Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — May 07, 2025

By Jingyi Pan

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated that global trade conditions deteriorated in April after having stabilised at the end of the first quarter, as the impact of additional US tariffs, announced at the start of April, reportedly weighed on export performance.

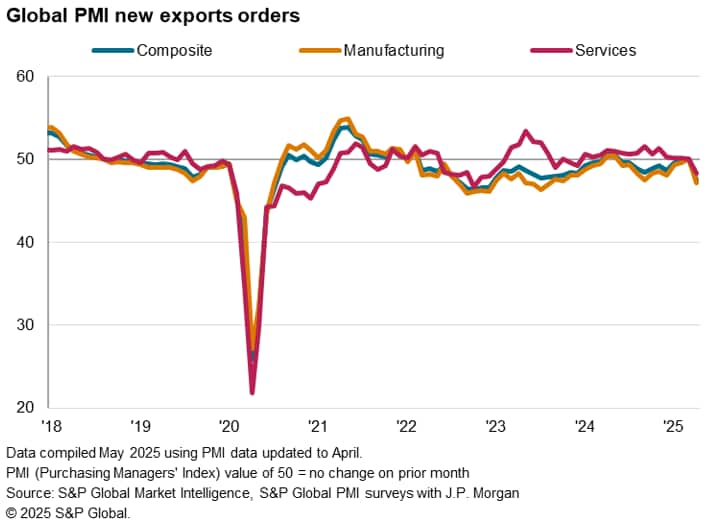

The seasonally adjusted Global PMI New Export Orders Index, sponsored by JPMorgan and compiled by S&P Global, fell to 47.5 in April, down from 50.1 in March. Posting below the 50.0 neutral mark, the latest reading signalled a renewed contraction of trade activity. Moreover, the reading is the lowest since the end of 2022 and below the long-run average, reflecting subdued performance in the immediate aftermath of additional tariff implementation by the US.

Manufacturing export contraction resumed in April following a brief stabilisation of conditions in March, according to the latest PMI data. Excluding March's print, goods exports have fallen continuously since the second half of 2024. Moreover, the latest reduction in goods trade was the sharpest since August 2023.

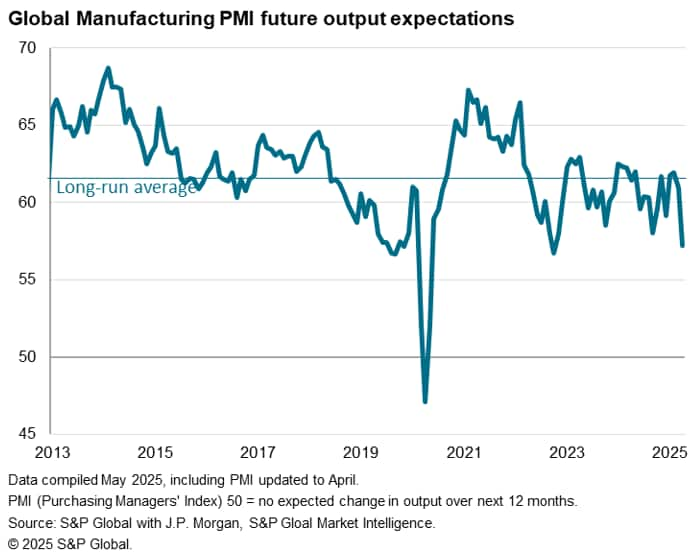

While exports data have started to reflect some impact from the April 2nd US tariff announcement, according to surveyed companies, indications from the wider manufacturing survey suggested that the worst may not be over as April's goods activity was supported by front-running of higher tariffs going into the 90-day extension period announced by US President Trump. As it is, business optimism in the manufacturing sector declined noticeably in April. The Future Output Index slipped to the lowest since October 2022, nearly matching levels in 2019 when trade protectionism during President Trump's first term in office hit business confidence.

Goods' selling prices meanwhile rose globally at the fastest rate since March 2023. However, higher inflation was concentrated in places such as the US, where higher tariffs were at play, whereas the rest of world saw a roughly unchanged rate of selling price inflation on average compared to March.

Meanwhile services exports contracted in April for the first time since the end of 2023. While modest, the rate of contraction was the steepest since December 2022, outlining the spillover of recent US policy developments upon the service sector.

Weakness on the trade side had also contributed to the softening of overall services activity growth in April. As with the trend for manufacturing, service sector business confidence fell sharply at the start of the second quarter of 2025. Global services firms were the least upbeat since the pandemic, citing concerns of the negative impact of US tariffs upon the outlook for growth.

Detailed sector PMI data revealed that service sectors, namely insurance, other 'non-bank' financials, software & services and transportation, led in terms of global exports growth, followed by tourism & recreation and media, which barely grew in April. The remaining sectors all reported falling export business, led by real estate and banking firms.

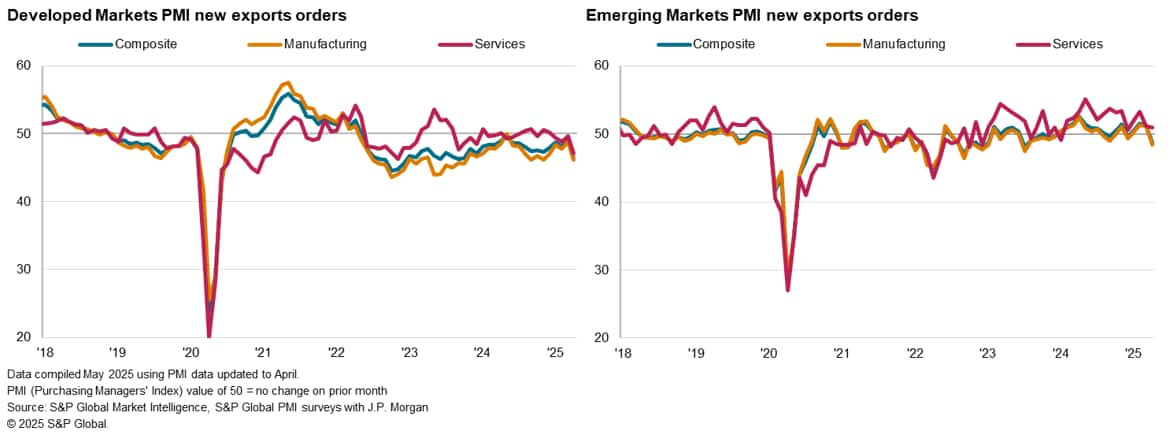

Regionally, the April PMI data revealed a broad-based deterioration in trade conditions, albeit led by developed markets.

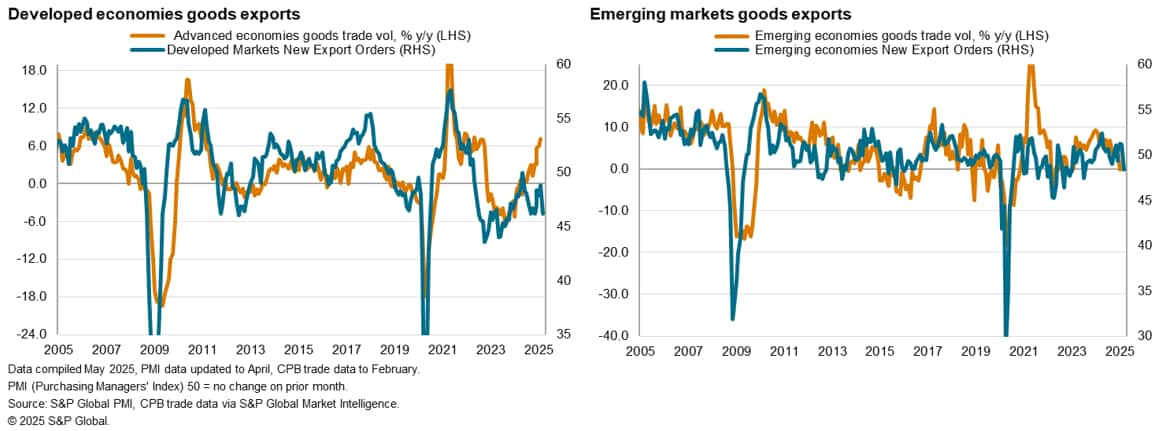

A reduction in goods trade extended the sequence of falling exports among developed markets to nearly three years. The developed world downturn in export business was the most pronounced since October 2023, reportedly affected by the announcement of additional US tariffs. April's trade contraction was led by good producers, where export orders declined at the fastest pace since last November. Developed world service providers meanwhile recorded their first drop in export business for nearly two-and-a-half years, reflecting aggravated damage to services trade exchanges from recent changes in trade policies.

Over in emerging markets, export business fell for the first time this year, dropping at the strongest pace since July 2023. The contraction of exports was underpinned by a renewed fall in manufacturing export orders though services export business also rose at a softer and only marginal rate. While front-loading of goods orders had managed to keep emerging market goods export orders in growth in the first quarter of 2025, April's data clearly showed that higher US tariffs have started to bite.

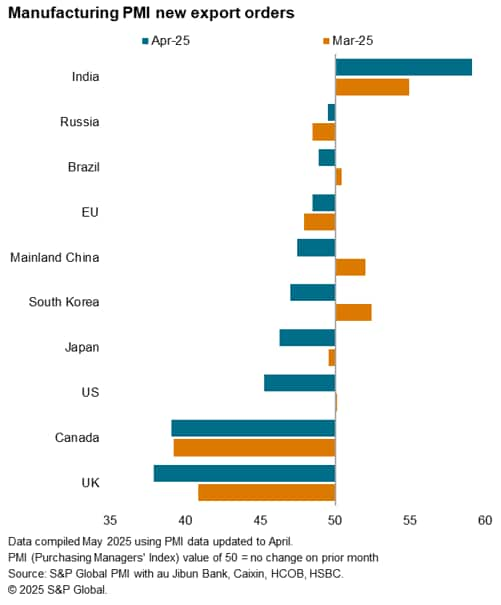

The number of top ten trading economies reporting higher goods exports was reduced to one, down from five in March, with India being the only remaining economy enjoying higher foreign sales. India notably recorded the second-highest expansion in goods orders from abroad in over 14 years. Anecdotal evidence suggested that front-loading of goods orders ahead of the implementation of higher tariffs continued to drive the rise in manufacturing export orders.

On the other hand, the UK registered the sharpest reduction in good exports among the top ten largest trading economies, as the US tariffs and a lack of competitiveness reportedly affected performance. This was followed closely by Canada, which saw the rate of goods exports contraction accelerate for a second successive month, similarly coming under pressure from elevated US tariffs. Less steep, but still solid, rates of goods trade decline were meanwhile observed for the US and Japan. In particular, the pace at which goods exports fell in the US is now the fastest in almost two years.

Finally, more modest rates of contraction were observed for South Korea, mainland China and the EU, while Brazil and Russia saw only marginal reductions in goods trade orders. Notably, the US, South Korea, Mainland China and Brazil all saw goods export orders move from a state of expansion in March to contraction territory in April.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2025, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location

Products & Offerings