European and APAC equity markets closed mixed, while all major US indices were lower on the day. US and benchmark European government bonds closed lower. European iTraxx and CDX-NA closed slightly wider across IG and high yield. The US dollar closed sharply higher, WTI was flat, and Brent, natural gas, gold, silver, and copper were lower on the day. All eyes will be focused on tomorrow morning's US nonfarm payroll report after last month's much lower than expected increase in payrolls completely surprised the markets.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- All major US equity indices closed lower; DJIA -0.1%, S&P 500 -0.4%, Russell 2000 -0.8%, and Nasdaq -1.0%.

- Inflation fears remain the main theme in global markets, though major equity markets have extended their gains for the year. Investors are increasingly optimistic on an improving economic outlook, including that captured by a strong upswing in the J.P. Morgan Global Manufacturing PMI, led by solid expansions in the eurozone, UK and US. However, the survey continues to point towards increased inflationary pressures, as confirmed by the steepest rise in input costs for over a decade and record inflation of selling prices. While Fed officials maintain the view that inflation is largely driven by transitory factors, similar questions remain on the transitory nature of another key theme to markets surrounding the staying power of the current value cycle. (IHS Markit's Research Signals)

- US: Strong performance was posted across value factors, including Book-to-Market for large caps and TTM Free Cash Flow-to-Enterprise Value for small caps

- Developed Europe: Forward 12-M EPS-to-Enterprise Value was a top performing Deep Value factor, while Rational Decay Alpha sat at the opposite extreme of Price Momentum factors

- Developed Pacific: In Japan, investors have consistently taken on higher risk, as confirmed by negative spreads to 60-Month Beta in 10 of the last 12 months

- Emerging markets: Investors demonstrated a renewed interest in large cap names, as gauged by Natural Logarithm of Market Capitalization, in addition to firms with high 2-Year Ahead EPS Growth

- 10yr US govt bonds closed +4bps/1.63% yield and 30yr bonds +3bps/2.30% yield.

- CDX-NAIG closed +1bp/51bps and CDX-NAHY +3bps/288bps.

- DXY US dollar index closed +0.7%/90.51.

- Gold closed -1.9%/$1,873 per troy oz, silver -2.6%/$27.48 per troy oz, and copper -2.8%/$4.46 per pound.

- Crude oil closed flat/$68.81 per barrel and natural gas closed -1.1%/$3.04 per mmbtu.

- US seasonally adjusted (SA) initial claims for unemployment insurance fell by 20,000 to 385,000 in the week ended 29 May, its lowest level since the week ended 14 March 2020. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs) rose by 169,000 to 3,771,000 in the week ended 22 May. The insured unemployment rate edged up to 2.7%.

- In the week ended 15 May, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) rose by 102,200 to 5,293,842.

- There were 76,098 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 29 May. In the week ended 15 May, continuing claims for PUA dropped by 147,356 to 6,368,301.

- In the week ended 15 May, the unadjusted total of continuing claims for benefits in all programs fell by 366,178 to 15,435,982.

- Governors in many states—25 at last count—have announced an early end to pandemic-related federal unemployment programs. The federal pandemic-related unemployment programs, which include extra $300-a-week payments, the PUA, and the PEUC, were set to expire on 6 September. They are now slated to expire between 12 June and 19 July in the 25 states that have opted out.

- US employers announced 24,586 planned layoffs in May, according to Challenger, Gray & Christmas—up 7.3% from April's 22,913, which was the lowest reading in over 20 years. Despite the modest increase, May's total remains low by historical standards and is 93.8% lower than the 397,106 cuts announced in May 2020, when the negative effects of the pandemic were still in full force. (IHS Markit Economist Juan Turcios)

- For the year to date (YTD), 192,185 job cuts have been announced, down 86% from the 1,414,828 job cuts announced over the same period in 2020.

- So far this year employers have cited COVID-19 as a reason for 7,608 planned job cuts. Employers have cited other reasons including market conditions (48,047), demand downturn (39,444), closing (31,328), restructuring (27,275), and acquisition/merger (9,260) more frequently than COVID-19 as causes of job cut announcements.

- Job hiring plans are also down from the pandemic highs of last year. So far in 2021 employers have announced plans to add 441,696 jobs, down 65% from the 1,260,661 announced through the same time last year. The robust hiring announcements last year reflected a surge in hiring in grocers, delivery apps, food chains, and warehouses as employers dealt with a pandemic-driven increase in demand for online shopping.

- Aerospace/defense has announced 32,779 job cuts so far this year, the highest number of any industry. The entertainment/leisure sector has announced 11,848 job cuts YTD, down a whopping 98% from the same point last year. This sector was pummeled by the pandemic and announced the highest number of jobs cut in 2020. This is another indicator of the rapidly diminishing role of COVID-19 on job-cut decisions.

- Rounding out the five sectors that have announced the most job cuts this year are telecommunications (24,824), services (16,608), retail (13,594), and entertainment/leisure (11,848).

- US productivity (output per hour) rose at a 5.4% annual rate in the first quarter, more than reversing a fourth-quarter 2020 decline. Since the fourth quarter of 2019, productivity has risen at a 3.1% annual rate. (IHS Markit Economists Ken Matheny and Lawrence Nelson)

- Compensation per hour rose 7.2% in the first quarter and 9.7% in the fourth quarter, encompassing substantial upward revisions relative to prior estimates. From the fourth quarter of 2019, compensation per hour has risen at an 8.5% annual rate, far higher than the 3.1% annualized increase in productivity over that span. The marked increase in compensation per hour reflects pandemic-induced effects on employment: employment in lower-wage sectors has declined relative to employment in higher-wage sectors.

- Unit labor costs have shifted up since the pandemic began, as increases in compensation per hour have exceeded net gains in productivity. During the first quarter, unit labor costs rose at a 1.7% rate, but relative to the fourth quarter of 2019, unit labor costs have risen at a 5.2% rate, the largest five-quarter increase since the period ending in the fourth quarter of 1990.

- Hours rose at a 3.0% rate in the first quarter, continuing a strong recovery that began in the third quarter of 2020. Over the last three quarters, hours have risen 11.9% (not annualized), reversing a little more than two-thirds of the 14.4% decline over the first two quarters of 2020.

- As pandemic-induced distortions on labor markets unwind, we expect growth in compensation per hour and productivity to moderate, resulting in some easing in unit labor costs.

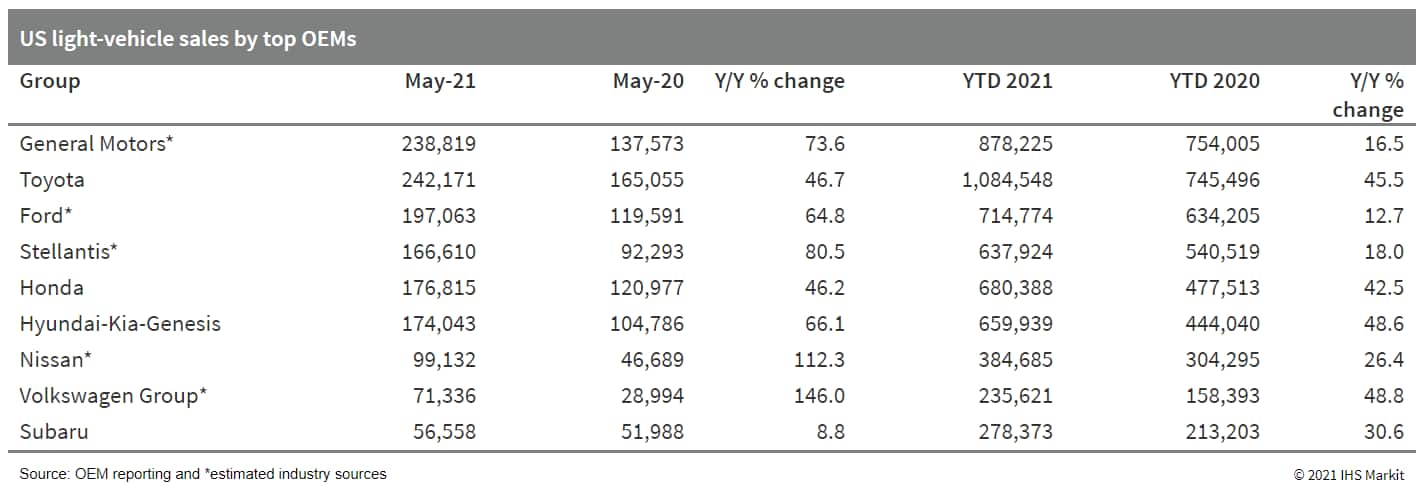

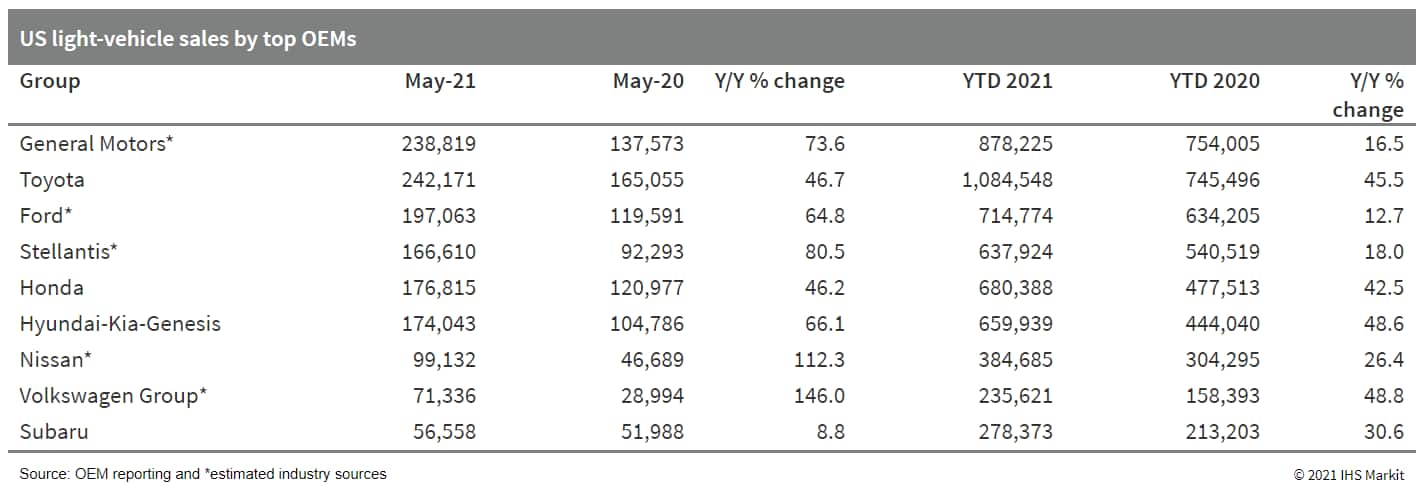

- In May, US light-vehicle sales settled down somewhat on a SAAR basis compared with the frantic pace of March and April. US light-vehicle sales increased 42% y/y in May, on comparison with a weak market a year earlier amid the COVID-19 pandemic. IHS Markit forecasts US light-vehicle sales at 16.5 million units in full-year 2021. As expected, auto demand levels in May moderated compared with the pace of the previous two months. However, despite supply pressures, US light-vehicle sales remained strong in May, with the seasonally adjusted annualized rate (SAAR) estimated to be in the range of 16.9-17.1 million units. (IHS Markit AutoIntelligence's Stephanie Brinley)

- US financial services company Nasdaq said 1 June it had acquired a majority stake in Puro.earth, a marketplace for carbon removal. Nasdaq intends to scale up Puro.earth's operations, based in Finland, to address a growing demand for carbon removal by corporations, it said. The platform, launched in April 2019, counts companies such as Microsoft and the Swedish financial group SEB as participants. Puro.earth calls itself the world's first business-to-business marketplace, standard, and registry focused solely on carbon removal. Its customers are issued CO2 Removal Certificates (CORCs) for each metric ton of carbon dioxide removed and verified by an independent third party that meets Puro.earth's methodologies. (IHS Markit Climate and Sustainability News' Kevin Adler)

- New research finds methane emissions from concentrated meat and dairy operations may be significantly undercounted, warning that existing methods used by the EPA and other agencies are inadequate and could compromise efforts to reduce agriculture's contribution to climate change. Published this week by researchers at New York University and Johns Hopkins University in the journal Environmental Research Letters, the new analysis assessed eight existing studies on methane and found that estimates of emissions from large livestock operations are not corroborated by measuring concentrations of the gas in the air. Recent studies monitoring methane concentrations in the air above and downwind of animal production facilities "consistently found more methane than the EPA and other agencies expected coming from livestock." The discrepancy is significant as the researchers reported methane amounts some 39-90% higher than previously estimated. (IHS Markit Food and Agricultural Policy's JR Pegg)

- Genetically engineered salmon maker AquaBounty Technologies reached two milestones this week - approval by regulatory officials in Brazil and the first harvest of its biotech fish from its Indiana fish farm. In a June 1 announcement, the company said Brazil's National Biosafety Technical Commission has granted its application for the sale of its GE salmon in Brazil, a move CEO Sylvia Wulf calls "another significant achievement" in AquaBounty's effort to open new markets. FDA was the first to approve the GE salmon, which is an Atlantic salmon that contains a gene from a Chinook salmon and a DNA sequence from an eel-like fish known as an ocean pout. The modification allows it to grow to market size in about half the time compared to a normal Atlantic salmon. (IHS Markit Food and Agricultural Policy's JR Pegg)

- Wood has been engaged by Summit Carbon Solutions to perform pre-FEED analysis on its carbon dioxide (CO2) pipeline network. The contract was announced on 17 May. Summit had recently announced plans to develop a new CO2 capture, transportation, and sequestration project, which will connect multiple sources throughout Iowa, Minnesota, Nebraska, South Dakota and North Dakota. The project includes a gathering and transmission pipeline system to support capture and permanent storage of up to 10 million tons of CO2 annually. Wood will support Summit with concept selection activities for the pipeline system, including route development, hydraulics, preliminary engineering, cost estimating, and an initial decarbonization SCORE assessment (Wood's in-house scoring metric). (IHS Markit Upstream Costs and Technology's Jie Sheng Aw)

- Pembina Pipeline (Calgary, Alberta, Canada) has agreed to acquire Inter Pipeline (Calgary) in a share-for-share transaction valued at C$15.2 billion ($12.6 billion), including the assumption of Inter Pipeline's debt. The combination will create one of the largest energy infrastructure companies in Canada, with a pro forma enterprise value of C$53 billion, the companies say. Among the assets included in the deal is Inter Pipeline's Heartland Petrochemical Complex (HPC), an integrated propane dehydrogenation (PDH)/polypropylene (PP) complex under construction near Edmonton, Alberta. Last month, Inter Pipeline said that the PDH plant is "substantially complete," the PP plant will be completed by the end of this year, and the complex as a whole will be operational in early 2022. PP capacity of the complex will be 525,000 metric tons/year. (IHS Markit Chemical Advisory)

- According to the Central Bank of Chile (Banco Central de Chile: BCC), the country's unadjusted monthly economic activity indicator, which is a proxy for GDP, accelerated from a revised 5.8% year on year (y/y) in March to 14.1% y/y during April, the fastest rate in the past three decades. (IHS Markit Economist Claudia Wehbe)

- The positive result was mainly driven by contributions in services and commercial activities followed by goods production, due partially to the very negative comparison base during April 2020 at the beginning of the coronavirus disease 2019 (COVID-19) virus pandemic.

- The 16.3% y/y rise in services was led by personal and health services, followed by entrepreneurial services, transportation, and restaurants and hotels. Meanwhile, the 33.1% y/y increase in commercial activities was propelled by gains in wholesale and retail trade, amid moderate gains in car sales. Gains in manufacturing and mining production explained a 3.8% y/y rise in goods production, more than offsetting a modest drop in construction.

- Seasonally adjusted data show a 2.8% m/m fall in services - the largest driver that explains the overall drop in Chile's monthly economic activity indicator - and 0.9% m/m drop in commercial activity. Within goods production, the increase in mining activity more than partially offset a contraction in manufacturing industry.

Europe/Middle East/Africa

- Major European equity indices closed mixed; Italy +0.3%, Germany +0.2%, France -0.2%, Spain -0.4%, and UK -0.6%.

- 10yr European govt bonds closed lower; UK +4bps, Germany +2bps, and France/Italy/Spain +1bp.

- iTraxx-Europe closed +1bp/50bps and iTraxx-Xover +4bps/247bps.

- Brent crude closed -0.1%/$71.31 per barrel.

- An offshore wind project set to supply the UK will reach into Icelandic waters, one of several unprecedented measures being taken to boost the project's wind turbine availability. The developer of the HIP Atlantic Project, Hecate Independent Power (HIP), hopes to export the entire output of the planned 10 GW fixed-and-floating turbine offshore wind farm from the generation site in Icelandic waters to the UK. HIP is a 50-50 joint venture between UK-headquartered conventional and hydro-electric generator Independent Power Corporation and US solar and storage developer Hecate Energy, chaired by Tony Baldry, a former British energy minister. The UK government has long envisioned a role for captive foreign wind farms in the country's energy mix, as it was specifically permitted in the 2013 Energy Act that laid down rules for offshore wind development. (IHS Markit Climate and Sustainability News' Cristina Brooks)

- Wood has been awarded a pre-FEED contract by Simply Blue Energy for its Western Star floating offshore wind farm located off the west coast of Ireland. The contract was announced on 27 May. Wood's team of cross-functional experts will assess the suitability of multiple floating platform designs against the site-specific criteria. Simply Blue Energy is developing the floating offshore wind farm in parallel with the company's Saoirse wave energy conversion array. (IHS Markit Upstream Costs and Technology's Jie Sheng Aw)

- German biopharma MorphoSys and US-based Constellation Pharmaceuticals have announced that they have entered into a definitive agreement under which MorphoSys will acquire Constellation for a total consideration of USD1.7 billion. The acquisition is expected to be concluded in the third quarter of 2021. Constellation specializes in epigenetics and has two leading product candidates currently under development that address severe unmet medical needs in particular groups of cancer patients. Pelabresib (CPI-0610) is a potential first-in-class bromodomain and extra-terminal motif (BET) inhibitor, currently undergoing Phase III clinical trials in myelofibrosis, and CPI-0209 is a second-generation EZH2 inhibitor undergoing Phase II clinical trials in hematological and solid tumors. It is planned that once the deal on the acquisition of Constellation is complete, the merged company will headquartered in Germany and will maintain an important commercial and R&D presence in Boston. (IHS Markit Life Sciences' Brendan Melck)

- The Volkswagen (VW) Group has delivered electric vehicles (EVs) to Astypalea in a step towards transforming the Greek island's transport system. Greek Prime Minister Kyriakos Mitsotakis and VW Group CEO Herbert Diess attended the delivery event, which also involved the inauguration of the first public and private charging points on the island. The EVs will be used by the police, municipality, and at the local airport with an aim of increasing the number of zero-emission vehicles and replacing about 1,500 ICE vehicles. VW's EVs, which include the e-up!, ID.3, and ID.4, as well as e-scooters from SEAT, will be available to customers. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- German-based transport app FlixMobility has closed more than USD650 million in a Series G round of funding that will value the company at over USD3 billion, reports TechCrunch. New backer Canyon Partners, existing investors General Atlantic, Permira, TCV, HV Capital, Blackrock, Baillie Gifford and SilverLake, and the founders, all participated in this round. The company said the round was a balanced mix of equity and debt and it plans to use the proceeds to expand its network in the United States and across the Europe. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Local Motors, a developer of hi-tech vehicles, has partnered with German-based mobility software company door2door to jointly offer autonomous on-demand shuttles in Europe. Under this partnership, Local Motors' electric autonomous vehicle, Olli 2.0, will be integrated with door2door's software to increase transit ridership and optimise transit investment by identifying gaps in cities, villages, and rural areas. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Maire Tecnimont subsidiary NextChem has been awarded a contract by TotalEnergies to carry out FEED on its Sustainable Aviation Fuel (SAF) plant in Grandpuits, France. This forms part of an overall plan to convert the Grandpuits Refinery into a zero-crude platform that will include a biorefinery, where NextChem is already engineering Europe's first plant to produce compostable and biodegradable plastics, with a capacity of 100,000 tons per year. The biojet plant, due to be operational in 2024, will strengthen NextChem's role in TotalEnergies's net-zero strategy as a major part of the Grandpuits Refinery 'zero-crude' platform development, known as "Projet Galaxie". (IHS Markit Upstream Costs and Technology's William Cunningham)

- Renault Group is to set up a standalone production unit that will manufacture battery electric vehicles (BEVs) in France, reports Bloomberg News. People familiar with the matter have told the news service that the plan will make its Douai, Maubeuge and Ruitz facilities into a separate, fully owned legal entity. The sources added that this would pave the way for talks with unions on pay and working conditions. Renault announced in May 2020 that as part of its '2o22' restructuring plan, the company would undertake a consultation related to the Douai and Maubeuge plants to create "an optimized center of excellence" for BEVs and light commercial vehicles (LCVs) in northern France. (IHS Markit AutoIntelligence's Ian Fletcher)

- Italy now avoided a technical recession in early 2021, which is defined as two consecutive quarters of GDP contraction. The national statistical office reports that the economy grew by 0.1% quarter on quarter (q/q) in the first three months of the year, compared to its first estimate of a 0.4% q/q drop. The economy shrank by 1.8% q/q in the fourth quarter of 2020. (IHS Markit Economist Raj Badiani)

- In annual terms, GDP fell by 0.8% year on year (y/y) in the first quarter, after 8.9% drop in the full year 2020.

- ISTAT provided a detailed breakdown of the first-quarter GDP data, which reveals that domestic demand excluding a change in inventories was a drag on growth, lowering the GDP gain between the fourth and first quarters by 0.1 percentage point.

- Consumer spending shrank by 1.2% q/q and 4.2% y/y in the first quarter. Clearly, consumer-facing services continued to be affected by fears of the spread of infection and by the impact of the tight regional restrictions.

- Fixed investment provided a hugely positive surprise in the first quarter, rising by 3.7% q/q and 11.4% y/y, and all the components rose markedly, namely expenditure on plant, machinery and armaments grew by 3.5% q/q while spending on homes and non-residential buildings and other works grew by 4.8% q/q and 5.2% q/q, respectively.

- According to Dutch maritime trade media, Heerema Marine Contractors (HMC) is aiming for an end-2021 launch of its fixed wind turbine generator (WTG) installation method, using its DP heavy-lift fleet. The heavy-lift major is said to be gaining approvals for its turbine assembly method, which would construct the nacelle and blades on a dummy tower based on one of its HL3 vessels, before lifting the entire turbine "head" onto its corresponding pre-installed tower and foundation. HMC expects to offer the solution commercially to clients by the end of 2021, for WTG installation contracts starting from 2024 onwards. HMC intends to prove its dummy-tower WTG installation method with 9.5 MW WTGs at Parkwind's Arcadis Ost 1, located in the German Baltic Sea sector, where seabed conditions prohibit the use of traditional jackup turbine installation vessels (WTIVs). The company's HL3 vessel Aegir is currently scheduled to execute this contract in 2023. (IHS Markit Upstream Costs and Technology's Genevieve Wheeler Melvin)

- Croatian battery electric vehicle (BEV) hypercar manufacturer Rimac has unveiled its latest model in the form of the Nevera. The model is effectively the production version of the C Two electric concept car that Rimac debuted at the Geneva Motor Show in 2018 (see Switzerland: 7 March 2021: Geneva Motor Show 2018: Rimac unveils C_Two EV hypercar) Speaking at the car's launch, Rimac CEO Mate Rimac said, "This is it. This is the car I had in mind when I embarked on the impossible journey 10 years ago." Rimac said that the company plans to deliver 150 units of the car to customers, who will each pay USD2.4 million for the car. The Nevera has an incredible level of power and torque, with the equivalent of 1,914 bhp and 1,740 pounds feet of torque. According to Rimac's own performance data, this will propel the car to 60 mph in 1.85 seconds and will take the car to a top speed of 258 mph. (IHS Markit AutoIntelligence's Tim Urquhart)

- Limited import gains in early 2021 led to a narrowing of Turkey's merchandise-trade deficit. However, President Recep Tayyip Erdoǧan's demand to relax monetary policy over the summer will result in greater domestic demand and, subsequently, stronger import growth, fueling a widening of the trade gap. More expansionary monetary policy also adds to lira depreciation risks. (IHS Markit Economist Andrew Birch)

- In January-April 2021, Turkey posted a merchandise-trade deficit of USD14.128 billion according to the Turkish Statistical Institute (TurkStat). The gap was down by nearly 20% against its year-earlier level.

- Strong demand from the resilient European production cycle buoyed merchandise export growth through the first four months of the year. Shipments to the European Union rose by 35.4% year on year (y/y). While base effects was a major contributor to the strong acceleration of growth of both exports and imports, the shipment of intermediate goods to the EU grew particularly strongly.

- Meanwhile, the tightening of monetary policy from November 2020 to February 2021 limited the impact of the base effects somewhat on import gains. However, the ending of the tightening cycle in February contributed to a more rapid rise of consumer good imports, particularly in April.

- Shifting gold flows also affected Turkey's overall trade patterns. In the first four months of 2021, a nearly doubling of gold exports compared to a year earlier inflated overall export gains while lower gold purchases deflated overall import gains. Without the gold trade, Turkey posted a trade deficit of USD13.756 billion, up by about USD250 million from a year earlier.

- Wood has been engaged by ADNOC to perform pre-FEED work for its planned blue ammonia production facility and the six additional chemicals projects at the TA'ZIZ chemicals production hub at Ruwais, Abu Dhabi, UAE. This contract was announced on 26 May. The facility will have a capacity of 1,000,000 tons per annum. Blue ammonia is made from nitrogen and "blue" hydrogen derived from natural gas feedstock. In parallel ADNOC will undertake a feasibility study on the supply of blue hydrogen to the project from its operations in Ruwais. FID is expected in 2022 while and startup is targeted for 2025. (IHS Markit Upstream Costs and Technology's Jie Sheng Aw)

Asia-Pacific

- APAC equity markets closed mixed; India/South Korea +0.7%, Australia +0.6%, Japan +0.4%, Mainland China -0.4%, and Hong Kong -1.1%.

- Sinopec Heavy Lifting & Transportation Company, a wholly-owned subsidiary of Sinopec Engineering (Group) Company, has bareboat chartered and is converting Sinopec Offshore Oilfield Services' retired drilling jackup Kan Tan II into a wind turbine installation vessel (WTIV) for offshore wind farm projects in Mainland China. Market sources have indicated that a two-year bareboat charter contract, with an option for extension, started from December 2020. The conversion and modification work on the jackup is underway at China State Shipbuilding Corp. (CSSC) Huangpu Wenchong Shipbuilding in Guangzhou. The yard work started in late February 2021 and is expected to conclude in the second half of 2021. It is understood that the derrick equipment set and cantilever module blocks will be removed to increase the deck space to hold wind turbine parts. The modified WTIV is expected to undertake installation and maintenance works on foundations, wind towers, and wind turbines for offshore wind farm projects in Mainland China. Kan Tan II is an ETA Robray 300-S design, 91 m (300 ft)-capable rig built in 1977, and has only worked offshore Mainland China in its 44-year career as a drilling rig. (IHS Markit Upstream Costs and Technology's Genevieve Wheeler Melvin)

- Chinese battery manufacturer Contemporary Amperex Technology Co. Ltd (CATL) is planning a new automotive battery plant in Shanghai (China), according to a report by Reuters citing two unnamed people familiar with the matter. The battery supplier is currently in discussions with the local government, but there is currently no clear indication as to when an agreement might be reached. According to the report, the planned plant would have the capacity to produce 80 gigawatt-hours (GWh) of battery cells annually. This would be in addition to CATL's current capacity of 69.1 GWh and another 77.5 GWh under construction. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Great Wall Motors has signed a framework agreement for a 10-year partnership with Chinese battery manufacturer Contemporary Amperex Technology Co. Ltd (CATL) to develop new-energy vehicle (NEV) technologies, reports Gasgoo. The two parties are said to have co-operated on the development of models since 2016. The partnership is an important one to support an uninterrupted supply of batteries for Great Wall's NEVs in the Chinese market. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Premium car manufacturer BMW plans to make its Chinese plants carbon neutral by the end of this year, according to Reuters. The automaker is also aiming to reduce the total carbon emissions in its Chinese production chain by 80% by 2030. In a separate statement, it has revealed plans to set up 360,000 electric vehicle (EV) charging stations across the country in a bid to enhance its new energy vehicle (NEV) sales, according to Hindustan Times Auto. (IHS Markit AutoIntelligence's Nitin Budhiraja)

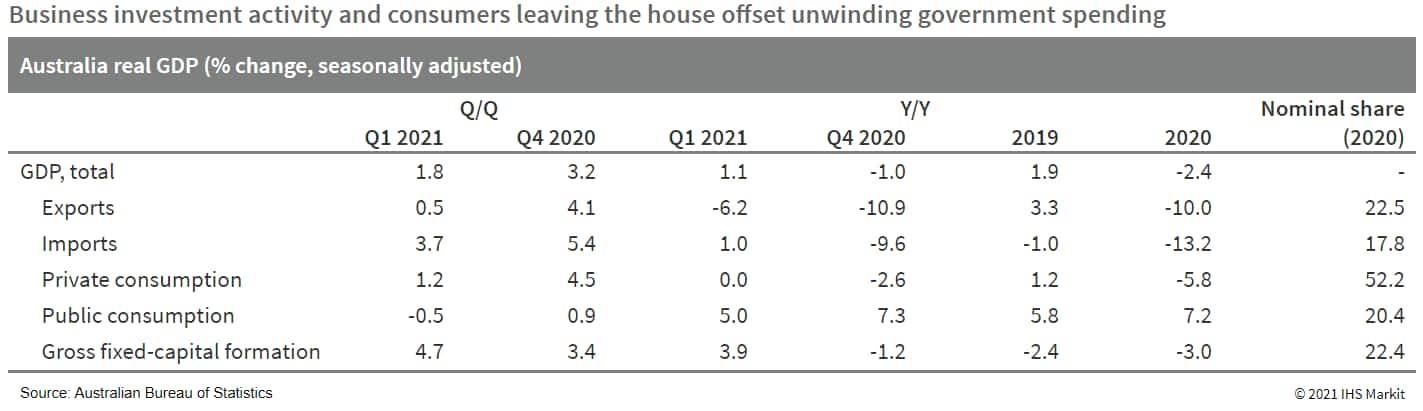

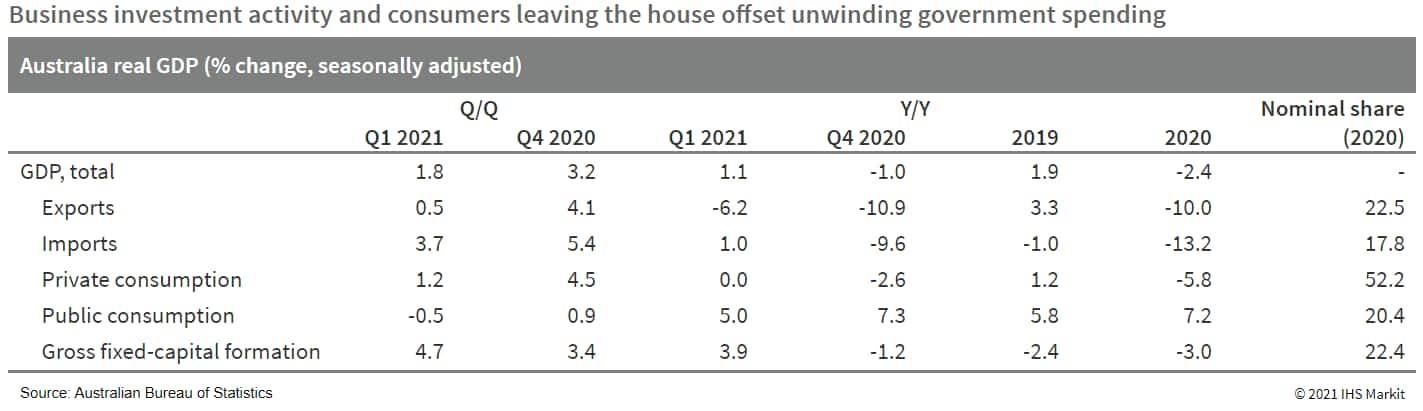

- The private sector helped to propel Australia's economy's March quarter (Q1) results and the return to pre-pandemic levels of GDP output, as the economy expanded by a seasonally adjusted 1.8% quarter on quarter (q/q). Given its firm commitments to returning the economy to full employment and a recent outbreak of COVID-19 infections in Victoria, the GDP result may not heavily influence the Reserve Bank of Australia's anticipated announcements related to its yield targeting and quantitative easing programs in July. (IHS Markit Economist Bree Neff)

- Fixed investment spending led the economy's strong performance, making the largest positive contribution to growth. The biggest upside surprise was that machinery and equipment spending in real terms expanded at its fastest pace since the December quarter of 2009 (up 11.5% q/q) after it rose by a robust 9.4% q/q in the December quarter. Dwelling investment also expanded for a third consecutive quarter (6.4% q/q in the March quarter), bolstered by the construction pipeline build by the government's successful HomeBuilder subsidy program.

- Household consumption also made a substantial contribution to growth, as households drew down on their excess savings, with the household savings ratio edging down to 11.6% from 12.2% in the December quarter. Households moved away from spending on goods, as all major goods categories recorded declines in real terms during the quarter. In an indication that Australians are venturing out of the house, growth areas were primarily for services with a 14.8% q/q rise in spending at hotels, restaurants, and cafes (after an 18.2% q/q rise in December), an 8.8% q/q rise in transport services expenditures, and solid increases in recreation and culture and operation of vehicles.

- An executive order granting a PHP3-billion (USD62.7-million) subsidy package for the eco-friendly vehicle manufacturing sector has been submitted and is awaiting approval from President Rodrigo Duterte, reports the Manila Bulletin, citing Philippine Trade and Industry Undersecretary Rafaelita Aldaba. Under the executive order, the PHP3-billion subsidy would be granted through tax credits to manufacturers of Euro IV vehicles and electric public utility vehicles (PUVs). Aside from the proposed subsidy, manufacturers of batteries for electric vehicles (EVs) are entitled to zero excise duty, while for hybrid vehicles it is 50% of the statutory rate. (IHS Markit AutoIntelligence's Jamal Amir)

Posted 03 June 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.