Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jun 08, 2021

The post-pandemic rebound in prices, exacerbated in sectors where demand is recovering faster than atrophied supply chains can accommodate, has proved stronger than expected. In response, we have raised our forecasts of CPI inflation for 2021 and 2022, from 2.6% and 1.7%, respectively, to 3.3% and 2.1%. However, as supply expands, we expect inflation in prices for core personal consumption expenditures to remain near 2% after 2021.

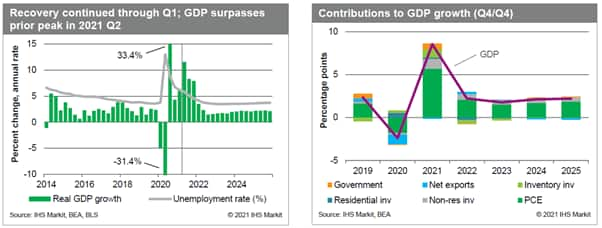

Recent strong demand has combined with sharply falling inventories, which will add to growth as firms replenish inventories during the second half of the year. Moreover, the relaxation of state containment measures has accelerated as the vaccinated share of the population continues to rise. These factors have encouraged us to raise again our forecasts of GDP growth for this year and next, from 6.7% to 7.4% for 2021, and from 4.7% to 4.8% for 2022.

We expect GDP to surpass its previous peak in the second quarter of this year and the output gap to be eliminated in 2022. The previous peak of employment will be regained in mid-2022, and the unemployment rate is expected to decline to 3.5% by late 2022.

As negotiations continue on an infrastructure bill, we've yet to include an assumed package in our base forecast, given the range of possible outcomes. The potential economic impact depends on the final scope of the bill, and importantly, how much of the total is new spending.