Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Feb 26, 2020

By William May

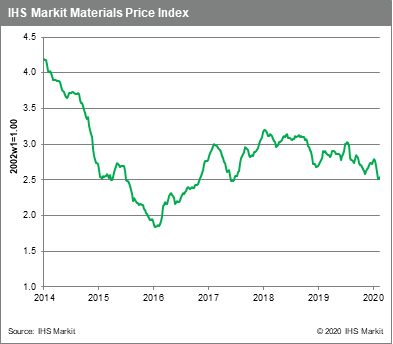

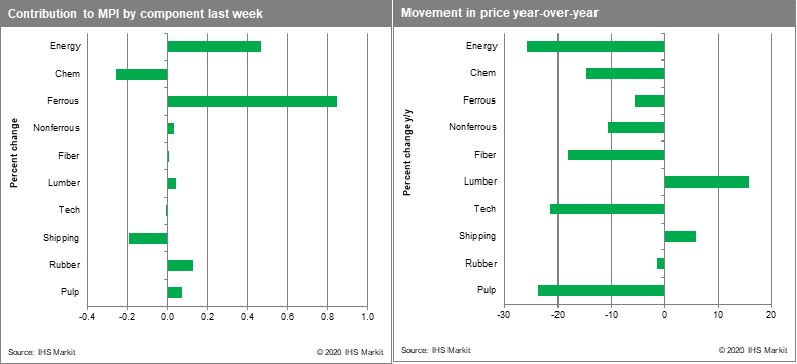

Commodity prices strengthened for a second consecutive week, though recent gains have not come close to offsetting the weakness that has emerged in markets since mid-January. Our Materials Price Index (MPI) rose 1.1% last week with seven of the MPI's ten subcomponents recording increases. A slowing rate of new coronavirus cases reported in China provided support to markets, which seemed to calm as the week progressed. However, the mood changed dramatically over the weekend with the reported jump in confirmed coronavirus cases in South Korea, Italy and Iran.

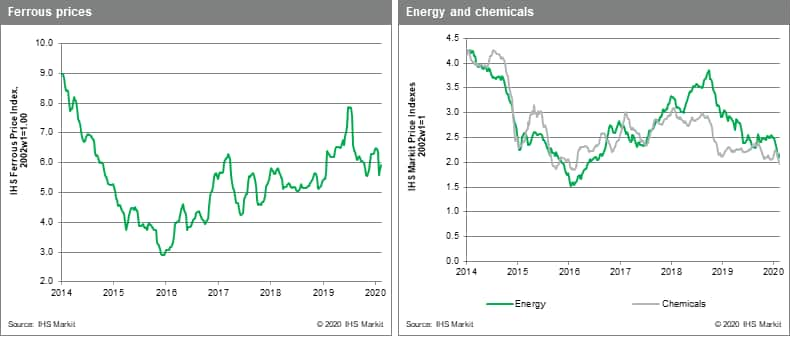

Energy prices jumped 3.5% for the week but remain below late January levels. Natural gas prices, which have been particularly volatile lately, posted an 8.8% increase this past week after an 8.2% decline in the week before. Oil also enjoyed a good week, with crude prices increasing almost 5%. Like energy prices, ferrous metals prices rebounded, rising 2.4%. Both iron ore and steel scrap prices showed solid gains, though both remain below late January levels. In spite of some positive news in most commodity markets last week, freight rates have continued to weaken, with the MPI's subcomponent index declining another 5%, its ninth consecutive slide since late December. Falling export volume from China is outstripping carrier measures to withdraw capacity, with dry bulk and container rates tumbling on Asia-Europe and trans-Pacific routes as a result.

Commodity markets appeared to find some footing in mid-February as factory production in China slowly restarted. Transportation bottlenecks in China and, in particular, a lack of trucking services in central China seemed to be the big stumbling block to normal flows in supply chains. Now, however, the possibility of the epidemic spreading outside of China threatens disruptions on a global scale. The question facing markets becomes how well do countries like Italy and South Korea, not just China, contain outbreaks of the virus?

Posted 26 February 2020 by Mr. William May, Senior Economist Pricing and Purchasing