All major US and European equity indices closed higher, while APAC markets were mixed. US and benchmark European government bonds closed sharply lower. CDX-NA and European iTraxx closed almost unchanged across IG and high yield. The US dollar, natural gas, and oil closed higher, while gold, silver, and copper closed lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher; Nasdaq +1.3%, S&P 500 +1.1%, DJIA +0.9%, and Russell 2000 +0.5%.

- 10yr US govt bonds closed +5bps/1.53% yield and 30yr bonds +6bps/2.10% yield.

- CDX-NAIG +1bp/54bps and CDX-NAHY +1bp/305bps.

- DXY US dollar index closed +0.2%/93.98.

- Gold closed -0.4%/$1,761 per troy oz, silver -0.2%/$22.61 per troy oz, and copper -1.1%/$4.19 per pound.

- Crude oil closed +1.7%/$78.93 per barrel and natural gas closed +9.5%/$6.31 per mmbtu.

- Greater municipal bond new issue volumes continue to be openly welcomed on behalf of the buyside community after last week's calendar peaked at $13 billion, with several large-scale issuers offering new issue deals providing hungry investors greater par size on a wider maturity basis. As investor demand continues to run high, the State of Hawaii came to market last week with $1.9 billion of taxable general obligation bonds across seven series, with the greatest par size housed in series GD ($700 million). Market demand for the Hawaii offering was noteworthy with bumps registered across the scale with the 10/2041 maturity witnessing the greatest investor traction resulting in a 16bp bump or +79bps spread to the 30yr UST. The Golden State Tobacco Securitization Corporation also stepped up to the plate to price $1.84 billion of tobacco settlement bonds with extreme bumps of 15-30bps driven by strong buyside appetite, with the greatest investor demand noted in the intermediate range falling 70-80bps off the 10yr UST coupon. This week's calendar is slated to taper slightly to $10.9 billion, represented by 223 new issue offerings largely represented by California issuers supplying $2.7 billion to market in addition to numerous ESG offerings for an aggregated total of $2.5 billion. The Alabama Federal Aid Highway Finance Authority (Aa2/AAA/-/-) is positioned to lead this week's negotiated calendar, supplying $1.5 billion of taxable special obligation revenue bonds led by Bank of America. The San Diego Unified School district will also tap into the primary market to finance $575 million of education bonds across four series spanning 01/2022-07/2051, selling on Wednesday 6 October with JP Morgan listed as senior manager. This week's competitive calendar will include 107 new issues for a total of $1.2 billion led by the Jefferson County School District Corporation of Kentucky auctioning $92 million of school building revenue bonds. (IHS Markit Global Markets Group's Matthew Gerstenfeld)

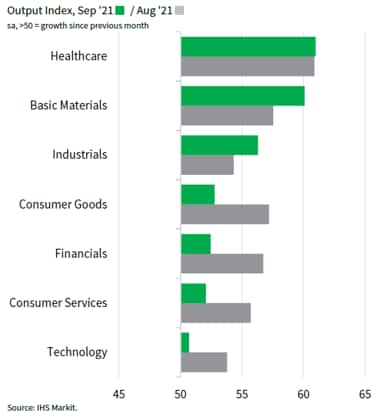

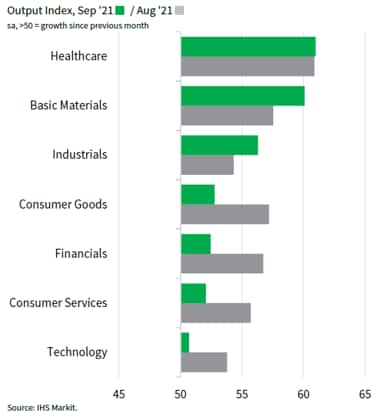

- The latest IHS Markit US Sector PMI™ indicated a slowdown in growth across four of the seven sectors tracked, led by the technology sector. This was consistent with the broad picture whereby the US remained adversely affected by the ongoing COVID-19 Delta wave, despite the decline in case numbers in recent weeks. Meanwhile the US bond market has shown signs of converging with economic conditions. (IHS Markit Economist Jingyi Pan)

- US Sector PMI™, compiled by IHS Markit, showed that all seven broad categories monitored by the surveys expanded in September, although four saw growth slow when compared to August. The decline in growth momentum had been the most apparent for the technology and consumer service sectors, with the former falling to a 14-month low.

- On the other hand, pandemic-related demand continued to support the healthcare sector. Basic material output growth also accelerated as firms sought to counter the ongoing supply crunch.

- General Motors (GM) has announced that it is building a new battery innovation facility on the campus of its Warren Technical Center in Michigan, United States. The company says the Wallace Battery Cell Innovation Center is due to open in mid-2022. GM says the new facility will expand its battery technology operations and accelerate development and commercialization of longer-range, more-affordable electric vehicle (EV) batteries. GM plans to expand the facility to three times its initial size with additional investment. The company aims to build its first prototype battery cells in the fourth quarter of 2022. GM says the Wallace Battery Cell Innovation Center will bring together battery development innovators and manufacturing development. The company declined to provide a specific investment amount in the new facility, only saying that it is in the hundreds of millions of US dollars. (IHS Markit AutoIntelligence's Stephanie Brinley)

- General Motors (GM) and Wolfspeed have reached a strategic supplier agreement on silicon carbide. Under the agreement, the supplier is to develop and provide silicon-carbide power device solutions to the automaker. No financial terms were disclosed. GM's statement said, "Wolfspeed's silicon carbide devices will enable GM to install more efficient EV [electric vehicle] propulsion systems that will extend the range of its rapidly expanding EV portfolio." The silicon-carbide devices will be used in the integrated power electronics in the GM Ultium Drive units in EVs. GM will participate in the Wolfspeed Assurance of Supply Program, a project the company says is intended to secure domestic, sustainable and scalable materials for EV production. The silicon-carbide power device solutions are to be produced at Wolfspeed's 200mm-capable Mohawk Valley fabrication facility in Marcy, New York (United States). The facility is due to open in mid-2022 and will be the world's largest silicon-carbide fabrication facility, according to the announcement. (IHS Markit AutoIntelligence's Stephanie Brinley)

- General Motors (GM)-backed autonomous vehicle (AV) unit Cruise will reportedly conduct an investor presentation this week. The presentation could reveal Cruise's plans to charge for rides using its modified version of the Chevrolet Bolt electric vehicle (EV) by 2022. If California Public Utility Commission (CPUC) permissions are obtained, Cruise expects to begin shared ride services in 2023 with its Origin autonomous shuttle. Cruise intends to expand its offerings beyond San Francisco with the Origin, which can carry four to six passengers, but requires approval from the National Highway Traffic and Safety Administration (NHTSA) to deploy the shuttle on public roads. The company envisions a path for its robotaxi business to reach USD50 billion in revenue over the next couple of years. GM's presentation will also include updates on its EV plans, SuperCruise driver-assistance feature, and Ultify software platform, reports Bloomberg. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The world's three largest orange juice (OJ) producers, Brazil, the US and Mexico, are expected to produce 1.76 billion gallons of single strength equivalent (SSE) orange juice in 2020-21, according to the final season outlook update published by Florida Department of Citrus (FDOC) on 30 September. (IHS Markit Food and Agricultural Commodities' Vladimir Pekic)

- Taking into account the combined beginning inventories that amounted to 604.6 million gallons of SSE OJ at the start of the 2020-21 season and the expected total production of 1.76 billion gallons of SSE OJ in 2020-21, the total availability of OJ will reach 2.36 billion gallons of SSE juice. This represents a 19% y/y drop from the comparative figure of 2.92 billion gallons of total available SSE OJ in the previous season.

- This represents a decrease of almost 500 million gallons of SSE OJ from the previous season, which is largely due to the decline in juice yields and reduced orange production.

- "At the conclusion of the Florida 2020-21 season, preliminary estimates indicate that total supply of orange juice on the world market was forecasted to decrease by 21.8% over the previous period from 2.25 billion SSE gallons to 1.76 billion SSE gallons due to reduced availability in production from leading suppliers, such as Brazil, Mexico, and the United States," stated the FDOC.

- Brazil, the largest global OJ producer, is expected to produce 1.22 billion gallons (-30.9% y/y) of SSE OJ during its season that runs from July 2020 to June 2021, followed by Mexico with 278.5 million gallons (+122.2% y/y) of SSE OJ in its season that runs from October 2020 to September 2021.

- Mexico has overtaken the US in the rankings as the US is projected to produce 263.5 million gallons (-27.7% y/y) of SSE OJ in the October 2020 to September 2021 season.

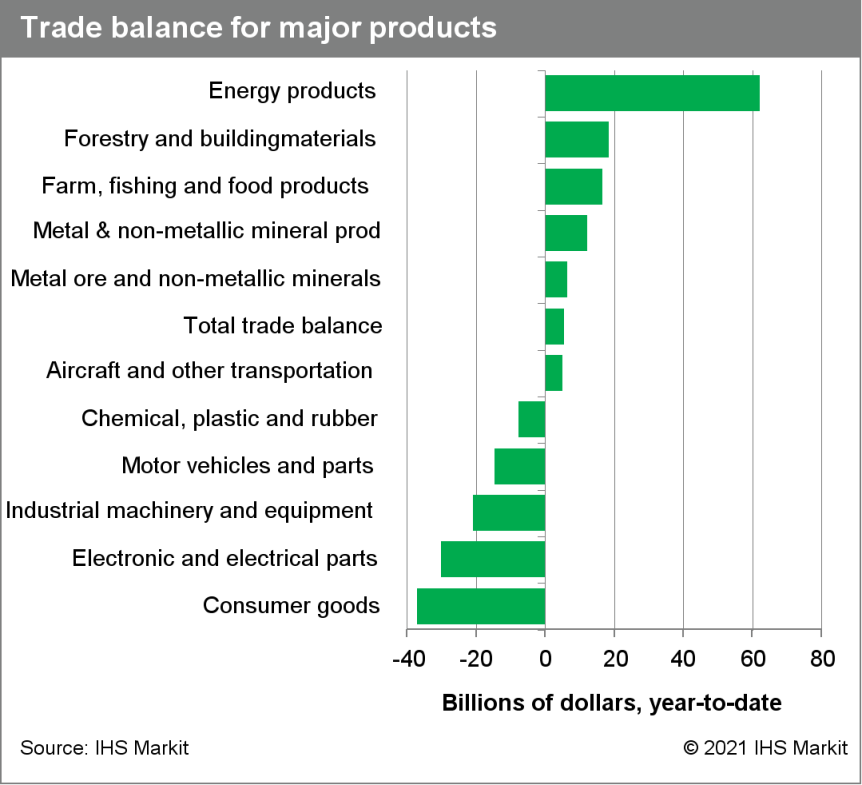

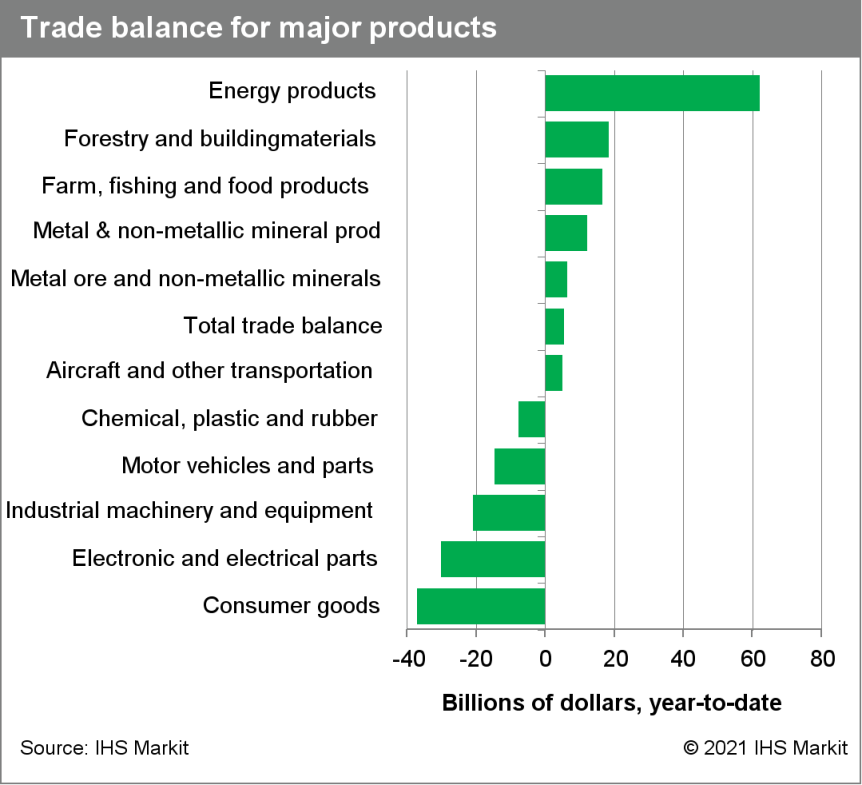

- Canada's merchandise trade balance has registered three consecutive—and six total—surpluses in 2021 so far, after consistent deficits since late 2014.This month's export gain was supported by higher levels of natural gas, crude oil, and coal pushing energy product exports up 5.1% m/m. Intermediate metal products also helped lift exports. (IHS Markit Economist Evan Andrade)

- The merchandise trade balance reached a surplus of $1.9 billion in August, after posting a surplus of $778 million the month prior.

- Nominal exports grew 0.8% month on month (m/m) to $54.4 billion—advancing for a third consecutive month—while imports declined 1.4% m/m to $52.5 billion.

- On a volume basis, real exports advanced a further 2.3% m/m while imports fell 2.5% m/m.

- Automotive trade took a bite out of both sides of the trade ledger, as exports fell 7.3% m/m and imports fell a further 11.1% m/m, driven almost entirely by lower volumes.

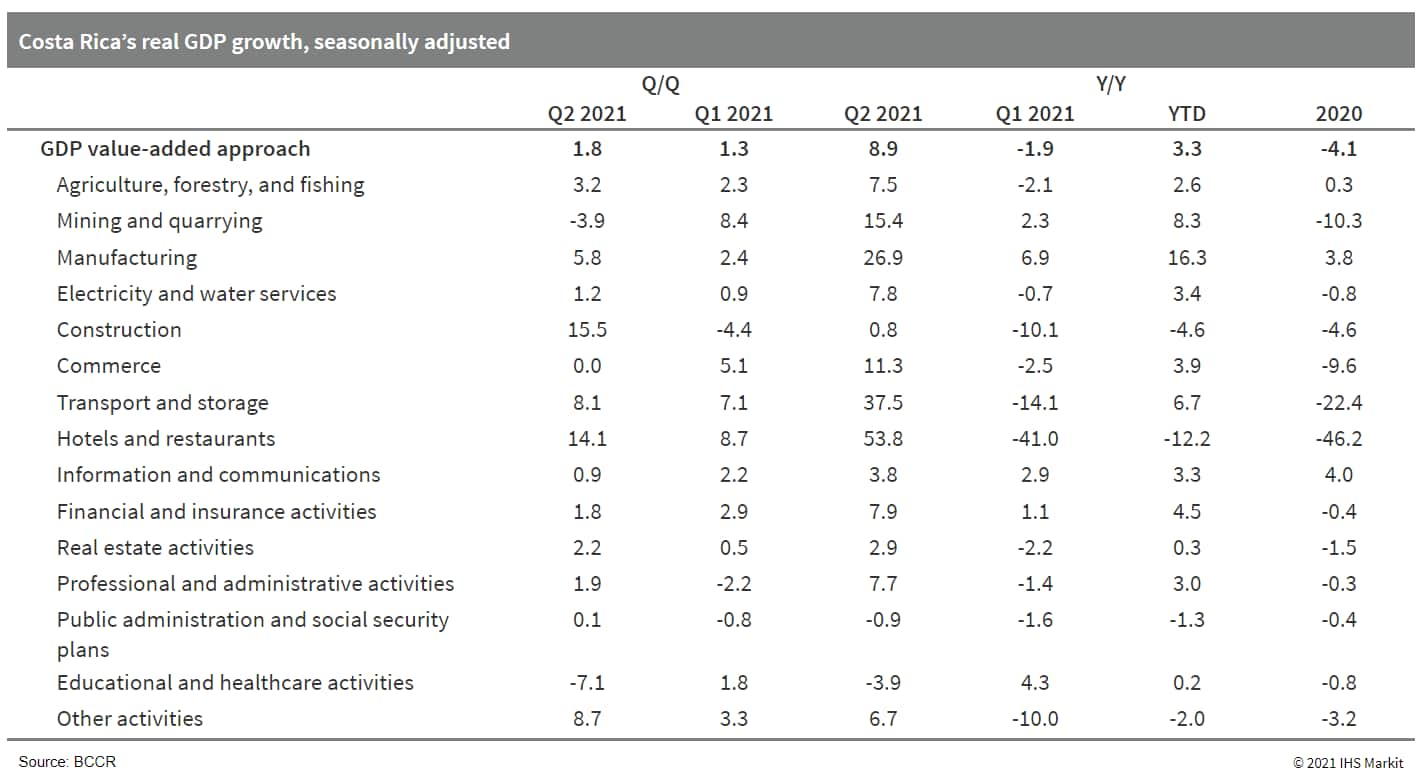

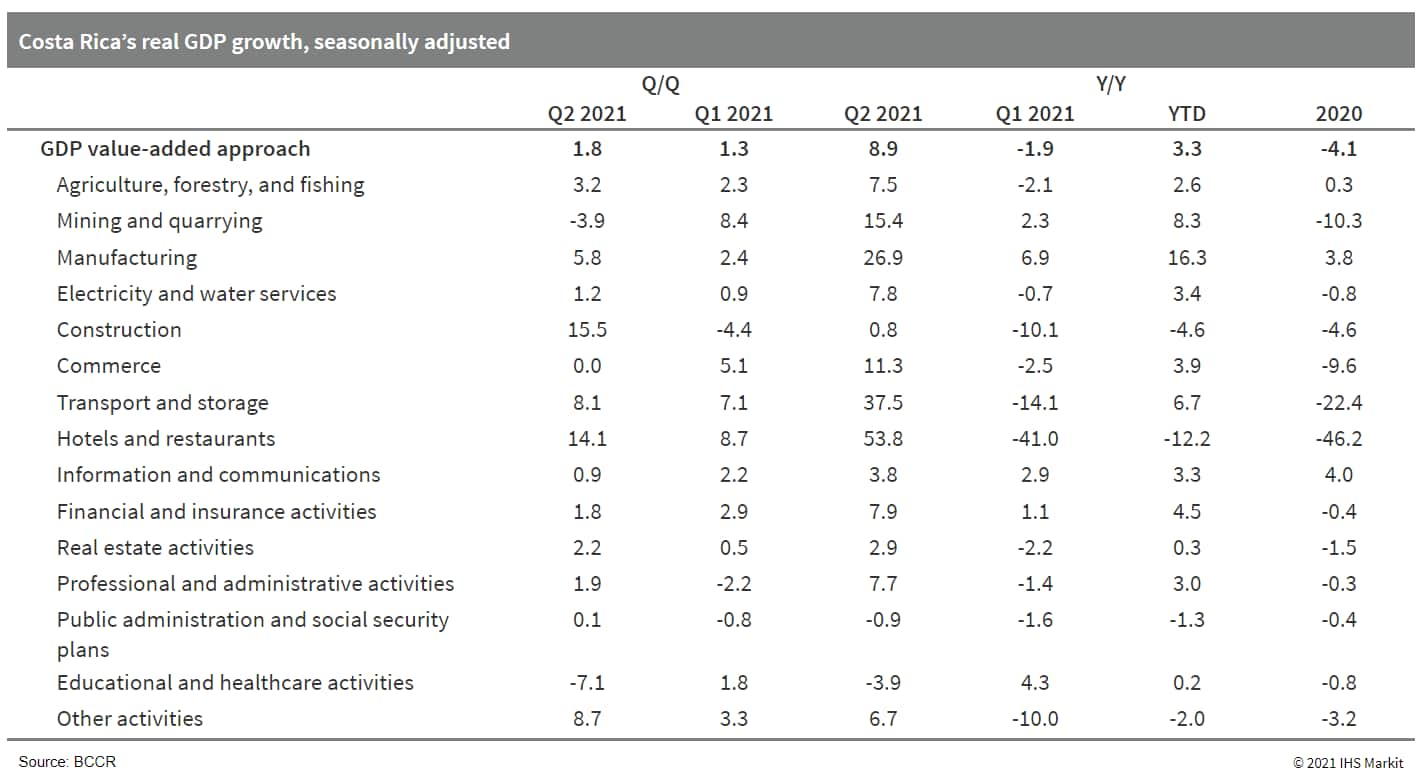

- The recovery of the Costa Rican economy is strengthening and is set to continue in the second half of the year as broad vaccinations will allow for further restrictions on business and mobility to be lifted over the next few months. However, the global spread of new COVID-19 virus strains remains a major downside risk to the outlook. (IHS Markit Economist Dariana Tani)

- According to the Central Bank of Costa Rica (Banco Central de Costa Rica: BCCR), the country's real GDP expanded by 8.9% year on year (y/y) in the second quarter of 2021 following a contraction of 1.9% in the previous quarter. The high growth figure in the second quarter is largely explained by the low comparative base during the same period last year. Overall, real GDP remains 1% below its pre-pandemic level (fourth quarter 2019).

- On a quarter-on-quarter (q/q) basis, the economy rose from a downwardly revised 1.3% in the first quarter of 2021 (2.7% q/q previously) to 1.8% q/q in second-quarter 2021 despite the surge in the number of coronavirus disease 2019 (COVID-19) cases in April and May, which prompted a tightening of containment measures.

- On the production side, the results were mostly driven by gains in manufacturing, agriculture, and construction and the better performance of various service sectors, including professional and administrative activities, hotels and restaurants, and real estate services. By contrast, the main drags on growth came from educational and healthcare activities and mining and quarrying. The manufacturing sector, which is leading the economic recovery, rose for the fourth consecutive quarter in the second quarter, helped by robust external demand, especially from the United States, Costa Rica's main trading partner.

Europe/Middle East/Africa

- All major European equity indices closed higher; Italy +2.0%, Spain +1.5%, France +1.5%, Germany +1.1%, and UK +0.9%.

- 10yr European govt bonds closed lower; Spain +2bps, France/Italy/Germany +3bps, and UK +8bps.

- iTraxx-Europe closed flat/51bps and iTraxx-Xover -1bp/258bps.

- Brent crude closed +1.6%/$82.56 per barrel.

- UK beef exporters lost access to one of their most promising new markets this week as the Philippines imposed a temporary ban on British beef due to animal health concerns. In a memorandum order on Monday (4 October), Philippines Agriculture Minister William Dar said the ban would apply to live cattle, beef and meat products derived from cattle in the UK. It does not apply to products with a slaughter or production date on or before 31 August. Sanitary clearances for products not yet loaded or in transit have been revoked. Dar said the suspension was a response to a recent case of classical bovine spongiform encephalopathy (BSE) in Somerset in southwest England, which was confirmed on 17 September. The Philippines ban will also come as a blow to the UK as it comes at a time when exporters are looking to expand sales to non-EU markets after Brexit. The Philippines was one of the fastest growing markets for British beef in the first seven months of this year, upping purchases by 64% y/y to 3,900 tons. (IHS Markit Food and Agricultural Commodities' Max Green)

- The EU is likely about 10 weeks away from authorizing frozen, dried and powder forms of Locusta migratoria (migratory locust) as a novel food, with strict allergy labelling requirements to apply. Authorization would make the migratory locust the second insect to gain approval under the 2015 novel foods regulation (2283/2015) after the dried yellow mealworm (Tenebrio molitor larva). National governments are expected to greenlight the locust authorization through a written procedure which closes at the end of this week after being launched following the September 28 meeting of the Standing Committee on Plants, Animals, Food and Feed (SCoPAFF) novel foods and toxicological safety of the food chain section. If the committee delivers a favorable opinion, the regulation will be translated into all official language versions - the EU has 24 - a process that takes about a month. (IHS Markit Food and Agricultural Policy's Sara Lewis)

- Qualcomm and partner SSW Partners announced yesterday (4 October) that they have reached a definitive agreement to acquire automotive technology and components supplier Veoneer, pushing out a bid from Magna. Qualcomm and SSW Partners issued a joint statement saying that, under the all-cash transaction, they would buy Veoneer for USD37 per share, resulting in a total equity value of USD4.5 billion. Veoneer had been negotiating with Magna for the Canadian supplier to acquire the tech company; however, the Magna talks are now terminated. Under the announced deal, SSW Partners, an investment company, is to acquire all outstanding capital stock of Veoneer. SSW will then sell the Arriver automotive automation business to Qualcomm and retain Veoneer's Tier-1 supplier businesses, the companies said. This agreement will see Veoneer receive an 18% premium compared with its potential agreement with Magna and an 86% premium over the share price prior to the announcement of the potential Magna deal. The boards of directors of Qualcomm and Veoneer have approved the deal, which is still subject to regulatory approvals. The deal is expected to be closed in 2022. Magna has waived its right to submit a revised proposal. (IHS Markit AutoIntelligence's Stephanie Brinley)

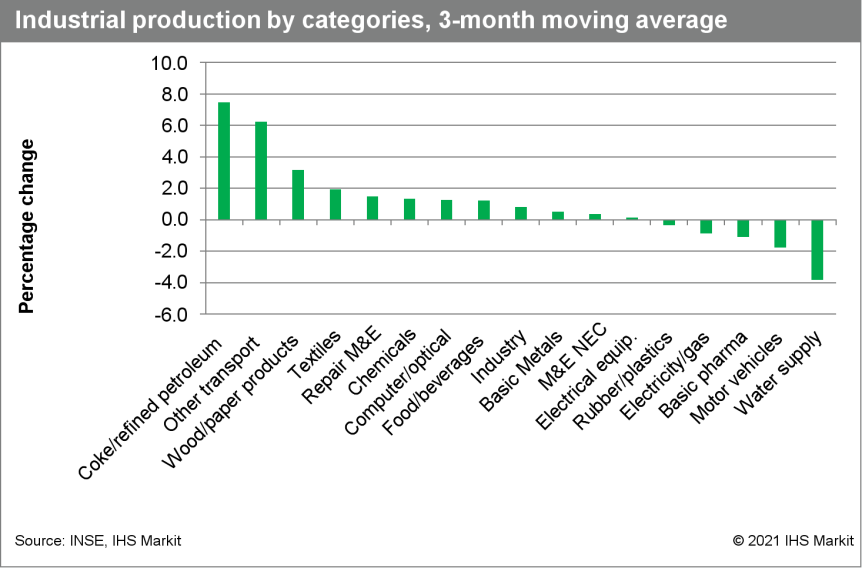

- French industrial production grew by 1.0% month on month (m/m) in August, according to seasonally adjusted figures released by the National Institute of Statistics and Economic Studies (Institut national de la statistique et des études économiques: INSEE). Production had increased by an upwardly revised 0.5% m/m in July (originally reported as +0.3% m/m) and 0.4% m/m in June. (IHS Markit Economist Diego Iscaro)

- Industrial output rose by 4.9% year on year (y/y) in August. However, it was still 3.9% below its level right before the pandemic in early 2020.

- The breakdown by categories shows large increases in production of motor vehicles (+9.7% m/m) and basic pharmaceutical products (+14.3% m/m). However, both categories had experienced large declines in June-July.

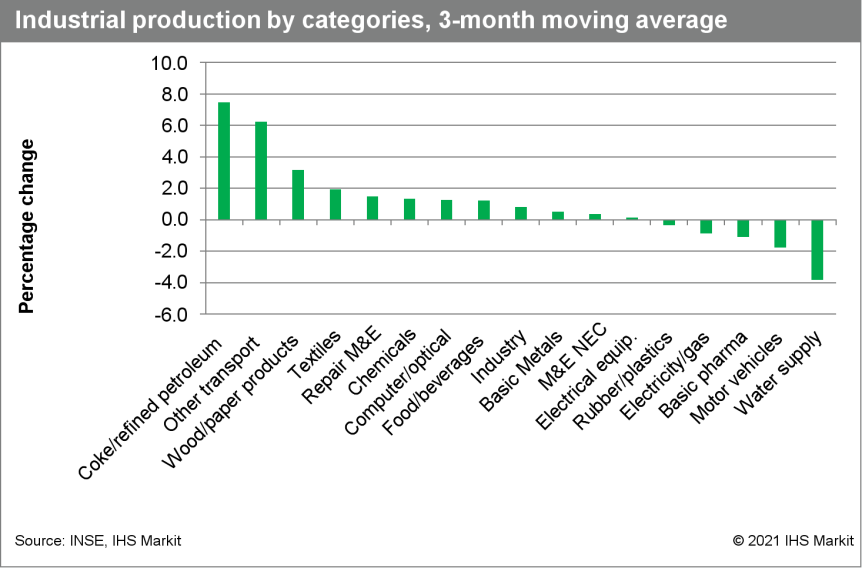

- The three-month moving average, which removes some of the volatility found in the monthly data, shows production of coke/petroleum and other transport equipment (including ships and aircraft, among others) driving the increase in overall industrial output during the three months to August.

- On the other hand, production of basic pharmaceutical products and automobiles was particularly weak. However, the production trend in these two sectors is starkly different: while production of pharma goods in August was 10.4% above its pre-pandemic level, production of automobiles, which struggled over the shortage of semiconductors, stood one-fifth below its level in February 2020.

- The breakdown by main industrial grouping shows production of capital (+2.3% m/m) and consumer durable and non-durable goods rising in August (+2.3% m/m and +1.1% m/m, respectively). Production of energy also rose by 0.5%, following a decline of 1.2% m/m in July, while production of intermediate goods edged downwards by 0.1% m/m.

- Volvo Cars announced yesterday (4 October) that it is planning an initial public offering (IPO) on Nasdaq Stockholm (Sweden). According to a statement, the automaker's Board of Directors and its main shareholder, Geely Sweden Holdings AB, have agreed to make the application "to support the company's transformation and its continued growth," as well as "gaining access to the Swedish and international capital markets and diversify its ownership base". However, Geely Sweden intends to remain its largest shareholder following the completion of the IPO, with the pair continuing to benefit from both the scale and market synergies of their relationship. In addition, institutional investors AMF and Folksam, which currently hold a 2.2% stake in the business through preference shares, intend to remain shareholders in Volvo Cars through listed shares. The IPO is expected to consist of the issuing of new class B common shares issued by Volvo Cars, which is expected to raise gross proceeds of approximately SEK25 billion. It will also potentially include class B common shares being sold by Geely Sweden. The offering will be divided in to two parts, with one being an offer to the general public in Sweden, Denmark, Finland, and Norway, and the other being an offer to institutional investors in Sweden and overseas. The latter includes a private placement in the US to what it refers to as qualified institutional buyers (QIB). The first day of trading on Nasdaq Stockholm is expected to be during 2021. (IHS Markit AutoIntelligence's Ian Fletcher)

- Albania's economy recorded a surge in growth in the second quarter of 2021. The global surge in commodity prices is helping offset the weakness in textile exports. An acceleration in the vaccination program and reopening of travel on the continent should provide a continued boost in the third quarter, boosting diaspora inflows and visitors. However, Albania's overreliance on tourism, remittances, Italy and Greece as export destination continue to present risks. (IHS Markit Economist Dragana Ignjatovic)

- According to detailed data released by the Albanian Institute of Statistics (INSTAT), real GDP growth surged in the second quarter of 2021, rising by 17.9% year on year (y/y). This is the third consecutive quarter of expanding economic activity following four quarters of falling real GDP during the COVID-19 virus pandemic and 2019 earthquake. In the first half of 2021, economic activity jumped by an average 12% compared with the same period of 2020.

- The rebound has been led by domestic demand, with investment jumping 36% y/y in the second quarter. This is partially due to base effects, with diaspora inflows also likely to have helped boost investment particularly in the real estate sector as well as ongoing post-earthquake reconstruction. Households are likely to have benefited from ongoing government support as well as a rebound in remittance inflows, pushing private consumption to 10% y/y. Meanwhile, government spending has remained robust, rising by 11% y/, to support the country with pandemic-related challenges as well as reflecting promises made during the April election.

- According to a separate INSTAT release, consumer price inflation accelerated again in August, rising by 2.4% y/y, up from 2.2% y/y in July. This is the highest y/y inflation rate recorded since June 2018. The August acceleration is due to surging food and transport prices amid a rapid rise in global prices. Food is one of Albania's largest imports, with this segment accounting for nearly two-fifths of the consumer basket. In January-August, consumer price inflation averaged 1.6% compared with the same period of 2020.

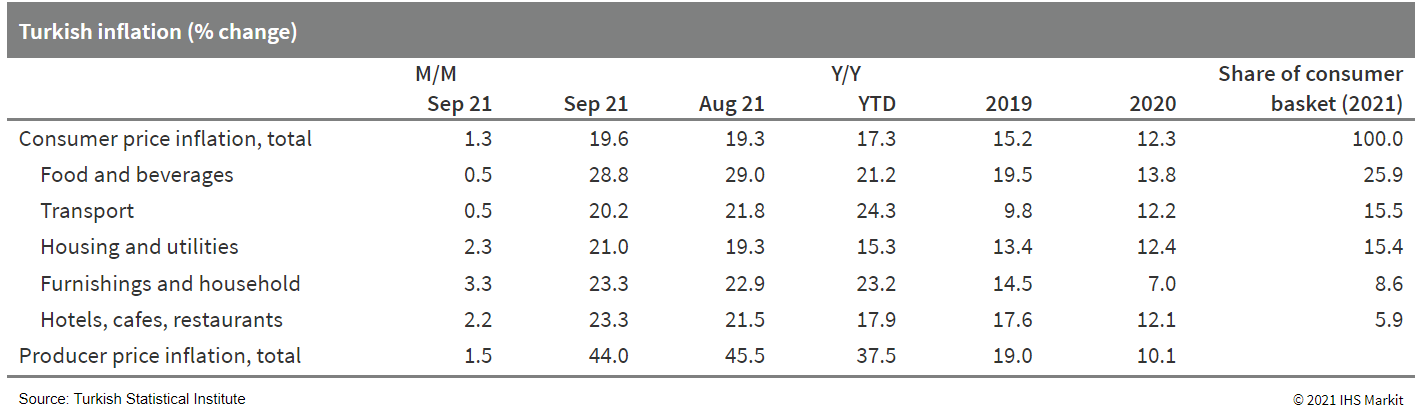

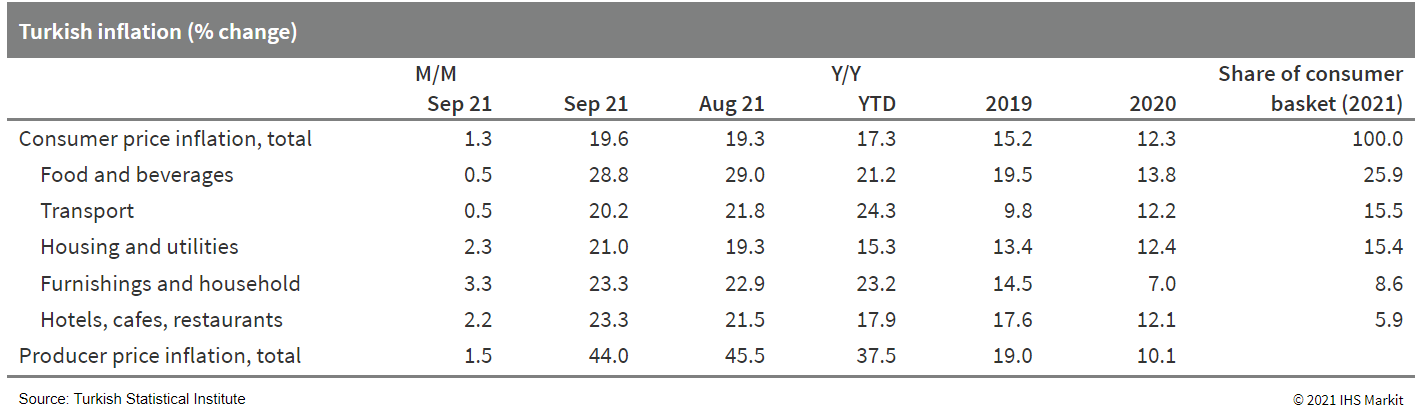

- In September, Turkish annual consumer price inflation continued to rise, pushing to 19.6% according to data from the Turkish Statistical Institute (TurkStat). Inflation has been on an upward trajectory since late 2019, nearly eight percentage points higher than it had been a year earlier. (IHS Markit Economist Andrew Birch)

- The sharp rise of food prices - which comprise more than one-quarter of the consumer price index basket - was the primary driver of overall inflation, up 28.8% as of September. However, transport, housing, and hotel, café, and restaurant prices all also contributed strongly to headline inflation.

- Core inflation also continued to accelerate in September, up to 17.0% according to TurkStat, up from 16.8% the previous month and more than 5.5 percentage points higher than it had been a year earlier. Sharp lira losses over the past year are contributing to the rise of all prices.

- The sharp acceleration of producer price inflation paused in September, though price growth was still substantial, at 44.0%. Soaring input prices are putting upward pressure on producers, who will pass along those added costs, eventually, to consumers.

Asia-Pacific

- APAC equity markets closed mixed; India +0.8%, Hong Kong +0.3%, Australia -0.4%, South Korea -1.9%, and Japan -2.2%.

- US Trade Representative Katherine Tai spoke about US-China trade relations at the Center for Strategic and International Studies in Washington, DC on 4 October, announcing the US's intention to begin a new round of trade negotiations with her Chinese Counterpart - Vice Premier and Communist Party of China (CPC) Politburo member Liu He - over China's performance under the Phase-one trade agreement. (IHS Markit Country Risk's David Li and John Raines)

- The US policy position appears largely unchanged, with potential for additional measures and stronger scrutiny of Chinese state-owned firms. Although the official restart of negotiations is a risk-positive development for both sides, the US's overall policy position on trade relations with China remains largely unchanged, with US media suggesting that most existing tariffs will remain in place. Tai's speech also raised the possibility of additional levies against Chinese products, following the conclusion of the Phase-one agreement's two-year purchasing commitment timeline. However, Tai also said that the administration of President Joe Biden would reinitiate the process under which US companies can apply for tariff exclusions with the aim of "optimally serving [US] economic interests", suggesting a more targeted approach and greater openness to adjust the current tariff regime.

- The US also indicated that it would move away from a unilateral approach, signaling greater intent to engage with Indo-Pacific allies through bilateral and multilateral channels. Although it remains highly unlikely that the US would directly engage Indo-Pacific countries through multilateral trade agreements (Tai indicated that the US does not intend to rejoin the CPTPP), it is likely to utilise multilateral platforms more actively for dispute settlement, and to provide political support to countries that face discriminatory economic measures from China.

- China is unlikely to make significant concessions regarding its state-led economic development model, and is also likely to continue its combative diplomatic position against the US. Upcoming domestic political events in China will encourage President Xi Jinping and his administration to project strength domestically, bolster unity, and to avoid the risk of being perceived domestically to have yielded to US demands.

- The US position of challenging China from a "position of strength" would threaten Chinese interests if it were accompanied by targeted statements or actions, such as new sanctions or support for allies in areas that Beijing perceives as crossing "red lines", including territorial issues in the South China Sea and the Taiwan Strait.

- If the US applies a more generous tariff exemption mechanism than during the previous Trump administration - particularly in the technology, electronics, and manufacturing sectors - this would indicate US intent to de-escalate trade disputes with China, improving the prospects for a favorable outcome for negotiations.

- China has initiated a series of reforms for green bonds in the country in recent months that could eventually help domestic issuers become more attractive to foreign investors. While China's green bond market is one of the world's largest, finance experts said Chinese issuance lacked consistent definitions and adequate information disclosure, aside from not always being properly evaluated. (IHS Markit Net-Zero Business Daily's Max Lin)

- In an effort to boost investor confidence, Chinese authorities have published draft regulations for third-party certifiers, guidelines on listed companies' environment risk disclosures, while also pushing for harmonization of green taxonomy at home and abroad.

- The Green Bond Standards Committee, overseen by China's National Association of Financial Market Institutional Investors, issued trial rules 24 September on how green bond certification agencies should operate. "This is to enhance the quality of green bond evaluation and certification, and to promote the development of green bond instruments in a regulated manner," the committee said in an announcement.

- The Operational Rules for Market Evaluation of Green Bond Evaluation and Certification Institutions cover certification agencies' workflows, qualifications, manpower, and credibility. The committee believes they can lead to more specialized services and help limit "greenwashing"—a term referring to creating misleading information on a product's green benefits.

- Multinational certifiers like Viego Eiris, Cicero, and Trucost have emerged over the past decade as more international investors seek trusted agencies to evaluate the environmental credentials of the bonds they purchase. In China, nearly 20 players have been active in the space. Notable certifiers include Zongcai Green Financing and China Quality Certification Centre.

- Geely has begun mass production of low earth orbit satellites to enable accurate navigation data for autonomous vehicle (AV) development, reports The Nikkei. The production takes place in China's Taizhou, Zhejiang Province, with an annual capacity target of approximately 500 satellites. These satellites are independently developed by Geely group company Geespace, which was launched in 2018 to develop and operate low-orbit satellites. This marks the entry of China's largest privately owned automaker into a field long dominated by the military. Low-orbit satellites will help Geely with the high-speed internet connectivity, accurate navigation, and cloud-computing capabilities that are required to develop AVs. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Huadian Heavy Industries (HHI) has concluded the Lot 1 turbine installation work for State Power Investment Corporation's 400 MW Jieyang Shenquan Phase 1 offshore wind farm (OWF) in China on 18 September. The engineering, procurement, construction, and installation (EPCI) Lot 1 contractor HHI contracted Shanghe (Shanghai) Ocean Engineering's heavy lift crane vessel Zhenjiang to install 16 units of 7 MW wind turbines and towers. HHI continues to manage the cable lay work under the EPCI Lot 1 scope. HHI completed the construction, installation and commissioning of the offshore substation in mid-June and installation of 16 monopiles in mid-August. The construction work for the wind farm is ongoing with the developer aiming for commercial operation by the end of 2021. The Jieyang Shenquan Phase 1 OWF comprises 29 units of 7 MW turbines and 37 units of 5.5 MW wind turbines plus an offshore substation. (IHS Markit Upstream Costs and Technology's Neeraj Kumar Tiwari)

- IHI Corporation has begun developing a large ammonia receiving terminal to bolster its ammonia receiving and storage technologies and to establish an infrastructure to handle large volumes of imported ammonia. Establishing an ammonia supply chain is vital to ensure the widespread adoption of this compound as a fuel. IHI embarked on this initiative in view of limited current uses of ammonia and an inadequate receiving and storage infrastructure. The company is looking to lift capacity at its receiving facility to that of an LNG receiving terminal. IHI aims to complete development in 2025. Ammonia is expected to contribute towards Japan's goal of reaching carbon neutrality by 2050. A distribution system like that of LNG will likely be necessary to match future fuel needs. Ammonia is a well-known raw material for fertilizers and chemical products, but availability is limited. It is an efficient and affordable energy carrier for hydrogen because it has a high hydrogen density and is easy to handle. Ammonia is also a good direct fuel for thermal power generation and is carbon-free, so it could help decarbonize thermal power operations. (IHS Markit Upstream Costs and Technology's Kamila Langklep)

- Chiyoda, Sembcorp Industries' (Sembcorp) subsidiary Sembcorp Utilities, and Mitsubishi have signed a strategic collaboration Memorandum of Understanding (MoU) to explore the feasibility and implementation of a commercial-scale supply chain to deliver decarbonized hydrogen into Singapore, utilizing Chiyoda's hydrogen storage and transportation technology "SPERA Hydrogen™". In March 2020, Chiyoda signed an MoU with Mitsubishi and five private companies in Singapore, including Sembcorp, and in collaboration with the Singaporean government, commenced discussions on the potential of importing and utilizing hydrogen in Singapore. (IHS Markit Upstream Costs and Technology's Dag Kristiansen)

Posted 05 October 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.