Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Sep 24, 2021

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

September manufacturing PMIs will be released with the turn of the month next week while inflation updates are awaited from the US and eurozone following a busy week of monetary policy meetings.

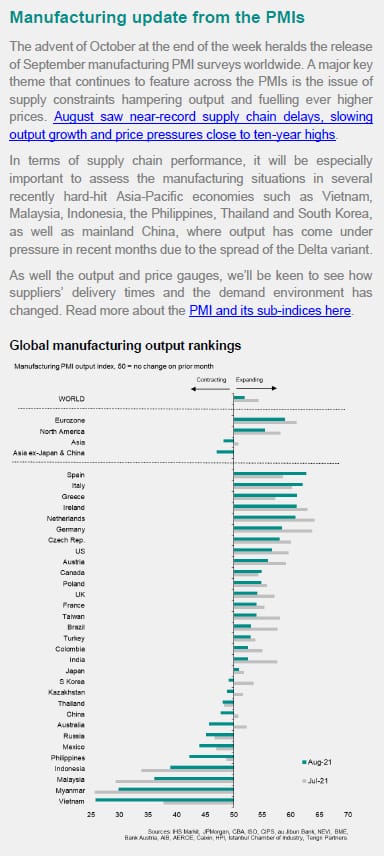

Worldwide manufacturing PMI data will be in focus in the coming week after September flash PMIs further fuelled concerns of stagflation, reflecting slowing growth and rising prices across the likes of the US, UK and eurozone. In particular, the extent to which the global economy has been affected by supply constraints, which evidently worsened in September according to the flash PMIs, will be the key question. The stickiness of the recent rise in prices, which can be examined through the rate at which rising input costs translate to higher output charges, will be of interest with the PMI sub-indices.

Official economic data releases also fill the calendar with special focus on the September eurozone inflation numbers. The latest IHS Markit Flash Eurozone PMI pointed to further accumulation of inflationary pressures and at a rapid pace, suggesting we may be seeing elevated readings up ahead.

Following a week of central bank meetings, including the US Fed FOMC meeting where a less hawkish than feared tone was adopted, the ECB forum on central banking brings across a series of appearances by developed market central bank chiefs. Any further details on the paths forward for these central banks will be closely watched in the week ahead.

PMI commentary: Chris Williamson, Jingyi Pan

APAC commentary: Rajiv Biswas

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.