Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Mar 10, 2023

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Another action-packed week follows US Fed chair Jerome Powell's testimony to Congress and the US jobs report, with special attention on the upcoming US inflation figures due for February. The European Central Bank and Bank Indonesia will also update monetary policy, while more China data, including industrial production and retail sales, are anticipated. Other data highlights include UK employment numbers, Norway and New Zealand GDP, and India's CPI.

The US Fed further dampened market spirits this week with chair Jerome Powell leaning on the hawkish end at the start of his testimony to Congress. Hints of faster interest rate increases come on the back of stronger than expected economic data so far this year. Amid this heightened attention on data, next week's US CPI will no doubt be the highlight, especially after flash PMI data earlier alluded to the likelihood of stubborn inflation. A higher-than-expected reading may deal another blow to risk sentiment. US industrial production and retail sales updates for February will also be eagerly assessed after the consensus-beating January numbers.

Meanwhile central bank meetings unfold in the eurozone and Indonesia, with the ECB expected to further raise rates. Amid similar indications of resilient economic conditions and still-elevated inflation rates gathered from the PMI surveys comparing the eurozone to the US, the risks are that the ECB may also adopt a more hawkish than currently expected lean in their upcoming meeting. A 50-basis point hike is already priced in to the markets after comments from ECB head Christine Lagarde stressed how inflation was proving sticker than anticipated, though some policymakers remain concerned about the economic toll of higher policy rates, which have risen by 3% since last summer. As such, the ECB meeting next week presents key event risk for markets.

Next week also sees the latest S&P Global Investment Manager Index (IMI) a survey, providing insights into the near-term risk appetite and expected returns for the US equity market. Money managers had continued to expect the US equity market returns to stay negative in February and, although it is hard to find strong reasons for a recovery at present, it will be interesting to see the direction of change and what's driving sentiment.

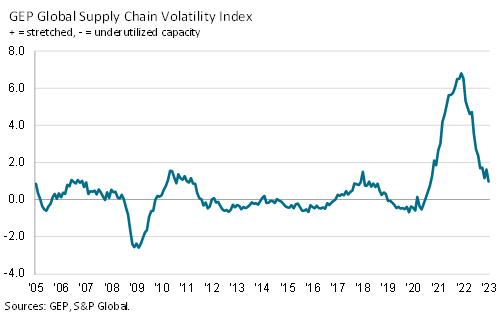

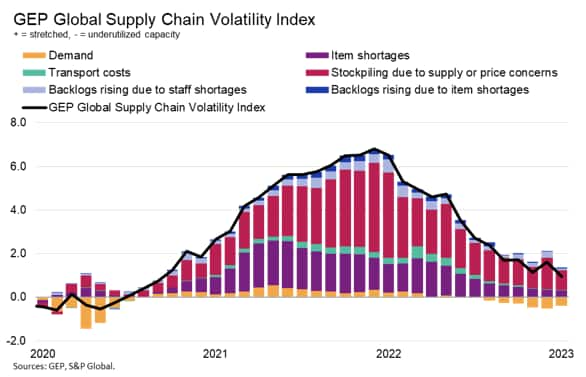

Next week sees new guidance on supply chain stress. Having surged to unprecedented highs in 2021 and 2022, the GEP Global Supply Chain Volatility Index - a comprehensive gauge of supply conditions based on survey data relating to backlogs, inventories, and the causes of delays and constraints cited by companies - fell to its lowest for over two years in January.

The February data will be eyed in particular for the impact of China's relaxation of COVID-19 restrictions. On one hand, looser restrictions will have boosted exports from mainland China and eased supply further. On the other hand, stronger economic growth will fuel more demand, putting renewed pressure on some supply chains. The development of these varying forces will provide key information for global inflation trends.

Monday 13 March

Malaysia Industrial Output (Jan)

India CPI (Feb)

S&P Global Outlook Surveys* (Feb)

GEP Global Supply Chain Volatility Index* (Feb)

Tuesday 14 March

Japan BOJ Meeting Minutes (Jan)

India WPI (Feb)

United Kingdom Labour Market Report (Jan)

Hong Kong Industrial Production (Q4)

Hong Kong PPI (Q4)

United States CPI (Feb)

Canada Manufacturing Sales (Jan)

S&P Global Investment Manager Index* (Mar)

Wednesday 15 March

New Zealand Current Account (Q4)

South Korea Export and Import Growth (Feb, revised)

China (Mainland) Industrial Output, Retail Sales, Urban Investment (Feb)

Indonesia Trade (Feb)

Eurozone Industrial Production (Jan)

Canada House Starts (Feb)

United States PPI (Feb)

United States Retail Sales (Feb)

United States Business Inventories (Jan)

United States NAHB Housing Market Index (Mar)

Thursday 16 March

New Zealand GDP (Q4)

Japan Machinery Orders (Jan)

Japan Trade (Feb)

Australia Employment (Feb)

Norway GDP (Jan)

United States Housing Starts (Feb)

United States Import Prices (Feb)

United States Initial Jobless Claims

Canada Wholesale Trade (Jan)

Eurozone ECB Deposit and Refinancing Rate (Mar)

Indonesia 7-Day Reverse Repo (Mar)

Friday 17 March

Singapore Non-Oil Exports (Feb)

Malaysia Trade (Feb)

Eurozone HICP (Feb, final)

Canada Producer Prices (Feb)

United States Industrial Production (Feb)

United States Capacity Utilization (Feb)

United States UoM Sentiment (Mar, prelim)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

Americas: US CPI, PPI, retail sales and IP updates

A key release in the coming week will be February's US CPI and PPI figures. Consensus expectations currently point to a slowdown in CPI increase at 0.4% month-on-month (m/m), down from 0.5% previously. Core CPI is expected to hold steady at 0.4% m/m. Indications from the S&P Global US Composite PMI suggested that , although cost inflation cooled for firms in the US, selling price inflation accelerated.

Retail sales figures will also be released on Wednesday though the consensus suggests a marked slowdown in retail consumption to 0.2% from 3.0% in January, with industrial production updated on Friday. Business inventories and housing market releases will also be eagerly assessed.

Europe: ECB meeting, UK employment report, eurozone industrial production, Norway GDP

In Europe, the key focus will be with the European Central Bank (ECB) meeting unfolding on Thursday, with the focus on the ECB's outlook and projections given that another rate hike is priced in by the market at present. Still-elevated inflation rates and hawkish rhetoric from Lagarde, coupled with indications of a rebound in eurozone growth despite recent tightening of monetary policy, places pressure on the ECB to act. From a data perspective, watch out for eurozone industrial production on Wednesday, which will come on the heels of better-than-expected data out of Germany.

In the UK, labour market data will be released, and wage growth in particular will be eyed for implication of any need for further rate hikes.

Asia-Pacific: BI meeting, China production, retail sales data, New Zealand GDP, India CPI, Australia employment

Bank Indonesia will be another central bank updating monetary policy in the coming week, though the focus is likely to be with more China data releases including industrial production and retail sales.

S&P Global Investment Manager Index (IMI)

The S&P Global Investment Manager Index survey will meanwhile provide insights into views on the US equity market from approximately 300 participants employed by firms that collectively represent approximately $3,500 billion assets under management. February's IMI data revealed that risk aversion cooled amongst investors amid growing hopes of a 'soft landing', though recent data challenge this view.

Special reports:

Global Economic Growth Accelerates to Eight-month High in February - Chris Williamson

Philippines Amongst World's Fastest Growing Emerging Markets - Rajiv Biswas

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.