Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Mar 16, 2023

By Raj Badiani

The cost-of-living crisis arising from very elevated inflation and higher borrowing costs, alongside record-high house price-to-income ratios, indicates a period of weaker UK house prices from late 2022 to mid-2024.

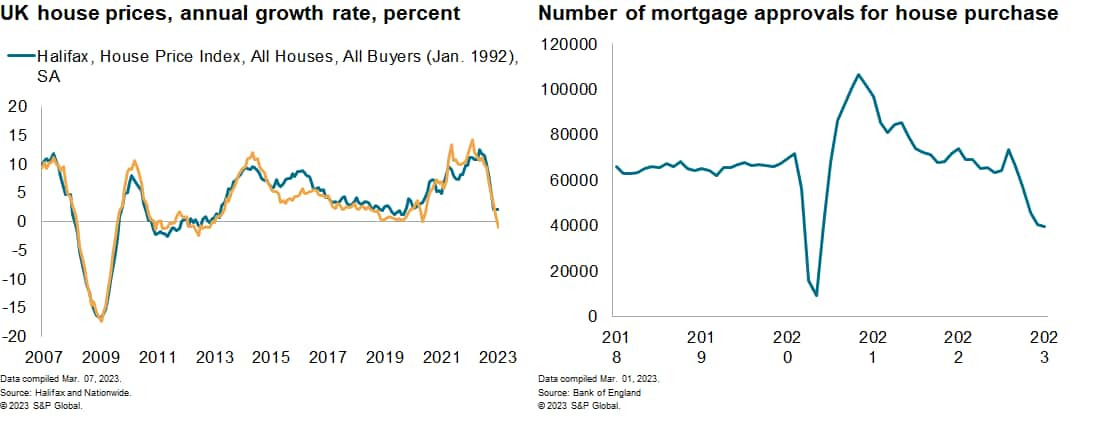

The Nationwide mortgage lender reports that UK house prices have fallen for a sixth month in a row, declining 0.5% between January and February. This was after house prices dropped by 1.8% quarter on quarter (q/q) in the fourth quarter of 2022, which was the first decline since mid-2020. House prices fell by 1.1% year on year (y/y) in February, which was the first annual decline since June 2020 and the weakest performance since November 2012.

Faltering demand for mortgages also signals weaker housing market activity. Specifically, the Bank of England (BoE) reports that the number of mortgages approved for house purchases fell to its lowest level since the global financial crisis, excluding the very start of the pandemic.

Mortgage approvals for house purchase fell for a fifth successive month to 39,367, according to the BoE.

Outlook

Housing market activity and prices will come under persistent pressure during 2023. Consumers' purchasing power will be pushed back as significantly elevated inflation triggers an unprecedented fall in real earnings alongside higher mortgage financing costs.

S&P Global Market Intelligence predicts that UK house prices will fall by a cumulative 9% between the fourth quarter of 2022 and mid-2024, driven by significantly higher mortgage rates as well as an evolving economic downturn.

This matches the government's independent forecast from the Office for Budget Responsibility, which predicts a fall of 9% between the fourth quarter of 2022 and the third quarter of 2024. Meanwhile, the BoE expects house prices to drop by over 6% this year after an 8.5% rise in 2022.

Main triggers

The economy is enduring a protracted slowdown, with real GDP expected to fall by a cumulative 0.9% from its estimated peak in the second quarter of 2022 to its trough in the second quarter of this year.

Although mortgage rates have fallen since the government's ill-fated "mini budget" in September 2022, they are still higher than they were at the beginning of that year. In addition, the BoE has increased its Bank Rate from 0.1% at end-2021 to a 15-year high of 4.0% in February 2023.

Higher mortgage interest payments represent a further blow to household budgets already buckling under the strain of rampant food and energy prices. According to the Office for National Statistics (ONS), households spent 4.6% of their average weekly expenditure on mortgage interest in 2021, which will climb aggressively during this year.

Tough housing affordability ratios add further strain to a creaking housing market. Specifically, the house price to income ratio was at 7.1 in early 2022, the highest level ever recorded.

Real household disposable income fell for a fourth consecutive quarter when declining by 0.5% q/q in the third quarter of 2022.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.