Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Feb 02, 2024

By Chris Williamson and Jingyi Pan

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

January's services PMI, plus detailed sector data, will be unveiled at the start of the week to kickstart a busy data calendar. Notably, inflation figures will be due across several economies including mainland China. Central bank meetings in Australia, India and Thailand will also be highlights.

Insights into service sector conditions will be sought from worldwide services PMI and US ISM numbers, all due at the start of the week. The evolution of services inflation may arguably be more important than how activity fared at the start of the year. This is especially with bullish market sentiment having been built on rate cut expectations. Central bankers, including the Fed, ECB and Bank of England, have continued to telegraph their data-dependent approach to lowering interest rates, all keen to see more evidence that inflation will not just drop to target but also remain there.

Detailed sector data will also be unveiled as we track the key areas of growth, notably in respect to the impact of looser financial conditions and the inventory cycle. The data will also add more evidence as to which industries are seeing supply pressures build up on the back of the Red Sea crisis.

In the UK, the PMI data are accompanied by recruitment industry survey data, which have been closely monitored by the Bank of England as it searches for clues as to whether wage growth pressures could keep inflation elevated. Two of the BoE's nine policymakers still voted to hike interest rates at the January meeting.

Additional central bank meetings unfold in Australia, India and Thailand in the week. While no changes to monetary policy settings are expected from the former two (see page 2), the Bank of Thailand's monetary policy meeting is seen as a 'live' meeting amid political pressure to lower rates. The decision will therefore be widely watched on Wednesday, but the RBA and RBI will similarly be scrutinised for their views with regards to inflation and the policy path forward.

Ahead of the Lunar New Year holidays, we will also be receiving a slew of economic releases in APAC including inflation figures out of mainland China. Factory gate inflation is expected to stay muted, as preluded by the latest Caixin Manufacturing PMI release. GDP figures will meanwhile be due from Indonesia.

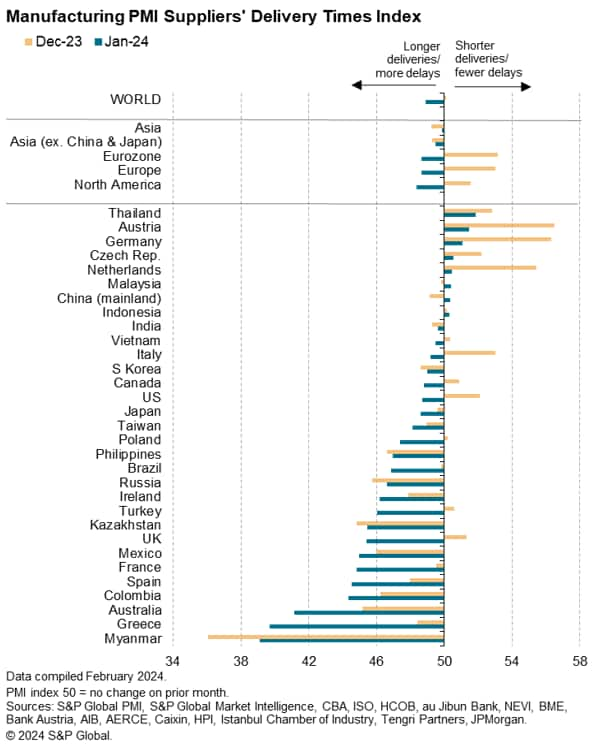

Supplier delivery times lengthened globally in January for the first time in a year, according to S&P Global's PMI surveys. Supply delays were most pronounced in areas affected by disruptions to Red Sea shipping routes, notably in Europe.

However, even in the most badly affected European economies, the supply delays are a far cry from those seen during the pandemic. The concern is that tensions around the Israel-Gaza war could disrupt shipping in the Red Sea at least into the second quarter, and any potential escalation of the war in the Middle East may drive up energy prices. Also, if ships and containers become unavailable due to changes to shipping routes and schedules, this could feed through to problems for other countries beyond Europe.

Monday 5 Feb

Worldwide Services, Composite PMIs, inc. global PMI* (Jan)

Australia Trade (Dec)

Indonesia GDP (Q4)

Thailand Inflation (Jan)

Singapore Retail Sales (Dec)

Germany Trade (Dec)

Turkey Inflation (Jan)

Eurozone PPI (Dec)

United States ISM Services PMI (Jan)

Tuesday 6 Feb

Japan Household Spending (Dec)

Philippines Inflation (Jan)

Australia RBA Interest Rate Decision

Germany Factory Orders (Dec)

Taiwan Inflation Rate (Jan)

Eurozone Retail Sales (Dec)

Global Sector PMI* (Jan)

Wednesday 7 Feb

New Zealand Unemployment Rate (Q4)

Philippines Unemployment Rate (Dec)

Japan Leading Index (Dec)

Switzerland Unemployment Rate (Jan)

Germany Industrial Production (Dec)

Thailand BoT Interest Rate Decision

United Kingdom Halifax House Price Index (Jan)

France Trade (Dec)

Taiwan Trade (Jan)

Italy Retail Sales (Dec)

Brazil Retail Sales (Dec)

Mexico Consumer Confidence (Jan)

Canada Trade (Dec)

United States Trade (Dec)

Global Metal Users and Electronics PMI* (Jan)

Thursday 8 Feb

Taiwan, Indonesia Market Holiday

Japan Current Account (Dec)

China (Mainland) CPI, PPI (Jan)

India RBI Interest Rate Decision

Brazil Inflation (Jan)

Mexico Inflation (Jan)

United States Initial Jobless Claims

United States Wholesale Inventories (Dec)

United Kingdom KPMG / REC Report on Jobs (Jan)

Friday 9 Feb

China (Mainland), South Korea, Taiwan, Hong Kong SAR (partial), Singapore (partial) Market Holiday

Germany Inflation (Jan, final)

Turkey Industrial Production (Dec)

Italy Industrial Production (Dec)

Mexico Industrial Production (Dec)

Canada Unemployment (Jan)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

Worldwide services and sector PMI for January

January's services PMI figures will be due at the start of the week to complete the picture following indications of a renewed improvement in global manufacturing output. Besides monitoring service sector growth momentum in key economies, the service sector price data - a key area of concern to policymakers - will need to be assessed for the overall wage growth and inflation trend.

Additionally, we will also have detailed sector PMI data for insights into changing performance across the US, European, Asian and global economies. Activity within the financial services sector improved at the end of 2023 as financial conditions loosened and it will be of particular interest to watch if this trend has carried through into 2024.

Americas: ISM services, Canada trade and employment

The ISM services data will be under particular scrutiny after the survey's employment index collapsed 7.3 index points in December, signalling a jobs cull on a scale not seen since 2008 if pandemic months are excluded. The S&P Global services PMI for the US is also updated after flash PMI numbers hinted at growth gaining momentum. Additionally, several releases will be due from Canada such as the services PMI plus trade and employment data. Business conditions were found to have further worsened at the end of 2023 according to S&P Global Canada Composite PMI.

EMEA: Germany trade, industrial production and inflation data, Turkey inflation, UK jobs report

In Europe, Germany releases trade, industrial production and final inflation figures for January. Latest PMI data showed that manufacturing conditions continued to worsen in Europe's largest manufacturing economy, though the rate at which manufacturing output fell eased from December as new orders contracted at a slower, albeit still significant, pace, despite Red Sea related shipping delays.

In the UK, the services PMI is accompanied by the REC/KPMG recruitment industry survey, a key indicator watched by the Bank of England for pay growth.

APAC: RBA, RBI, BoT meetings, Indonesia GDP, China, Taiwan, Philippines inflation

In APAC, several central bank meetings unfold in the week including in Australia, India and Thailand. The Reserve Bank of Australia is expected to leave policy rates unchanged through the first half of 2024, with still elevated cost inflation observed in the latest Judo Bank Flash Australia PMI. The Reserve Bank of India is meanwhile expected to hold rate cuts off until the second half of 2024, likewise watching inflation. The Bank of Thailand could buck the holding trend, however, with expectations having gathered for a rate cut.

In the data docket are also Indonesia's Q4 GDP release, in addition to inflation updates from mainland China, Taiwan and the Philippines. Attention will be on CPI and PPI figures out of mainland China with recent January Caixin Manufacturing PMI price indices showing inflationary pressures remained muted at the start of the year.

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location