Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Aug 25, 2021

By Michael Dall

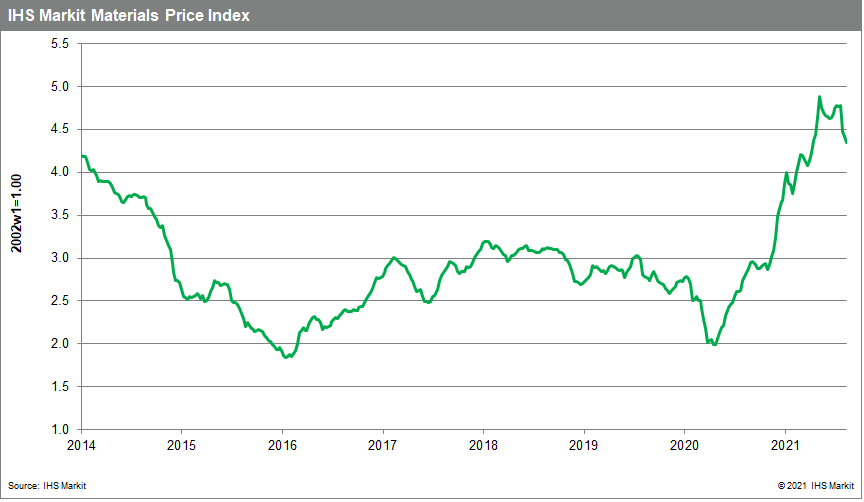

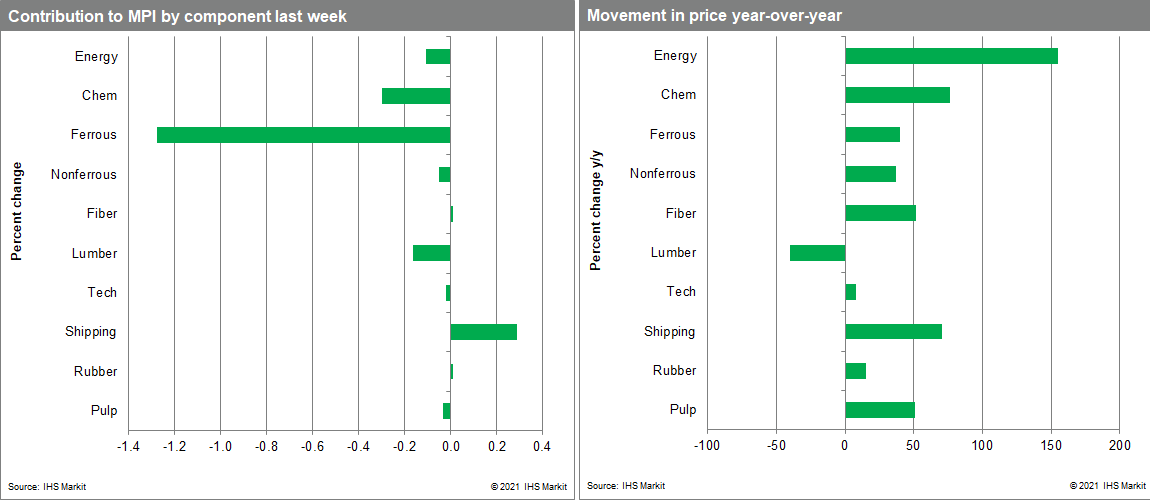

Our Materials Price Index (MPI) fell 1.6% last week, the third consecutive weekly drop. The declines were broad with seven out of the ten MPI sub-components down. This latest move means commodity prices are down 8.9% in August alone although prices collectively are still at an eight-year high.

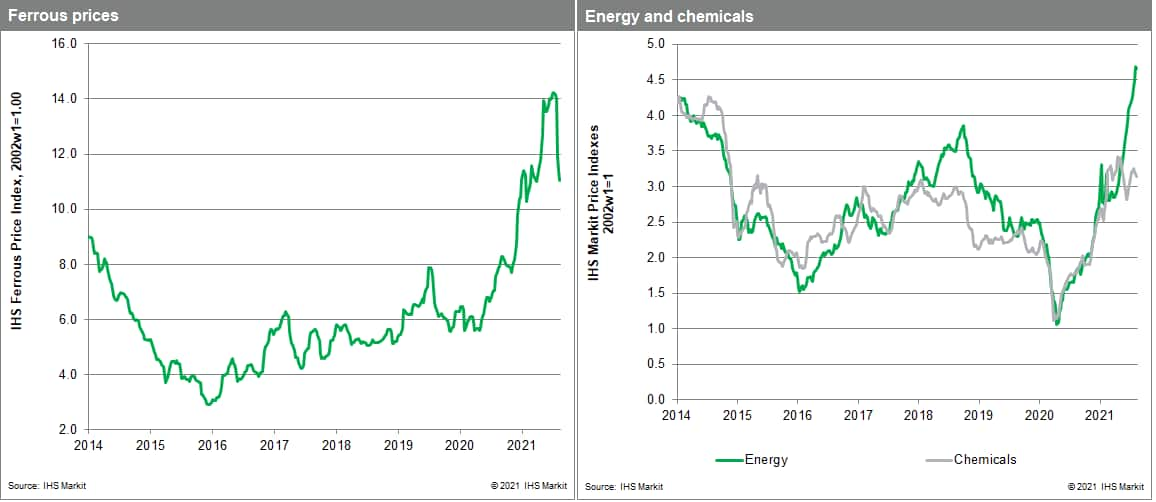

Industrial metals, chemicals, and energy prices were all notable fallers indicating the broad nature of last week's sell-off. Our ferrous sub-index was down 3.2%, its fifth consecutive weekly decline. Iron ore prices dropped to $159 a tonne last week, their lowest level since early April. The recent weakening in iron ore prices is linked to uncertainty over future Chinese steel consumption. Authorities in mainland China have asked steel mills to limit production to help reduce energy consumption and meet carbon emission targets and are threatening punishment for noncompliance. This intervention has reduced demand for iron ore sending prices lower. Industrial metal prices are also reacting negatively to weaker demand signals. Copper prices slipped below $9,000 a tonne for the first time since April reacting to a weaker global demand outlook. Our energy sub-index also declined last week, dropping 0.7%, its first decline in three months. A slowing rate of growth in natural gas prices and falling oil prices was enough to send the overall sub-index down. Brent crude oil slipped to $65, a full $10 below its peak last month, as investors feared a resurgence in COVID-19 cases would limit travel and hit demand. Elements of the MPI continue to show strength with our freight index increasing 7.8%. The partial closure of the Ningbo-Zhoushan shipping port in mainland China following a COVID-19 outbreak was behind the latest surge in global shipping prices last week.

August's drop in the MPI reinforces our sense that the year-long rally in commodity markets has now run its course with May now representing the high point in the current cycle. Growth is slowing, with markets now anxious about the spread of the COVID-19 Delta variant and what this may mean for future growth. In the US, concerns about softer growth centered on July retail sales, which fell worse than expected 1.1% in July. More important for commodities has been recent data from mainland China, which showed June growth in factory output and retail sales slowing sharply, with growth in fixed asset investment across the first half of the year coming in slightly below expectations. A second worry for markets is a looming change in US monetary policy. Recent statements by members of the Open Market Committee hint that the central bank could begin tapering its monthly bond purchases as early as the fourth quarter. The declines in commodity prices are encouraging in the sense that the cost pressures now present in supply chains will begin to dissipate if price declines continue into the fourth quarter. This said the threat of higher inflation will not be removed until the disruptions and bottlenecks that continue to plague the supply-side of markets are resolved.

Posted 25 August 2021 by Michael Dall, Associate Director, Pricing and Purchasing, S&P Global Market Intelligence