelerated, and more localized factors. There was also a negative calendar effect. The main factor that will be hitting their performance now will again be the shortage of semiconductors. This hit the majority of OEMs' production from early 2021, but the impact on sales accelerated in the second half of that year as production disruptions and stoppages worsened, and this could not be compensated for through inventory which had already been depleted, and not been restocked. Looking forward to 2022, IHS Markit currently expects semiconductor lead times will stabilize in the first half of 2022, but lead times will continue to be 26 weeks and longer. There are some uncertainties attached to this though. This comes from the impact from flooding in Malaysia during December 2021 and the potential for a rise in COVID-19 cases in the Philippines to hit supplies of semiconductors early in 2022. We also currently forecast that lead times will improve during the second half of 2022, but will still be longer than what is considered normal. We anticipate that passenger car registrations in the wider Western European region will improve by 9.2% y/y during 2022 to around 11.7 million units. However, this will be around 16.7% below the five-year pre-COVID-19 virus pandemic average between 2015 and 2019. We also expect the market to continue to grow over the coming years, peaking at around 13.9 million units in 2024. (IHS Markit AutoIntelligence's Ian Fletcher)

- Transatlantic trade in bivalve molluscan shellfish, such as mussels, clams, oysters and scallops, is to resume following more than a decade's suspension, after both the EU and US took the final steps to recognize the equivalence of each other's food safety systems last week. (IHS Markit Food and Agricultural Policy's Sara Lewis)

- Trade starts with exports to Europe from two states - Massachusetts and Washington - and to the US from the same number of EU countries - Spain and the Netherlands - according to 4 February statements from the European Commission and United States Trade Representative (USTR).

- Differences in regulatory standards meant trade in live molluscan shellfish has not been possible between the EU and the US since 2011, a situation that the Commission and US Food and Drug Administration (FDA) worked hard to resolve.

- In 2015, both sides carried out on-the-spot audits and, following years of discussions, the Commission and FDA recommended that the food safety systems for the production of raw bivalve mollusks in the two US states (Massachusetts and Washington) and the two EU member states can be considered equivalent.

- US Agriculture Secretary Tom Vilsack said the announcement "demonstrates an exciting opportunity for U.S. seafood producers to deliver world-leading products to consumers in the EU and furthers the U.S. Department of Agriculture's mission to provide U.S. stakeholders opportunities to better compete in the global marketplace."

- A subsidiary of Amazon has secured a warrant to acquire 39.6 million shares in LiDAR sensor maker Velodyne, reports Reuters. According to the deal, Amazon.com NV Investment Holdings, a wholly owned subsidiary of Amazon, can exercise the warrant at USD4.18 per share on or before 4 February 2030. The warrant shares will vest over time based on Amazon's "discretionary payments" of up to USD200 million to Velodyne. According to the deal, Amazon can appoint a board observer when its shareholding crosses 12.3 million shares. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Taiwan's Foxconn aims to produce 150,000 electric vehicles (EVs) in Thailand by 2030 through a joint venture (JV), Horizon Plus Co., Ltd. that started yesterday (7 February), reports Taiwan News. In September 2021, Foxconn signed a memorandum of understanding (MOU) with Thailand-based oil and gas conglomerate PTT Plc to set up a new company to build an EV production facility in Thailand's Eastern Economic Corridor. Foxconn's wholly owned subsidiary Lin Yin holds a 40% stake in Horizon Plus, while PTT's wholly owned subsidiary Arun Plus holds a 60% stake. The JV is expected to begin construction of the EV manufacturing plant this year, and production is expected to start in the first quarter of 2024. The initial capacity of the plant will be 50,000 vehicles per year, with the goal of ramping up production to 150,000 EVs a year by 2030. In the early stages of Horizon Plus, Foxconn and PTT are expected to invest around USD1 billion. As previously reported, Foxconn, best known for contract manufacturing high-technology consumer goods, such as Apple's iPhone, has recently expanded its activities in EVs. The company presented its EV platform in October 2020 and has since announced partnerships for EV production and technology sharing with several automakers, including Zhejiang Geely Holding Group, Stellantis, Fisker, and Lordstown Motors. (IHS Markit AutoIntelligence's Jamal Amir)

- Kia plans to scale up its investment in China and introduce a series of new electric vehicles (EVs). The South Korean automaker signed an agreement with the Yancheng city government on 7 February to expand its existing joint venture (JV), Dongfeng-Yueda-Kia, reports Korea JoongAng Daily. According to the report, Kia will release six EVs in China by 2027, starting with the EV6 next year. A separate report by China Daily indicates that the new investment committed by Kia and its Chinese partner Jiangsu Yueda Automotive Group could reach USD900 million. Dongfeng-Yueda-Kia was originally set up as a three-way JV between Kia, Jiangsu Yueda Investment (Yueda Investment) and Dongfeng Motor Group. However, Dongfeng already withdrew from the JV in December 2021 by selling its 25% share to Jiangsu Yueda Automotive Group, a subsidiary of Yueda Investment's parent company, Jiangsu Yueda Group (Yueda Group). Kia is expected to announce a new name for the JV in April. Dongfeng's withdrawal from the JV is primarily due to its poor performance, as Kia's sales have been declining over the past five years. The JV posted a net loss of CNY4.75 billion (USD746 million) in 2022 on revenue of CNY21.94 billion. In the next five years, much of Kia's China strategy will be centered on expanding its EV line-up and launching more higher-priced models in China. Between 2022 and 2027, Kia will introduce a new EV in China each year to meet growing consumer demand for them. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Mainland China's tourism and box office revenues during the 2022 Lunar New Year lag 2021 levels, suggesting weakening consumption growth and further roll-out of stimulus measures for economic stabilization in the first quarter. (IHS Markit Economist Yating Xu)

- Data from the Ministry of Transport showed a 31.7% year-on-year (y/y) increase in passenger trips by car, rail, and air and water transport during the week-long Lunar New Year holiday starting from 31 January.

- However, the rise in passenger trips may not have translated into higher consumption. According to the Ministry of Culture and Tourism, travelers made 251 million domestic trips during the holiday, down 2% compared with the same period in 2021 and equivalent to 73.9% of the pre-pandemic (2019) level. Revenue generated from domestic tourism during the period was 3.9% lower than the 2021 level and 43.7% lower than the 2019 level.

- Meanwhile, box office revenues during the holiday were 23.1% lower year on year according to Caixin, citing statistics from Dengta, a Chinese box office data tracker platform. Considering the 9% y/y increase in the average movie ticket price, the number of tickets sold this year was over 30% lower year on year.

- The higher volume of passenger trips is attributed to the less-stringent COVID-19 controls during the 2022 Lunar New Year compared with those in 2021. Despite the numerous regional outbreaks around the end of 2021 due to the spread of the Delta and Omicron variants of COVID-19, local authorities are now implementing more flexible and targeted pandemic controls under the "dynamic zero-COVID" policy. For example, migrants from low-risk regions were allowed to return to their hometowns to celebrate Lunar New Year this year.

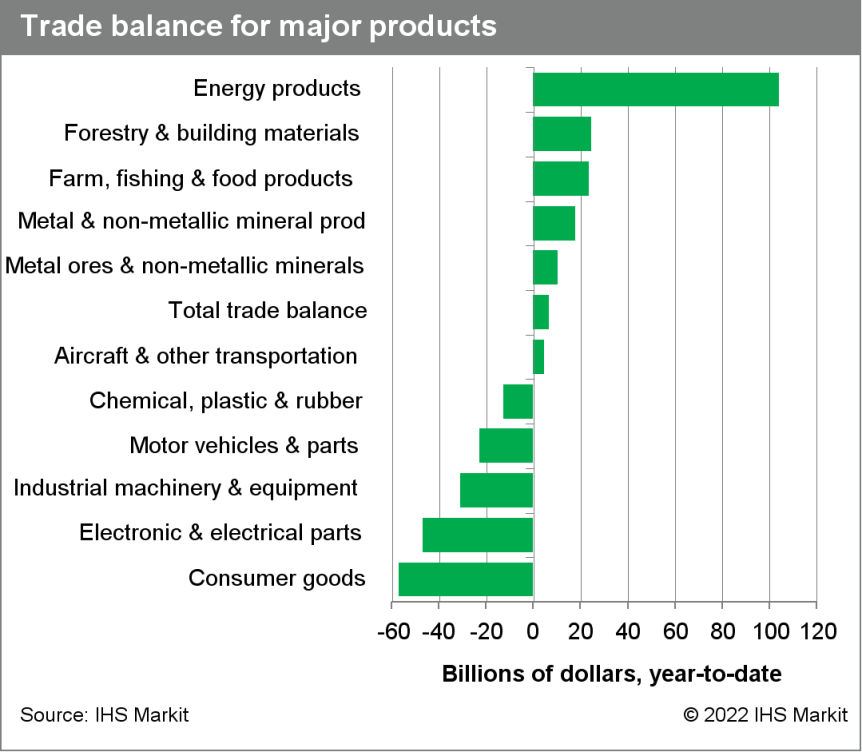

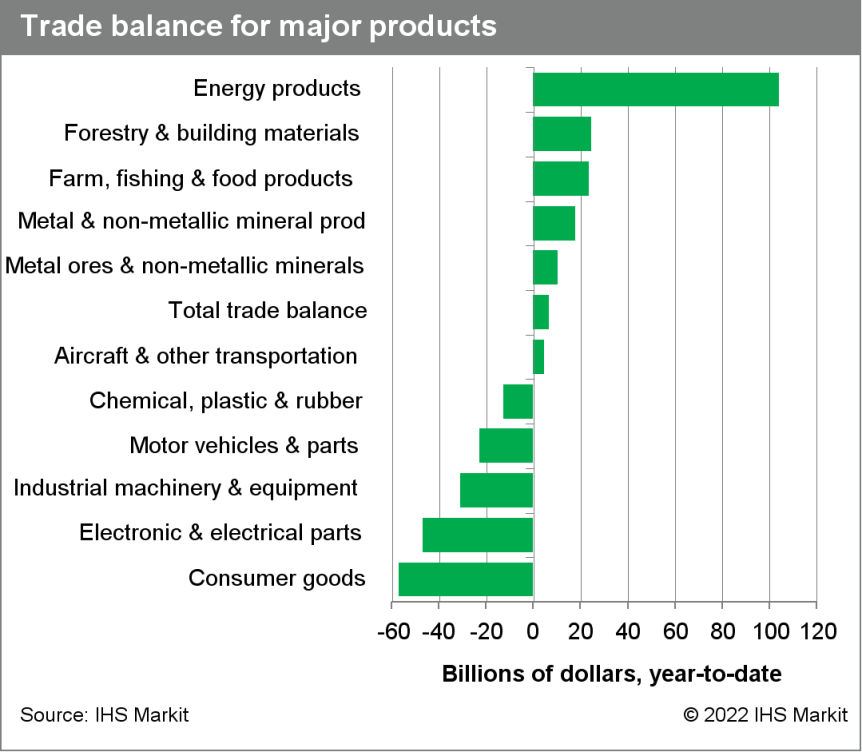

- Canada's nominal merchandise trade surpluses were recorded in nine months in 2021, reaching a total surplus of $6.6 billion. This is the first surplus since 2014 and the widest since 2008. (IHS Markit Economist Evan Andrade)

- High commodity prices, created by global demand-supply imbalances, helped Canada reach its merchandise trade surplus in 2021. Annual export growth in nominal energy products (up 82.8% year on year: y/y), forestry and building materials (up 31.8% y/y), and metal ores and non-metallic minerals (24.6% y/y) were far greater than each product category's import counterpart.

- December saw a substantial swing, as the merchandise trade balance returned to a modest deficit of $137 million from a surplus of $2.5 billion in November.

- Nominal exports fell 0.9% month on month (m/m) to $57.6 billion, while imports rose 3.7% m/m to $57.7 billion.

- In real terms, exports rose at a 10.8% quarter-on-quarter annualized rate (q/q a.r.) and imports jumped at a quicker 13.0% q/q a.r. This suggests that goods trade will be a drag on fourth-quarter and annual 2021 real GDP growth—in line with the latest forecast.

- On February 8, the Turlock Irrigation District (TID) in California announced Project Nexus, a pilot project to build solar panel canopies over a portion of TID's existing water canals, adding solar capacity while helping protect water in the canals from evaporation. Project Nexus is a public-private-academic partnership among TID, the state Department of Water Resources (DWR), Solar AquaGrid and the University of California, Merced. This first-ever solar panel over canal development in the US would (IHS Markit PointLogic's Barry Cassell):

- Assess reduction of water evaporation resulting from mid-day shade and wind mitigation.

- Improvements to water quality through reduced vegetative growth.

- Reduction in canal maintenance through reduced vegetative growth.

- Generation of renewable electricity.

- According to a joint statement issued by the People's Bank of China (PBoC) and the China Banking and Insurance Regulatory Commission (CBIRC) on 8 February, banks will no longer need to count loans to affordable rental real estate projects as part of their real estate lending target. (IHS Markit Banking Risk's Angus Lam)

- Chinese regulators normalized the real estate loan target for banks in September 2021, and banks have to meet a real estate lending target of between 12.5% and 40% of their total loans.

- The easing of loans to the real estate sector is not surprising considering that the regulators have previously asked banks to support the economy by lending more, and to also lower their short-term and medium-term loan prime rates (LPRs), which is a departure from only boosting lending to micro, small, and medium-sized enterprises and towards mortgages.

- IHS Markit has already noted that the rental market is likely to be a key area of lending in the real estate sector because of the central government's policy on establishing a rental market and supporting lower income individuals.

- Although the latest measure indicates easing of lending to real estate companies, we assess that it is not a complete opening up of lending to all types of real estate companies and will only be directed towards low-risk borrowers. This has been exemplified by the lending to state-owned real estate companies to acquire projects from weaker counterparts

- Tesla has excluded one of two electronic control units (ECUs) in the steering racks of some Chinese-made Model 3 and Model Y electric vehicles (EVs) to cope with microchip shortages, reports CNBC, citing two employees and company internal correspondence. This component reportedly is a secondary ECU in the electric power-steering system, which converts the movement of the steering wheel into turning of the wheels. Chinese media source Caijing reports that Tesla said the change poses no safety concerns as this secondary ECU is used primarily to support backup functions. Tesla did not disclose this change and it is unclear whether this is to be a temporary solution for the EV maker to cope with tight semiconductor supply or is part of an effort to lower production costs. However, CNBC reports that Tesla employees said adding "level 3" automated driving functionality, which would allow a driver to operate a Tesla vehicle hands-free without steering in normal driving scenarios, would require the dual ECU system and, therefore, require a retrofit at a service visit. Production at Tesla's Shanghai Gigafactory in China was 486,000 vehicles in 2021, accounting for more than half of Tesla's vehicle production globally. (IHS Markit AutoIntelligence's Abby Chun Tu)

- The US Army on February 8 released a climate-change strategy that, among other things, outlines an ambition to install a microgrid on every installation by 2035. There are over 130 Army installations around the world that protect, support and enable the force. In the last five years alone, the Army said it has enhanced installation-wide resilience by bringing systems online such as Fort Irwin's water treatment plant upgrade, Fort Knox's 2.1-MW solar field and Fort Carson's 8.5-megawatt-hour lithium battery. There are 950 renewable energy projects supplying 480 MW of power to the Army today and 25 microgrid projects scoped and planned through 2024. The policy goals also include (IHS Markit PointLogic's Barry Cassell):

- To achieve on-site carbon pollution-free power generation for Army critical missions on all installations by 2040.

- To provide 100% carbon-pollution-free electricity for Army installations' needs by 2030.

- To implement installation-wide building control systems by 2028.

- To achieve 50% reduction in greenhouse gas (GHG) emissions from all Army buildings by 2032, from a 2005 baseline.

- Petrofac has been awarded an early engineering services contract by H4 Energy for a wind-to-hydrogen development project on Sakhalin Island in Russia. As part of a three-year consultancy framework agreement, Petrofac will explore options for using predominantly wind energy to produce green hydrogen and other sustainable sources of energy at the site on the south-western tip of Sakhalin Island. (IHS Markit Upstream Costs and Technology's William Cunningham)

- Initial work will evaluate hydrogen production technology, hydrogen carriers such as liquid hydrogen and ammonia, export options, turbine sizing, electrical systems, and hazards analysis. Starting at 100 MW, Petrofac will also look at options for scaling up to 3GW of total installed capacity in future phases, including cost and execution phasing. The finished facility will target the production of 17,000 metric tons of hydrogen per year.

- Petrofac will undertake the work in Woking, United Kingdom with support from a team based in Sakhalin.

- Petrofac has been present in Sakhalin since 2006, when it opened the Sakhalin Technical Training Centre, providing training to operators and contractors in oil and gas projects. It expanded its presence in 2017 through an EPC contract with Sakhalin Energy for an onshore processing facility.

- Embark will supply its autonomous trucks to freight transportation company Knight-Swift in a pilot program, according to a company statement. The Truck Transfer Program will allow Knight-Swift to own an autonomous truck, maintain and deploy the truck, and place its own driver behind the wheel. This program will support both the companies to "collect driver feedback on the technology's performance, define how the system will improve driver jobs, and develop procedures and tools that enable Knight-Swift to maintain, inspect, dispatch, and remotely monitor Embark-equipped trucks". The Embark Universal Interface (EUI), the company's autonomous hardware and software stack, will be installed in a set of Knight-Swift trucks scheduled for OEM deliveries in 2022. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Russia exported 34 million tons of grains and oilseeds and their by-products as of February 3, down 19% y/y, according to the Federal Centre of Quality and Safety Assurance for Grain. This included 30 million tons of grains and pulses, and 28.7 million tons of grains specifically. (IHS Markit Food and Agricultural Commodities' Louisa Sabin)

- In particular, the country shipped 23.9 million tons of wheat, 2.8 million tons of barley, 1.8 million tons of corn, 1 million tons of peas, 0.6 million tons of wheat bran, 0.2 million tons of chickpeas, and 0.2 million tons of wheat flour.

- Russia also exported 0.4 million tons of soybeans, 0.7 million tons of sunflower meal, 0.5 million tons of flaxseed, and 0.2 million tons of rapeseed.

- Meanwhile, Russia sold a total of 32.9 million tons of wheat and meslin in 2021, down 14.4% compared to the previous year, according to the Federal Customs Service. Additionally, Russia sold 3.1 million tons of sunflower oil in 2021, down 15.1% y/y.

- The Turkish agricultural industry closed 2021 with a sharp rise in prices. Its Producer Price of Index of Agricultural Products rose by 36 % y/y in December 2021, being listed the following product categories: citrus (+2%), rice (+20%); vegetables, melons and tubers (+25%); sheep, goats and wool (21%); nuts and bush fruits (36%); dairy cattle (+48% y/y); poultry and eggs (+49%); cereals, leguminous and oilseeds (+67%); and fiber plants (+123%). Turkey is a key cereal supplier to the Middle East and of several edible nuts and dried fruits in the global markets (hazelnuts, sultanas, dried apricots and dried figs, mainly). Fertilizer and labor costs will be at the core of farming costs in 2022, especially for labor-intensive crops such as stone fruits, hazelnuts, grapes and figs. (IHS Markit Food and Agricultural Commodities' Jose Gutierrez)

- Fertilizers: 120% year-on-year growth in November 2021, due to the combination of rising international prices and lira devaluation. Fertilizer imports reached 4.8 million tons valued at $1.99 billion in 2021, 11% more year on year in volume and 78% more in value.

- Labor costs rose by 30% y/y. in November 2021.

- Energy (oil, gas and electricity) and lubricants: up 22% in November 2021.

- Pesticides: up 12% in November 2021.

- Seeds: up 9.5% in November 2021.

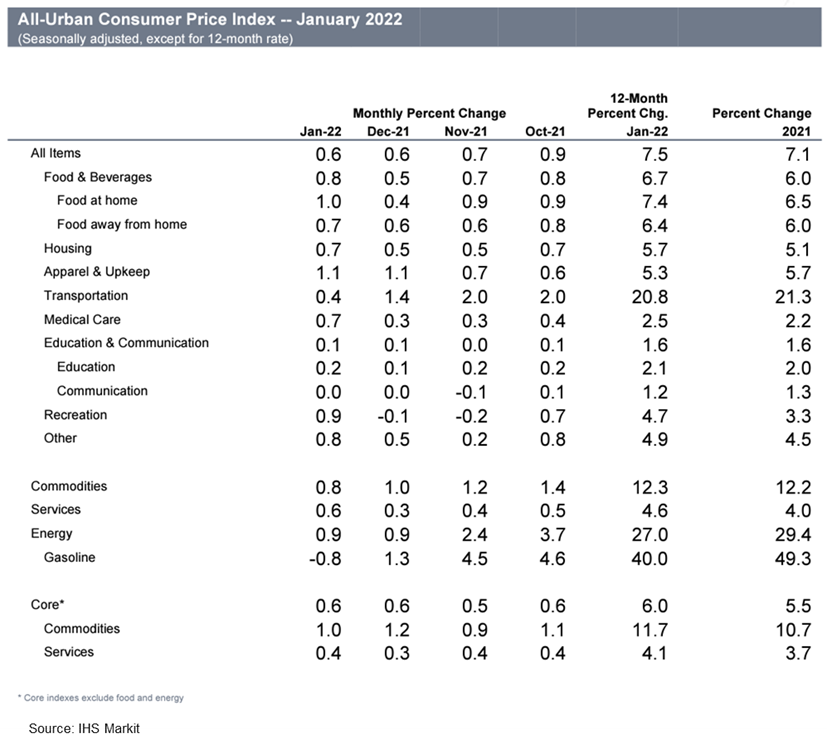

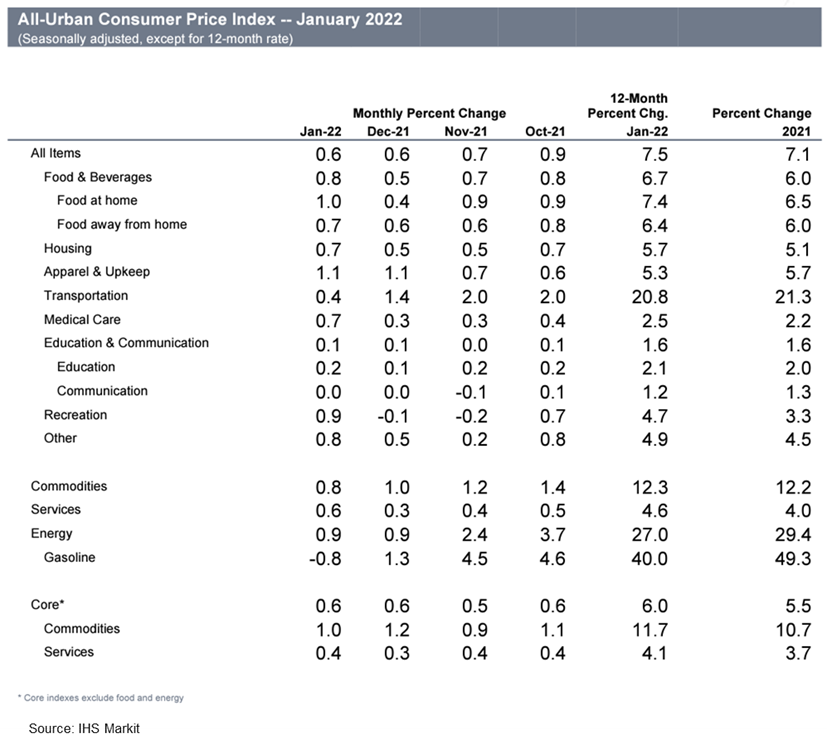

- Both the overall US Consumer Price Index (CPI) and the core CPI, which excludes the direct effects of moves in food and energy prices, rose 0.6% in January. CPIs for food and energy rose 0.9% and 0.6%, respectively. (IHS Markit Economists Ken Matheny and Juan Turcios)

- The 12-month change in the overall CPI climbed 0.5 percentage point to 7.5%, the highest since February 1982. The 12-month change in the core CPI rose to 6.0%, the highest since August 1982.

- Upward pressure on prices has broadened beyond those most impacted during the early stages of the pandemic. Among notable increases in January were those for apparel (1.1%), airline fares (2.3%), used vehicles (1.5%), and medical care services (0.6%).

- Sharp price increases within goods have contributed to the rise in annual core inflation since 2020. The CPI for commodities less food and energy rose sharply beginning last spring, with an annualized increase of 14.2% since March 2021. Its 12-month change was 11.7% in January.

- Prices within nonenergy services have also risen but more gradually overall. Since March 2021, the CPI for services less energy services has risen at a 4.2% rate. Its 12-month change was 4.1% in January.

- A quick rebound in rent inflation has contributed to the rise of services inflation. The 12-month change in owners' equivalent rent (OER) and rent of primary residence (RPR) in January was 4.1% and 3.8%, respectively, up from 2.0% and 1.8%, respectively, in April 2021.

- Today's (10 February) report on consumer prices supports the IHS Markit expectation that the Federal Reserve will tighten monetary policy several times over the course of 2022, beginning with consecutive rate hikes at each of the next three policy meetings in March, May, and June.

- Taiwan's Foxconn will start a USD8-billion investment in Indonesia during the third quarter of 2022 to produce electric vehicles (EVs) and batteries, reports Reuters, citing Indonesian Investment Minister and head of the Investment Coordinating Board (BKPM) Bahlil Lahadalia. The company will build a plant, which will span over an area of 200 hectares, in an industrial zone in Batang in Central Java to make battery cells, cathode precursors, and telecommunications spare parts, in addition to the vehicles. The Reuters report highlights that Foxconn did not immediately respond to a request for comment on the investment. Last month, Foxconn signed a memorandum of understanding (MOU) with the Indonesian Ministry of Investment as well as Indonesia Battery Corporation, energy firm PT Indika Energy, and Taiwanese electric scooter vendor Gogoro to jointly develop a battery manufacturing and EV ecosystem in the country. (IHS Markit AutoIntelligence's Jamal Amir)

- Battery electric vehicles (BEVs) are emitting more lifecycle CO2 than internal combustion engine (ICE) cars in parts of northern China, mainly due to the region's fossil fuel-dominated power generation mix, according to a recent study from Chinese researchers. (IHS Markit Net-Zero Business Daily's Max Lin)

- With strong policy support measures, including subsidies for vehicle purchases as well as government-sponsored technology and infrastructure rollouts in the past decade, China has emerged as the largest producer and buyer of BEVs globally.

- Chinese policymakers see higher penetration of low-emission cars as essential to meeting the country's targets of peak CO2 emissions by 2030 and carbon neutrality by 2060. But the study from Bowen Tang of Hubei University of Technology, Yi Xu of Wuhan University, and Mingyang Wang of State Grid Sichuan Electric Power Company suggests more BEVs do not always lead to lower emissions.

- Assessing 30 Chinese provinces and municipalities, the study found higher CO2 emissions from BEVs than ICE vehicles in Beijing, Heilongjiang, Jilin, Tianjin, Shandong, Shanxi, and Hebei. In Beijing, where the difference is widest, a BEV would emit 45.7 metric tons (mt) in its lifecycle while an ICE vehicle would emit 42.2 mt.

- In contrast, BEVs can help reduce CO2 emissions in other areas. In Yunnan, where the decarbonization impact is the strongest, a BEV's lifecycle emissions amount to nearly 12 mt while an ICE vehicle's emissions are 30.3 mt.

- "The promotion of BEVs helps to reduce carbon emissions in most regions in China," the researchers said. "However, the effectiveness of the emissions reduction dramatically varies … due to the difference in electricity generation mix, thermal power generation technology, and electricity transmission efficiency."

- The study highlighted the high proportions of coal, natural gas, and oil-fired power units in the electricity mix of the seven Chinese regions where BEVs have negative climate effects. Fossil fuels are responsible for 85%-90% of the power generation in three of them, and more than 90% in the other four.

- Indonesia's state-owned energy company Pertamina plans to jointly develop carbon capture, utilization and storage (CCUS) technology with Japan's Chiyoda Corporation, Chiyoda said in late-January. (IHS Markit Chemical Market Advisory Service's Chuan Ong)

- Both parties signed a memorandum of understanding on the CCUS project in mid-January, which aimed to provide solutions to climate change issues and to work towards a low-carbon society.

- Pertamina and Chiyoda agreed to support emission reductions through the development of new and renewable energy.

- They also agreed to target net-zero emissions and to promote climate goals.

- Additionally, both parties will collaborate on CCUS technology application studies, and hydrogen production.

- Japanese engineering company Chiyoda said it has been working with Pertamina since the early 1980s, providing engineering, procurement and construction

- (EPC) service for LNG plants and utility facilities in Bontang, Kalimantan Island, Arun, and Sumatra Island.

- Hong Kong SAR's consumers are struggling with fresh vegetable price hikes, with a huge temporary supply shortage due to the Covid disruption. Panic buying has been observed. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- Leafy vegetables from the mainland have seen prices rise significantly. On 5 February, the wholesale price for Choi Sum was HKD23.8 per kilo ($3.05/kg) compared with HKD12.6/kg on 24 January, 89% up; Pak Choi went up to HKD21.8/kg from HKD12.2/kg, Dou Miao was sold for HKD72.6/kg from HKD32.2/kg, according to the vegetable trade body. Meanwhile, retail prices soared 20-40%.

- The supply of meat, poultry and eggs remains stable.

- Vegetable vendors at the wet market said that wholesalers had raised their prices with some even doubling their usual rates. Vendors have had to pass on those increased costs to their consumers, local media reported.

- Hong Kong SAR's daily production (about 40 tons) of fresh vegetables accounts for only 1.6% of its total consumption. In 2021, Hong Kong SAR's fresh vegetable imports rose 14% y/y to $812 million. Imports of vegetables from the US lowered 12% y/y to $17 million, according to the USDA.

- Vegetables from the mainland make up about 91% by volume and 80% by value of the local market, according to the Hong Kong Imported Vegetable Wholesale Merchants Association.

- JBS, the world's largest meat processor, has launched a new ground beef product that can be cooked from frozen without thawing. The group's US division said its new Pound of Ground Crumbles would fill a 'crucial gap' in offerings for ground beef. (IHS Markit Food and Agricultural Commodities' Max Green)

- Created using a proprietary process, the product is made of quick-frozen ground beef that JBS USA claims will bring 'unmatched convenience and ease to meal planning'.

- "Ground beef is at the heart of dinnertime, and even though 62% of ground beef is stored frozen at home, it's easy to forget to thaw a brick of ground beef in time to start cooking," said product creator Heidi Meyer.

- "Crumbles can be pulled from the freezer and poured freely right into the pan, cooking in 10 minutes or less," she added.

- The new product is anticipated to add 83% of incremental category growth in the meat industry, according to an A.C. Nielsen Quantitative Test.

- Pound of Ground Crumbles is available at select stores across the US, including BJ's Wholesale Club, Festival Foods, GIANT, Meijer, Save A Lot, Weis Markets and WinCo Foods. It comes in three varieties - Original 80/20, Hearty-Sized Pieces 80/20 and Original with Onion.

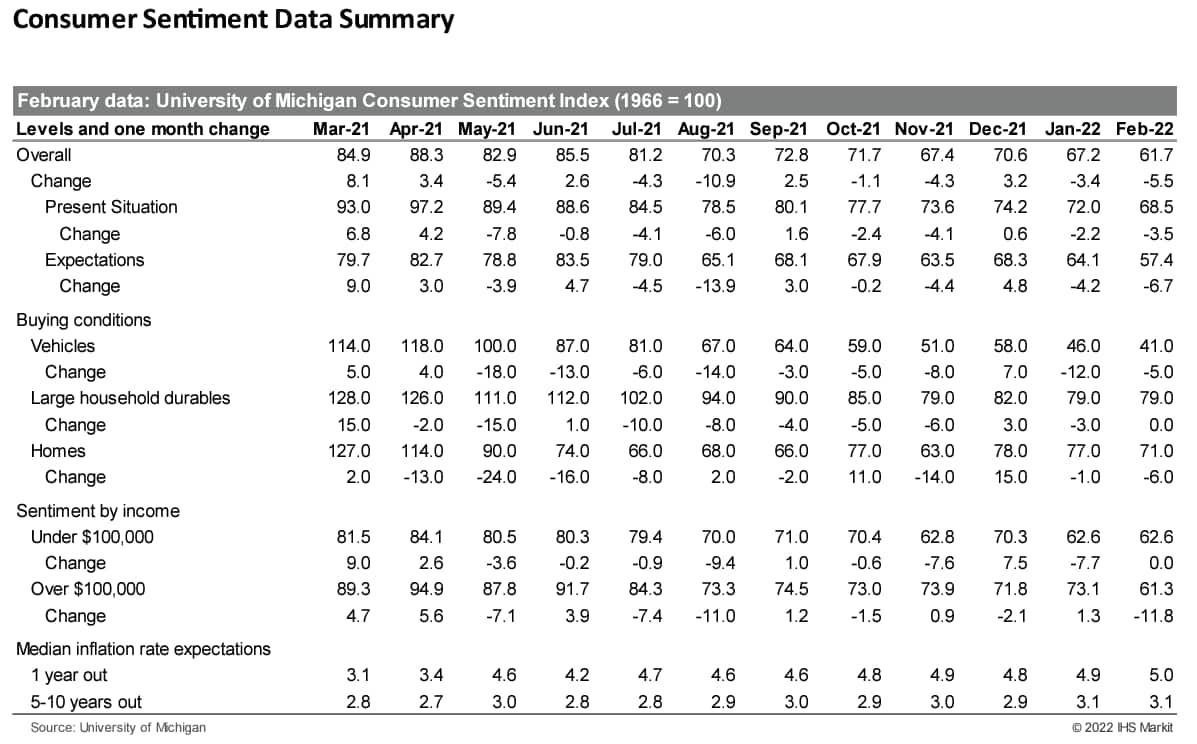

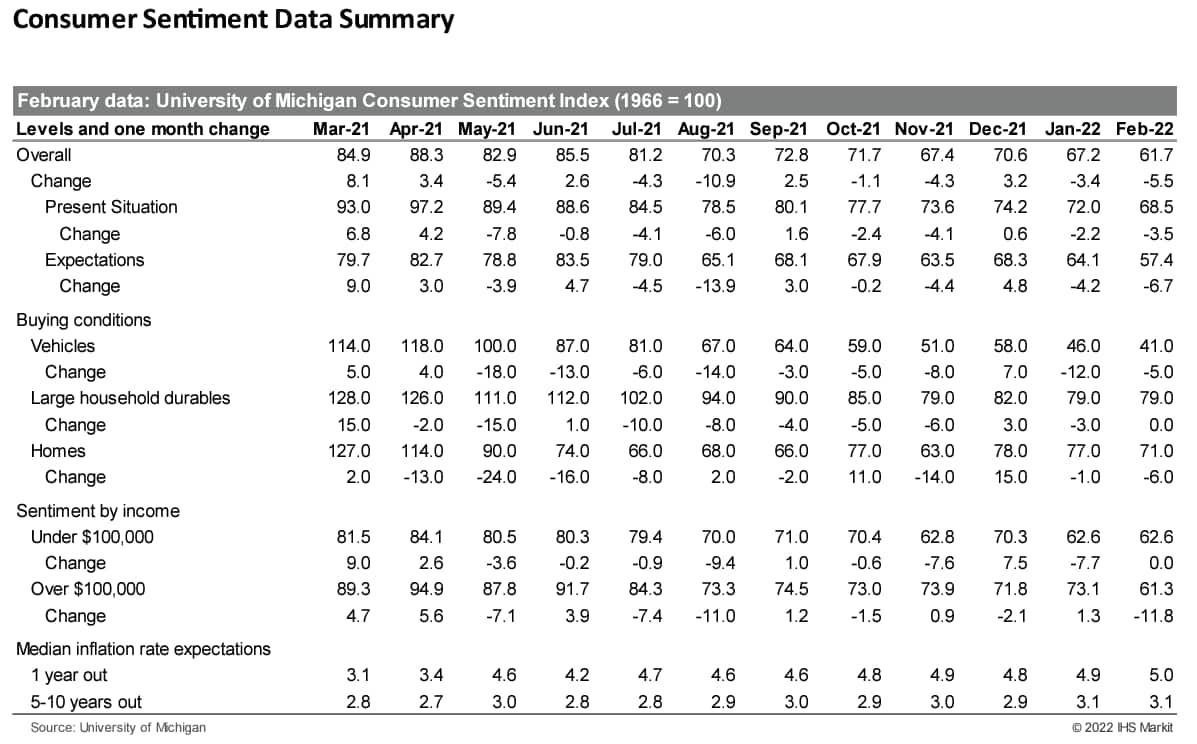

- The US University of Michigan Consumer Sentiment Index fell 5.5 points to 61.7 in the preliminary February reading—crashing to its lowest level since November 2011. A combination of rising inflation, low confidence in government economic policies, and a dim view of the long-term economic outlook has created the perfect storm for consumer sentiment—sentiment is down 30.1% since April 2021. (IHS Markit Economists Akshat Goel and William Magee)

- While there are myriad factors pulling down sentiment, escalating inflation appears to be the foremost source of drag. At 7.5%, the 12-month increase in the consumer price index (CPI) in January was the highest in nearly four decades. The median expected one-year inflation rate in the University of Michigan survey edged higher 0.1 percentage point to 5.0%, its highest level since 2008.

- While households with incomes below $100,000 per year are more sensitive to higher consumer prices, households with incomes above $100,000 are also feeling the impact. Indeed, the decline in sentiment in February was driven entirely by households earning more than $100,000, with their sentiment index falling 11.8 points to 61.3.

- The index of buying conditions for automobiles and homes fell by 5.0 points and 6.0 points, respectively, in February as high prices and limited inventories continue to be a drag on buying sentiment.

- The recent trend in consumer sentiment underscores the downside risks related to a prolonged period of above-trend inflation. However, inflation risks are balanced by the IHS Markit expectation for solid job and wage growth in the coming months, which should continue to support ongoing growth of consumer spending. Sentiment will track spending more closely as inflation subsides, although these may not align until 2023.

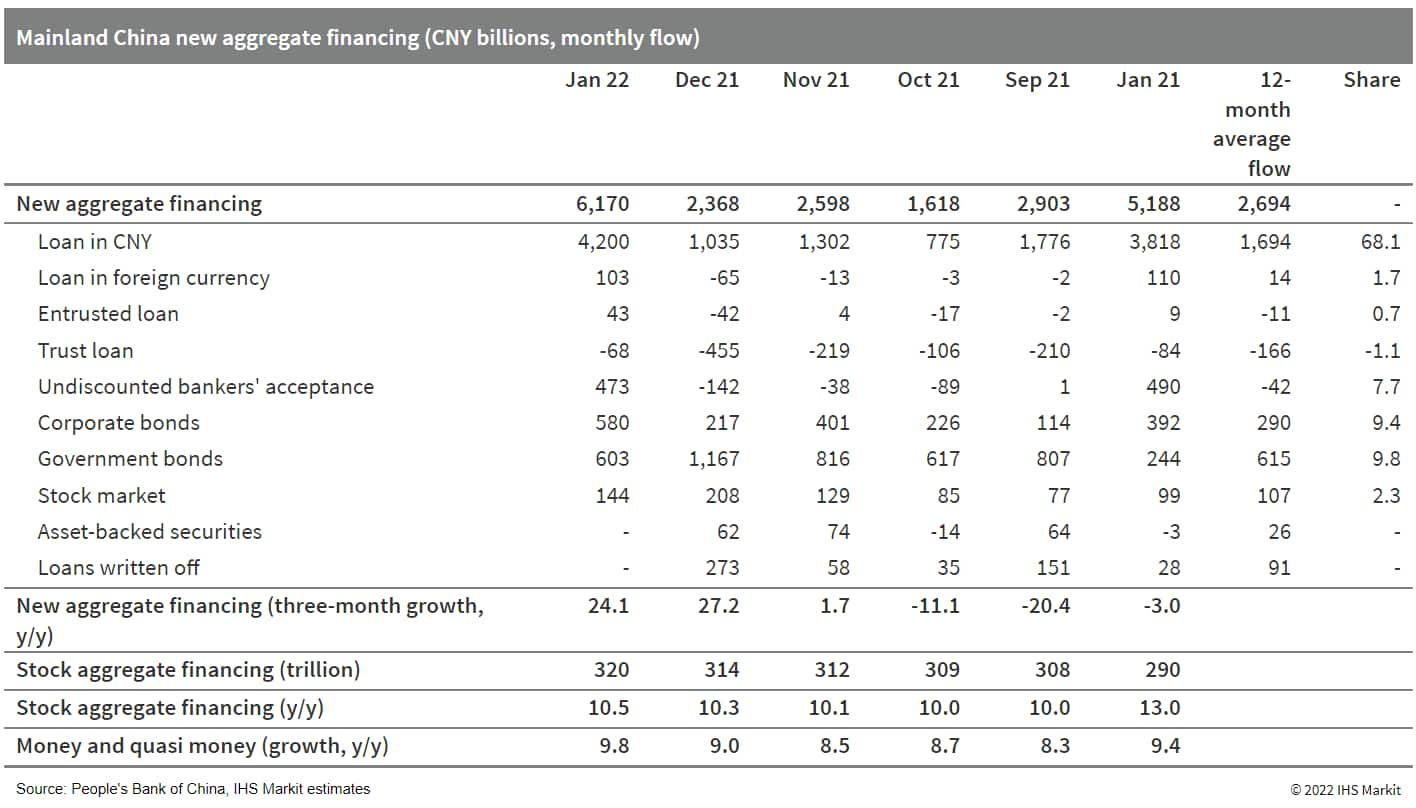

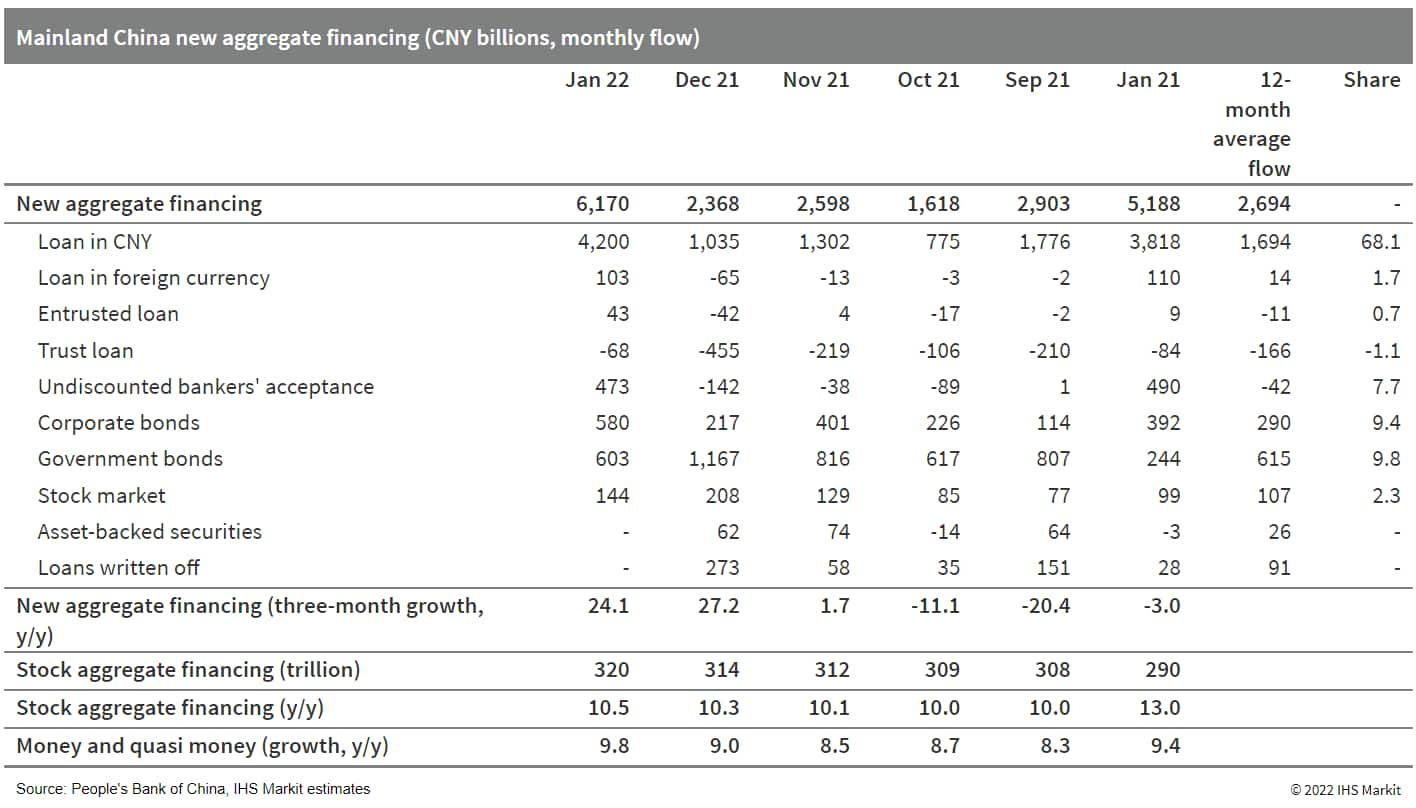

- Mainland China's new total social financing (TSF), the broadest measure of net new financing to the real economy, amounted to CNY6.17 trillion (USD970.67 billion) in January, up by CNY984.2 billion year on year (y/y), according to the People's Bank of China (PBOC). Stock TSF expanded by 10.5% y/y, up by 0.2 percentage point from the December 2021 reading. (IHS Markit Economist Lei Yi)

- While strong government bond issuance continued to contribute to the year-on-year gains in January's new TSF, bank borrowing also logged notable improvement even compared with the relatively high base in January 2021. New bank loans came in at a monthly high of CNY3.98 trillion in January, higher by CNY394.4 billion y/y. By sector, medium-to-long-term borrowing by corporates increased from year-ago level, ending the six-month-long year-on-year contraction in the second half of 2021; yet on the household front, medium-to-long term borrowing posted deeper year-on-year contraction in January, likely indicating still sluggish home sales during the start of the year.

- Broad money supply (M2) increased by 9.8% y/y in January, up 0.8 percentage point from the month-ago reading. M1 growth came in at -1.9% y/y, or 2% y/y if adjusted by the Spring Festival holiday impact, as compensation dispersions ahead of the holiday transferred deposits from corporates to households.

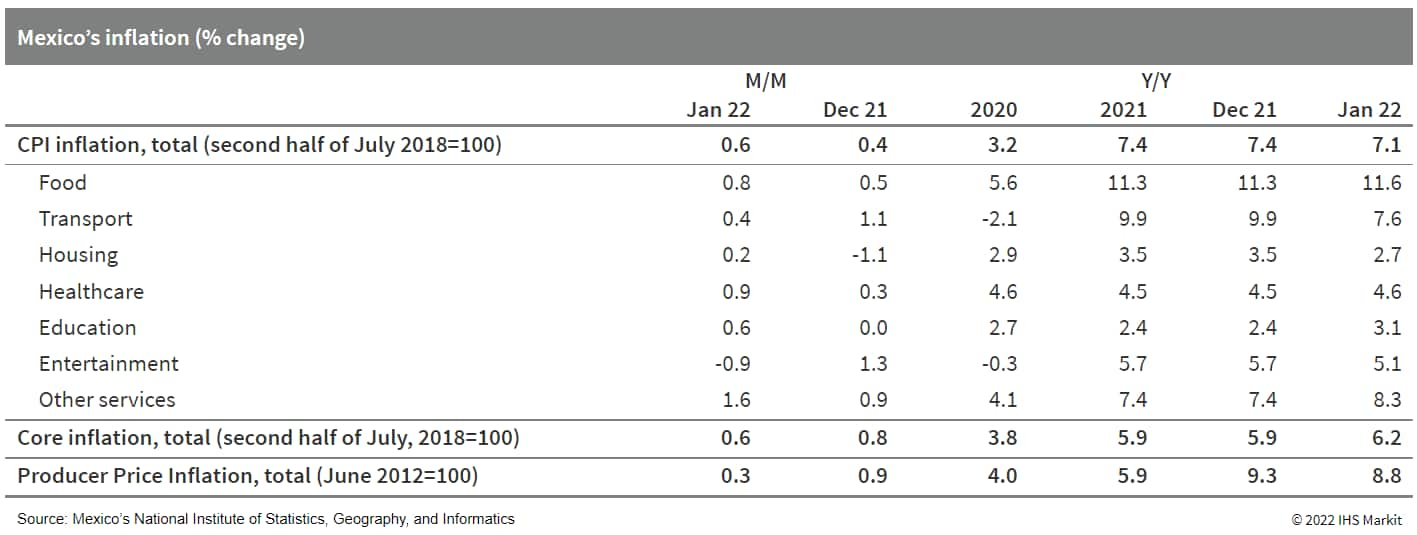

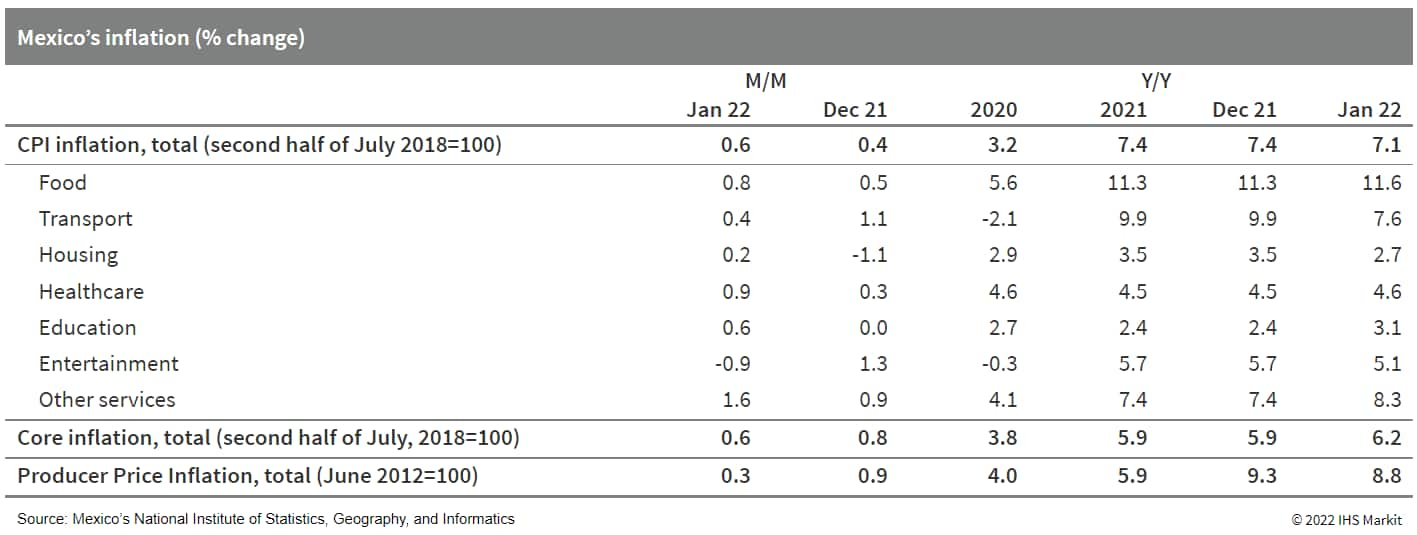

- The Bank of Mexico (Banco de México: Banxico) during its 10 February policy meeting increased the policy rate from 5.5% to 6.0%. This marks the sixth time in as many consecutive meetings that the monetary authority has increased the policy rate as it battles against high inflation. (IHS Markit Economist Rafael Amiel)

- In recent quarters, similar to most regions in the world, the drivers of inflation in Mexico have been high energy and food prices, supply chain disruption, and shortages. At the end of January, annual inflation amounted to 7.1%, well above Banxico's target of 3.0% +/- 1 percentage point.

- A major concern is that core inflation, which excludes items with high price volatile such as agricultural products and energy-related goods, has increased to 6.2%, revealing that there have been second-round effects or contagion from the price escalation that began in the energy and food sectors.

- In terms of risks, the bank highlights several upside risks: external inflationary pressures, the depreciation of the exchange rate, increases in costs, persistently high core inflation, and high energy and food prices.

- Banxico has also highlighted downside risks to inflation: a higher impact from the slack of the economy, the appreciation of the Mexican peso, and possible social-distancing measures that may reduce further demand for services.

- Chinese plant-based protein company Starfield Food Science & Technology has raised USD100 million, the largest investment round for plant-based protein in the country to date. Beijing's Primavera Capital Group led the round and other investors included Alibaba's chief strategy officer Ming Zeng and existing investors Joy Capital, Lightspeed China Partners, Sky9 Capital, and Matrix Partners China. (IHS Markit Food and Agricultural Commodities' Eugene Ong)

- Starfield says the funding will be used to significantly increase production capacity, improve research and development capabilities to enhance taste and texture profiles of plant-based proteins as well as financing team expansion, wider marketing, and brand awareness campaigns.

- To increase production, Starfield is building its first commercial-scale manufacturing plant in Xiaogan, Hubei with the capacity to produce hundreds of vegan meat variations including whole-cuts, chunks, mince, steaks, patties, sausage, meatballs, and hams. The company says that bringing the manufacturing process in-house will reduce both manufacturing and logistics costs, and in turn bring product pricing below other animal meats.

- Starfield also plans to launch new products such as braised beef, chicken thigh steaks, and pork chops. "Starfield will continue to launch more affordable, delicious, and healthy plant-based green foods based on plant protein technology, to create a better eating experience for our target Generation Z consumers, thereby delivering more sustainable lifestyles" chief executive officer Kiki Wu said in a statement.

- This funding makes Starfield the fastest growing plant-based proteins company in China. The company, which manufactures self-branded products that are sold by retailers, has partnered with over 100 local and foreign food suppliers and is present in more than 14,000 retail outlets in China, such as fast-food chains Tim Hortons and Dicos; convenience stores 7-Eleven, FamilyMart, and Lawson; supermarket Hema; as well as beverage chains Heytea, Luckin Coffee, and Nayuki.

- Starfield has pursued its R&D through collaboration with academic research teams from the Beijing University of Technology and Industry, Jiangnan University, and Wageningen University in the Netherlands. It also has submitted about 30 patents for products developed through its proprietary "enzymatic cross-linking" techniques that can replicate textures and support whole-cuts.

- After a landmark year for edible insects in 2021, with the first two approvals under the EU's 2015 novel foods regulation (2283/2015), 2022 is promising to be just as momentous after the European Commission approved the third and fourth insect product ranges on 9 and 11 February. (IHS Markit Food and Agricultural Policy's Sara Lewis)

- Dutch producer Fair Insects, which is the edible insect arm of Protix, produces both the yellow mealworm (Tenebrio molitor) and house cricket (Acheta domesticus) authorised in Commission regulations updating the Union list of approved novel foods under a 2017 implementing law (2017/2470) to the framework novel foods legislation.

- The implementing regulation authorizing dried and powdered yellow mealworm (Tenebrio molitor) as a novel food was published in the EU's Official Journal (OJ) on 9 February, while the implementing regulation authorizing whole Acheta domesticus in frozen, dried, and powder (ground) forms to be used as snacks and as food ingredient was published in the OJ two days later. Both are authorized "in a number of food products for the general population".

- The two applications have travelled through the EU authorization procedure together, with member states greenlighting approval on 8 December following a week-long written procedure in the Standing Committee on Plants, Animals, Food and Feed (PAFF) novel foods and toxicological safety of the food chain section.

- However, IHS Markit learned that the time lag between the Commission adopting the two implementing regulations and subsequent publication in the OJ was down to translation delays, rather than reluctance to approve the house cricket, or any other problem with the application.

- Both insect ranges will benefit from five years' proprietary data protection because the European Food Safety Authority (EFSA) judged that it could not have reached the conclusions on their safety without the studies that Fair Insects provided in each case.

- Protection means that a competitor cannot put a generic product on the market using Fair Insects data until 1 March 2027 for the yellow mealworm and two days later for the house cricket.

- New energy vehicle (NEV) sales, including battery electric vehicles (BEVs) and plug-in hybrid vehicles (PHEVs), accounted for 43% of new vehicles sold in Shanghai during 2021, according to data released by the Shanghai Economy and Informatization Commission. In 2021, sales of NEVs reached 254,000 units in Shanghai, up 105% year on year (y/y), and Shanghai leads the way on EV adoption. By the end of 2021, cumulative sales of NEVs in Shanghai reached over 677,000 units, the highest number among Chinese cities. The goal of the local government is not just to electrify its transportation system but also make Shanghai a production hub for EVs. Mayor Gong Zheng said during a recent press conference held by the municipal government of Shanghai, that the city aims to bring its total NEV production output to 1.2 million units by 2025 and for BEVs to account for more than 50% of new vehicle sales. Official data suggest that Shanghai's new vehicle production output totaled 2.833 million units last year, marking an increase of 7% y/y. Of this total, production volume of NEVs reached 632,000 units, an improvement of 160% from 2020. The NEV sector also contributed significantly to Shanghai's manufacturing industry in terms of industry value increase. In 2021, total industry value of NEV manufacturing surpassed the CNY100-billion mark for the first time, reaching CNY177.26 billion (USD278 billion). (IHS Markit AutoIntelligence's Abby Chun Tu)

- China's Hainan Yisheng plans to shut its 2 million mt/yr purified terephthalic acid (PTA) unit for servicing in April this year, a source close to Yisheng told OPIS. (IHS Markit Chemical Market Advisory Service's Chuan Ong)

- The company did not specify how long this unit will be shut, the source said.

- Hainan Yisheng's PTA unit was also shut around the same period in 2021 - it was unexpectedly taken off-stream from Feb. 11 to Mar. 16 last year due to a glitch.

- Started up in 2013, this PTA line has been Hainan Yisheng's only unit in its Danzhou City base, within China's Hainan Province.

- The company's second PTA unit is in the works, scheduled to come onstream in 2023 with a 2.5 million mt/yr capacity.

- Yisheng's affiliated companies together have the largest PTA production capacity in the world. They are hence also the world's largest consumer of paraxylene (PX) collectively.

Posted 14 February 2022 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.