Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jan 30, 2023

By Arlene Kish

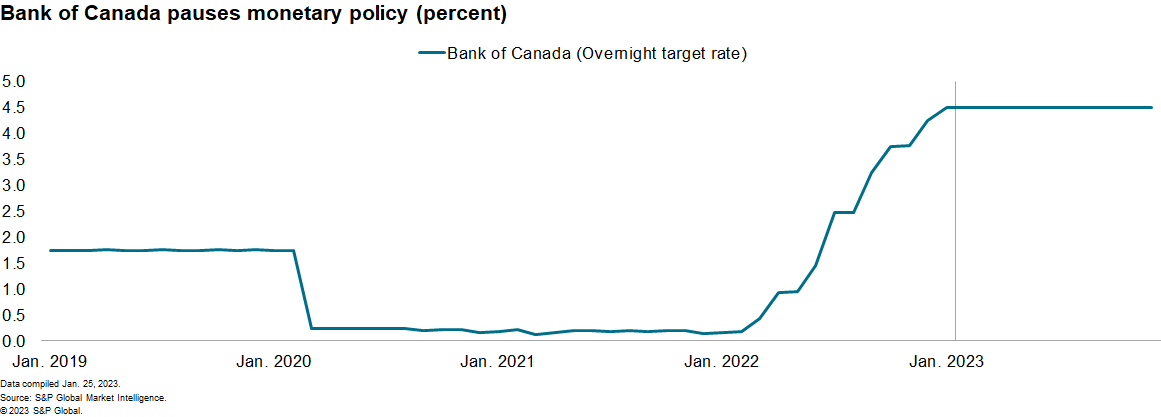

The Bank of Canada increased the overnight policy rate, as expected, by 25 basis points. The overnight rate target is 4.50%. The bank rate is 4.75% and the deposit rate is 4.50%.

In the January Monetary Policy Report (MPR), the Bank of Canada is forecasting Canada's real GDP growth to be 1.0% this year, after the 3.6% gain in 2022—both upward revisions. Real GDP growth for 2024 is 1.8%, which is a softer outlook compared with October's forecast.

The Bank's inflation outlook was revised down to 3.6% this year but revised up to 2.3% in 2024.

The Bank of Canada will remain neutral for now as it assesses the cumulative effects of the eight interest rate hikes to date. However, the risk of another rate hike is positive if consumer price and wage inflation rates, tight labour markets, and excess demand in the economy do not soften according to the Bank's outlook.

Outlook

The Bank of Canada's policy actions to date are working.

The changes to the global outlook, namely mainland China's removal of pandemic restrictions, that would lead to stronger global growth and potentially higher commodity prices drove the real GDP outlook.

The Bank of Canada is forecasting annual inflation to slip from an average of 5.4% in the first quarter to 2.6% in the last quarter of this year. Inflation will hit the 2% target inflation rate by the end of 2024.

Notably, the January MPR provided the first glance of the early 2023 real GDP outlook. The Bank of Canada is not calling for a decline in real GDP in the first quarter. Instead, it is predicting a 0.5% quarter-on-quarter annualized increase. This real GDP soft landing is realistic given the repeatedly upward revisions to monthly real GDP by industry output. It is widely expected that the lag from monetary policy tightening should show up in the real economy in the first half of 2023.

In the press conference that followed the MPR and policy announcement release, Bank of Canada Governor Tiff Macklem firmly stressed that the monetary policy pause is conditional. Based on the latest guidance, Bank views regarding the risks to the outlook are balanced.

Risks could tilt to the upside, driving inflation higher. The economy is not cooling as much as the central bank previously expected. Core inflation needs to decline for total inflation to ease significantly. Services inflation is above goods inflation, with high wage inflation contributing to both.

In general, the Bank of Canada is "trying to balance the risks of under and over tightening." Namely, too few interest rate hikes increase the risk that the decline in inflation will stall before achieving the 2% target. Conversely, too many rate hikes increase the risk that the adjustment within the broad economy will be negatively adverse and overshoot the central bank's inflation target. The Bank of Canada will follow up with a detailed summary of the Governing Council's decision two weeks post policy announcement.

Given the latest guidance from the central bank, the previously anticipated March interest rate hike will be removed in the February macroeconomic forecast. Governor Macklem repeatedly emphasized the pause in monetary policy tightening is conditional on the outlook.

As the forecast evolves, a rate hike could creep back into the macroeconomic outlook. The Bank of Canada will remain on the sidelines throughout this year before it even contemplates cutting interest rates.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.