Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Nov 25, 2022

By Chris Williamson and Jingyi Pan

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Worldwide manufacturing PMIs will be eagerly anticipated in the coming week after flash PMIs alluded to further recession risks in the major developed economies. Key releases in the coming week also include US Q3 GDP and the November US labour market report. Additionally, various inflation data from the eurozone to Indonesia will be keenly watched. On the central bank front, the Bank of Thailand meets while several Fed members will also be making appearances.

Minutes from the November Federal Open Market Committee (FOMC) meeting reinforced expectations that the US central bank may slow the pace of rate increases in upcoming meetings. While this had returned some colour to risk assets this week, there remains much uncertainty about the US economy's near-term outlook.

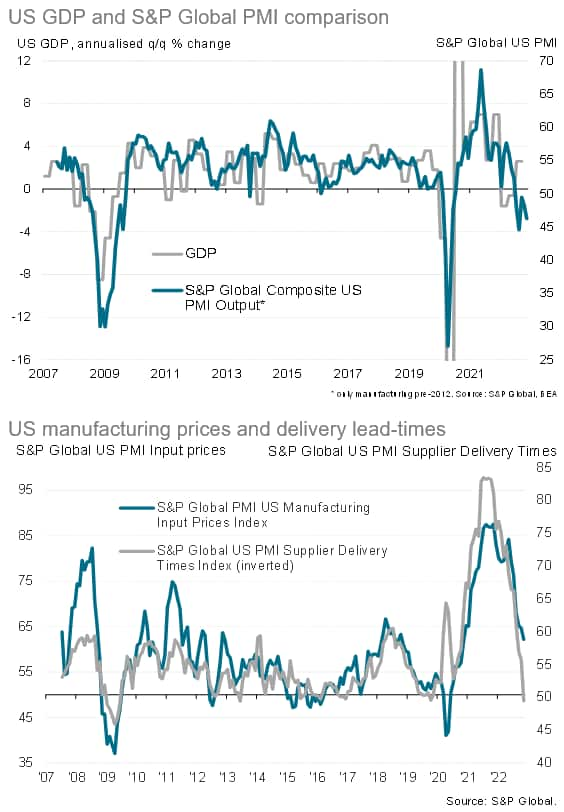

Specifically, discussions on the terminal rate for Fed funds pointed to potential for upward revisions to current projections given the stubbornly high inflation indications via official data. This will not be welcoming news for the market if it materialises. As seen via the latest November flash PMI numbers, softening demand has led to the alleviation of supply constraints and cooling of price pressures. Input cost inflation amongst goods producer notably fell at the fastest rate in the US compared to other developed economies such as the UK, eurozone and Japan in November. This is while the US also registered the fastest contraction in output in the abovementioned regions. The fear is that central bankers, including the Fed, may tighten further into a recession especially as the survey weakness has yet to fully manifest in the lagging official data, a phenomenon resembling that seen in 2008-9 (see special report).

While the uncertainty regarding the Fed's rate hike trajectory remains in question, the market will continue to chew on whatever crumbs we find along the way. The earliest indication of manufacturing conditions worldwide will be unveiled next week with the November PMIs and can provide a fuller picture of the global supply chain conditions, especially in Asia. Other key data including the US jobs report and eurozone inflation data are also highlights for the coming week.

A wide gap has opened up between PMI survey data and other US economic data. While the S&P Global surveys point to a growing US recession risk in Q4, the Atlanta Fed nowcast points to annualised GDP growth of over 4%. From a survey perspective, companies are reporting that demand is falling amid tighter Fed policy, which has also taken pressure off supply chains (with delivery times now improving). This has clear implications for inflation to continue to moderate, potentially sharply, in the coming months. It will therefore be interesting to see which metrics the Fed chooses to focus on.

Monday 28 November

Australia Retail Sales (Oct)

Canada Current Account (Q3)

Tuesday 29 November

Japan Unemployment Rate (Oct)

Japan Retail Sales (Oct)

Switzerland GDP (Q3)

Taiwan GDP (Q3, revised)

United Kingdom Mortgage Lending and Approvals (Oct)

Eurozone Business Climate (Nov)

Eurozone Consumer Confidence (Nov, final)

Germany CPI (Nov, prelim)

Canada GDP (Q3)

United States Consumer Confidence (Nov)

Wednesday 30 November

Philippines Market Holiday

South Korea Industrial Output (Oct)

South Korea Retail Sales (Oct)

Japan Industrial Output (Oct, prelim)

Australia Building Approvals (Oct)

China (Mainland) NBS Manufacturing PMI (Nov)

Thailand Trade (Oct)

Thailand 1-Day Repo Rate (30 Nov)

Germany Unemployment Rate (Nov)

Eurozone HICP (Nov, flash)

India GDP (Q2)

United States ADP National Employment (Nov)

United States GDP (Q3, 2nd estimate)

United States JOLTS Job Openings (Oct)

United Kingdom Nationwide House Price (Nov)

United States Fed Beige Book

Thursday 1 December

Worldwide Manufacturing PMIs, incl. global PMI* (Nov)

South Korea GDP Growth (Q3)

Indonesia Inflation (Nov)

Germany Retail Sales (Oct)

Switzerland CPI (Nov)

Switzerland Retail Sales (Oct)

Hong Kong Retail Sale (Oct)

Eurozone Unemployment Rate (Oct)

United States Personal Income and Consumption (Oct)

United States Core PCE (Oct)

United States Initial Jobless Claims

United States Construction Spending (Oct)

United States ISM Manufacturing PMI (Nov)

Friday 2 December

South Korea CPI (Nov)

Germany Trade (Oct)

Eurozone Producer Prices (Oct)

United States Non-Farm Payrolls, Unemployment Rate, Average Earnings (Nov)

Canada Unemployment Rate (Nov)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

Worldwide manufacturing PMI for November

Manufacturing PMI data for November will be released at the start of the final month of the year, eagerly awaited after flash PMI data pointed to falling output across major developed economies including the US, Europe and Japan.

Specifically, manufacturing output fell across these G4 economies - US, UK, eurozone and Japan - and at a faster pace compared to services activity. Manufacturing demand weakness had been prominent, but it had also contributed to the cooling of price pressures. It will be of interest to study how the manufacturing sector performance varied across the different regions, particularly in Asia. An important sub-metric to watch in the PMIs will be supplier delivery times. Longer lead times led to a major uplift in prices during the pandemic, but supply delays are now easing, and have even shortened in the US and Germany, helping bring prices down.

Americas: US Q3 GDP, November labour market report, consumer confidence

Second estimates of the US Q3 GDP will be released on Wednesday with Refinitiv consensus pointing to a slight upward revision of the reading to 2.8% from 2.6%. More crucially, the attention will be on the November labour market report with expectations of strong non-farm payrolls additions and only a slight uptick in the unemployment rate to 3.8%. The latest S&P Global Flash US Composite PMI revealed that workforce numbers continued to climb in November, albeit only marginally. Further Fed talks in the week will also be closely followed after the latest Fed minutes reinforced expectations for smaller hikes in upcoming meetings.

Europe: Eurozone inflation, business climate, Germany employment data

Eurozone flash November inflation figures will be released on Wednesday following the flash PMI data which showed price pressures cooling in the region even as recession risks gathered, albeit remaining elevated. Official figures will be tracked for confirmation of this trend.

Asia-Pacific: China NBS PMI data, Bank of Thailand meeting, South Korea, Taiwan GDP, Indonesia inflation

In APAC, besides the PMI and GDP figures, the Bank of Thailand will be one to watch for further tightening. Indonesia also updates November inflation figures.

Flash PMI Data Point to Falling Output in the US, Europe and Japan, but Price Pressures Also Cool - Chris Williamson

ASEAN Region Continues to Show Rapid Economic Expansion - Rajiv Biswas

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location