Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Dec 23, 2022

By Jingyi Pan

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

The final week of 2022 brings about a series of data releases before the new year ushers in worldwide manufacturing and services PMI data for the month of December. The US jobs report due the first Friday will also be closely watched for insights into labour market conditions with the Fed closely monitoring wage inflation. A series of CPI data due across the eurozone to parts of Asia will also reveal more about inflation at the end of 2022.

Inflation will remain one to watch in the months ahead, to see if there are further signs of easing price pressures. That appears to be the direction of early PMI indicators and recent official data as 2022 draws to a close, albeit being at the very early stages of easing inflationary pressures. Consequently, we have seen central bankers progressively shift away from more aggressive monetary policy tightening which led risk assets, such as equities, to find footing in recent months.

That said, the tightening of monetary conditions is expected to persist into the new year for major central banks including the US Federal Reserve that had piled on the hawkish tone in December. Whether the market's conviction that the worst seems to be over holds true or much more needs to be done to hold down prices remains up for debate. As far as data have indicated, the trend is on the decline for inflationary pressures and we will have worldwide PMI data to reveal more upstream on the global supply chain situation in the first week of 2023. Moreover, detailed output performance will also be of interest as the baton gets passed from concerns of inflation to jitters over risks of recession.

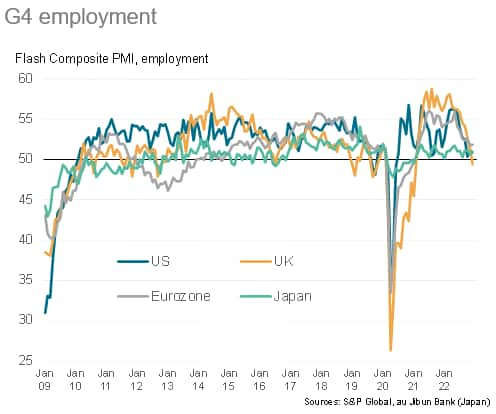

Official data including the US jobs report for December are also lined up to ring in the new year. Amid the growing attention on wages, the employment conditions will be scrutinised though flash PMI indications have so far given early indications of slowing jobs growth as demand slumped.

Finally, the series of CPI figures from the eurozone, Germany and a number of Asian economies will provide insights into the extent to which inflation may have eased in the final month of 2022. Conditions in Asia will be of significant interest especially after China loosened restrictions over the month.

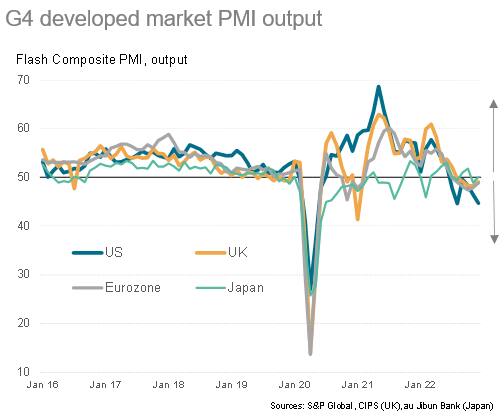

Flash PMIs reflected worsening developed market economic growth in December with the downturn especially sharp in the US while other 'G4' economies showed tentative signs of moderation in decline. Final numbers from the G4 economies and more widely across the globe will therefore be eagerly anticipated at the start of 2023 for the earliest snapshot of conditions at the end of 2022.

Alongside the slowdown in inflation had been easing jobs growth in the US. The official jobs report will therefore be watched for confirmation of the trend in the first week of the year particularly given its growing importance in guiding monetary policy in the US.

Monday 26 December

US, UK, Germany, Switzerland, Norway, Canada, Australia, New Zealand, China, Hong Kong, Malaysia, Singapore Market Holiday

Japan Service PPI (Nov)

Tuesday 27 December

UK, Canada, Australia, New Zealand, China, Hong Kong Market Holiday

Japan Unemployment Rate (Nov)

Japan Retail Sales (Nov)

Japan Housing Starts (Nov)

Norway Retail Sales (Nov)

United States S&P Global/Case Shiller Home Price (Oct)

Wednesday 28 December

Japan Industrial Output (Nov, prelim)

United States Pending Sales Change (Nov)

Thursday 29 December

South Korea Industrial Output (Nov)

South Korea Retail Sales (Nov)

Eurozone M3 (Nov)

United States Initial Jobless Claims

Friday 30 December

US, UK (Partial), New Zealand (Partial), South Korea, Philippines Market Holiday

South Korea CPI Growth (Dec)

Thailand Current Account (Nov)

Switzerland Official Reserves Assets (Nov)

United Kingdom Nationwide House Price (Dec)

Hong Kong Retail Sale (Nov)

Saturday 31 December

China (Mainland) NBS Manufacturing PMI (Dec)

-------------------------------------------------------------

Monday 2 January

US, UK, Switzerland, Canada, Australia, New Zealand, Japan, China, Hong Kong, Taiwan, Thailand, Malaysia, Singapore Market Holiday

South Korea S&P Global Manufacturing PMI* (Dec)

Indonesia S&P Global PMI* (Dec)

Indonesia Inflation (Dec)

India S&P Global Manufacturing PMI* (Dec)

Germany S&P Global/BME Manufacturing PMI* (Dec)

Eurozone S&P Global Manufacturing PMI (Dec)

Tuesday 3 January

Australia, New Zealand, Japan Market Holiday

Worldwide Manufacturing PMIs, incl. global PMI* (Dec)

Germany Unemployment Rate (Dec)

United States Construction Spending (Nov)

Philippines CPI (Dec)

Wednesday 4 January

Japan au Jibun Bank Manufacturing PMI* (Dec)

Thailand S&P Global Manufacturing PMI* (Dec)

India S&P Global Services PMI* (Dec)

Germany Import Prices (Nov)

Switzerland CPI (Dec)

Germany S&P Global Services PMI* (Dec)

Eurozone S&P Global Services PMI* (Dec)

United Kingdom Mortgage Lending and Approvals (Nov)

Germany CPI (Dec, prelim)

United States ISM Manufacturing PMI (Dec)

United States JOLTS Job Openings (Nov)

Thursday 5 January

Worldwide Services, Composite PMIs, inc. global PMI* (Dec)

Japan Monetary Base (Dec)

Thailand CPI (Dec)

Germany Trade Balance (Nov)

Eurozone S&P Global Construction PMI* (Dec)

Germany S&P Global Construction PMI* (Dec)

United Kingdom Reserve Assets Total (Dec)

Eurozone Producer Prices (Nov)

United States ADP National Employment (Dec)

United States International Trade (Nov)

United States Initial Jobless Claims

Canada Trade Balance (Nov)

Friday 6 January

Japan au Jibun Bank Services PMI* (Dec)

Germany Industrial Orders (Nov)

Germany Manufacturing Output (Nov)

Germany Retail Sales (Nov)

United Kingdom Halifax House Prices* (Dec)

Norway Manufacturing Output (Nov)

Switzerland Retail Sales (Nov)

Taiwan CPI (Dec)

United Kingdom S&P Global/CIPS Construction PMI* (Dec)

Eurozone HICP (Dec, flash)

Eurozone Retail Sales (Nov)

Eurozone Business Climate (Dec)

Eurozone Consumer Confidence (Dec, final)

United States Non-Farm Payrolls, Average Earnings, Unemployment Rate (Dec)

Canada Unemployment Rate (Dec)

United States Factory Orders (Nov)

United States ISM Non-manufacturing PMI (Dec)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

US Flash PMI Survey Data Signal Growing Impact from Rate Hikes on Economy and Inflation - Chris Williamson

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location