Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Oct 21, 2022

By Chris Williamson and Shreeya Patel

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

A number of central bank meetings take place in the coming week, encompassing Japan, the Eurozone, Canada, Brazil and Russia. Third quarter GDP updates will provide a backward-looking view of macroeconomic conditions in mainland China, the US, Germany, France and South Korea, while flash PMIs will give a glimpse of economic performance at the start of the fourth quarter.

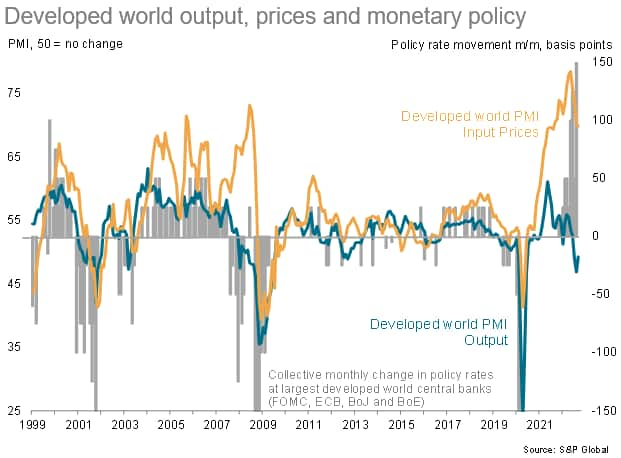

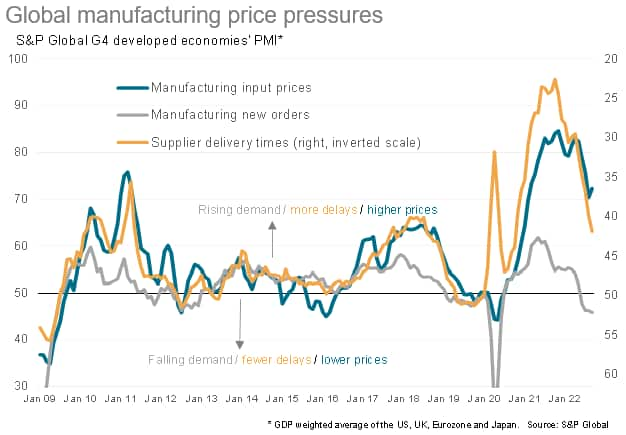

The flash PMIs will be watched closely at the start of the week as markets look for updates on the macro trends in Australia, Japan, the US, the UK and the Eurozone. Output growth has generally remained subdued or has fallen into contraction territory, fuelling recession talk. Inflation indicators will also be watched for further signs of varying pressures around the world (see box).

The UK's flash PMI data will be especially eagerly awaited, providing the first indications of changing business conditions after the market turmoil associated with the mini-budget, albeit collected prior to the resignation of the prime minister.

GDP updates will also be followed, led by the delayed publication of data for mainland China, with additional industrial production and retail sales data give more timely indicators of economic performance. A rebound from the second quarter malaise is expected, with forecasters predicting a 3.5% expansion in Q3 GDP, while retail sales and industrial production figures are expected to show improved performance. Q3 GDP updates for the US will also be in the spotlight, thought conditions should remain resilient with third quarter growth projected. Also watch out for Q3 GDP updates for Germany, France, Spain and South Korea.

Central bank watchers are treated to a number of key meetings with the ECB, BoJ, BoC, BcB and CBR among those making monetary policy decisions this week. Focus will be on the ECB who have reaffirmed their stance on putting a lid on inflation. A 50bp hike is expected, though a 75bp rise is also on the table. The Bank of Canada is also set to retain a similarly hawkish tone where a 50 bp hike is likely.

Other key releases include US durable goods, Eurozone & US consumer sentiment, Canada GDP, and inflation updates for Singapore, Russia, France, Germany, Spain and Italy.

October flash PMI data will provide key insights into recession risks for some of the world's major economies. Prior data showed global output dropping for a second successive month in September amid worsening worldwide demand linked to the escalating cost of living, tightening financial conditions and rising risk aversion. However, this slowdown is also exerting downward pressure on many prices, which could in turn drive speculation about monetary policy needing to be tightened less than previously anticipated. However, it is evident that trends vary by region. Read more in our special report on page 4.

Monday 24 October

India, New Zealand & Singapore Market Holiday

S&P Global Worldwide Flash PMIs*

China, mainland GDP (Q3), Industrial Production (Sep), Retail Sales, (Sep), Balance of Trade (Sep)

Taiwan Industrial Production (Sep), Retail Sales (Sep)

United States Chicago Fed National Activity Index (Sep)

Tuesday 25 October

Thailand Balance of Trade (Sep)

Singapore Inflation (Sep)

Germany Ifo Business Climate (Oct)

Australia Federal Budget

Mexico Economic Activity (Aug)

United States House Price Index (Aug),

US CB Consumer Confidence (Oct)

South Korea Business Confidence (Oct)

Wednesday 26 October

India & Austria Market Holiday

New Zealand ANZ Business Confidence (Oct)

Australia Inflation Rate (Q3)

Japan Leading Economic Index Final (Aug)

Singapore Industrial Production (Sep)

France Consumer Confidence (Oct)

France Unemployment Benefit Claims (Sep)

United States Goods Trade Balance (Sep)

US Retail Inventories (Sep), New Home Sales (Sep)

Canada BoC Interest Rate Decision

Russia Industrial Production (Sep)

Brazil Interest Rate Decision

Thursday 27 October

South Korea GDP (Q3)

Japan Foreign Bond Investment (Oct)

Thailand Industrial Production (Sep)

Germany GfK Consumer Confidence (Nov)

Spain Unemployment Rate (Q3)

Italy Business Confidence (Oct), Consumer Confidence (Oct)

Mexico Balance of Trade (Sep), Unemployment Rate (Sep)

Brazil Unemployment Rate (Sep)

Eurozone ECB Interest Rate Decision

United States Durable Goods Orders (Sep), GDP (Q3)

Friday 28 October

Japan Unemployment (Sep) BoJ Interest Rate Decision

Singapore Unemployment Rate (Q3)

France GDP (Q3), Inflation (Oct)

Spain GDP (Q3), Inflation Rate (Oct), Sentiment (Oct)

Germany GDP (Q3), Inflation (Oct)

Eurozone Consumer Confidence (Oct)

Italy Inflation (Oct)

Russia Interest Rate Decision

Canada GDP (Aug)

United States PCE Prices Index (Sep)

US University of Michigan Consumer Sentiment (Oct)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

Americas: US Q3 GDP, PMI, PCE prices and durable goods orders, Canada and Brazil interest rate decisions

October's flash PMIs will be watched to gauge economic performance at the start of the fourth quarter. Recent US survey data have alluded to weakening economic performance amid high prices and tightening financial conditions. While third quarter GDP data will likely signal robust growth, with the consensus expecting a 2% annualised uptick, US house price and homes sales data will be eagerly assessed amid concerns over the impact of rising interest rates, as will consumer confidence numbers. Also watch out for retail inventories, PCE price data and trade numbers plus durable goods orders.

In Canada, the central bank will convene where a 50 bp hike is priced in by markets. The BoC has already hiked rates by 300 basis points this year, and many are expecting interest rates to hit 4.5% next year.

Europe: France, Spain and Germany Q3 GDP, ECB interest rate decision and Eurozone sentiment

Third quarter GDP updates flow thick and fast in Europe, notably for Germany, France and Spain. PMIs have pointed to weak demand in Germany as inflation peaked to a 70-year high in September, which exacerbated recession fears. Forecasters are predicting a 0.7% contraction.

The ECB meanwhile is nevertheless poised to hike rates again in order tame rising inflation, with markets expecting at least a 50bp hike. October inflation numbers will also be updated for some major European economies. PMI numbers and EC sentiment data will also be watched this week for further signs of recession and sticky price pressures.

Asia-Pacific: China GDP, retail sales, IP, South Korea Q3 GDP & Singapore IP, unemployment and inflation

Key releases for mainland China will be eagerly anticipated to assess the impact of the region's zero-COVID policy and the associated restrictions. On the whole, restrictions have retreated over the third quarter, but the government is clearly retaining its strict approach. After moderating to 0.4% (YoY) in Q2 our forecasts point to a 3.5% expansion in GDP for Q3 (YoY). Industrial production and retail sales data are likely to signal growth remaining firmly in positive territory.

South Korea Q3 GDP will also be updated, along with Singapore industrial production, unemployment and inflation figures. Thailand's industrial production data is meanwhile expected to remain strong.

Flash PMI preview - Chris Williamson

Malaysia - Rajiv Biswas

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.