Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Nov 18, 2022

By Jingyi Pan

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

November flash PMI figures for major developed economies will be eagerly awaited in the coming week while interest rates updates in mainland China and South Korea will also be due. The US Federal Reserve meanwhile releases minutes from the November FOMC meeting ahead of the Thanksgiving holidays. Amidst a busy data calendar, a string of Q3 GDP data arrives out of Germany, Singapore and Thailand.

The market has well demonstrated its sensitivity to data of late and this was especially so in the US. Equity prices rose previously following lower-than-expected October US CPI readings while the latest stronger-than-expected retail sales data kept investors on edge.

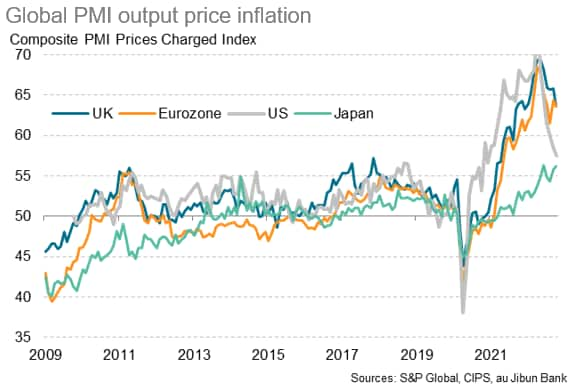

At the root of this phenomenon had been the uncertainty shrouding the US Federal Reserve's path forward after various Fed members signalled their openness to slower rate hikes in upcoming meetings. The pace at which interest rates may be further lifted is expected to be primarily data-driven. Therefore, against this backdrop, not only will the November Fed minutes be parsed in the coming week, data including the flash November US PMI figures will be closely watched for clues on inflation, employment and output trends in the coming week. Any indications of easing inflationary pressures and, regrettably, slowing economic or jobs market conditions may be taken as signs of slower rate hikes that could provide support for risk assets.

Across the Atlantic, a series of economic releases will also be due from Europe alongside the flash PMI figures that is expected to shed light on the degree to which recession risks further grip the region. As far as the S&P Global Europe Business Outlook alluded to, business confidence sank to a survey low in October while cost inflation expectations soared to a survey peak amid the energy crisis, which does not bode well for the near-term outlook.

Finally, in APAC, the Bank of Korea meeting will be one to watch with further tightening expected to tackle the ongoing inflation pressures. Thailand and Singapore also release Q3 GDP data.

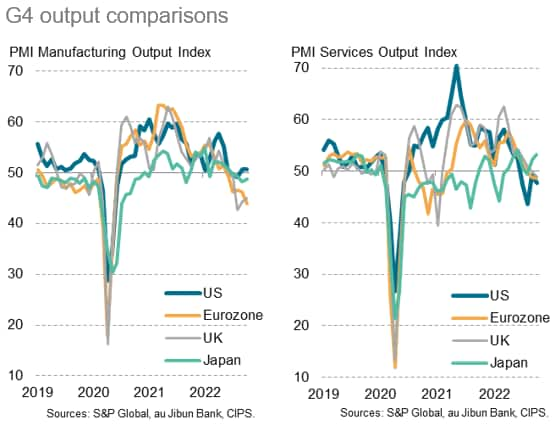

October's S&P Global PMI data revealed major developed economies to be at greater risks of recession, although Japan had been the exception, buoyed by service sector outperformance. Moving closer to the year end, November's flash PMI figures will further outline whether conditions in the US and Europe have deteriorated as we watch these releases next week.

More importantly, it will be the inflation trend in focus with any further signs of inflation easing to be taken positively by the market.

Monday 21 November

China (Mainland) Loan Prime Rate (Nov)

Thailand GDP (Q3)

Germany Producer Prices (Oct)

Taiwan Export Orders (Oct)

Tuesday 22 November

New Zealand Trade (Oct)

Taiwan Jobless Rate (Oct)

Canada Retail Sales (Sep)

Eurozone Consumer Confidence (Nov, flash)

Wednesday 23 November

Japan Market Holiday

Australia S&P Global Flash PMI, Manufacturing & Services*

UK S&P Global/CIPS Flash PMI, Manufacturing & Services*

Germany S&P Global Flash PMI, Manufacturing & Services*

France S&P Global Flash PMI, Manufacturing & Services*

Eurozone S&P Global Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

New Zealand Cash Rate (23 Nov)

Thailand Customs-Based Trade Data (Oct)

Singapore Consumer Price Index (Oct)

Taiwan Industrial Output (Oct)

United States Durable Goods (Oct)

United States Initial Jobless Claims

United States UoM Sentiment (Nov, final)

United States New Home Sales (Oct)

Thailand Manufacturing Production (Oct)

US Fed FOMC Meeting Minutes (Nov)

Thursday 24 November

US Market Holiday

Japan au Jibun Bank Flash Manufacturing PMI*

South Korea Bank of Korea Base Rate (Nov)

Japan Leading Indicator (Sep)

Germany Ifo Business Climate (Nov)

United Kingdom CBI Trends (Nov)

Canada Business Barometer (Nov)

Friday 25 November

US Market Holiday (Partial)

New Zealand Retail Sales (Q3)

Singapore GDP (Q3, final)

United Kingdom GfK Consumer Confidence (Nov)

Singapore Manufacturing Output (Oct)

Germany GDP (Q3)

Germany GfK Consumer Sentiment (Dec)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

November flash PMI releases

Flash PMI figures for major developed economies including the US, eurozone, UK, Japan and Australia will be released in the coming week for a first look at economic conditions in the penultimate month of the year. Prior data in October outlined a further slowdown of the global economy while inflation rates remain elevated by historical standards to warrant continued central bank attention. As such, November's data will be tracked for further risks of recession and implications for monetary policy and businesses. Read more in our special report below.

Americas: US Fed minutes, UoM sentiment

Meeting minutes for the November US Federal Open Market Committee (FOMC) meeting will be released in the coming week where the Fed hiked 75 basis points (bps) but hinted at a step down in upcoming meetings. Recent developments including the sliding of US CPI to +0.4% month-on-month (m/m) backs the likelihood of a 50bps hike in December, and the Fed minutes will be studied for confirmation of the Fed's resolve to lift rates at a more moderate pace.

Europe: Eurozone consumer confidence, Germany Q3 GDP, Ifo business expectations

Eurozone flash November consumer confidence figures will be due Tuesday following weak readings seen previously. Recent S&P Global Business Outlook surveys have also shown regions such as Germany facing record low business confidence on the back of the Ukraine war, inflation concerns and the energy crisis. Germany's detailed Q3 GDP figures will also be released in the coming week.

Asia-Pacific: China, South Korea interest rates, Thailand and Singapore Q3 GDP

In APAC, China's November loan prime rates will be published on Monday while the Bank of Korea will update their base rate on Thursday with a smaller hike expected following the 50 basis points rise on 12 October. Inflationary pressures remain the key issue for the South Korean economy while a weaker domestic currency, especially against the US dollar, has aggravated the issue.

Meanwhile Q3 GDP will be due from Thailand and Singapore. Singapore's release will be the final figures after the 4.4% year-on-year (y/y) advance reading.

November flash PMI data to provide insights into inflation trends and recession risks - Jingyi Pan

Malaysian economy shows buoyant growth in third quarter - Rajiv Biswas

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location