Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Aug 04, 2021

By Michael Dall

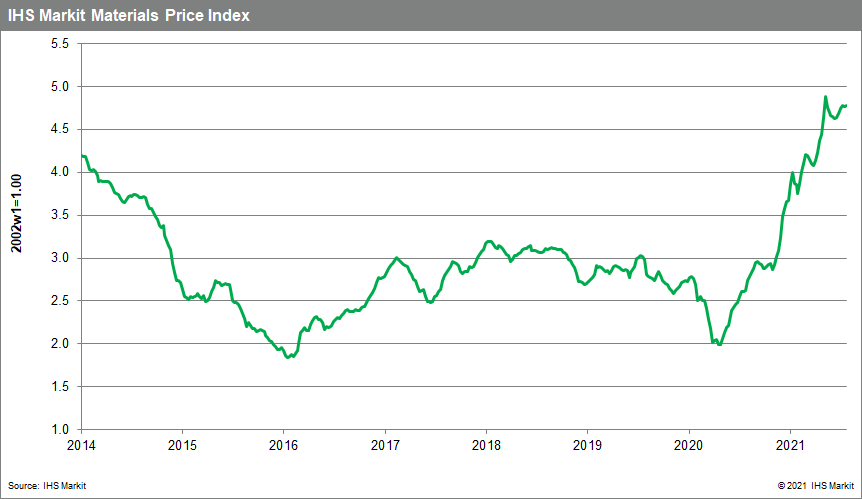

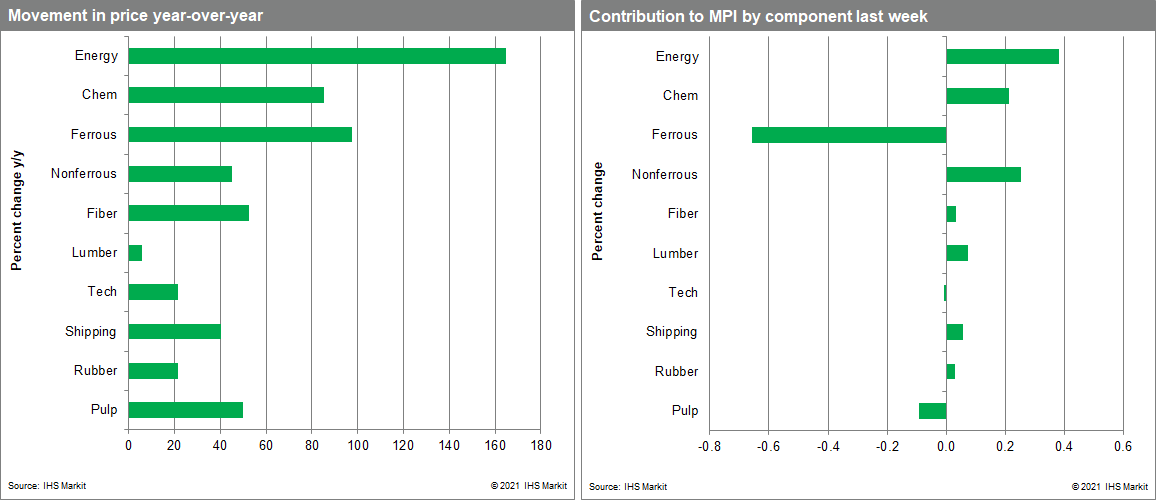

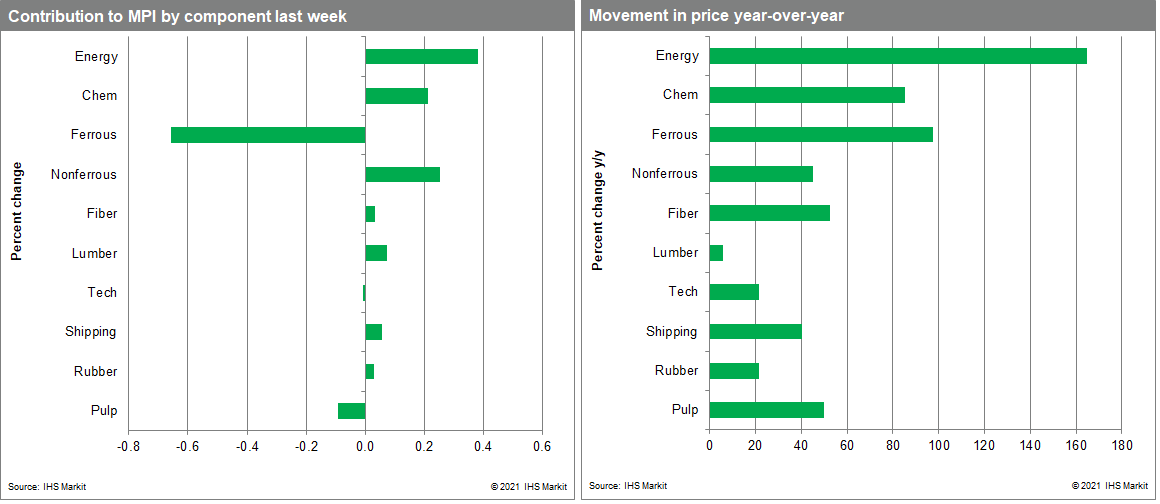

Our Materials Price Index (MPI) increased 0.3% last week, resuming an upward move following the previous week's decline. The increases were widespread with seven of the ten MPI sub-components up last week. Commodity price inflation, as measured by the MPI, is 83.4% higher than the corresponding week in 2020. While a significant jump, this is much lower than May when annual price increases reached 130%. More important, prices have become choppy since early April, a lack of direction characteristic of a market top.

Energy prices were the main contributor to the MPI's climb last week. Our energy sub-index was up 2.8% as both natural gas and oil prices pushed higher. European gas prices were notably strong as UK spot landed prices of Liquefied Natural Gas (LNG) hit $12.95/mmbtu, a level last seen in 2008. A severe winter had already depleted European stocks and supply has faced significant challenges since. A drop in Russian imports and lower oil production in the North Sea (natural gas is often a crude oil byproduct) has reduced natural gas availability. Overall global natural gas prices increased 5.6% last week. Oil prices were up by 3.9%, a rebound that almost reversed the previous week's fall sparked by the OPEC+ agreement to increase future production. Elements of the MPI showed weakness last week, with iron ore prices dropping once more. Authorities in mainland China have asked steel mills to limit production and are threatening punishment for any noncompliance. This intervention reduced demand for iron ore and sent prices lower, with our steel raw materials sub-index down 1.4%.

Although commodity prices did rise last week, there are hints that the year-long rally in commodity markets has run its course. Growth has begun to slow, though supply-chain disruptions and bottlenecks continue to plague markets. Vendor performance remains poor, with little sign that logistics services are becoming better. Most worrisome, service sectors are now experiencing the same kinds of problems manufacturing encountered last year, which means top-line inflation pressures may persist until year-end or even early 2022. This said, decelerating in commodity price escalation is a sign that the worst may be over, at least in goods markets.

Posted 04 August 2021 by Michael Dall, Associate Director, Pricing and Purchasing, S&P Global Market Intelligence