Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Dec 02, 2022

By Chris Williamson and Jingyi Pan

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Worldwide services PMI data will be due at the start of a busy week that includes central bank meetings in Canada, Australia and India. Inflation data will also be in abundance from mainland China, the Philippines and Thailand while the US PPI figures are set to be updated. Helping assess the global economic environment, Germany's industrial output and China's trade numbers will also offer deeper insights into conditions within the goods producing sector.

Stocks gained this week with Federal Reserve Chairman Jerome Powell taking to the podium to signal a potential slowdown in interest rate rises, thereby enthusing markets. Prior to which, flash PMI released last week reinforced the picture of recent aggressive policy tightening doing its job in bringing down inflationary pressures.

All said, the risks remain that rates may lift higher before the Fed take a definitive pause, and this is amid a divergence between resilient official data and softer business survey statistics that has historically shown to be providing important advance signs. The coming week's worldwide services PMI figures will therefore be closely watched for a fuller picture on the health of the global economy, including the US with additional data from the ISM. Details from sub-indices such as on employment will be particularly scrutinised after the Fed indicated that the further cooling of the heated labour market is required.

Meanwhile a series of central bank meetings unfold in Canada, Australia and India, each their last monetary policy meeting for 2022. Our country economists have pencilled in hikes expected from all three central banks with the Bank of Canada widely forecast to deliver their final outsized policy hike in December. Following a series of interest rate hikes across major central banks, many are joining the Fed, in tightening at a slower pace. Latest November flash manufacturing PMI data had certainly pointed to prices easing in the current weakened economic environment, backing the need for further policy fine-tuning.

Finally, China's trade and inflation figures will be eagerly watched in APAC after the latest Caixin manufacturing PMI data reflected a slighter deterioration in conditions midway into the final quarter of 2022.

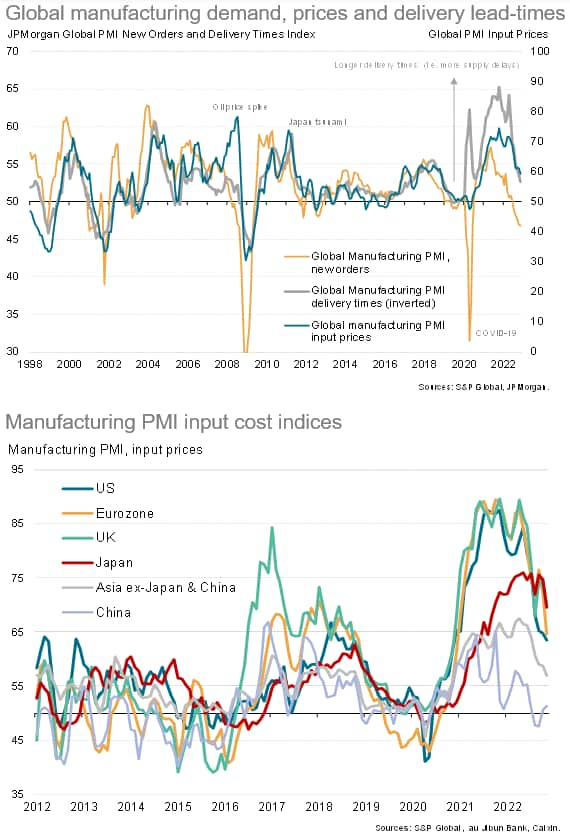

Worldwide manufacturing PMI data revealed that goods producers faced a slowdown in demand in November, though supply constraints and price pressures simultaneously cooled. While uncertainties persist, particularly on the energy prices front and China's latest COVID response, the present fall in industrial prices bodes well for consumer goods prices in the coming months. This also suggests that policymakers may have greater room to manoeuvre in their endeavours to douse the inflation fire.

Monday 5 December

Thailand Market Holiday

Worldwide Services & Composite PMI* (Nov)

Australia Business Inventories (Q3)

Eurozone Sentix Index (Dec)

United Kingdom Reserve Assets (Nov)

Eurozone Retail Sales (Oct)

United States Factory Orders (Oct)

United States ISM Non-manufacturing PMI (Nov)

Tuesday 6 December

Japan All Household Spending (Oct)

Australia Current Account Balance (Q3)

Philippines CPI (Nov)

Australia RBA Cash Rate (Dec)

Thailand CPI (Nov)

Germany Industrial Orders (Oct)

Germany Manufacturing Output (Oct)

Taiwan CPI (Nov)

Eurozone S&P Global Construction PMI* (Nov)

Germany S&P Global Construction PMI* (Nov)

United Kingdom S&P Global/CIPS Construction PMI* (Nov)

United States International Trade (Oct)

Canada Trade Balance (Oct)

S&P Global Sector PMI* (Nov)

Wednesday 7 December

Australia GDP (Q3)

China (Mainland) Trade (Nov)

India Repo and Reverse Repo Rate (7 Dec)

Switzerland Unemployment Rate (Nov)

Germany Industrial Output (Oct)

United Kingdom Halifax House Prices* (Nov)

Norway Manufacturing Output (Oct)

Taiwan Trade Balance (Nov)

Eurozone GDP Revised (Q3)

Canada BoC Rate Decision (7 Dec)

S&P Global Metals PMI* (Nov)

S&P Global Electronics PMI* (Nov)

Thursday 8 December

Philippines Market Holiday

Japan Current Account (Oct)

Japan GDP (Q3, revised)

Australia Trade Balance (Oct)

United Kingdom S&P Global/REC Report on Jobs* (Nov)

Canada Leading Index (Nov)

United States Initial Jobless Claims

Friday 9 December

Japan M2 Money Supply (Nov)

China (Mainland) CPI, PPI (Nov)

Norway Consumer Price Index (Nov)

United States PPI (Nov)

Canada Capacity Utilization (Q3)

United States UoM Sentiment (Dec, prelim)

United States Wholesale Inventories (Oct)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

Worldwide services PMI for November

Following the manufacturing PMI release, services figures will be awaited at the start of the week for indications on the health of the global economy beyond the goods producing sector. Flash PMI data for major developed economies pointed to output declining across both manufacturing and service sectors with reduced price pressures now evident even in the service sectors. Concurrently, jobs growth softened, altogether suggesting more limited scope for further monetary policy tightening although it remains to be seen if central bankers will be persuaded so. Headline services PMIs will therefore be eyed for the degree of slowdown in activity while the sub-indices provide a fuller picture on prices, employment, business confidence and more.

Americas: Bank of Canada meeting, US PPI, UoM sentiment

Bank of Canada policymakers convene on Wednesday for their December meeting. The BoC is expected to deliver their final outsized policy hike at this yearend meeting, lifting the policy rate from the current 3.75%, thus balancing inflation concerns with the focus on wage growth and employment.

Meanwhile in the US, final PPI readings for November will be due alongside the preliminary December UoM sentiment survey. Latest composite flash PMI readings showed improved sentiment across private sector firms in the US despite growing impact from rate hikes on the economy.

Europe: Eurozone Q3 GDP, retail sales, Germany industrial output

Besides the slew of PMI data, revised Q3 GDP from the eurozone will be released. A few tier-2 data releases such as eurozone retail sales and German industrial output figures will also be updated providing indications on the degree of slowdown in the economic bloc.

Asia-Pacific: RBA, RBI meetings, China trade and inflation figures

In APAC, the economic calendar is packed with central bank meetings in Australia and India while China's October trade and inflation figures will also be tracked after the latest Caixin China General Manufacturing PMI indicated a slower deterioration in manufacturing conditions.

Global Manufacturing Downturn Intensifies as Firms Cut Capacity in line with Slumping Demand - Chris Williamson

Taiwan Economy Faces Headwinds from Slowing Exports - Rajiv Biswas

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location