Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Sep 03, 2021

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Central bank meetings in the eurozone, Australia and Malaysia pack the week ahead, with the focus firmly on whether the European Central Bank (ECB) will update its asset purchase programme. China and the US will also release factory gate inflation figures amid continued COVID-19 related supply disruptions in August. In the UK, July GDP growth and trade numbers are also eagerly anticipated.

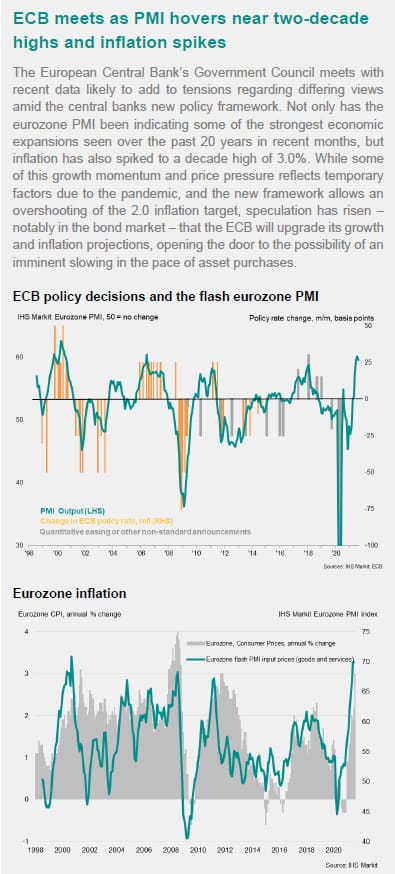

In line with the Fed, extraordinary support measures are being reviewed by the ECB with expectations that the net asset purchases under the Pandemic Emergency Purchase Programme (PEPP) may slow from this month. Indeed, flash IHS Markit Eurozone PMI data pointed to the economy growing at a rate little-changed from July's 15 year high midway into Q3, while price pressures remained steep by historical standards, supporting some paring back of these support measures. That said, the uncertainty caused by the recent COVID-19 Delta wave may encourage a more dovish stance.

The UK meanwhile finds a number of data releases including July GDP and trade figures. Facing significant supply chain and labour constraints in Q3, which were reported to have subdued output, the readings will be studied to assess whether the economy can sustain recent growth momentum.

In APAC, the RBA and BNM meet with no changes expected. China's August data will be the highlight instead after manufacturing sector conditions worsened for the first time since April 2020.

PMI commentary: Chris Williamson, Jingyi Pan

APAC commentary: Rajiv Biswas

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.