Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Mar 27, 2023

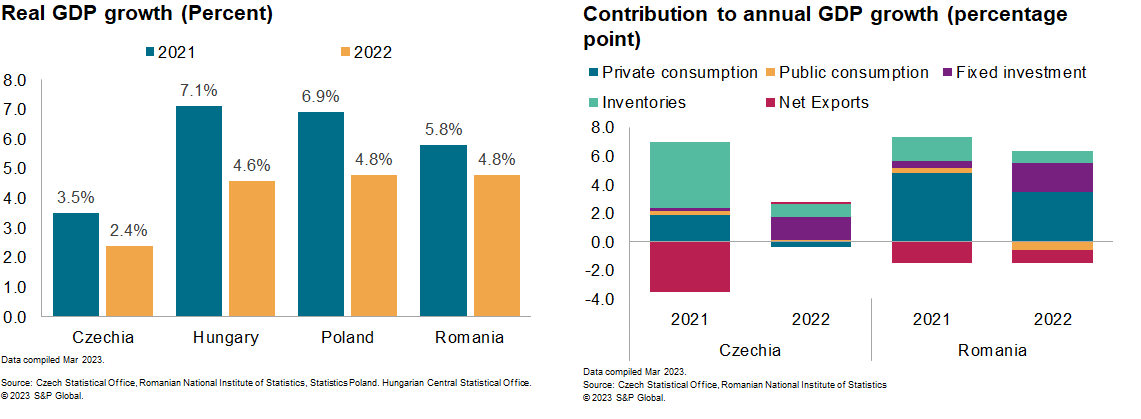

Private consumption contracted sharply in Czechia, slowing overall GDP growth to 2.4% last year. Consumer spending was much more resilient in Romania, supporting overall GDP growth of 4.8%. The current pattern of Romanian outperformance and Czech weakness is forecast to persist in 2023.

Fourth-quarter 2022 GDP results confirm the full-year growth slowdown across the four Central and Eastern European (CEE-4; Czechia, Hungary, Poland, and Romania) economies. The data also paint a disparate underlying picture across the region. Both Czechia and Hungary slipped into a technical recession at the end of 2022, while Polish momentum declined sharply in the last quarter of the year. Romania, on the other hand, broadly avoided slowing down, maintaining steady average quarterly growth of 1.2% through the year.

At 2.4% and 4.8% full-year growth, respectively, Czechia and Romania represent the two ends of CEE-4 GDP performance last year, reflecting their relative external exposures especially on the energy supply front. Polish and Hungarian growth performance was closer to the Romanian side of the spectrum. Shrinking private consumption dragged on growth in both these countries and Hungary's stand-off with the EU also weakened investments there.

We note the higher uncertainty around Romania's GDP figures, which have been prone to substantial data revisions and are decoupled from weakening sectoral momentum. In fact, the Romanian industrial sector has been contracting since the second quarter of 2022, with the weakness being partially offset by strong construction activity — mainly civil engineering and capital repair work — over the second half of 2022.

Sharper demand erosion

The data currently available point to a much sharper erosion of Czech private consumption compared with Romania, amid faster monetary tightening and a deeper real wage decline in the former last year. Extensive electricity and gas price caps, which have been in place since October 2021, shielded Romanian consumer spending.

From 2021 to 2022, the contribution of fixed investments to headline growth increased in both countries. In Czechia, this mainly reflected a catch-up boost to pre-pandemic levels, which was only completed by the end of the year and was led by the machinery and equipment verticals.

In Romania, inflows of EU funding supported the government's ongoing investment drive to boost potential growth and narrow the twin deficits. Investment spending was led by the dwellings, machinery, equipment, and intellectual property verticals.

Inventories buildup also supported annual growth in both countries. Net trade was less of a drag in Czechia as weaker domestic demand dampened real imports. Government consumption was reigned in much more sharply in Romania. Remaining committed to fiscal consolidation under the EU's excessive deficit procedure, which Romania entered at the end of 2019, is key for maintaining investor confidence in the country.

Outlook

In 2023, annual growth is forecast to decelerate further across the CEE-4, and the current pattern of Romanian outperformance and Czech weakness will persist. That said, Hungary is forecast to replace Czechia as the CEE-4 underperformer this year, given a more substantial negative carryover from 2022, higher policy rate, and still-rising inflation. In our March update, we are projecting full-year GDP growth of 2.5% for Romania and a 0.2% decline for Czechia.

Continued geopolitical uncertainties, tighter financial conditions, constrained household budgets, and weaker demand prospects in key export markets — the EU, especially Germany — will be the main headwinds for CEE-4 growth this year.

In Czechia, we expect the downturn to continue into the first quarter of 2023 as demand remains under pressure. January output and sales data signal limited activity boost from a warmer winter, mainly concentrated in construction work. European Commission surveys indicate that insufficient demand is quickly becoming the leading constraint on industrial production. Affected by construction-sector weakness, fixed investment growth is also expected to slow this year.

In Romania, a technical recession is not in our baseline. We do expect growth to slow sharply in early 2023 as higher prices and interest burden catch up with consumers. A contractionary fiscal policy will also drag on domestic demand. Instead, fixed investments are expected to be the main driver of growth this year, and forthcoming EU funding the main engine. The country also enjoys greater energy security in lieu of its sizeable domestic gas production and a balanced energy mix, supporting its growth outlook.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.