Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Dec 09, 2022

By Chris Williamson and Jingyi Pan

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Central bankers around the world meet in the coming week before winding down for the end of 2022 with monetary policy meetings scheduled across the US, UK, eurozone, Taiwan and more. This is while the last flash PMI readings across major developed economies are published for an update on December's business conditions. Several key official economic releases will also keep the market informed including the US CPI, UK GDP, labour market and inflation data, in addition to retail sales and industrial production numbers from both US and China.

There is no pleasing the market right now with stronger-than-expected US economic data being the latest to send investors into a quandary, concerned with interest rates being lifted more than earlier expected. The issue is that, while many official economic data series remain resilient in the face of consecutive rate hikes, survey statistics have been sending early signals of persistent slowdown, with the latest S&P Global US Composite PMI notably having pointed to the fifth straight month of contraction. Next week's flash figures for December will add further to the debate as to whether the US economy is showing resilience or fading.

Meanwhile as far as the Fed is concerned, a step down to a 50-basis points hike is widely expected by the market in the upcoming Fed FOMC meeting, a magnitude of move that will likely be matched by both the ECB and BoE. Contributing to the event risks will, however, be indications on the path from hereon in, with potential signals anticipated from both the Fed's projections and comments from the press conference. Inflation data from the US and UK will also be key releases after PMI data earlier revealed easing supply constraints and price pressures on the back of deteriorating conditions. Also watch out for official UK labour market and GDP data, with wage growth particularly pertinent to policymaking.

In APAC, a series of economic releases will be eagerly anticipated in addition to the Taiwan CBC meeting. Mainland China's industrial production and retail sales readings are meanwhile expected to be on the weaker side in November, according to consensus, reflecting COVID-19 restrictions. Finally, Australia's November employment data will be unveiled for the latest developments in the tight Aussie labour market.

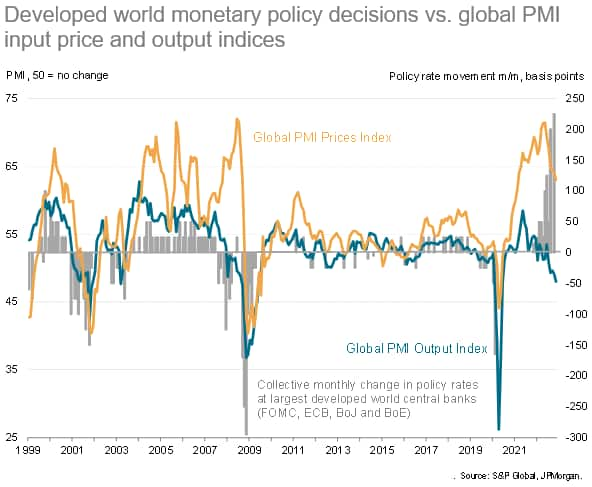

The coming week closes with the publication of early PMI data for the main developed economies, which will give important updates on recession risks and accompanying inflationary trends. However, ahead of the PMI releases we will see fresh policy decisions form the US FOMC, the ECB and Bank of England. November's PMI data pointed to a slowing of global economic growth to a pace which, barring initial pandemic lockdowns, signalled the strongest global recession risks since 2008. The US, UK and eurozone were all in contraction territory. One positive side effect of the economic slump was a further marked cooling of inflation pressures, both via lower input cost inflation and moderating supply-side constraints.

The markets welcomed November's PMI data in boosting the possibility of a potential pivot by the US and European central banks, whereby the pace of policy tightening will need to be wound down as policymakers realise the growing economic risks.

December's policy meetings will be a key test of this scenario, with the major central banks widely expected to dial back the pace of tightening from bumper 75 basis point hikes in prior months. More important will be the rhetoric on the expected pace of hikes going into 2023. Certainly from a PMI perspective, we would anticipate the language to become more dovish, but we are eager to see those December flash PMIs for more information on the economic situation and the impact of prior rate hikes.

Monday 12 December

Thailand Market Holiday

Malaysia Industrial Output (Oct)

United Kingdom monthly GDP, incl. Manufacturing, Services and Construction Output (Oct)

United Kingdom Goods Trade Balance (Oct)

India CPI and Industrial Output(Nov)

China (Mainland) M2, New Yuan Loans, Loan Growth (Nov)

Tuesday 13 December

Germany CPI (Nov, final)

United Kingdom Labour Market Report (Oct)

Norway GDP (Oct)

Hong Kong Industrial Production, PPI (Q3)

Germany ZEW Economic Sentiment (Dec)

United States CPI (Nov)

Wednesday 14 December

Japan Machinery Orders (Oct)

Japan Tankan Survey (Q4)

Thailand BOT Meeting Minutes (Nov)

India WPI (Nov)

United Kingdom Inflation (Nov)

Eurozone Industrial Production (Oct)

United States Fed Funds Target Rate (14 Dec)

Thursday 15 December

New Zealand GDP (Q3)

Japan Trade Balance (Nov)

South Korea Export and Import Growth (Nov)

Australia Employment (Nov)

China (Mainland) Industrial Output, Retail Sales, Urban Investment (Nov)

Indonesia Trade Balance (Nov)

Philippines Policy Interest Rate (15 Dec)

Switzerland SNB Policy Rate (Q4)

Norway Key Policy Rate (15 Dec)

United Kingdom BOE Bank Rate (Dec)

Eurozone ECB Deposit and Refinancing Rate (Dec)

United States Initial Jobless Claims

United States Retail Sales and Industrial Production (Nov)

Taiwan Discount Rate (Q4)

Friday 16 December

Australia Judo Bank Flash PMI, Manufacturing & Services*

Japan au Jibun Bank Flash Manufacturing PMI*

UK S&P Global/CIPS Flash PMI, Manufacturing & Services*

Germany S&P Global Flash PMI, Manufacturing & Services*

France S&P Global Flash PMI, Manufacturing & Services*

Eurozone S&P Global Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

United Kingdom GfK Consumer Confidence (Dec)

Singapore Non-Oil Exports (Nov)

United Kingdom Retail Sales (Nov)

Eurozone Total Trade Balance (Oct)

Eurozone HICP (Nov, final)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

Flash PMI data release for December

The US, eurozone, UK, Japan and Australia will all see flash PMI releases for December to provide closing snapshots of business conditions for 2022. Key themes to watch with the December figures include business output and order book growth, price trends and the employment situation. November's data outlined a deepening and broadening of the ongoing global slowdown. Specifically, weak demand can be seen at the core of the decline in overall activity, though price pressures also eased as a result of a combination of falling demand and supply chain improvements. The latest developments supported the dialling-down of aggressive monetary tightening by central banks, so whether the abovementioned trends persist into the year-end will be keenly watched with the upcoming flash releases for these major developed economies.

Americas: Fed FOMC meeting, US CPI, retail sales and industrial production

The final Federal Open Market Committee (FOMC) meeting of 2022 will unfold next week with the market widely expecting a step down to a 50 basis points (bps) hike. Indications on subsequent hikes will be closely watched with recent official economic data staying resilient while business survey statistics have been showing cracks, the latter calling for further slowing down of aggressive tightening. November CPI data and flash December PMI data will also be key to assessing the future rate path.

Europe: ECB, BoE, SNB, Norges Bank meetings, UK October output and inflation data

It is a central bank galore in Europe with both the European Central Bank and the Bank of England convening in addition to other central banks in the area. Both the ECB and BoE are expected to lift rates by 50 bps but markets are eager to assess the appetite for further rate hikes and any revisions to the outlooks for economic growth and inflation.

Asia-Pacific: CBC meeting, China retail sales and industrial production data, Japan Tankan survey, Australia employment and New Zealand GDP

In APAC, a packed week ahead contains a central bank meeting in Taiwan and several key data releases out of mainland China, Japan and more. The focus will be on China's latest retail sales and industrial production performance amid COVID-19 disruptions.

Global Sector Data Reveal Broadening Slowdown - Jingyi Pan

APAC Exports Slow as Global Growth Weakens - Rajiv Biswas

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location