Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Apr 29, 2021

We recently hosted a series of virtual roadshow meetings in EMEA, North America and Asia to discuss the most recent developments in the implementation of the Fundamental Review of the Trading Book (FRTB).

We focused both on FRTB Standardized Approach (SA) as European banks are finalizing their programme deliveries for a September 2021 reporting date and on FRTB Internal Model Approach (IMA) as many banks are now looking to ramp up development after a hiatus due to regulatory delays and uncertainty.

FRTB SA

For FRTB SA, the focus revolved around two main areas:

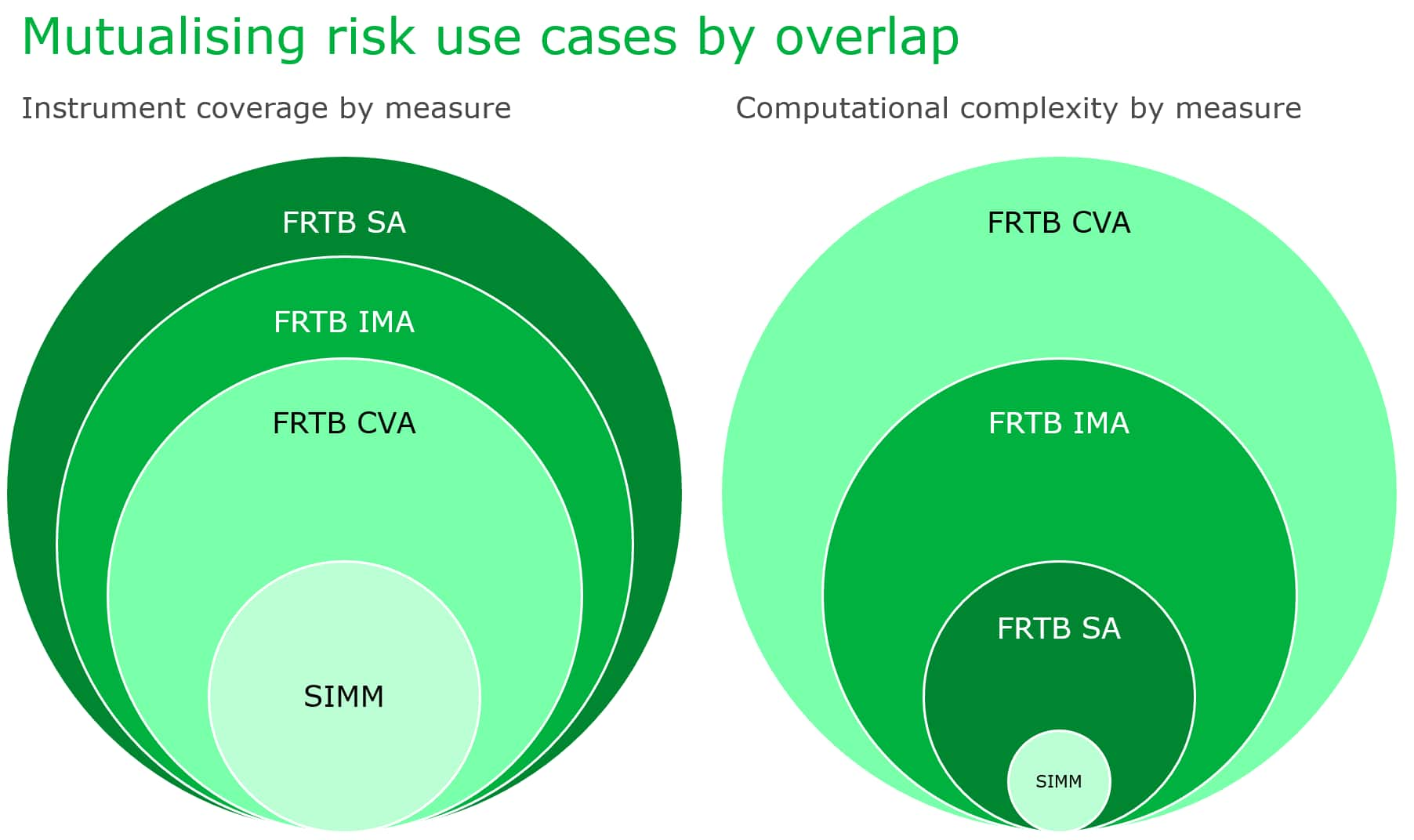

With a growing shift towards cloud-native or at least cloud-based risk architecture, now is the time to start looking at the overlap between risk calculations and how to mutualise infrastructure and development work for higher operational efficiency.

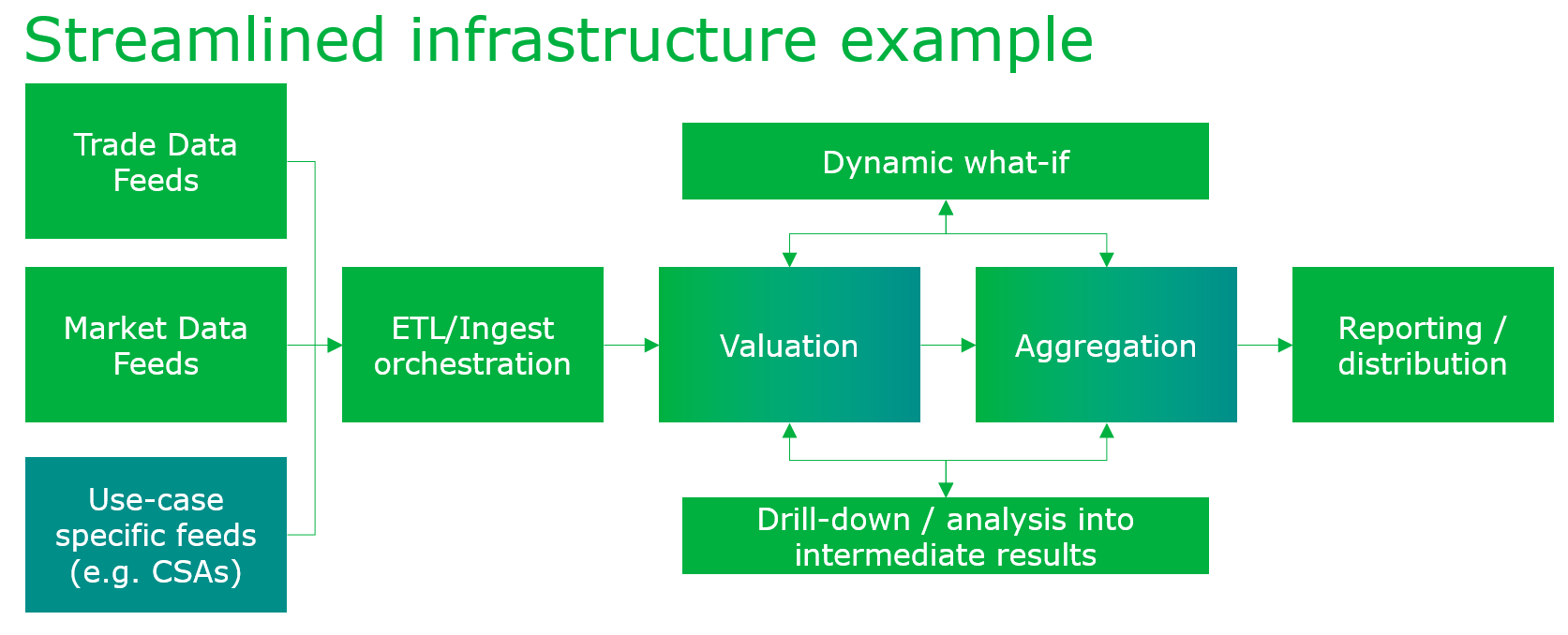

We have indeed been discussing more and more projects straddling teams and risk use cases with a view to maximise reusability and switch from a siloed, segregated programme view to adding use cases like add-on applications on a common platform - see a simplified infrastructure example below:

With most of the input data originating from similar sources in similar formats (even with varying coverage or depth), it makes sense to centralise feed management and orchestration.

FRTB-SA and ISDA-SIMM for instance are both sensitivity-based calculations using similar valuation components albeit with slightly different configurations.

Similarly, the corresponding risk measures can be aggregated using the same components with a different set of formulas.

And more importantly, such mutualised infrastructure allows for all users to benefit from the same overarching features: resilient, scalable production calculations with flexible what-ifs based on consistent datasets, full drill-down capability into capital measures but also intermediate results for reconciliation and analysis and consistent end-user interactions in the reporting layer or dedicated UIs.

FRTB IMA

As for FRTB IMA, two trends we have been seeing for a few years now have firmly established themselves as high priority for both banks and regulators:

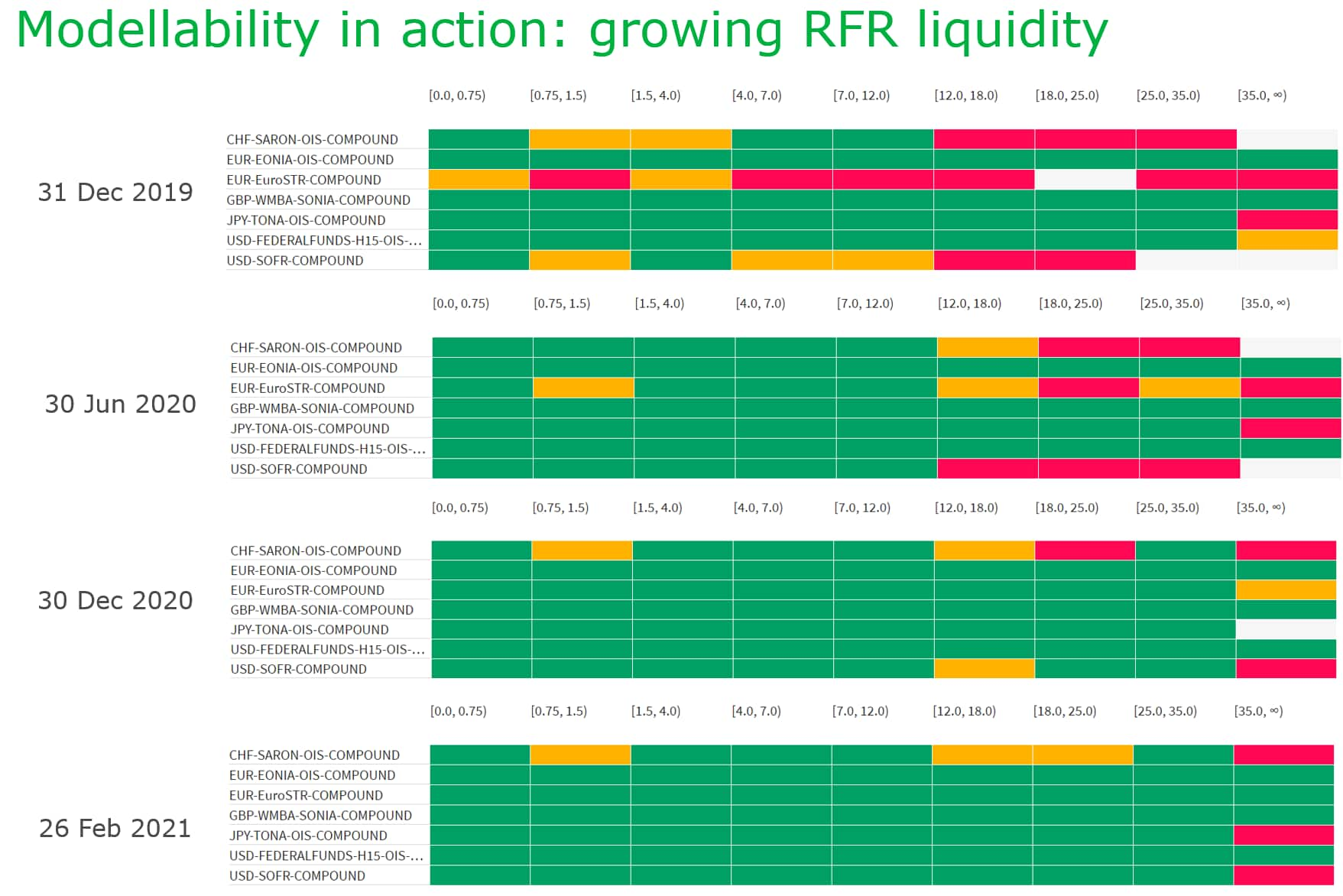

On the former, we have regularly been publishing RFET seasonality studies so we were used to seeing some volatility in counts of modellable and non-modellable risk factors but even we were surprised by the results of comparing 31-Dec-19 to 31-Dec-20.

Let's start with the clear winners of the period: the new risk-free rates. We started monitoring SOFR and EuroSTR as the first instruments started trading and we are happy to report that all but one bucket are modellable:

When looking at asset classes in aggregate the trend is net positive with a few nuances (and bear in mind that individual banks' views of this will be filtered on their respective exposures):

But the most interesting development we wanted to share with a wider audience of banks were the findings of our most recent studies, confirming a lot of the principles we have used to build our solution: calibrating IMA properly potentially requires numerous iterations between its moving parts:

Did you miss our roadshows? If you would like to discuss recent FRTB developments please reach out to us.

Location