Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jan 28, 2022

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Worldwide manufacturing and services PMIs will be released in a busy week ahead filled with key economic data such as the US jobs report and eurozone GDP and inflation. Central bank meetings in the UK and eurozone will also unfold. All of which happens while a large part of Asia, including China, will be away for Lunar New Year holidays.

Global markets are being rattled by mounting concerns over inflation and the US Federal Reserve's increasingly hawkish stance. The January US jobs report will therefore be eyed for further clues as to the recent strength of the labour market, which the Fed alluded to in its latest Federal Open Market Committee (FOMC) statement. According to flash PMI data, US firms continued to hire at a solid clip in January, with many reporting rising staff costs amid labour shortages.

The final worldwide PMI survey data will be therefore also be watched for further clues on the growth, supply chain and price outlook after flash PMIs alluded to slowing developed world growth at the start of 2022 as the Omicron wave hit. How the latest Omicron wave has affected the supply chain, notably in Asia, and if global price pressures continued to ease from December 2021 will be in focus.

In Europe, the ECB and BOE hold monetary policy meetings. While the ECB is expected to remain on hold, the market will be looking closely for signs that the mood could be turning more hawkish. Markets are meanwhile pricing in another hike from the UK central bank following the December surprise hike to 0.25%.

Supply chains used to be something that only supply chain managers talked about. Now they are of deep concern to everyone from consumers waiting for their deliveries to retailers, major manufacturers, prime ministers and presidents, and of course central banks.

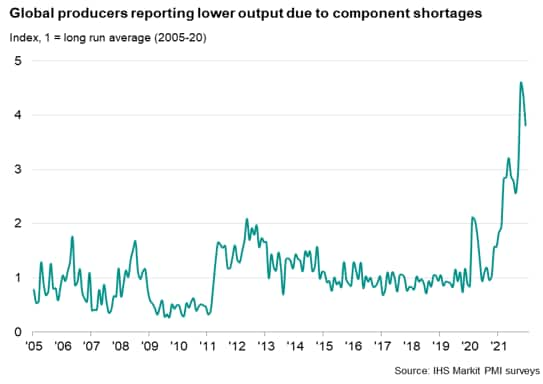

The highly synchronized global supply chain system developed over the past 30 years is under strain like never before and resolving the disruption will be less a "sprint" and more of a "marathon" that runs well into 2022. This is the first major disjunction in the highly-integrated supply chain system that has developed over the last three decades of globalization. The intense new debate on inflation adds to the urgency to understand what is ahead for supply chains in 2022.

"What is unfolding in supply chains globally is not only disruptive, it is also historic," says Daniel Yergin*, vice chairman, IHS Markit and editor of a new report from IHS Markit entitled The Great Supply Chain Disruption: Why it Continues in 2022.

While COVID-19 has been a significant factor in driving the disruptions—with the current Omicron variant creating new uncertainties—it is not the only factor, the report says. Substantial capacity, logistical and labour challenges also exist beyond the pandemic.

The report includes key insights and observations from IHS Markit experts on manufacturing, shipping and logistics, automotive, oil, agriculture, labour and materials, as well as ESG and geopolitical strains.

The complete report is available for free at:

https://ihsmarkit.com/Info/0122/great-supply-chain-disruption.html

* Daniel Yergin, vice chairman of IHS Markit, is a Pulitzer Prize winning author. His latest book is "The New Map: Energy, Climate, and the Clash of Nations."

Monday 31 Jan

China (Mainland), South Korea, Taiwan Market Holiday, Singapore, Malaysia Market Holiday (Partial)

Japan Industrial Output and Retail Sales (Dec)

United Kingdom Nationwide House Price (Jan)

Eurozone GDP Flash (Q4, prelim)

Germany CPI (Jan, prelim)

Canada Producer Prices (Dec)

Tuesday 1 Feb

China (Mainland), South Korea, Singapore, Indonesia, Malaysia, Taiwan Market Holiday

Worldwide Manufacturing PMIs, incl. global PMI* (Jan)

Japan Unemployment Rate (Dec)

Australia RBA Cash Rate (Feb)

Indonesia Inflation (Jan)

Germany Unemployment Rate (Jan)

United Kingdom Mortgage Lending and Approvals (Dec)

Eurozone Unemployment Rate (Dec)

Canada GDP (Nov)

United States ISM Manufacturing PMI (Jan)

Wednesday 2 Feb

China (Mainland), South Korea, Singapore, Malaysia, Taiwan Market Holiday

Eurozone HICP (Jan, flash)

United States ADP National Employment (Jan)

Thursday 3 Feb

China (Mainland), Taiwan Market Holiday

Worldwide Services & Composite PMI, incl. Japan, Brazil, Eurozone, India* (Jan)

Australia Trade Balance (Dec)

Eurozone Producer Prices (Dec)

United Kingdom BOE Bank Rate (Feb)

Eurozone ECB Deposit and Refinancing Rate (Feb)

United States Initial Jobless Claims

United States ISM non-manufacturing PMI (Jan)

Indonesia GDP (Q4)

Friday 4 Feb

China (Mainland), Taiwan Market Holiday

Australia RBA Monetary Policy Statement

South Korea CPI Growth (Jan)

Thailand CPI (Jan)

Germany Industrial Orders (Dec)

United Kingdom Markit/CIPS Construction PMI* (Jan)

Eurozone Retail Sales (Dec)

United States Non-Farm Payrolls, Unemployment Rate, Average Earnings (Jan)

*Press releases of indices produced by IHS Markit and relevant sponsors can be foundhere.

Worldwide manufacturing and services PMIs

Amid the spread of the COVID-19 Omicron variant, worldwide manufacturing and services PMIs will be watched intently next week for indications of how the global economy has fared at the start of 2022.

January flash PMIs alluded to sharp slowing in developed world growth, with US growth notably slipping to an 18-month low. Japan and Australia meanwhile fell into their third economic downturns of the pandemic as the Omicron wave hit, though the UK displayed some encouraging economic resilience in the face of the Omicron variant's spread.

A common theme that emerged was the disruption to output as COVID-19 conditions worsened, even though demand appeared to have held up on balance across the G4 economies. On the other hand, price trends varied at the start of 2022, with easing raw material price inflation contrasting with rising service sector prices. The upcoming data will therefore be watched in particular for indications of the supply situation out of Asia and the corresponding implications for prices.

North America: January jobs data

The turn of the month brings the January jobs report from the US, with the market currently pencilling in a stronger 238k addition for non-farm payrolls, while the unemployment rate comes in at 3.9% and average hourly earnings grow by 0.5% month-on-month. The latest IHS Markit Flash US Composite PMI pointed to firms expanding their workforce numbers in January despite challenging labour market conditions. This pace of jobs growth will be closely watched amid the market's concern with the rising interest rates outlook.

Europe: BOE, ECB meetings, eurozone GDP and inflation

The Bank of England (BOE) and European Central Bank (ECB) both meet for the first time in 2022. No change to rates is expected from the ECB though the current consensus points to the BOE hiking the bank rate by 0.25% to 0.50% at the upcoming meeting. Key economic releases for the eurozone meanwhile include Q4 GDP and January 'flash' inflation.

Flash PMIs Signal Sharp Slowing in Developed World Growth at Start of 2022 as Omicron Wave Hits - Chris Williamson

Philippines to Become USD 1 Trillion Economy by 2033 - Rajiv Biswas

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.