All major US and European equity indices closed higher, while APAC markets were sharply lower. US and most benchmark European government bonds closed lower. European iTraxx was close to flat on the day, while CDX-NA was modestly tighter across IG and high yield. The US dollar and natural gas closed lower, while oil, gold, silver, and copper were higher on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Major US equity indices closed higher; Russell 2000 +2.2%, DJIA +1.8%, S&P 500 +1.4%, and Nasdaq +0.8%.

- 10yr US govt bonds closed +6bps/1.50% yield and 30yr bonds +10bps/2.12% yield, with yields as low as 1.36% and 1.93%, respectively, during the APAC trading session.

- CDX-NAIG closed -1bp/50bps and CDX-NAHY -6bps/281bps.

- DXY US dollar index closed -0.4%/91.9.

- Gold closed +0.8%/$1,783 per troy oz, silver +0.2%/$26.03 per troy oz, and copper +0.6%/$4.18 per pound.

- Crude oil closed +2.6%/$73.12 per barrel and natural gas closed -0.7%/$3.19 per mmbtu.

- At its simplest, any bullish commodity cycle fundamentally boils down to one thing: short-term inelasticity. This in turn takes two forms, the inelasticity of supply in rising to meet demand, and the inelasticity of demand to rising prices. The surge in oil prices to $75/bbl reflects an implicit assumption that both of these factors are coalescing post-COVID-19, with shale discipline, capex destruction, and OPEC+ cautious management underpinning the former and the broad economic/mobility rebound and pent-up demand supporting the latter. (IHS Markit Energy Advisory's Roger Diwan, Karim Fawaz, Ian Stewart, Edward Moe, and Sean Karst)

- We maintain that the supply picture will become more nuanced at current prices but there is also an underappreciated factor on the demand side of the ledger: China.

- Chinese buyers bailed out the oil market at the depths of the 2020 crisis by absorbing an otherwise unmanageable surplus. The pendulum has started to swing in the other direction as the storage incentive reverses dramatically and the Chinese government sets its sights on a ballooning crude import bill amid broader commodity inflation.

- We have started to see a clear pivot by Chinese authorities in the oil arena from relative laissez faire in 2019-2020 to interventionism in recent months, and while the extent of the negative global market ramifications have been relatively muted to date, more direct intervention that unshackles some of China's ample crude inventories could significantly change the market calculus over the summer and fall.

- COVID-19 transmission is accelerating in several poorly vaccinated states, primarily in the South plus Missouri and Utah, and more young people are turning up at hospitals. The data present the clearest sign of a rebound in the U.S. in months. In Missouri, Arkansas and Utah, the seven-day average of hospital admissions with confirmed COVID-19 has increased more than 30% in the past two weeks, according to the U.S. Department of Health & Human Services. In Mississippi, the hospitalization rate is up 5% in the period. The jump in hospitalization is particularly jarring among 18- to 29-year-olds in the outlier states. (Bloomberg)

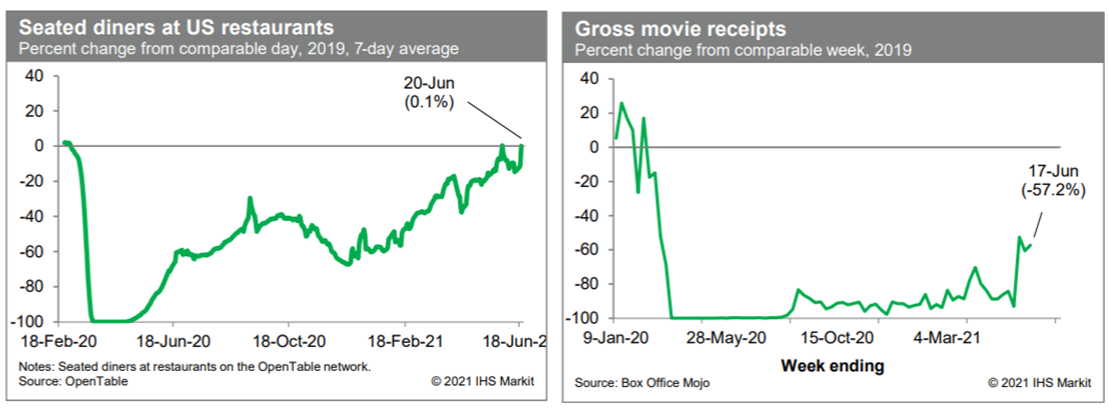

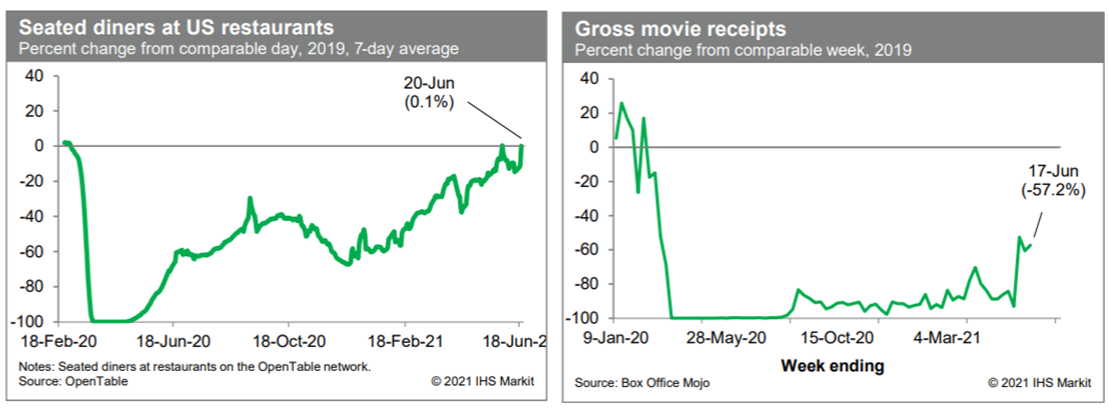

- Averaged over the last seven days, the count of seated diners on the OpenTable platform was roughly equal to the comparable period in 2019. Easing restrictions on restaurants and rising vaccination rates have propelled the restaurant industry toward full recovery. Meanwhile, box office revenues last week were about 57% below the comparable week in 2019, marking the third consecutive week of similar readings. This is a vast improvement over prior weeks, when revenues were down 70-90%. Movie theater activity has firmed, but not nearly to the extent that dining out has. (IHS Markit Economists Ben Herzon and Joel Prakken)

- Coca-Cola and other leading US bottled water companies are misleading consumers by falsely claiming their bottles are "100% recyclable," according to a pair of similar lawsuits filed last week by California consumers and the Sierra Club. The lawsuits target Coca-Cola's Dasani brand as well as BlueTriton, which sells Deer Park, Poland Spring and other brands, and Niagara Bottling. The companies named in the lawsuit produce more than 100 billion single-use plastic bottles every year. Filed June 17 in the US District Court for the Northern District of California, the lawsuits allege the bottles are not "100% recyclable" because the bottle caps and labels are made of plastic that is not recyclable. And while the bottles are made of polyethylene terephthalate ("PET"), at least 28% of PET plastic that is deposited for recycling is unrecyclable because of contamination and processing loss, according to the complaints. Furthermore, the lawsuits say US domestic recycling facilities only have the capacity to process some 22.5% of the PET consumed in the United States. "More than 60 million plastic bottles end up in landfills or incinerators every day," according to the complaints, which contend the bottled water companies are taking advantage of consumer demand for compostable or recyclable products. (IHS Markit Food and Agricultural Policy's JR Pegg)

- Private equity firm SK Capital Partners (New York, New York) and flavors and nutrition products firm Kerry Group (Tralee, Ireland) say they have reached a deal under which Kerry Group will acquire SK Capital portfolio company Niacet for €853 million ($1.02 billion). Niacet is a maker of preservatives with "clear leadership positions" in the bakery and pharma markets, as well a s a presence in meat and plant products, and proprietary dying and granulation process technologies, according to Kerry. The business has customers in 75 countries and manufacturing sites in the US and the Netherlands. Niacet is expected to generate €220 million in revenue and €66 million in EBITDA during the year ended 31 December 2021, implying a transaction value of 15.4 times (x) annualized EBITDA. It will become a part of Kerry's food protection and preservation operating platform. The acquisition will be funded mostly by proceeds from the sale of Kerry's consumer foods' meats and meals business, an E819-million deal that was announced earlier this month. The Niacet transaction is expected to close in the third-quarter of this year. SK Capital acquired Niacet in February 2017. The Valence Group of Piper Sandler and Credit Suit acted as financial advisors to Niacet on the deal, and Latham & Watkins acted as legal advisor to SK Capital and Niacet. (IHS Markit Chemical Advisory)

- "Mercedes me Charge" is a new program to support the Mercedes-Benz EQS and other electric vehicles (EVs) in the United States and Canada, and is meant to simplify the charging process for owners. Mercedes is working with both ChargePoint and Electrify America, although it describes the charging ecosystem as "enabled by Chargepoint". The goal of the program is to simplify the "process of finding, using and paying for charging sessions on all major networks in North America". "The MBUX head unit and Mercedes Me app seamlessly handle trip-planning, locating stations and initiating payment for all charging sessions," Mercedes said. The partnership with ChargePoint enables access to more than 60,000 places to charge nationwide, both through ChargePoint and other providers. In addition, Electrify America and Mercedes me Charge make plug and charge available at DC fast chargers, while the car comes with complimentary 30-minute charging sessions for the first two years of ownership. (IHS Markit AutoIntelligence's Stephanie Brinley)

Europe/Middle East/Africa

- All major European equity indices closed higher; Germany +1.0%, Italy +0.7%, UK +0.6%, France +0.5%, and Spain +0.2%.

- Most 10yr European govt bonds closed lower except for Spain flat; France/Italy +1bp, UK +2bps, and Germany +3bps.

- iTraxx-Europe closed flat/48bps and iTraxx-Xover -2bps/237bps.

- Brent crude closed +1.9%/$74.90 per barrel.

- The Office for National Statistics (ONS) has reported that UK retail sales retreated in May after rising in the previous three months. The volume of retail sales declined by 1.4% month on month (m/m) in May but this was after a 9.2% m/m gain in April. The spike in spending during April was driven by the reopening of non-essential retailers on the high street from 12 April in England and Wales and from 26 April in Scotland. (IHS Markit Economist Raj Badiani)

- Despite the fall in May, retail sales volumes during the month stood 9.1% above their pre-COVID-19 virus level (February 2020). Retailers have benefited from households spending less on services and foreign travel during the three national lockdowns in England.

- Sales in food stores fell by 5.7% m/m in May. The ONS reported that the further easing of restrictions on the hospitality sector during the month encouraged more people to eat and drink at restaurants and bars. Despite the fall in May, food store sales were 2.6% higher than their pre-pandemic level (February 2020).

- Meanwhile, non-food store sales grew by 2.3% m/m in volume terms in May. The best performers were stores selling household goods (such as hardware and furniture stores) and "other" non-food stores.

- On the flipside, sales fell for both clothing and department stores during May, down by 2.5% m/m and 6.7% m/m, respectively, but this was partly owing to the very robust gains in April. The ONS reported that shoppers bought new clothing during April because of fewer restrictions on English households mixing socially. Specifically, households in England were able to meet outside, while restaurants and bars could serve groups of up to six people outdoors from 12 April and indoors since 17 May.

- Non-store retailing declined by 4.2% m/m in May, lowering its share of overall retail spending to 28.5% in May from 30.0% in April and 34.7% in March.

- A Fugro-led consortium has developed a mooring line fatigue tracker that safely monitors offshore floating wind turbines with funding from the Scottish Government. The consortium won the funding to develop the tracker, that will combine the motion and position of floating hulls with a simulation model to monitor fatigue. Floating offshore wind real-time monitoring solution will be needed to operate reliably and cut back on in-person inspections to achieve minimal HSSE risk exposure and remain cost-effective. Another benefit of the monitoring solution is that the monitoring is continuous and can be used to detect any problems or failures, such as anchor drag or trawler snagging, as they require quick resolution. (IHS Markit Upstream Costs and Technology's Lopamudra De)

- EU member states have failed to agree on proposed approvals for products from two genetically modified soybean lines from Corteva Agriscience and a renewed approval for Syngenta's Bt11 maize. The return of the "no opinion" votes in June means that the European Commission's proposals will be put forward for a second vote in an appeals committee. The applications for use of the soybeans in food and feed were submitted by Corteva legacy company Dow AgroSciences. One covers the insect-resistant DAS81419, sold as Conkesta. The second is for a stack of Conkesta with DAS44406, sold as Enlist E3, which is resistant to 2,4-D, glyphosate and glufosinate-ammonium herbicides. The stacked-trait line passed the European Food Safety Authority's risk assessment last year. Conkesta is mainly targeted at the Latin American market. Enlist E3 was granted EU approval for use in food and feed in 2017. Syngenta's insect-resistant Agrisure CB/LL (Bt11) maize was previously renewed for food/feed use in the EU in 2010. (IHS Markit Crop Science's Jackie Bird)

- Porsche is setting up a new high-performance battery production joint venture (JV) in Germany, reports Autocar. The sports car manufacturer will work in partnership with Customcells to manufacture lithium-ion cells, which have a higher energy density. The automaker has said that it will invest a "middle double-digit [euro] amount" into the JV known as Cellforce in which it will have an 83.75% holding. It will also benefit from around EUR60 million of funding from the German government and the state of Baden-Württemberg. The new site will be called the Weissach Development Centre and will be in Tübingen (Germany). Around 13 engineers will be employed initially, rising to around 80 in 2025. The company said that the site will have the capacity to manufacture around 100MWh of batteries per year. Separately, Audi has reportedly agreed a strategy to launch its final internal combustion engine (ICE) vehicle in 2026. Citing an article in Germany's Süddeutsche Zeitung, the brand's CEO Markus Duesmann presented this timeline to the board of management last week. (IHS Markit AutoIntelligence's Ian Fletcher)

- Spain's research-based pharmaceutical industry association Farmaindustria has provided an update on the progress of a plan to boost the national production of essential medicines, announced in January 2021. The plan seeks to boost local manufacturing capabilities and reduce reliance on imported active ingredients and essential drugs, in particular off-patent, mature products that are considered strategic. The organization has revealed that 40 national and international pharma companies have joined the project since its inception - up from an initial group of 14 companies - with a combined investment commitment of EUR1.7 billion (USD2.02 billion). The Spanish associations of generic and over-the-counter (OTC) drug manufacturers, Aeseg and Aefp, have also adhered to the initiative. The plan's twofold objectives focus on bolstering local manufacturing capacities to increase supply security, and improving the productive competitiveness of the Spanish pharmaceutical industry through knowledge, technology, and digitization. To fulfil the first objective, the plan envisages that a list of strategic drugs and active ingredients will be drawn in collaboration with Spanish healthcare authorities, along with an analysis of shortage risks and local manufacturing capabilities to define reshoring priorities. (IHS Markit Life Sciences' Ewa Oliveira da Silva)

- The Russian government plans to build up to 50,000 electric vehicle (EV) battery chargers by 2030, reports TASS. Deputy Prime Minister Alexander Novak said on a visit to the Nizhny Novgorod region last week, "In general, the goal is more serious and ambitious both by 2024 and by 2030. By 2024, we need 11,000 charging stations in the country, and by 2030 - already 50,000." He added that the Russian government will support investment in this area alongside domestic production of EVs, details of which are currently being worked out by the Ministries of Industry and Trade, Transport and Energy. (IHS Markit AutoIntelligence's Ian Fletcher)

- The official commissioning in June of the first production train at one of the world's largest gas-processing plants, Gazprom's (Moscow, Russia) Amur facility in Russia's Far East, is a key milestone for Gazprom as well as for the associated development of a major gas-based petrochemicals facility being built by Sibur (Moscow). (IHS Markit Chemical Advisory)

- Located near the town of Svobodny in the Amur Region, the €11.4-billion ($13.5 billion) Amur gas-processing plant (GPP) will have the capacity by 2025 to process 42 billion cubic meters/year of gas, received via the Power of Siberia gas pipeline initially from the Chayandinskoye field in eastern Russia. The 2,100-kilometer (km) pipeline will export dry, purified gas to mainland China after the other components of the raw gas are removed.

- The first production train, with processing capacity for 7 billion cu meters/year, was completed on schedule. A second train is 65% complete with commissioning scheduled for later this year, according to Gazprom. Construction of the next three trains is "well underway" with six production trains to be built in total by the end of 2024, according to a research report by IHS Markit.

- The GPP will eventually extract and produce 2.4 million metric tons/year (MMt/y) of ethane, 1.5 MMt/y of liquefied petroleum gas (LPG), and 200,000 metric tons/year of pentane-hexane fraction, as well as 60 million cu meters/year of helium.

- Crucially for Sibur, the GPP will supply the ethane and LPG needed for the company's Amur gas chemicals complex (GCC), a 60/40 joint venture (JV) project of Sibur and Sinopec, for which construction began in August last year. The Amur GCC will be the primary consumer of ethane and LPG output from Gazprom's GPP, after the signing in 2018 by Sibur and Gazprom of a 20-year, ethane-supply agreement.

- The Albanian Institute of Statistics (INSTAT) has published its latest high-frequency data, showing a continued surge in performance in May. Export growth jumped to 53% year on year (y/y) in lek terms. This reflected a doubling of growth in EU demand, as well as a triple-digit jump in demand from Kosovo and Turkey. (IHS Markit Economist Dragana Ignjatovic)

- The growth was spurred largely by construction materials and minerals while demand in the traditionally most important textile category was significantly more subdued. Import growth also remained buoyant in April, rising by 38.4% y/y. With imports accounting for more than double exports, the trade gap widened by one-quarter y/y in May to ALL29 billion. Overall, in the first five months of 2021, the trade gap widened by nearly one-quarter y/y to ALL145 billion.

- According to a separate INSTAT release, consumer price inflation ticked down in May, rising by 1.8% y/y, down from 1.9% y/y in April. This reflected a surge in food and transport prices amid a rapid rise in global commodities. Food is one of Albania's largest imports, with this segment accounting for nearly two-fifths of the consumer basket. In January-May, consumer price inflation averaged 1.3% compared with the same period of 2020.

- Auve Tech, in partnership with the University of Tartu, has unveiled an autonomous hydrogen-powered vehicle in Estonia, reports Fuel Cells Works. After successfully completing a series of field tests, Estonian Highway Administration authorities have permitted the vehicle to start operating on public roads in the country. The shuttle bus, which can seat up to six passengers, will be officially launched in the Estonian town of Tartu on 5 July. Auve Tech's solution allows the shuttle to operate autonomously in open and closed areas with an aim to enhance last-mile transportation. It deploys low-temperature hydrogen fuel cells developed by the University of Tartu. (IHS Markit Automotive Mobility's

- Ghana's real GDP expanded by 3.5% quarter on quarter (q/q) and 3.1% year on year (y/y) during the first quarter of 2021, the Ghana Statistical Service (GSS) reports. All sectors of the economy reported growth in activity, with the exception of the mining and quarrying sector, which contracted by 11.1% y/y because of a 16.2% y/y fall in oil production; the hotels and restaurants sector, which slowed by 10.7% y/y; and the personal, administrative and support services sector, which declined by 2.9% y/y. (IHS Markit Economist Thea Fourie)

- Agricultural production, which accounts for 21% of real GDP, expanded by 4.3% y/y during the first quarter, as output of crops and cocoa production rose by 4.8% y/y. Manufacturing production, accounting for close to 15% of real GDP, increased by 6.0% y/y. Other sectors recording strong growth in activity during the first quarter included construction (up 14.2% y/y) and water and sewerage services (up 6.5% y/y).

- Output in the services sector of the economy, accounting for more than 40% of real GDP, rose by 4.0%, as retail trade rebounded by 2.7% y/y over the period. The information and communication sector expanded by a massive 22.1% y/y, while the output of the financial services and insurance industry rose by 4.8%.

Asia-Pacific

- APAC equity markets closed mixed; India +0.4%, Mainland China +0.1%, South Korea -0.8%, Hong Kong -1.1%, Australia -1.8%, and Japan -3.3%.

- BYD will reportedly assist smartphone maker Xiaomi in developing intelligent electric vehicles (EVs). BYD founder and chairman Wang Chuanfu, said, "BYD and Xiaomi are negotiating some projects for cooperation in the automotive field" at an auto industry forum in the southwest China municipality of Chongqing this week, reports Automotive News China. The latest development marks an important move following Xiaomi's formal announcement in March of plans to make EVs. The company plans to hire 20 engineers for autonomous technology and invest CNY10 billion (USD1.6 billion) in the initial phase of the development to support its EV business. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Toyota's Woven Capital has invested an undisclosed amount in US-based software-as-a-service (SaaS) solution provider Ridecell. In future, the companies will also consider a partnership in the field of mobility services. Michiko Kato, principal at Woven Capital, said, "Ridecell is responsible for expanding fleet connectivity and workflow automation and accelerating key digital transformations in the mobility industry. Woven Capital will continue to invest with a focus on innovative technologies that enable safe, secure, efficient and seamless mobility." Woven Capital is the investment arm of Woven Planet Group, a spin-off in January 2021 from Toyota Research Institute-Advanced Development (TRI-AD). Woven Planet is to act as a decision-maker for the entire group and provide corporate shared services to the operating companies. It has created an USD800-million global growth-stage investment fund, Woven Capital, to invest in startup companies in Toyota AI Ventures that are focused on developing innovative technologies and business models. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- A consortium led by South Korean conglomerate LG and Indonesia Battery Corporation will hold a groundbreaking ceremony for an electric vehicle (EV) battery plant in Indonesia in July or early August, reports Kompas.com. The USD1.2-billion battery plant will be constructed in the Kota Deltamas industrial area in Bekasi, West Java Province, in Indonesia. The facility is expected to have production capacity of 10 GWh. The site is in close proximity to South Korean automaker Hyundai, which is nearing the completion of its first manufacturing plant in Indonesia. Batteries produced there are slated to be used in Hyundai's EVs. (IHS Markit AutoIntelligence's Jamal Amir)

- New Zealand's real expenditure-side GDP rose by a seasonally adjusted 1.4% quarter on quarter (q/q) in the March (first) quarter of 2021 as private consumption and fixed investment continued their recovery. However, the current-account deficit widened further from the previous quarter, due to both a large increase in imports and a sharp drop in exports. (IHS Markit Economist Andrew Vogel)

- The small contraction in the December 2020 quarter was a correction from the previous quarter's record growth rebound, and therefore a return to growth was expected to follow in the March 2021 quarter. In annual terms, expenditure-side GDP was up 3.6% over the same quarter in 2020, above IHS Markit's forecast for the quarter.

- Gross fixed capital formation growth surged after the previous quarter's small contraction, helped in large part by significant renewed growth in plant and machinery equipment spending (15.5% q/q) and transport equipment spending (18.5% q/q), as well as both residential building (2.3% q/q) and non-residential building construction (2.9% q/q). The only drags came from land improvements (-9.2% q/q) and intangible fixed assets (-1.1% q/q), while other construction remained unchanged. It should be noted that the increase in business investment was smaller than the increase in gross fixed capital formation - likely due to government investment spending.

- Real exports registered a sharp decline following the previous quarter's minor contraction. Both goods and services exports were down in real terms, with services exports being the stronger drag of the two, falling 20.2% q/q. Every category of goods exports declined in the March quarter, with the sole exception of dairy products (up 2.5% q/q), with the largest drags on growth arising from exports of chemicals, rubber, and plastics (-17.0% q/q), agriculture and fishing products (-10.4% q/q), and other food, beverages, and tobacco (-8.1%).

Posted 21 June 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.