Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jul 03, 2023

Average prices charged by factories for their goods fell worldwide for a second straight month in June, according to the JPMorgan Global Manufacturing Purchasing Managers' Index™ (PMI™) compiled by S&P Global. The rate of decline accelerated reflecting a second month of falling input prices.

Improved supply chains, lower energy prices and subdued demand have all contributed to growing deflation in the global manufacturing economy. However, these deflationary forces were partially offset in June by historically elevated wage pressures, which hint at some stubborn stickiness of core inflation.

Falling prices, or lower inflation rates, were observed in almost all monitored economies.

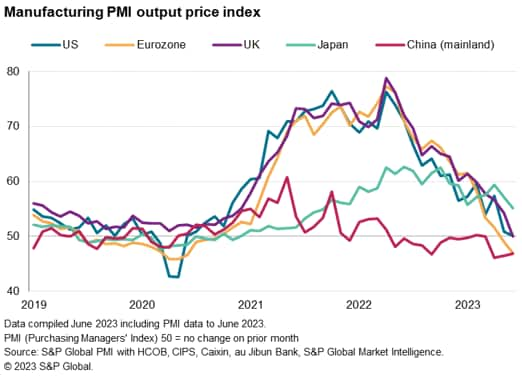

Manufacturing output prices - average charges levied for goods leaving the factory gate - fell worldwide for a second month running in June, dropping at the sharpest rate snice May 2020. If the early COVID-19 lockdown months are excluded, the fall in prices was the sharpest since February 2016, according to the latest PMI surveys compiled by S&P Global.

The declines represent a marked reversal of the inflation trend, with the survey having seen record increases in factory selling prices just over a year ago.

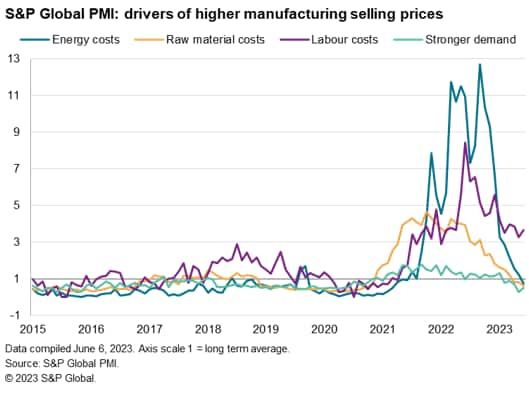

The lowering of selling prices has been facilitated by a recent turnaround in input cost inflation. Whereas producer input prices were rising at a near-record rate in early 2022, as the invasion of Ukraine added to the inflationary impact of the pandemic - notably via soaring energy costs and food security worries - cost pressures have abated sharply in recent months. In fact, June saw the second month of falling global factory input prices, with the rate of decline hitting the fastest since January 2016 if the early pandemic months of 2020 are excluded.

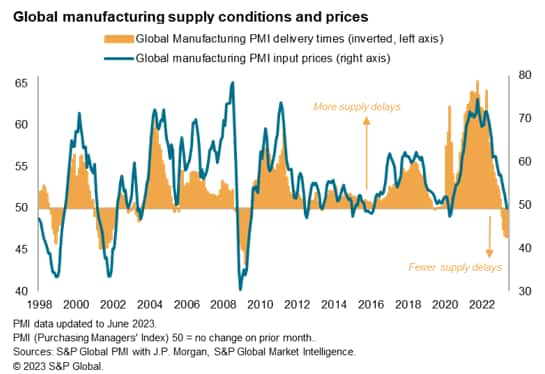

A key development in recent months has been an improvement in supply chains. Supplier delays hit unprecedented levels during the pandemic, with prices soaring higher for a variety of goods and components as shortages handed pricing power to suppliers. In recent months, pricing power has shifted to the buyer, as shortages and supply chain delays have disappeared, replaced in many cases by situations of excess supply.

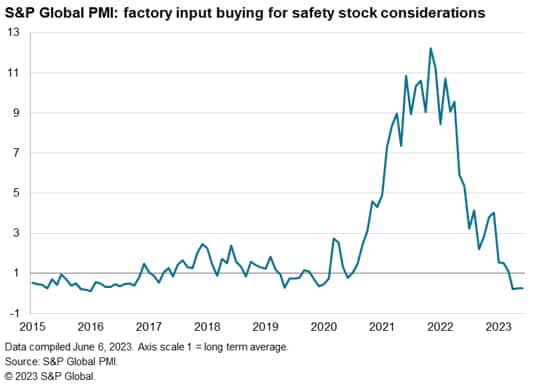

This excess supply has been in part a consequence of a growing shift toward inventory reduction, as manufacturers, their suppliers and their customers seek to reduce stock holdings for cost considerations in the face of disappointing demand. In recent months, for example, safety stock building - which had risen to record highs during the pandemic - has now gone into reverse.

However, while survey responses indicate that raw material costs, energy and demand are acting as drivers of worldwide manufacturing prices to extents below their long run averages (an average which extends back to 2005), wage growth remains a stubbornly elevated influence on prices. Although down on peaks seen last year, the upward inflation pressure from wages continues to run well above the pre-pandemic average. The wage pressure in fact even lifted slightly higher in June, which hints at a stickiness of core inflation pressure in the global economy.

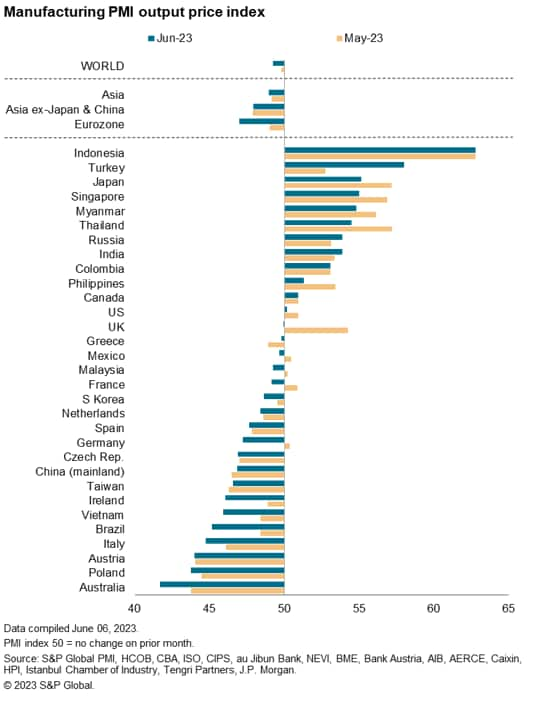

Of the 31 economies for which S&P Global manufacturing PMI data are available, selling prices fell in 19 cases, albeit in some instances only marginally. Australia reported the steepest decline, followed by Poland, Austria, Italy and Brazil. In all cases bar Taiwan, mainland China and Greece, either the rate of deflation accelerated or prices fell after having risen in May.

Prices rose at increased rates in Turkey, India and Russia, although the steepest rate of increase was again reported in Indonesia, followed by Turkey and Japan.

Looking at the major economies, the eurozone is seeing the sharpest rate of manufacturing selling price deflation, followed by mainland China. Prices are largely unchanged in the UK and US, though this likewise signals a marked contrast from the steep inflation seen last year.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location