Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jan 20, 2023

By Chris Williamson and Jingyi Pan

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

January flash PMI data from major developed economies will be unveiled in the coming week for the earliest indications of economic conditions at the start of 2023. Other key data releases to watch include US Q4 GDP, core PCEand personal income and consumption data. APAC economies such as Australia, New Zealand and Singapore will also update inflation figures and South Korea and the Philippines release Q4 GDP data. Meanwhile central bank meetings will be held in Canada and Thailand.

The flash PMI data for January will be highly anticipated for indications of recession risks and price trends at the start of the year (see box). The US PMI data will be especially interesting to watch, with recent data having shown a steep cooling in the rate of economic growth. In contrast, official data up to the end of last year have shown surprising resilience, as will likely be confirmed with the publication of fourth quarter GDP data, but there remains great uncertainty as to whether this growth can persist into the new year.

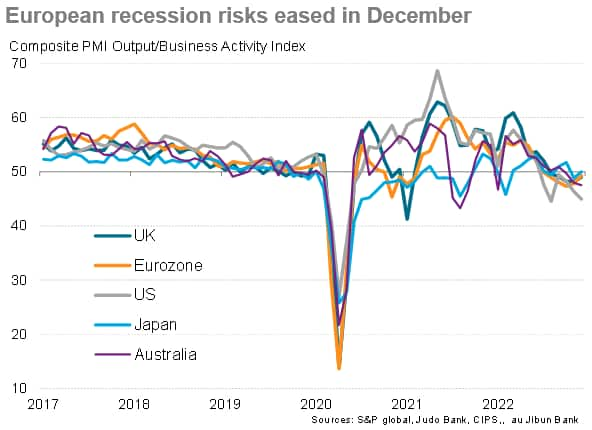

Europe's data calendar is light with the exception of the PMI surveys. December's PMIs for both the Eurozone and UK surprised to the upside, with both economies showing signs of downturns moderating to thereby assuage worries over possible deep recessions.

In APAC, December's PMIs had shown signs of business confidence lifting on the back of looser COVID-19 restrictions in mainland China. January's surveys will be eagerly scoured for signs of actual business activity being buoyed in the region by China's policy shift. Despite rounding off the weakest growth in decades at 3.0% in 2022, China's 2.9% year-on-year (y/y) GDP growth in Q4 beat expectations owing to an earlier than expected recovery of demand. December retail sales and industrial output also outperformed expectations, congruent with indications from the Caixin PMIs.

Finally, the Bank of Canada and Bank of Thailand convenes in the coming week while the Bank of Japan also releases their summary of opinions from this week's meeting that saw no further changes to monetary policy settings. The Bank of Canada meeting is widely viewed as a 'live' meeting with uncertainty over further increases to the overnight policy rate as the central bank balances the extent to which they would need to tightening monetary conditions.

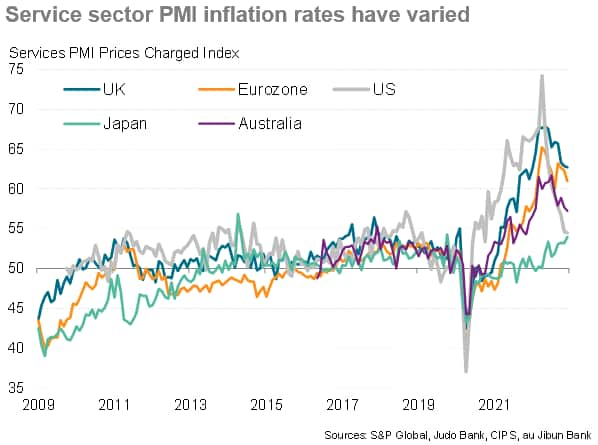

Flash PMI surveys will first and foremost be scoured for indicators of recession risks, notably in the US and Europe. While the latter saw business activity decline at a steepening rate in December, the UK and Eurozone both saw signs of activity stabilising. Second on the list of indicators to watch will be service sector inflation rates, for which the US has seen a far sharper cooling than evident in Europe, as these are key gauges of second-round inflation effects.

Monday 23 January

China, Hong Kong, Taiwan, South Korea, Indonesia, Malaysia, Singapore Market Holiday

Japan BOJ Meeting Minutes (Dec)

Tuesday 24 January

China, Hong Kong, Taiwan South Korea, Malaysia, Singapore Market Holiday

Australia Judo Bank Flash PMI, Manufacturing & Services*

Japan au Jibun Bank Flash Manufacturing PMI*

UK S&P Global/CIPS Flash PMI, Manufacturing & Services*

Germany S&P Global Flash PMI, Manufacturing & Services*

France S&P Global Flash PMI, Manufacturing & Services*

Eurozone S&P Global Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

Thailand Customs-Based Trade Data (Dec)

Germany GfK Consumer Sentiment (Feb)

United Kingdom CBI Trends (Jan)

Wednesday 25 January

China, Hong Kong, Taiwan Market Holiday

New Zealand CPI (Q4)

Australia Composite Leading Index (Dec)

Australia CPI (Q4)

Japan Leading Indicator (Nov, revised)

Singapore Consumer Price Index (Dec)

United Kingdom PPI (Dec)

Thailand 1-Day Repo Rate (25 Jan)

Germany Ifo Business Climate New (Jan)

Canada BoC Rate Decision (25 Jan)

Thursday 26 January

Australia, China, Taiwan, India Market Holiday

Japan BOJ Summary of Opinions (Jan)

South Korea GDP (Q4)

Japan Services PPI (Dec)

Philippines GDP (Q4)

Singapore Manufacturing Output (Dec)

Norway Labour Force Survey (Dec)

United Kingdom CBI Distributive Trades (Jan)

Canada Business Barometer (Jan)

United States Durable Goods (Dec)

United States GDP (Q4, advance)

United States Initial Jobless Claims

United States New Home Sales (Dec)

Friday 27 January

China, Taiwan Market Holiday

Japan CPI, Overall Tokyo (Jan)

Australia PPI (Q4)

Australia Export and Import Prices (Q4)

United States Personal Income and Consumption (Dec)

United States Core PCE (Dec)

United States UoM Sentiment (Jan, final)

United States Pending Home Sales (Dec)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

January flash PMIs

The first set of flash PMIs for 2023 will be unveiled on Tuesday across developed economies including the US, UK, eurozone, Japan and Australia. We have witnessed global business activity contracting for the fifth consecutive month in December, with developed economies exhibiting mixed trends. While the downturn in Europe moderated, allaying recession fears, business conditioned worsened in the US. January's flash data will therefore help assess whether recession risks have altered in the new year and provide updates on inflation trends. Japan and Australia's performance will also be examined, with the easing of restrictions in China having hopefully buoyed APAC activity.

Americas: Bank of Canada meeting, US Q4 GDP, core PCE, personal income and consumption data

The Bank of Canada convenes for the first time in 2023 after having raised the policy rate by 50 basis points to 4.25% in December. Expectations for a further lifting of rates had been bolstered by strong jobs data, but this hawkishness has been offset by a further cooling of inflation. A 25 basis point hike is still expected, but a pause should not be ruled out.

In the US, the first estimate of Q4 GDP will also be released on Thursday which looks set to contrast with recent weak survey data. The current consensus indicates that the US economy likely grew at a 2.8% rate in Q4, slowing from the 3.2% growth previously. December core PCE, a key metric watched by the Fed, is meanwhile expected to stay unchanged at a 0.2% month-on-month. Also watch out for durable goods orders and housing sales data.

Europe: German Ifo business climate, UK PPI

Besides the flash PMI releases, a relative light data calendar is expected for Europe in the coming week with the German Ifo business climate and UK PPI figures to be of greatest interest.

Asia-Pacific: Australia, New Zealand and Singapore CPI, South Korea and Philippines GDP, Bank of Thailand meeting

Several tier-1 data will be due in APAC including inflation figures from Australia and Singapore. Separately, following China's indications of slowing Q4 growth, GDP figures will also be out from South Korea and the Philippines.

Recession Risks and Inflation Indicators: Previewing January's US Flash PMI Data - Chris Williamson

Philippines Economy Shows Strong Expansion - Rajiv Biswas

© 2023, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location