Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Dec 01, 2022

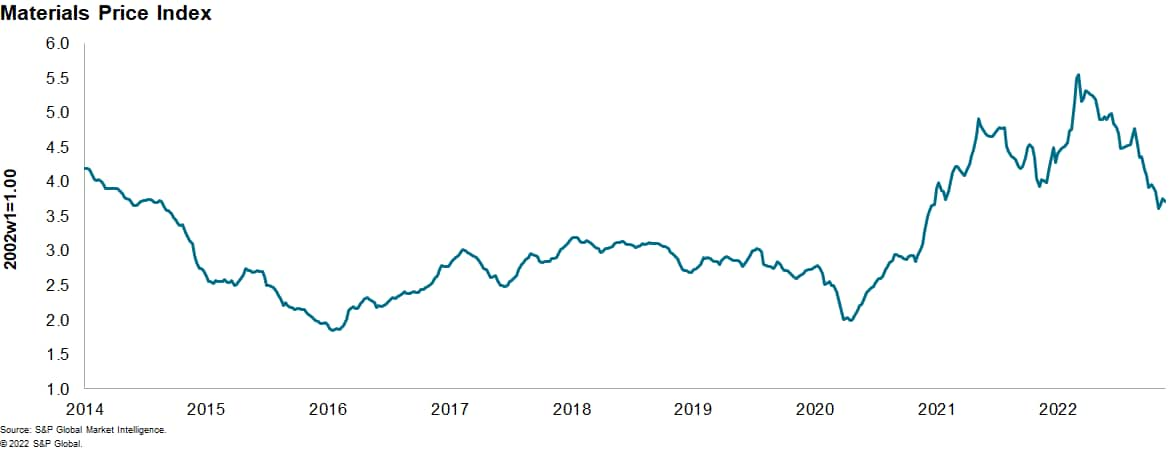

Our Materials Price Index (MPI) decreased 1.4% last week, following two weeks of increases. All ten subcomponents fell week-over-week. The longer-term trend of downward correction in commodity prices remains intact with the MPI 33% lower than its all-time high established back in early March. However, commodity prices remain far higher than the pre-pandemic levels of early 2020.

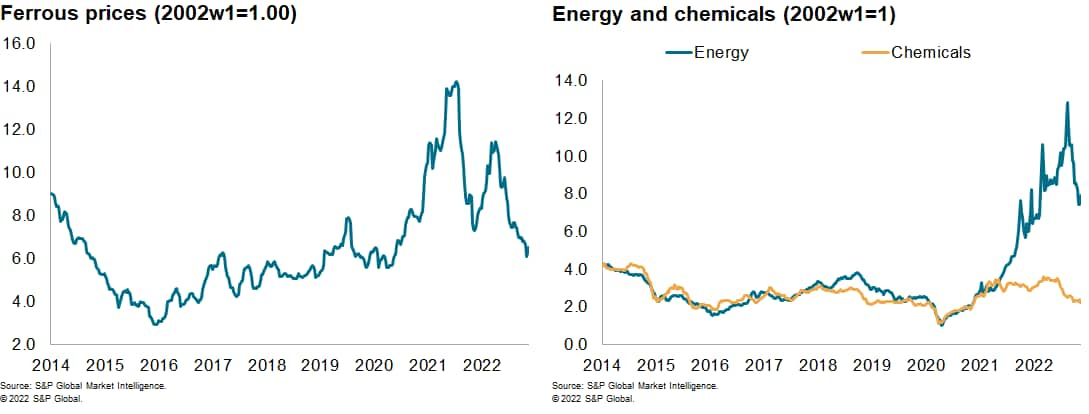

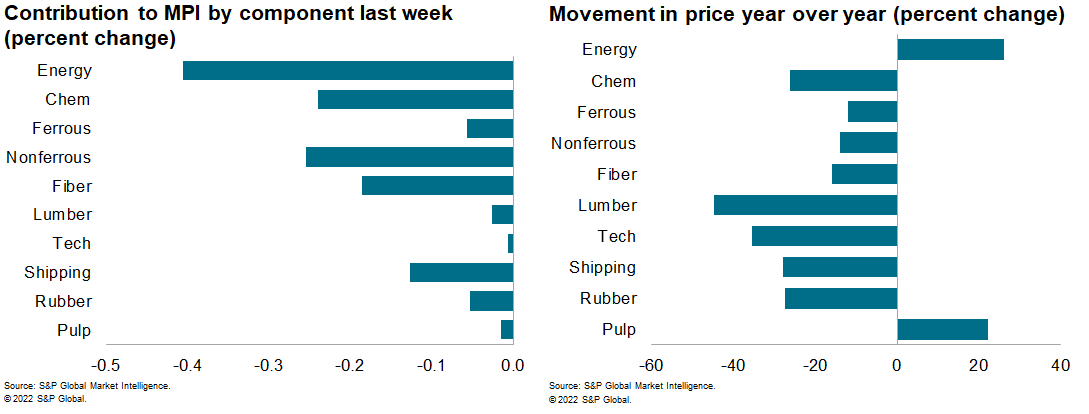

Within the ten subcomponents, half posted declines smaller than 2% and half declined by more than 2%. The freight rate index saw the largest decline, down 4.1%. Iron ore rallied a bit too much in prior weeks on hopes of COVID lockdown lifting, leading to a retreat last week as sentiment pulled back. The fiber index was down 3.4% last week with the polyester market facing oversupply amid soft demand and steady production. In a reversal of the 3.4% climb last week, nonferrous metals prices retreated 2.9%. As we had noted last week, the initial sentiment bump from the prospect of less strict zero-covid policies in mainland China had eased by the end of the week as renewed lockdowns indicate the initial reaction was overdone.

Last week was a mix of a few upbeat data releases as well as more gloomy indicators for industrial materials demand. While US core durable goods orders registered a 0.7% increase in October, broader measures such as the S&P Global flash manufacturing PMIs were in contractionary territory for the US, United Kingdom, Eurozone, and Japan in November. The flash composite PMIs were also in contractionary territory for the G4 economies. Also in the last week, major cities across mainland China have put in place tighter COVID-19-related controls as case counts continue to surge. The bottom line is that the evidence for a global downturn in demand for industrial materials continued to build last week. In the current week, we will get data releases for major indicators on prices, employment, and output across Europe, Asia, and North America.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.